How to register a business in the UK [The Comprehensive Guide]

All the steps you need to take in order to register and start doing business in the UK.

Starting a business in the UK is an exciting venture, and understanding the registration process is crucial to setting a solid foundation. There can be a lot of paperwork to complete when setting up a business, and different types of businesses require different levels of bureaucracy. This comprehensive guide will walk you through the necessary steps, costs, and considerations on how to register your business in the UK.

Additionally, we have numerous online tools, such as a business registration portal and accounting software, that help small businesses. With careful planning, research, and advice, it is possible to set up a profitable business in the UK. Let’s dive in.

How do I register a business?

The first step in business registration is deciding on the appropriate structure for your enterprise. In the UK, the main types are:

- Sole Trader: Ideal for individuals starting alone. It's straightforward to set u, but comes with personal liability for business debts.

- Limited Company (Ltd): A separate legal entity offering limited liability protection. It involves more administrative responsibilities but can be more tax-efficient.

- Partnership: Suitable for two or more individuals sharing responsibilities and profits. There are general partnerships and limited liability partnerships (LLPs).

For a detailed comparison, refer to our guide on sole trader vs limited company.

Have a name for your new business yet?

Check it in our free company name checker below:

Register a business as a Sole trader

What is a sole trader?

A sole trader is a person who runs their own business as an individual and is self-employed.

When do I need to set up as a sole trader?

If you earned more than £1,000 from self-employment in the financial year (in this case between 6 April 2021 and 5 April 2022), then you need to set yourself up as a sole trader. There can be additional reasons to do it, for example, if you want to claim childcare support or qualify for certain National Insurance benefits.

How do I register as a sole trader?

To set up as a sole trader, you need to let HMRC know that you pay tax through self-assessment. Then you’ll need to file a self-assessment tax return every year.

Do sole traders need to register with Companies House?

No, you don’t need to register with Companies House.

As a sole trader, what records should I keep?

You’ll need to:

- Keep business records of sales, income, and records of your expenses

- File a self-assessment tax return every year

- Pay Income Tax on your profits

- Class 2 and Class 4 National Insurance – you can use HMRC’s calculator to help you budget for this

Can I claim business expenses?

If you’re self-employed (aka a sole trader), your business will have various running costs. You can deduct some of these costs to work out your taxable profit, as long as they’re allowable expenses. You can find out more about what can be claimed as an expense in our blog post.

As a sole trader, do I have to pay tax and National Insurance?

Yes, you pay tax and National Insurance on your self-employed profits. You’ll do this at the same time as you pay tax on all of your other income via a Self Assessment system.

What is self-assessment?

Self-assessment is a system HM Revenue and Customs (HMRC) uses to collect Income Tax. Your tax and National Insurance contributions are calculated on your self-assessment form and then need to be paid to HMRC.

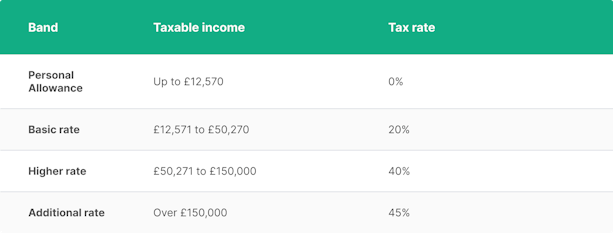

How much is income tax?

The amount of income tax you pay will depend on your salary and your personal tax allowance. The standard personal tax allowance is currently £12,570 per tax year, which is what you can earn before you start to pay tax. The more you earn, the more tax you pay. For example, see the chart below.

When do I have to pay HMRC?

The deadline for paying your tax bill is usually 31 January. That’s for any tax you owe for the previous tax year (so on 31 January 2026, you’d pay tax for the year 2024-2025).

You may well also have to make a payment on account, which means you pay some of the next year’s taxes in advance.

Your payment on account is normally split across the year, and the 31st of July is the deadline for your second payment on account.

How do I pay HMRC?

You can pay in a lump sum, or you can make weekly or monthly payments towards your bill if that’s easier for you. You can also now pay your Self Assessment bill through the HMRC app.

If you’re struggling to pay your tax bill on time, you can contact HMRC, and they can try to arrange a schedule that works for you.

When should I expand my business?

There’s no set answer as it’ll be affected by different factors. You may decide that a different structure, like an LTD company or a partnership, will suit you better.

Factors include:

- tax advantages;

- any particular growth plans you may have, and

- whether you’re looking to gain specific legal protections.

It’s best to ask yourself the following questions:

- What are the short, medium and long-term goals you have in mind for your business?

- How do you want to generate income? Will this be via dividends, or are you looking to generate income return through the eventual sale of your business?

- What impact would your chosen structure have on the taxation of your business and on you?

- How much will it cost you to set up and maintain the structure you’ve chosen?

- Will your chosen structure affect your personal liability? Will your personal assets be at risk?

Sole Trader FAQs

How should I register as a sole trader?

To set up as a sole trader, you need to tell HMRC that you pay tax through self-assessment. You’ll need to file a tax return every year.

What tax does a sole trader pay?

You’ll pay tax on your profits and National Insurance.

Can a sole trader have employees?

Yes, sole traders can have employees as long as they (the sole trader) remain the sole owner of the business

Do I need a business account as a sole trader?

No, you don’t legally need to have a separate business bank account when you're a sole trader, but it is a very good idea. Trying to separate your business costs from your personal ones can get messy if all your payments are from one account. It’s much harder to keep records and keep track of everything. ANNA business account is well tailored to the needs of sole traders.

Do I need an accountant as a sole trader?

You don’t need an accountant as a sole trader, but they might be useful in making sure you’re meeting all your tax obligations. You can use apps like ANNA to keep on top of your business and tax obligations. We will remind you to take pictures of your receipts, send and chase invoices, categorise transactions and much more.

Do sole traders pay corporation tax?

No. Sole traders or partnerships don’t pay corporation tax.

Do sole traders have limited liability?

No. As a sole trader, you have unlimited liability, which means that if your business gets into debt, you’re personally liable.

Do sole traders need public liability insurance?

Sole traders aren't required by law to have public liability insurance in the UK, but it can definitely be useful.

How do you pay tax as a sole trader?

You pay tax to HMRC via a self-assessment form.

What expenses can I claim as a sole trader?

Being self-employed means your business will have various running costs. You can deduct some of these (allowable) costs to work out your taxable profit. Examples of these are office costs, travel costs, advertising, training courses, etc. You can find out more about what can be claimed as an expense in the blog post.

Do sole traders pay VAT?

If your business turnover is under £85,000, you won’t be liable for VAT. If your turnover is over £85,000 (or you think it’ll go over that amount soon), you’ll need to register for VAT. You can find out more about VAT in our blog post.

Does IR35 apply to sole traders?

No. IR35 doesn’t affect sole traders – it only applies to incorporated companies.

Do sole traders have a company registration number?

No, they’re not registered companies.

What is a UTR number?

It is your Unique Tax Reference number issued to you when you register as self-employed with HMRC. It will remain the name number for your lifetime!

How do I get a UTR number?

You need to register with HMRC on the Government Gateway. You’ll be issued with a user ID and password. Once you’ve registered, you will be issued a UTR in around 10 days.

Register a business as a Limited company

What is a limited company?

Setting up a limited company means you limit the amount of liability undertaken as a shareholder of the company. It means that the company, not you personally, is liable for any debts. That’s why it’s called ‘limited’.

How do I set up a limited company?

You can register a company online using the ANNA formation service for free, or you can register a business directly on the Companies House and pay £12.

How much does it cost to set up a limited company?

It’s free if you open it with the ANNA company registration tool, and you also get a business bank account that gives you all the tools to run your business, from invoicing to expenses. Alternatively, you can register a business online with Companies House for £12. Postal registrations normally cost £40, though you can pay £100 for a same-day postal registration if that’s what you want.

How long does it take to set up a limited company?

Your company is usually registered within 24 hours if you register online. Postal registrations can take up to 10 days.

What are an LTD company’s directors' responsibilities?

As a director of a limited company, you need to:

- follow the company’s rules, which are shown in its articles of association

- keep company records and report changes

- file your accounts and your Company Tax return

- tell other shareholders if you might personally benefit from a transaction the company makes

- pay Corporation Tax

The full list of responsibilities is on the HMRC website.

What are the Memorandum and articles of association?

A memorandum of association is a legal statement signed by all initial shareholders or guarantors agreeing to form the company. Articles of association are the written rules about running the company agreed by the shareholders or guarantors, directors and the company secretary. You can find out more on the gov.uk website.

Is there a Memorandum of Association template?

Yes. There’s a handy online template for writing the Memorandum of Association.

Are there articles of association my company can use?

All limited companies must have articles of association. These set the rules company officers must follow when running their companies. “Model” articles of association are the standard default articles a company can use. They are prescribed by the Companies Act 2006, and you can find them on the gov.uk website.

What company and accounting records do I need to keep?

Limited companies need to keep accurate, up-to-date records. With the introduction of Making Tax Digital, this is increasingly important.

You’ll need to keep:

- Records about the company itself

- Financial and accounting records

What records about the company should I keep?

You also need to keep records of:

- Directors, shareholders and company secretaries

- The results of any shareholder votes and resolutions

- Promises for the company to repay loans at a specific date in the future (‘debentures’) and whom they must be paid back

- Promises the company makes for payments if something goes wrong and it’s the company’s fault (‘indemnities’)

- Transactions occur when someone buys shares in the company

- Loans or mortgages secured against the company’s assets

What is a register of ‘people with significant control’?

You also need to keep a register of ‘people with significant control’ (PSC). A PSC is someone who:

- Has more than 25% shares or voting rights in your company

- Can appoint or remove a majority of directors

- Can influence or control your company or trust

What accounting records do I need to keep?

Your accounting records must include:

- all money received and spent by the company, including grants and payments from COVID-19 support schemes

- details of assets owned by the company

- debts the company owes or is owed

- stock the company owns at the end of the financial year

- the stocktakings you used to work out the stock figure

- all goods bought and sold

- who you bought and sold them to and from (unless you run a retail business)

You must also keep any other financial records, information and calculations you need to prepare and file your annual accounts and Company Tax return.

This includes records of:

- all money spent by the company – for example, receipts, petty cash books, orders and delivery notes

- all money received by the company, for example, invoices, contracts, sales books and till rolls

- any other relevant documents, for example, bank statements and correspondence

How long should a limited company keep records for?

You need to keep records for 6 years from the end of the last company financial year they relate to (this is known as 6 years +1).

What to do if your records are lost, stolen or destroyed

With the government’s introduction of Making Tax Digital (MTD), you should be keeping digital copies of any records, in case any original paper documents are lost or destroyed. But if you can’t replace your records after they were lost, stolen or destroyed, you need to:

- do your best to recreate them

- tell your Corporation Tax office straight away

- include this information in your Company Tax return

What accounts and tax returns does my limited company need to do?

After the end of its financial year, your private limited company must prepare:

- full (‘statutory’) annual accounts

- a Company Tax return

You’ll need your accounts and tax return so you can meet deadlines for filing with Companies House and HM Revenue and Customs (HMRC).

You can also use them to work out how much Corporation Tax to pay.

What are my annual accounts?

Your company’s annual accounts are also known as your ‘statutory accounts’. They’re prepared from the company’s financial records at the end of your company’s financial year.

You must send copies of the statutory accounts to:

- all shareholders

- people who can go to the company’s general meetings

- Companies House

- HM Revenue and Customs (HMRC) as part of your Company Tax return

You’ll have different deadlines for sending your accounts to Companies House and your tax return to HMRC, but you may be able to send them at the same time.

What is a Company Tax return?

Your limited company must file a Company Tax return if you get a ‘notice to deliver a Company Tax return’ from HMRC.

When you file your tax return, you work out your:

- profit or loss for Corporation Tax (this is different from the profit or loss shown in your annual accounts)

- Corporation Tax bill

The deadline for your Company Tax return is 12 months after the end of the accounting period it covers. It’s worth remembering that you still have to file a return if you make a loss or have no Corporation Tax to pay.

What do limited companies do about tax and National Insurance?

Limited companies don't pay income tax or direct National Insurance. Instead, they pay a tax based on their business profits, minus any allowable expenses and salaries. This is known as Corporation Tax.

What about salary, expenses and benefits?

If you want the company to pay you (or anyone else) a salary, expenses or benefits, you need to register a business as an employer.

When you make salary payments, the company has to take Income Tax and National Insurance contributions from these payments and pay them to HMRC along with any employers’ National Insurance contributions.

If you (or one of your employees) make personal use of something that belongs to the business, you also need to report it as a benefit and then pay any tax due.

What are dividends?

A dividend is a payment a company can make to shareholders if it has made a profit. Be aware that you cannot count dividends as business costs when you work out your Corporation Tax.

Note: your company can’t pay out more in dividends than its available profits from current and previous financial years.

How does a company pay a dividend?

To pay a dividend, you must:

- hold a directors’ meeting to ‘declare’ the dividend

- keep minutes of the meeting, even if you’re the only director

For every dividend payment the company makes, you need to write up a dividend voucher showing the:

- date

- company name

- names of the shareholders being paid a dividend

- amount of the dividend

You then have to give a copy of the voucher to recipients of the dividend and also keep a copy for your company’s records.

Is there a tax on dividends?

Your company doesn’t need to pay tax on dividend payments. But shareholders may have to pay Income Tax if the dividend is over £2,000.

What are directors’ loans?

If you take more money out of a company than you’ve put in – and it’s not salary or dividend – this is called a ‘directors’ loan’. If your company makes directors’ loans, you have to keep records of them. There are also some detailed tax rules about how directors’ loans are handled.

What about changing my company’s registered office address?

You have to inform Companies House if you want to change your company’s registered office address. If the change is approved, they’ll tell HMRC.

Your company’s new registered office address must be in the same part of the UK that the company was registered (incorporated). For example, if your company was registered in England and Wales, the new registered office address must be in England or Wales.

Your address won’t officially change until Companies House has registered it.

What other changes do I have to report?

You must tell HMRC if:

- your business’ contact details change – for example, your name, gender, business name or your personal or trading address

- you appoint an accountant or tax adviser

You must tell Companies House within 14 days if you make changes to:

- the address where you keep your records, and which records you keep there

- directors or their personal details, like their address

- ‘people with significant control’ (PSC), or their personal details like a new address

- company secretaries (appointing a new one or ending an existing one’s appointment)

You must also tell Companies House within a month if you issue more shares in your company.

How do I report changes to Companies House

You can:

- use the Companies House online service

- fill in and send paper forms

What are the changes that shareholders must approve?

You may need to get shareholders to vote on the decision if you want to:

- change the company name

- remove a director

- change the company’s articles of association

This is called ‘passing a resolution’. Most resolutions will need a majority to agree (called an ‘ordinary resolution’). Some might require a 75% majority (called a ‘special resolution’).

Companies House has more details about the types of changes and resolutions you must report to them.

Your new company name won’t take effect until it’s registered by Companies House – they’ll tell you when this happens.

What about shareholder voting?

When you’re working out whether you have a majority, count the number of shares that give the owner the right to vote, rather than the number of shareholders.

You don’t necessarily need to have a meeting of shareholders to pass a resolution. If the right number of shareholders have told you they agree, you can confirm the resolution in writing. But you must write to all shareholders to let them know about the decision.

What’s a confirmation statement?

Every year you need to check that the information Companies House has about your company is correct. This is called a confirmation statement. You need to send a confirmation statement even if no information has changed.

You need to check:

- the details of your registered office, directors, secretary and the address where you keep your records

- your statement of capital and shareholder information if your company has shares

- your SIC code (this is the number that identifies what your company does)

- your register of ‘people with significant control’ (PSC)

You can send your confirmation statement online or by post. It costs £13 to file your confirmation statement online and £40 by post.

You can find out more about the confirmation statement in our blog post here.

What tax does a limited company pay?

It’s important to understand how much money you should aim to set aside so you can settle your tax bill each year.

- Corporation Tax

- Value Added Tax (VAT)

- Employer National Insurance Contributions

- Personal tax payments for limited company directors

What about personal Tax Payments For limited company directors?

Limited companies are required to pay Corporation Tax, VAT and Employer National Insurance Contributions – but it doesn’t stop there. Company directors should also be aware of their personal tax liabilities that come from taking a salary and withdrawing dividends as a director of a limited company.

Personal tax payments include:

- Income Tax

- Dividend payments

- National Insurance Contributions

- Capital Gains Tax

How do I pay myself from a limited company?

Most directors will choose to pay themselves a small salary from the business. To do this, the company must be registered with HMRC, and you’ll need to make sure that any tax, National Insurance (both employee and employer), is deducted and paid to HMRC. Although you have a choice of how to pay yourself and it will really depend on your business.

Does a limited company have to be VAT registered?

No. You won’t be liable to register for VAT if your business turnover is under £85,000. If you think your company will go over this threshold, you’ll need to register for VAT.

Do I have to put my company name on signs?

You have to display a sign showing your company name at your registered company address and wherever else your business operates. Don’t worry – if you’re running your business from home, you don’t need to display a sign there.

What about stationery and promotional material?

You also have to include your company’s name on all company documents, publicity and letters.

On business letters, order forms and websites, you need to show:

- the company’s registered number

- its registered office address

- where the company is registered (England and Wales, Scotland or Northern Ireland)

- the fact that it’s a limited company (usually by spelling out the company’s full name including ‘Limited’ or ‘Ltd’)

If you want to include directors’ names, you must list them all.

If you want to show your company’s share capital (how much the shares were worth when you issued them), you must say how much is ‘paid up’ (owned by shareholders).

Register a business as a Partnership

What is a partnership?

There are two main types of partnerships:

- Limited Partnerships

- Limited Liability Partnerships (LLPs)

Limited Partnership (LP) consists of two or more partners, who can be individuals or corporate entities (such as another company or LLP). The partners can be located in any country around the world, but the partnership must have a principal place of business in the UK. This is similar to a UK company having a registered office.

In a Limited Partnership, there are 2 types of partners, and they have different roles and responsibilities. Each LP must have at least one General Partner AND one Limited Partner.

Limited Liability Partnerships (LLPs) – allow for a partnership structure where each partner's liabilities are limited to the amount they put into the business. Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labour. In an LLP, each partner is not responsible or liable for another partner's misconduct or negligence.

Where do I register as a partnership?

You can register as a partnership online on the gov.uk website.

What can I name my partnership?

You can trade under your own names, or you can choose another name for your business. You don’t need to register your name.

You must include all the partners’ names and the business name (if you have one) on any official paperwork, for example, invoices and letters.

Are there any limits on partnership names?

Business partnership names must not:

- include ‘limited’, ‘Ltd’, ‘limited liability partnership, ‘LLP’, ‘public limited company’ or ‘plc’

- be offensive

- be the same as an existing trade mark

What taxes does a partnership pay?

You have to register your partnership for Self Assessment with HM Revenue and Customs (HMRC) if you’re the ‘nominated partner’. This means you’re responsible for sending the partnership tax return.

The other partners will need to register separately.

All partners also need to send their own tax returns as individuals.

You must register by 5 October in your business’s second tax year, or you could be charged a penalty. For example, if you started a partnership or became a partner during the 2024 to 2025 tax year, you must register before 5 October 2025.

Are there other ways to register?

If you can’t register online, you can also register the partnership using form SA400. You can then register as a partner using form SA401.

Does a partnership have to register for VAT?

No. You have to register for VAT if your VAT taxable turnover is over £85,000. You can choose to register if it’s below this, for example, to reclaim VAT on business supplies.

Ready to start your new business?

Get started by checking that the name is not taken yet, then feel free to proceed to registering your company with ANNA – we'll be with you every step of the way.

Open a business account in minutes