Explore how to start a currency exchange business in the UK, meet legal requirements, stay compliant, attract customers, and build trust.

The UK is full of movement – people travelling for work or holidays, businesses trading overseas, and students moving in and out.

That constant flow creates a clear need for fast and reliable currency services – and that's exactly where a currency exchange business comes in. Whether people need foreign cash for a trip, a secure way to pay international suppliers, or a simple method to send money to relatives abroad, they're all looking for convenient, good-value solutions.

With this guide, you can learn how to start a currency exchange business in the UK, turning these everyday needs into a thriving venture.

Key takeaways

- Choosing the right business structure matters

A limited company is generally the best option for currency exchange businesses, offering credibility and alignment with regulatory expectations. - Compliance is non-negotiable

Registering as a Money Service Business with HMRC, following anti-money laundering rules, verifying customer identities, and keeping accurate records are essential steps for operating legally and protecting both your business and customers. - Financial planning ensures stability

Understanding startup costs, operational expenses, and pricing strategies helps you maintain profitability, set competitive rates, and manage cash flow without surprises. - Visibility and trust drive growth

Attract customers through strategic location choices, transparent rates, professional branding, and clear communication. Building trust from day one encourages repeat business and a strong reputation. - Efficient systems make running the business easier

Proper accounting, tax management, and record-keeping can help you not only stay compliant but also streamline daily operations, reduce mistakes, and free up time to focus on growing your business.

Why start a currency exchange business now?

The demand for currency exchange is a structural feature of the UK's global mobility, trade, and travel. Even with the rise of digital payments, there are consistent patterns that keep this industry profitable:

- The Office for National Statistics (ONS) reports that UK residents made about 94.6 million visits abroad in 2024, driving demand for foreign-currency cash before travel.

- The same data show significant inbound tourism: in 2024, there were roughly 42.6 million visits to the UK by overseas residents, who spent an estimated £32.5 billion while in the country, many of whom likely needed currency exchange services upon arrival or departure.

- The UK hosts a large population of international students: in 2023/24, there were 732,285 overseas students enrolled at UK higher-education institutions, many of whom need currency exchange or remittance services.

- Regarding transfers from migrant communities, the Migration Observatory reports that a significant share of non-EU migrants regularly send money abroad from the UK, underscoring ongoing demand from migrant communities for secure exchange and transfer services.

All of these insights paint a clear picture – currency exchange businesses are as relevant as ever, and starting now allows entrepreneurs to enter a stable market.

How to start a currency exchange business in the UK: The steps explained

Running a currency exchange business includes more than simply buying and selling foreign currency. Because you'll be handling cash and carrying out regulated financial activity, you'll need to follow a clear setup process to stay compliant, protected, and ready to trade.

Below is a step-by-step guide to help you move from an idea to a fully operational business.

Step 1: Set up your business

Before you launch your currency exchange business, it's important to choose a legal structure that matches the regulatory expectations of the financial services industry. Each option comes with different levels of liability, credibility and administrative obligations:

| Business Structure | Pros | Cons | Suitability |

| Sole Trader | Quick and inexpensive to set up; simple tax reporting | Full personal liability; limited credibility with regulators and banks | Low – generally not recommended due to liability and compliance challenges |

| Partnership | Can share responsibilities and startup costs; flexible setup | Partners have shared liability; disputes can complicate operations | Moderate – possible, but still carries legal/financial risks that aren’t ideal for regulated services |

| Limited Company | Limited personal liability; stronger credibility; better aligned with regulatory expectations | More administrative work; stricter reporting requirements | High – the preferred structure for currency exchange businesses aiming for Financial Conduct Authority and HMRC compliance |

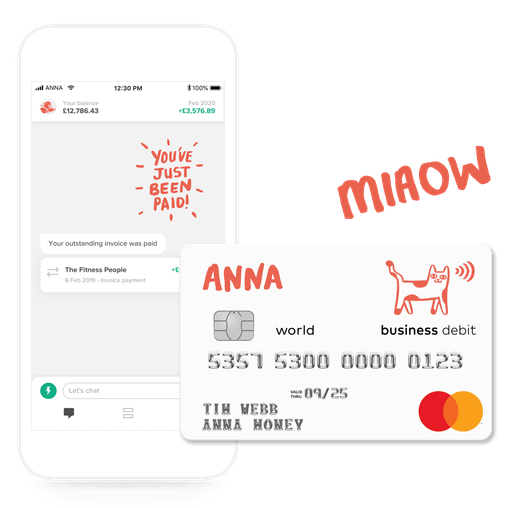

Tip: Set up your limited company quickly and effortlessly with ANNA, so you can start trading without the usual paperwork headaches.

Step 2: Handle all the legal requirements

To operate a currency exchange business legally in the UK, you must register as a Money Service Business (MSB) with HMRC and comply with all associated regulatory obligations.

Key requirements include:

- Anti-Money Laundering (AML) supervision

Register with the appropriate regulator (such as the FCA or HMRC) and follow strict anti-money laundering rules. - Customer Due Diligence (CDD) & Know Your Customer (KYC) compliance

Verify customer identities, monitor transactions, keep detailed records, and flag suspicious activity to prevent financial misuse. - Secure cash-handling procedures

Implement systems for the safe storage, transportation, and management of cash, including secure premises, CCTV, and controlled access. - Appropriate business insurance

Obtain policies such as professional indemnity, public liability, and employer's liability (if hiring staff) to protect against financial and legal risks. - Ongoing compliance, documentation & audit-readiness

Maintain up-to-date records, document procedures, and be prepared to demonstrate consistent compliance to regulators at any time.

Building these foundations early also strengthens customer confidence, enhances your professional image, and reduces the risk of regulatory issues as your business grows.

Step 3: Stay compliant

The way you handle taxes and accounting depends on your business structure. Getting it right from the start isn't just about ticking boxes – it keeps your business compliant, protects you from fines, and makes day-to-day operations a whole lot easier.

These are the main things you need to take care of:

| Category | Requirements/Actions | Tips/Details |

| Sole Trader Taxes | Pay Income Tax on profits above the personal allowance; pay Class 4 National Insurance contributions. | Calculate based on yearly profits; submit via self-assessment. |

| Limited Company Taxes | Pay Corporation Tax on company profits; pay yourself via salary or dividends; pay employer National Insurance if employing staff. | File accounts and tax returns with Companies House and HMRC on schedule. |

| VAT Registration | Register for VAT once turnover reaches the threshold (£90,000). | Confirm VAT status; apply professional advice for exemptions. |

| Transaction Records | Maintain detailed records of all trades and customer transactions. | Keep records up to date for accounting, audits, and compliance. |

| AML & Compliance Logs | Maintain anti-money laundering (AML) logs and customer due diligence records. | Ensure logs are complete and ready for regulator inspection. |

| Annual Filings | Submit annual accounts (for LTD) and tax returns on time. | Complete filings according to deadlines for your business structure. |

| Receipts & Invoices | Organise and store all receipts and invoices systematically. | Keep documentation accessible for bookkeeping, audits, and tax purposes. |

Step 4: Make a financial plan

Before starting a currency exchange business, it's important to understand both the initial investment required and the ongoing operational costs. Planning ahead ensures you have enough capital to cover startup expenses and maintain day-to-day operations.

Startup costs

Besides the obvious items like marketing materials and rent, you should also take into account regulatory fees, premises setup, equipment, and initial currency stock.

Here's what you can expect:

| Item | Estimated Cost (£) | Notes |

| Limited company registration | £50 (get £25 cashback with ANNA) | Registers you officially with Companies House |

| FCA application and supervision fees | 1,000–3,000 | Covers application and supervision for FCA requirements |

| HMRC Money Service Business registration | 50–150 | Registers for AML compliance with HMRC |

| Premises rental | 5,000–15,000 | Covers annual rent for a small shop or kiosk |

| Initial currency stock | 5,000–20,000 | Provides initial cash holdings to start trading |

| Insurance (professional indemnity, public liability) | 500–1,500 | Protects against legal and financial risks |

| Secure storage & cash-handling equipment | 1,000–3,000 | Covers safes, CCTV, cash counters, security systems |

| Branding, signage & website | 500–2,000 | Covers logo, signage, online presence, basic marketing |

Estimated total startup cost: £13,000–£45,000

Remember that these numbers are approximate and vary by location, business size, and currency holdings. Always include a contingency buffer for unexpected expenses.

Operational costs

Once your business is up and running, you'll need to budget for regular, ongoing expenses to keep operations smooth and compliant.

This is what you should plan for:

| Item | Estimated Monthly Cost (£) | Notes |

| Staff salaries | 1,500–5,000 | Covers wages for employees |

| Premises utilities | 200–500 | Covers electricity, water, and internet |

| Accounting/bookkeeping software | 30–100 | Provides software for managing accounts and records |

| Security systems | 50–200 | Covers CCTV, alarms, and monitoring equipment |

| FCA annual supervision fee | 200–1,000 | Covers mandatory compliance with FCA regulations |

| Cash transport services | 100–500 | Covers secure transport of cash, if required |

Estimated monthly operational cost: £2,080–£7,300

Having a clear understanding of both startup and operational costs helps you plan pricing strategies and profit expectations.

Pricing and profit margins

Revenue in a currency exchange business primarily comes from the spread between the buying and selling rates – the difference between the rate you pay to acquire foreign currency and the rate at which you sell it to customers.

You can also earn additional income through service fees for transactions, particularly for online or premium services.

Here are some tips for setting rates effectively:

- Understand market rates: A great way to ensure your prices are competitive but profitable is to track interbank and wholesale rates daily.

- Adjust spreads by currency: High-demand currencies (like euros or dollars) can have narrower spreads due to competition, while exotic or less commonly traded currencies may justify wider spreads.

- Consider location and footfall: Shops in tourist areas, airports, or transport hubs can charge slightly higher spreads because of convenience and accessibility.

- Use service fees strategically: Small fixed fees per transaction can supplement profits without affecting customer perception, particularly for large amounts or fast delivery services.

By combining competitive spreads with smart service fees and location-aware pricing, a well-run currency exchange business can achieve healthy margins while attracting repeat and high-volume customers.

Step 5: Find your customers

People choose currency exchange businesses that are reliable, accessible, and clearly offer value, so your goal is to make that obvious from the start.

Here are four ways to draw people in:

1. Choose a good location

Position your shop or kiosk in high-footfall areas such as train stations, airports, retail centres, or districts popular with international visitors. Consider your proximity to hotels, hostels, and travel agencies, where people are actively looking for foreign currency services.

2. Highlight your rates

Clearly display your buy and sell rates outside your premises and online. Transparent service fees will make customers feel confident and informed before trading.

3. Advertise strategically

Promote your services where your target customers gather. Join local expat and student groups, advertise at cultural festivals, collaborate with community organisations, or use local forums and social media groups popular with international residents.

4. Partner with the right businesses

Form partnerships with organisations that naturally interact with international audiences: hotels, travel agencies, tour operators, relocation services, international offices at universities, language schools, and coworking spaces with foreign workers. These partnerships create steady referrals.

Consistently sticking to these principles will help your business grow and earn a reputation for professionalism and trustworthiness.

Ready to start a currency exchange business? Register your business with ANNA

Starting a currency exchange business can seem complex, with regulations, cash management, and compliance to handle. However, with ANNA, launching is simple and quick.

Here's what ANNA can do for your business:

- Register your limited company – Go through a quick and seamless business registration without piles of paperwork.

- Virtual office address - keep your address private and simplify mail management

- Company secretary services - need to update information at Companies House or make sure your company is compliant with regulators? ANNA's secretary services will help you to sort it out

- VAT registration - we can register you for VAT with HMRC

Unfortunately, we’re unable to offer you a business account, as currency exchange businesses fall under our prohibited business categories. However, we’d be happy to support you with company registration, administrative services, and tax support.

Give yourself the best chance of success: start smoothly, run efficiently, and build a trusted currency exchange service with ANNA in your corner.

Read the latest updates

You may also like

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)

![How to Start a Self-Employed Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_fe5b6edef1/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_fe5b6edef1.webp)

![How to Start an Electrician Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_How_to_Start_a_Car_Detailing_Business_Successfully_74488a6268/small_Cover_3000_How_to_Start_a_Car_Detailing_Business_Successfully_74488a6268.webp)

![How to Start a Graphic Design Business in 2026 [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_How_to_Start_a_Graphic_Design_Business_in_2025_d8d412cdf5/small_Cover_3000_How_to_Start_a_Graphic_Design_Business_in_2025_d8d412cdf5.webp)