Congratulations, you have registered your new limited business on Companies House! The next step is registering for the Corporation Tax.

- In this article

- What is CT41G form?

- What do I need to report to HMRC after registering the company?

- Where to start registering for Corporation Tax?

- Once you’ve got a user ID and can access your Government Gateway, what’s next?

- What taxes will your new business need to pay?

- What if I am late filing my company tax return?

What is CT41G form?

After registering, Companies House will automatically inform HMRC of your new company details.

Within approximately three weeks of the new business being incorporated, HMRC will send you a letter which includes a CT41G form confirming your company’s unique tax reference number (UTR). CT41G is a document issued by HMRC which declares that a company is a UK resident for tax purposes. It is issued to newly incorporated companies or those that have changed their status so that they can prove to HMRC that they are a UK resident company. Make sure you keep UTR number safe as you will require it to complete your tax returns and to communicate with HMRC...

What do I need to report to HMRC after registering the company?

You will need to provide HMRC the following information on the CT41G form relating to the trading activities of your business:

- The date your company accounts are made up to

- Your full company name and registration number

- The date your business started trading

- The main trading address where day to day business is carried out

- The type of business activities carried out

If you have not received your company UTR letter within 2 months of registering your business, please contact HMRC as you have to register for Corporation Tax within 3 months of starting to do business.

Where to start registering for Corporation Tax?

In order to register for Corporation Tax online you first need to sign in to the Government Gateway for your business. If you do not have a user ID, you can create one on the government website.

Once you’ve got a user ID and can access your Government Gateway, what’s next?

It is time to start considering the taxes your business will have to pay.

What taxes will your new business need to pay?

This will depend on a couple of factors, but all limited businesses pay Corporation Tax on their business profits at the end of their financial year.

Corporation Tax

All limited businesses must pay Corporation Tax; this is a tax on the businesses' taxable profits. Taxable profit is the money the business makes from doing business (known as trading profits), investments and the profits made from selling assets for more than they cost (chargeable gains).

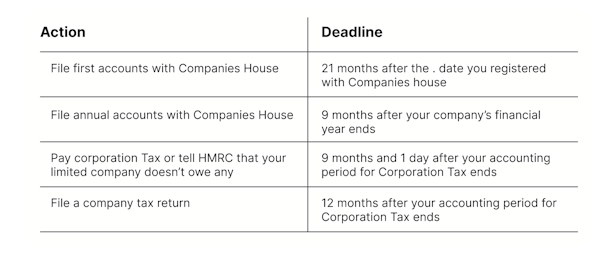

Once you’ve been trading and you come to the end of your first financial year, you need to prepare:

- Your annual accounts

- A company tax return

You are required to file these with Companies House and HMRC within specific deadlines. Here’s a handy guide:

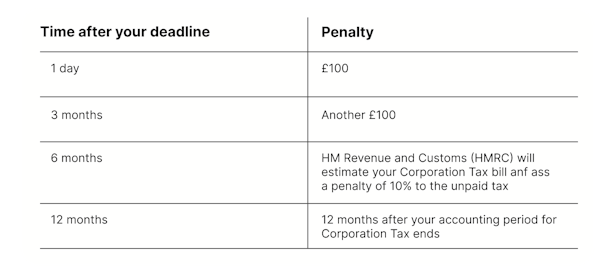

What if I am late filing my company tax return?

Being late with your filings can mean you receive penalties from HMRC. These are as follows:

Bear in mind if your tax return is late 3 times in a row, each £100 penalty is increased to £500.

Don't forget to check! Your new business might also be eligible to pay additional taxes including:

- Value Added Tax (VAT)

- Employer National Insurance contributions

- Personal tax payments for limited company directors

Open a business account in minutes