Learn how to start a self-employed business in the UK with simple steps that help you register, stay compliant, and grow with confidence.

Becoming self-employed is one of the most accessible ways to start your own business in the UK. Whether you want to turn a side hobby into extra income or build a full-time career around your skills, working for yourself gives you more freedom, flexibility, and control.

However, if you are new to the process, you may not know where to begin. From registering with HMRC to keeping track of expenses, managing invoices, and staying on top of taxes, learning how to start a self-employed business in the UK can feel overwhelming.

By following a clear plan and taking things step by step, you can build the career you want on your own terms. Here’s everything you need to do.

Key takeaways

- Sole trader status is the simplest way to start self-employment

Registering as a sole trader allows you to start earning almost immediately with minimal setup and admin. It suits freelancers, tradespeople, creatives, tutors, and anyone testing a new business idea. - Plan your business carefully from the start

Decide on a clear business name, define your services, and set your pricing. Planning early helps you appear professional, attract the right clients, and manage your workflow more efficiently. - Understand taxes and expenses to stay compliant

As a sole trader, you pay tax on your profit after allowable business expenses. Keep accurate records of income, receipts, and expenses, and be aware of Self Assessment and National Insurance deadlines. - Protect yourself with insurance

While optional, different types of insurance safeguard you from unexpected risks and may be required by clients.

What does it mean to be self-employed?

Being self-employed means you work for yourself rather than for an employer. Instead of being on a company payroll, you run your own small business as an individual, take responsibility for your income, and make decisions about your work processes.

In practical terms, being self-employed usually means you:

- Manage your own workload

- Set your own prices

- Find and work with your own clients

- Keep track of all your income and expenses

- Handle your tax through Self Assessment

- Take responsibility for the finances of your business

- Decide when, where, and how you work

For most beginners, the natural choice would be a sole trader. This structure requires very little admin, has no setup costs, and lets you start earning almost immediately. It is ideal for:

- Freelancers and contractors

- Tradespeople and labourers

- Beauty and wellness professionals

- Tutors and coaches

- Creatives, designers, and photographers

- Online sellers and resellers

- Anyone testing a new business idea

If you want flexibility, control, and the freedom to grow at your own pace, sole trader status offers the easiest path into self-employment.

Pros and cons of self-employment

Before registering, take a moment to understand how self-employment aligns with your personality, goals, and working style. Every work model has its upsides and challenges, and knowing what to expect from the beginning can make your first year far smoother

Here’s what you should have in mind:

| Pros of Being Self-Employed | Challenges of Being a Sole Trader |

| Set your hours, choose your clients, and decide which projects you take on.Grow your income as your skills, reputation, and client base expand.Run your business from home, a studio, a workshop, or any location that suits your lifestyle.Shape a business around your passion, expertise, and long-term goals.Accept clients who align with your values and decline those who don’t. | Earnings may rise and fall, especially at the beginning.Complete Self Assessment and pay any tax or National Insurance due.You’re responsible for marketing, networking, and generating work.Track invoices, receipts, expenses, and business records throughout the year.Budget carefully, forecast income, and prepare for slow periods. |

Self-employment: The steps explained

Once you’ve weighed the pros and cons and decided that this is the path you want to follow, the process becomes straightforward. Typical steps include the following:

Step 1: Choose your business name

As a sole trader, you have two options when it comes to business names:

1. Trading under your own name, such as ‘Alyssa Cole’

2. Choosing a separate business name, like ‘AC Creative Studio’

Many beginners start with their personal name because it is quick and easy. But if you want something more brand-like, here is what to keep in mind:

- Keep it short, clear, and easy to spell

- Make sure it reflects what you do (optional but helpful)

- Avoid complicated words or unusual spellings

- Check that no other business in your area uses the same name with ANNA’s free name checker

- Make sure the domain name and social media handles are available

- Avoid restricted words such as ‘Ltd’, ‘Limited’, or anything misleading

Once you’ve chosen a name that stands out, it’s time to get the legal side sorted.

Step 2: Register as a sole trader

When you begin earning money from self-employed work, you have to register with HMRC. This is obligatory if any of the following apply:

- You earn more than £1,000 in a tax year: This £1,000 is the trading allowance. Once you cross it, HMRC considers it taxable business income.

- You are trading regularly and intend to make a profit: Even if you haven’t earned £1,000 yet, consistent activity (selling, delivering services, advertising, invoicing) indicates you are running a business.

- You want to claim allowable business expenses: Registering allows you to deduct expenses such as equipment, travel, software, or phone use.

- You need official proof that you’re self-employed: Clients, landlords, banks, and financial services often ask for this.

If you’re required to file a tax return and it’s your first time doing so, you must complete your Self Assessment registration as a sole trader by 5 October of the tax year in which you crossed the £1,000 threshold.

Many people start earning before they realise they need to register, so it is best to do it as soon as business activity begins.

How to register as a sole trader

You can register as a sole trader directly through HMRC. The process is simple:

1. Create or sign in to your Government Gateway account

This is the secure login system you’ll use for all HMRC services, including your tax return.

2. Complete the Self Assessment registration form

You’ll confirm that you’re becoming self-employed, describe the type of work you do, and provide your personal details.

3. Receive your Unique Taxpayer Reference (UTR)

HMRC posts this to you. Keep it somewhere safe, because you’ll need it every time you manage your tax return.

4. Activate your Self Assessment account

HMRC may send an activation code separately. Enter this online to finish setting up your account.

Once these steps are complete, you’re officially registered as a sole trader and can begin running your business.

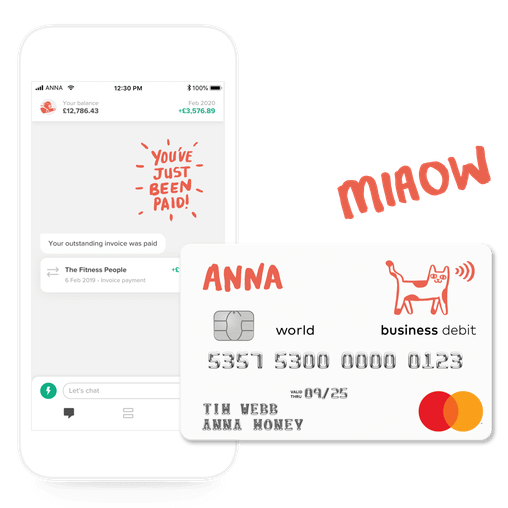

Prefer an easier option?

If you want to avoid the paperwork and reduce the risk of mistakes, ANNA can guide you through the entire registration process. ANNA walks you through each step, helping you stay compliant and making sure nothing gets overlooked.

Once you’re set up, ANNA continues to support your business with a dedicated sole trader account, simple invoicing, automatic expense tracking, Self Assessment support, and more, giving you everything you need to run your business smoothly from one place.

Step 3: Understand your tax responsibilities

As a sole trader, you pay tax on your profit, not on your total income. Your profit is what’s left after you subtract your allowable business expenses.

Here are the main taxes you may need to think about:

| Type of tax | What it covers | When you pay |

| Income Tax | Tax on your profit after allowable business expenses | Paid once a year through your Self Assessment return |

| Class 4 National Insurance | Contributions based on your annual profit level | Paid at the same time as your Income Tax bill |

| VAT (only if you register or exceed the £90,000 threshold) | Tax charged on the goods or services you supply | Paid monthly or quarterly depending on your VAT return schedule |

Most new sole traders will only deal with Income Tax and National Insurance, and they won’t need to register for VAT unless their business grows past the current VAT threshold.

Tax deadlines are dictated by the tax year. There are two key dates for sole traders:

- 5 April – End of the tax year

- 31 January – Deadline for submitting your Self Assessment tax return and paying any tax you owe

If your tax bill is more than £1,000, HMRC may ask you to make payments on account. These are advance payments toward next year’s tax bill, based on the assumption that you’ll earn a similar amount again. This helps spread the cost so you don’t face one large bill at the end of the year.

Keep your records organised

Being a sole trader comes with a lot of bookkeeping. HMRC expects you to maintain accurate information about your sales, income, business expenses, receipts, invoices, bank statements, and any mileage you claim for work purposes.

These records help you complete your Self Assessment correctly and support any figures you report. You must store them for at least five years after you file your tax return, so it’s a good idea to keep everything organised from the start.

Step 4: Understand what expenses you can claim

Claiming allowable expenses is one of the biggest advantages of being a sole trader. To do this correctly, you need to know which costs HMRC accepts and how to record them.

These are the types of business expenses you can usually claim:

- Tools and equipment: Costs for essential work items, from basic hand tools to specialist machinery

- Phone and internet (business portion): The percentage of your phone or internet bill used for business activity

- Laptop, software, and technology: Devices and software primarily used to serve clients or run your business

- Travel for work: Fuel, public transport, parking, and mileage for work-related journeys (not including everyday commuting)

- Protective work clothing: Safety clothing or specialist attire required for your job

- Marketing, websites, and advertising: Website hosting, design tools, online advertising, and printed promotional materials

- Office supplies: Stationery, printing, postage, and other routine business items

- Home office costs: A portion of your household bills or HMRC’s simplified flat rate if you work from home

- Training and development: Courses that improve or update skills you already use in your business

- Subscriptions and memberships: Fees for professional bodies, industry associations, or essential trade memberships

Tip: ANNA automatically categorises expenses for you, helping you avoid mistakes and ensuring you claim everything you are entitled to.

Step 5: Protect yourself with the right insurance

Insurance is there to protect you if something goes wrong, and some clients may require it before hiring you.

Here are the most common sole trader insurance types:

| Insurance type | What it covers | Who typically needs it |

| Public liability | Claims for injury or property damage caused to others | Tradespeople, beauty professionals, fitness professionals |

| Professional indemnity | Claims resulting from mistakes, missed deadlines, or inaccurate advice | Designers, tutors, consultants |

| Tools and equipment insurance | Costs to repair or replace lost, stolen, or damaged work items | Tradespeople, photographers, mobile workers |

| Income protection | Income support if you cannot work due to illness or injury | Anyone reliant on a single source of self-employed income |

Even though it’s completely optional for sole traders, insurance gives you peace of mind and protects your business reputation.

Step 6: Market your business and attract clients

You do not need a big budget or a complicated plan to start attracting clients. Focus on building trust, showing what you do, and staying consistent.

These simple elements can make it easier for people to understand your services:

- A short introduction (your ‘pitch’): One paragraph that explains what you do and who you help, which should be placed where people first encounter your business, such as your website, social media profiles, marketing materials, or client emails.

- A simple website, landing page, or social media bio: Even a single page is enough when you are starting.

- A professional email address: Ideally, you should be using your name or business name.

- A portfolio or examples of your work: Show screenshots, testimonials, or before-and-after photos.

Where to find your first clients

You should start looking where you feel the most comfortable, whether that's online or offline, and slowly expand your efforts from there. The most common marketing channels include:

| Channel | How it helps |

| Social media (LinkedIn, Instagram, TikTok) | Builds visibility by letting you share what you do and how you work |

| Local community groups | Connects you with people in your area who may need your services |

| Word-of-mouth referrals | Brings warm leads from people who already trust you |

| Google Business Profile | Helps local clients discover your services more easily |

| Networking events and meetups | Introduces you to potential clients and collaboration partners |

| Freelance platforms | Provides early visibility and opportunities to build testimonials |

| Partnering with local businesses | Creates steady work through simple referral arrangements |

How to start a self-employed business in the UK with ANNA

Starting your business on your own may seem overwhelming at first, but with the right tools – and a bit of help – running your business becomes straightforward and rewarding.

That’s where ANNA comes in. From guiding you through registration as a sole trader, to managing your business finances, tracking expenses, sending invoices, and helping with Self Assessment, ANNA takes care of the tricky admin so you can focus on what you do best – growing your business. With ANNA in your corner, staying compliant, organised, and on top of your finances has never been easier.

So, take the leap today, launch your business with confidence, and let ANNA support you every step of the way.

Read the latest updates

You may also like

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)

![How to Start an Electrician Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_How_to_Start_a_Car_Detailing_Business_Successfully_74488a6268/small_Cover_3000_How_to_Start_a_Car_Detailing_Business_Successfully_74488a6268.webp)

![How to Start a Currency Exchange Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_daad2f9e2a/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_daad2f9e2a.webp)

![How to Start a Graphic Design Business in 2026 [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_How_to_Start_a_Graphic_Design_Business_in_2025_d8d412cdf5/small_Cover_3000_How_to_Start_a_Graphic_Design_Business_in_2025_d8d412cdf5.webp)