If you’ve started your own business, it’s important that you know what business expenses are? What you can claim as a business expense to reduce your taxes? And what you can’t. We take a look at the basics.

- In this article

- Why is it important to claim business expenses?

- What can I claim as a business expense?

- How to understand if I can claim something as a business expense?

- Keep track of your expenses

- What are some other expenses I can claim?

- Are capital expenses tax deductible?

- What expenses can I claim when working from home?

- What if I use an item for both personal and business, like my mobile phone?

- This is all really complicated! Is there a simpler way?

What are business expenses?

Business expenses allowable expenses that are essential to the business. They are business costs which are not part of the business taxable profits, and therefore you don’t pay tax on them. The general rule is that expenses are costs incurred to the business with the purpose of operating your business.

Why is it important to claim business expenses?

When you run a business, you’ve got a turnover. That’s all the money you’re bringing in. Alongside that you’ve also got expenses – the cost of running your business.

Your turnover, minus any (allowable) expenses gives you your taxable profit. And this is what you pay taxes on.

So if your turnover is £45,000 and you claim £9000 in allowable expenses, you’ve got a taxable profit of £36,000 and that’s what you pay taxes on. Therefore, the more expenses you claim the less taxes you pay.

What can I claim as a business expense?

It’s important that you know what you can claim as a business expense and what you can’t. Not all expenses can be claimed.

Here are some of the most common allowable expenses that apply to the majority of businesses:

- Office costs – this ranges from big expenses like the cost of renting an office to smaller things like stationery. It also covers phone, fax and internet bills, postage, printing, printer ink and some computer software.

- Rents, rates, power and insurance costs – this includes rent for your business premises, business and water rates, utility bills, property insurance and security. If you work from home you can claim a proportion of these costs – but only for the parts of your home where your office is based.

- Car, van and travel expenses – you can claim for vehicle insurance, repairs and servicing, fuel, parking, hire charges, vehicle licence fees, breakdown cover train, bus, air and taxi fares, hotel rooms and meals when you work away from your normal place of business.

- Clothing expenses – this covers uniforms or protective clothing needed for your work, as well as costumes for actors or entertainers. Sadly you can’t expense your usual clothes, even if you wear them to the office.

- Staff expenses – this includes staff salaries, bonuses, pensions, benefits, agency fees, subcontractors, employer’s National Insurance and training courses (if they’re work-related).

- Reselling goods – this covers goods for resale, raw materials and the direct cost of making goods.

- Legal and financial costs – You can usually claim for the hiring of accountants, solicitors, surveyors and architects for business reasons and also professional indemnity insurance premiums. You can also claim for bank, overdraft and credit card charges, interest on bank and business loans, hire purchase interest, leasing payments and alternative finance payments, for example Islamic finance.

- Marketing, entertainment and subscriptions – this includes advertising in newspapers, bulk mail advertising, free samples and website costs.

- Training courses – you can claim for most business courses, particularly if they are refresher courses for skills you already have.

How to understand if I can claim something as a business expense?

If an expense you want to claim doesn’t fall into categories above and you want to fully understand if an expense will be allowable, it’s useful to consider the following three rules.

Rule №1 – Wholly and Exclusively

- The expense must be wholly and exclusively for the purposes of carrying on that particular business. If it’s not, it won’t be allowed.

- If an expense is partly for the business and partly non-business then the business part must be separately identifiable – otherwise the deduction won’t be allowed. A good example is a motoring expense: if you’re using your vehicle for private and business purposes HMRC will accept a detailed mileage log showing your business journeys as evidence to support an expense claim for business mileage.

Rule №2 – Capital vs Revenue

- This can get complicated! An expense will generally only be allowed if it’s revenue expenditure and not capital expenditure.

- The definition of what is capital and revenue is a tricky area of tax law but generally capital is defined as something of enduring benefit to your business – HMRC tends to say anything that will last in your business more than 2 years could be capital.

- Something is revenue expenditure if it’s an expense incurred as part of producing goods or services that your business provides (stock, materials etc.) or an expense incurred on items that are consumed to produce your business profits (energy, rent etc.).

- To make things even more complicated, something that’s capital for one business might be revenue for another. For example a van would be a capital expense for a builder but a revenue expense for a van dealer as it would be part of his stock. That’s why you should get professional advice if you’re not sure.

Rule №3 – It can’t be specifically disallowed by legislation

- There aren’t too many expenses that are specifically disallowed, so the two rules above are the best guide. However, there are a couple of things you need to watch out for: entertainment and gifts (although some small gifts are allowed).

Keep track of your expenses

One final note for you: keep a record of all your business expenses – you don’t need to include proof of your expenses when you submit your tax return, but you may need to show it to HMRC if asked.

What are some other expenses I can claim?

Some of the other expenses you can claim include capital allowances, working from home expenses and simplified expenses.

Are capital expenses tax deductible?

You can claim capital expenses if you are using traditional accounting (also known as accrual or invoice accounting). Capital expenses apply when you buy something to keep for use in your business such as:

- Equipment

- Machinery

- Business vehicles, for example cars, vans, lorries

If you are using cash accounting for your business then you would claim these as allowable expenses.

What expenses can I claim when working from home?

You may be able to claim a proportion of the costs you have incurred while working from home such as:

- Heating

- Electricity

- Council tax

- Mortgage interest or rent

- Internet and telephone use

However you need to use a reasonable method of dividing the costs between personal and business usage, i.e. the number of rooms in your home you use for the business or the amount of time you spend working from home.

If you are a sole trader working from home, you can try our free work from home calculator to calculate your tax relief.

What if I use an item for both personal and business, like my mobile phone?

Using something other than your home for dual purpose means you have to still proportion the cost between both. For example you’d need to break your mobile phone calls down between personal and business, and only claim for the business usage. For example if 40% were business calls out of a £100 mobile phone bill, £40 is your allowable expense.

This is all really complicated! Is there a simpler way?

Simplified expenses can be used by either sole traders or business partnerships that have no companies as partners. The types of expenses are based on a flat rate for business costs for some vehicles, working from home and living in your business premises. To use simplified expenses you need to keep records of your business expenditure as you work. For example, the business miles you use on your personal car or how many hours you work from home. At the end of the year, you then use flat rates supplied by HMRC to calculate your expenses. You can view the current flat rates on gov.uk.

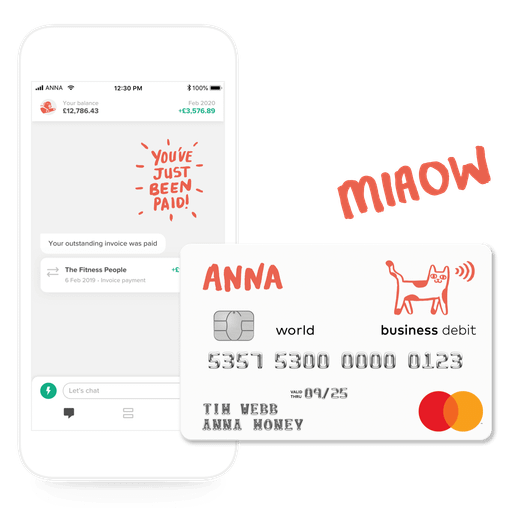

Open a business account in minutes