Discover how to start an IT business with clear steps on setup, clients, and tools so you can launch confidently and grow your tech services fast.

As companies of all sizes adopt new digital tools, move to the cloud, and strengthen their cybersecurity, there’s a growing need for reliable technical expertise.

From helping small businesses manage their networks to building software solutions for startups, the opportunities for IT businesses are diverse, scalable, and often highly profitable.

Whether you want to provide web development, cybersecurity, cloud consulting, or remote IT support, this guide will help you understand how to start an IT business.

Key takeaways

- Outsourcing IT is more common than ever before

With cybersecurity risks growing, many businesses rely on external experts to stay secure, compliant, and efficient. - Setting up your business properly from the start can help you later

Choosing the right structure, registering with Companies House, and having insurance protects you from legal, financial, and compliance risks while boosting your professional image. - Starting an IT business is affordable and scalable

Typical setup costs range from about £1,300 to £3,700, with ongoing monthly expenses manageable even for solo entrepreneurs. - Getting clients starts with visibility and trust

Designing a simple portfolio site, networking, offering small introductory projects, and collecting testimonials can help you land your first paying customers. - ANNA simplifies setup, finances, admin, and compliance

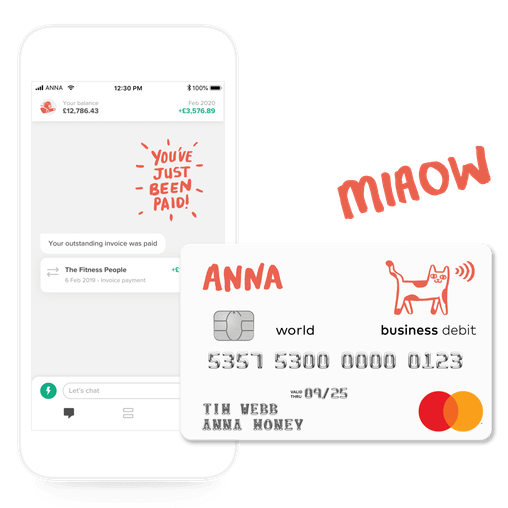

If you want to launch your IT business without drowning in paperwork, ANNA can register your company, manage invoicing and expenses, automate admin, and keep your finances tax-ready.

Why start an IT business now?

IT is one of the most consistently growing sectors because digital transformation isn’t a trend – for many UK businesses, it’s a necessity. So, if you launch your IT business now, you’ll enter at a time of real momentum.

Here’s what’s going on in the market:

- Cloud adoption is skyrocketing. Around 56% of UK small businesses now use at least one cloud-based service, up from about 35% just five years ago.

- Technology adoption, including cloud systems and software tools, is rising rapidly. In 2023, a broad survey found that 69% of businesses had adopted cloud‑based computing systems or applications, with 61% adopting specialised software.

- Remote and hybrid working models are quickly becoming the standard. A recent industry report highlights that many UK companies now rely on managed IT and cloud infrastructure to support these flexible work arrangements, creating demand for external IT support, secure setups, and remote‑friendly solutions.

These trends reflect a shift in how businesses use technology, from optional convenience to critical infrastructure. That shift fuels sustained demand for IT services.

Why do businesses outsource IT?

Outsourcing IT allows businesses to access expert skills, maintain security, and reduce costs.

Many companies don’t have the resources or expertise to manage IT internally. Also, security concerns and compliance needs are mounting. According to a recent survey, around 43% of UK businesses reported a cybersecurity breach or attack in the past 12 months.

With the rising complexity of IT, including hybrid clouds, multiple platforms, and remote endpoints, many companies now prefer to rely on external experts to keep systems updated, secure, and compliant.

By outsourcing IT, businesses can ensure their technology runs smoothly while freeing up time and resources to focus on growth and strategic priorities. And in turn, this growing demand presents a strong and sustainable market opportunity for IT providers.

How to start an IT business: A complete guide

Starting an IT business may seem nerve-wracking at first, but with the right guidance and tools, you can turn your technical skills into a thriving company.

Step 1: Register your business

Before you start offering IT services, it’s important to register your business with Companies House. Setting up correctly from the beginning will help you look professional, win clients, and avoid unnecessary risks, such as legal penalties, tax issues, and financial mismanagement.

When it comes to business structures, here are the most common choices:

| Business Structure | Description | Key Points |

| Sole Trader | Set up quickly and simply; ideal for one-person consultancies or freelance IT contractors | You assume personal responsibility for all business liabilities. |

| Limited Company (LTD) | Set up professionally with tax efficiency; suitable for agencies or recurring contracts | It allows you to protect personal assets and simplify working with corporate clients. |

| Partnership | Set up jointly with one or more co-founders or business partners | You are required to share profits, losses, and liabilities with clear agreements. |

Tip: You can register your business quickly with ANNA, so your company setup, business account, and basic admin are handled in a single, simple process.

Step 2: Get the right licences and insurance

Even if you don’t need special licences to start an IT business, protecting yourself with the right insurance and following basic rules is essential. This keeps you safe from unexpected problems and increases your credibility with potential clients.

For insurance, make sure you have:

- Professional Indemnity Insurance: If a client loses money because of advice, services, or software you provide, this insurance covers you. It’s especially important for consultants or developers.

- Public Liability Insurance: If someone gets hurt or property is damaged as a result of your work, this insurance will help. For example, if a client trips over your laptop cable, you’re covered.

- Cyber Liability Insurance: If you handle sensitive client data or manage IT security, this insurance covers losses from hacks, data breaches, or cyber attacks.

- Equipment Insurance: If you have a lot of equipment, this insurance can be a lifesaver. It protects your laptops, servers, or other tech gear from theft, loss, or accidental damage.

Licences and legal compliance

Most IT businesses don’t need special licences, but there are rules and standards to follow:

- General Data Protection Regulation (GDPR): If you handle personal information (such as client contact details or employee records), you must keep it secure and comply with UK privacy laws.

- Cybersecurity Certifications: Qualifications like Cyber Essentials or ISO 27001 show clients that you take security seriously. This can help you win bigger contracts.

- Disclosure and Barring Service (DBS) Checks: If you provide IT services in schools, in hospitals, or to vulnerable groups, you’ll need a background check.

Step 3: Plan your finances

Starting an IT business is relatively affordable compared to many other sectors. Your highest costs are usually equipment, software, and marketing, while ongoing expenses remain manageable.

Understanding your startup and monthly costs is key to setting appropriate pricing:

IT business setup costs

When it comes to the initial costs, here’s what you can expect:

| Expense | Description | Estimated Cost |

| Laptop/Workstation + Peripherals | A reliable laptop or desktop, monitor, keyboard, and accessories for your IT work | £1,000–£2,500 |

| Software & Cloud Services | IDEs, antivirus, backup, cloud hosting, and productivity tools | £20–£200/month |

| Website, Branding & Marketing Setup | Domain, hosting, website template, logo design, initial marketing materials | £100–£500 |

| Insurance & Business Registration | Professional indemnity, public liability, cyber insurance, plus registration costs | £150–£500 |

| Miscellaneous | Other small startup costs, like office setup, training, or minor tools | £50–£200 |

In total, you can expect to spend around £1,300–£3,700 when starting out.

Ongoing costs

Your ongoing costs will depend on different factors, such as whether you’re a freelancer or an agency. These are the main expenses for any IT provider:

| Expense | Description | Estimated Cost/Month |

| Software & Cloud Subscriptions | Ongoing licenses, hosting, cloud storage, project management tools | £20–£200 |

| Accounting & Admin Tools | Bookkeeping software, invoicing tools, business banking | £0–£30 |

| Marketing & Advertising | Social media ads, Google Ads, email campaigns, flyers | £50–£300 |

| Contractor/Freelancer Payments | Optional, if you scale or outsource certain tasks | £200–£2,000 |

| Insurance | Ongoing premiums for liability, indemnity, or cyber coverage | £10–£30 |

| Miscellaneous | Office supplies, backup storage, small tools | £10–£50 |

Depending on the scale of your marketing and software needs and whether you work solo or hire contractors, you can expect to spend around £290–£2,610 per month.

How to price your IT services

When setting your rates, consider your costs, expertise, and the type of service you offer. Here are the most common pricing models:

- Hourly Rate: This structure is common for freelance IT support or consultancy. It is typically £25–£120 per hour, depending on expertise.

- Project-Based Pricing: This type of pricing is ideal for fixed-scope development, migrations, or IT setup projects. It often ranges from £300–£5,000+ per project.

- Retainer/Subscription: This model is perfect for ongoing IT support or managed services. Monthly fees typically range from £150–£1,500 per month.

IT services tend to have healthy margins, especially when overheads are low and recurring revenue (retainers or subscriptions) is established.

Step 4: Get your first clients

With the right approach, landing your first clients is entirely achievable without spending a fortune. In IT, clients value reliability, competence, and clear communication, so your first steps should focus on visibility and trust.

Here are some practical strategies:

- Build a simple portfolio website: Showcase any prior work, including personal or demo projects, with screenshots, project descriptions, or case studies to demonstrate your skills.

- Leverage LinkedIn and tech networks: Share your expertise, comment on discussions, and connect with potential clients in your niche.

- Offer an initial ‘audit’ or small project: Provide a low-risk opportunity for clients to test your services and help you build credibility.

- Collect testimonials and referrals: Gather positive feedback from early clients to boost your credibility.

- List services on freelance platforms or B2B marketplaces: Use platforms like Upwork, Freelancer, or specialised IT marketplaces to get noticed if you’re starting without a brand.

Tip: Deliver quality work consistently, and referrals will soon follow.

Step 5: Streamline your workflow

Using the right tools and automation can save hours of work each week and help your IT business scale smoothly. Key areas to consider include:

| Purpose | Recommended Tools | Why It Helps |

| Accounting & Invoicing | ANNA | Track expenses, send invoices, and manage taxes easily |

| Project Management & Support | Trello, Asana, Jira | Organise tasks, track projects, and manage multiple clients efficiently |

| Client Relationship Management (CRM) | HubSpot, Zoho, or similar | Keep track of leads, clients, contracts, and follow-ups |

| Cloud Hosting & Backups | AWS, Google Cloud, Azure | Deploy, host, and securely back up client systems |

| Automated Admin Workflows | ANNA | Automate invoice reminders, expense tracking, and reporting to reduce manual work |

Step 6: Stay compliant

Understanding your tax and accounting obligations from the start is essential for compliance and ease of mind. Here’s what you need to know:

1. Sole Traders: Submit a Self Assessment each year (and be aware that rules for Self Assessment will change in 2026), and pay Income Tax plus National Insurance on your profits.

2. Limited Companies (LTD): Pay Corporation Tax on profits. If you take a salary, PAYE applies, and any dividends are taxed separately. Proper bookkeeping ensures you stay compliant and understand your profits.

3. VAT Registration: Register for VAT and account for it in your invoices and bookkeeping if your turnover exceeds the current VAT threshold (£90,000).

4. Record-keeping: Maintain organised invoices, receipts, and expense records. Using accounting software like ANNA simplifies this process, especially as your business grows or you hire contractors.

Staying on top of paperwork from day one prevents headaches later and keeps your business running smoothly.

Kickstart your IT business today with ANNA

Starting your IT business has never been easier. With ANNA, you can:

- Register your business with ease – Handle everything with little to no effort

- Keep your finances organised – Manage invoicing and expenses within one platform

- Stay on top of taxes and compliance – Track VAT, prepare for Self Assessment or Corporation Tax, and generate reports automatically

- Set up a professional virtual office – Get a business address without extra overhead

- Automate admin tasks – Schedule invoice reminders, categorise expenses, and streamline reporting

- Track your cash flow in real time – See incoming payments, upcoming bills, and overall financial health at a glance

- Access support whenever you need it – Get guidance from experts on accounting, compliance, and business growth

- Join over 100,000 UK businesses – Benefit from a trusted platform used by thousands of entrepreneurs.

Take the leap today – with ANNA managing the paperwork and finances, you can launch your IT business confidently and start turning your skills into profit immediately.

Read the latest updates

You may also like

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)

![How to Start a Self-Employed Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_fe5b6edef1/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_fe5b6edef1.webp)

![How to Start an Electrician Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_How_to_Start_a_Car_Detailing_Business_Successfully_74488a6268/small_Cover_3000_How_to_Start_a_Car_Detailing_Business_Successfully_74488a6268.webp)

![How to Start a Currency Exchange Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_daad2f9e2a/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_daad2f9e2a.webp)

![How to Start a Graphic Design Business in 2026 [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_How_to_Start_a_Graphic_Design_Business_in_2025_d8d412cdf5/small_Cover_3000_How_to_Start_a_Graphic_Design_Business_in_2025_d8d412cdf5.webp)