Income Tax & Salary Calculator

ANNA’s Income Tax & Salary Calculator

Calculate your income tax and take home salary. Convert gross pay to net income from employment salary

Tax calculation

Your take home pay is

£0.00 a year

Taxes and Deductions

From gross income of £0.00

What is an Income Tax Calculator?

Calculate the Income Tax due on your UK salary

An Income Tax calculator helps you work out your actual take-home pay by factoring in taxes, National Insurance Contributions (NICs), and other deductions. It’s a handy tool, and has lots of names: Gross Pay to Net Pay Calculator Take-Home Pay Calculator Salary Calculator (After Tax)

Whatever it’s called, it’s purpose is simple: it works out how much tax you pay and how much of your salary is left after other deductions are made.

Whatever it’s called, it’s purpose is simple: it works out how much tax you pay and how much of your salary is left after other deductions are made.

What are the current UK Income Tax rates? Year 2025/26

Personal allowance

0% – You can earn up to £12,570 tax-free. For higher earners, this allowance is reduced by £1 for every £2 earned over £100,000.

Basic rate

20% – Income above the Personal Allowance and up to £50,270 is taxed at 20%.

Higher rate

40% – Income between £50,271 to £125,140 is taxed at 40%.

Additional rate

45% – Income over £125,140 is taxed at 45%.

ANNA automatically calculates salary tax so you don’t have to

ANNA has a simple and easy-to-use payroll tool that calculates the income tax from your salary in real-time. Plus, if you’re a company director you can use our award-winning business account to pay yourself dividends, which may be more tax-efficient than just taking a salary

Income tax facts

What is Income Tax?

Income Tax is a tax paid on income, including your salary, pension, and savings interest.The UK government collects Income Tax through Pay As You Earn (PAYE) or via Self Assessment.

Understand gross salary

This is your total earnings before any deductions such as tax, National Insurance, pension contributions, and student loan repayments.

Understand net salary

This is what you take home after all deductions, including Income Tax and National Insurance Contributions, have been applied.

Taxable Income and Allowances

Income tax is only levied on taxable income, which includes earnings from employment, business profits, and certain benefits like bonuses or rental income. However, various allowances and deductions can reduce the portion of your income that is subject to tax, effectively lowering your overall tax bill.

Some of the most common allowances are:

Personal Allowance:

The amount you can earn tax-free, which is set at £12,570 for most individuals in the 2025/26 tax year.

Marriage Allowance:

Allows a spouse or civil partner to transfer up to 10% of their unused Personal Allowance to their partner, potentially saving up to £252 in tax.

Blind Person’s Allowance:

Provides additional tax-free income for individuals who are registered blind or severely sight-impaired, allowing them to earn more before paying tax.

These allowances can significantly reduce taxable income, ensuring that more of your earnings remain untaxed

Tax on Dividends, Capital Gains, and Savings

Income from savings and investments is taxed differently depending on its type. Savings income and dividend income each have their own tax rates, which apply to all UK taxpayers, including those in Scotland and Wales.

Dividend Tax:

Lower rates than income tax, but dividends are taxed depending on your tax band.

Capital Gains Tax:

Levied on profits from selling assets like property and shares.

Tax-Free Savings:

Savings from ISAs and Premium Bonds are typically tax-free up to certain limits.

Tax Credits and Reliefs

In addition to allowances, there are tax credits and reliefs that can directly reduce the amount of tax you owe, often aimed at specific circumstances or investments.

Some of the key tax credits and reliefs include:

Working Tax Credit:

Aimed at individuals or couples with lower incomes, this provides financial support if you're working but earning below a certain threshold. It helps reduce your tax liability and can supplement your earnings.

Child Tax Credit:

Available to families with dependent children, this credit provides additional support based on income and number of children, helping reduce your overall tax bill.

Enterprise Investment Scheme (EIS):

Investors in small, qualifying UK businesses can benefit from tax relief on investments. The scheme allows for tax relief of up to 30% of the investment, encouraging investments in growing businesses.

Seed Enterprise Investment Scheme (SEIS):

Similar to EIS, this scheme provides up to 50% tax relief on investments in very early-stage companies, supporting innovation and small business growth.

Pension Contributions Relief:

While already mentioned in allowances, it’s important to note that tax relief is given on pension contributions, effectively reducing your taxable income and supporting long-term savings.

These tax credits and reliefs are designed to either reduce the amount of tax you owe or, in some cases, increase your eligibility for a refund, depending on your specific circumstances. They serve as powerful tools for minimising your tax liability while encouraging behaviours such as investment, working, or raising a family.

How is Income Tax Calculated?

Income Tax is calculated in several steps

Work Out Gross Income

This includes salary, bonuses, pension, rental income, and any other earnings before deductions are made.

Apply the Personal Allowance

The first £12,570 of income is tax-free (2025/26). If your income exceeds £100,000, the Personal Allowance reduces and when your income hits £125,140 it's removed completely.

Calculate Taxable Income

Taxable income is your gross income minus the Personal Allowance. For example if you earn £38,000, your taxable income is (£38,000 - £12,570) = £25,430.

Apply Income Tax Rates

• 0% on the Personal Allowance

• 20% on income between £12,571 and £50,270

• 40% on income from £50,271 to £125,140

• 45% on income over £125,140

National Insurance Contributions (NICs)

National Insurance is 12% on earnings between £12,570 and £50,270, then 2% above £50,270.

Final Take-Home Pay

Subtract Income Tax, NICs, and any other deductions from your gross salary to get your net pay.

Frequently asked questions

What is the difference between gross and net salary?

Gross salary is before deductions, and net salary is what you take home after taxes and contributions.

How is income tax calculated in the UK?

Gross salary is before deductions, and net salary is what you take home after taxes and contributions.

What are tax allowances and how do they affect my tax bill?

Tax allowances like the Personal Allowance reduce the amount of income subject to tax.

What are the current income tax rates and bands for the tax year?

The rates are 20% for the basic rate, 40% for the higher rate, and 45% for the additional rate.

Do I need to pay National Insurance Contributions (NICs) as well as income tax?

Yes, NICs are separate from income tax but are deducted similarly from your salary.

Can I use deductions or expenses to reduce my taxable income?

Yes, expenses like pension contributions and charitable donations can reduce taxable income.

Is there a threshold for paying income tax in the UK?

Yes, you only start paying income tax if you earn more than the Personal Allowance (£12,570).

How do I calculate my take-home pay after income tax and NICs?

You can use an income tax calculator to input your salary and deductions to calculate net pay.

What are the consequences of not paying income tax on time?

Penalties include fines and interest on unpaid taxes.

Where can I find additional help and resources for income tax queries?

Refer to HMRC or use the GOV.UK website for resources on income tax queries.

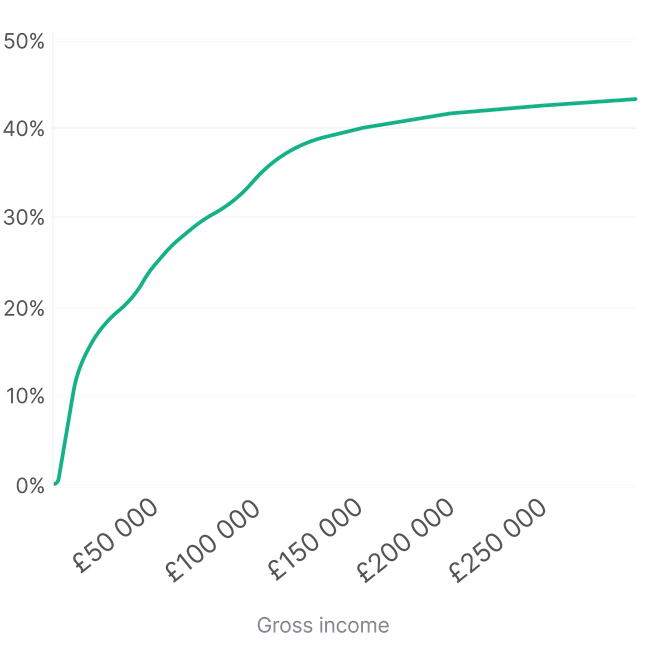

How much will you actually pay in taxes?

The real percentage

The percentage of taxes paid relative to gross income changes primarily due to the structure of the income tax system and National Insurance Contributions. It is a progressive system, meaning that as gross income increases, the percentage of income paid in taxes generally increases. As you can see on the graph is ranges from 0% to 45%. However, due to the flat rates on National Insurance for higher incomes, very high earners might see a slower increase in the percentage of total taxes paid as a percentage of their income.

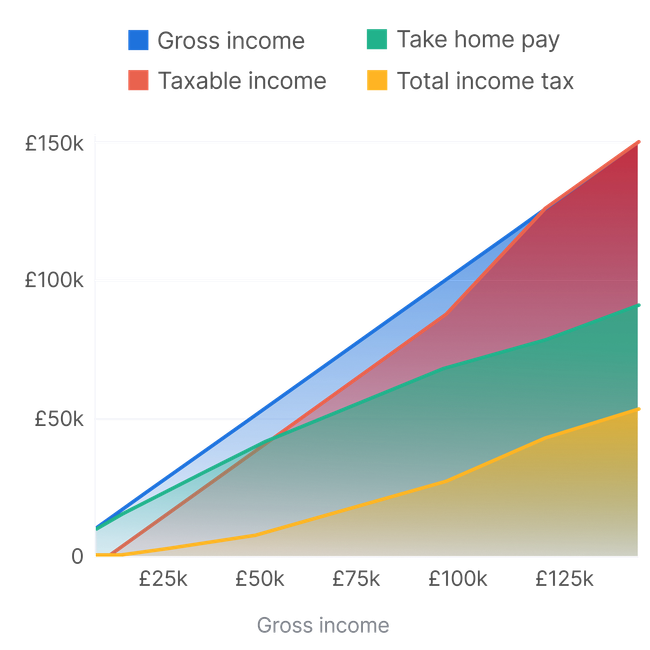

Take home pay chart

Gross to net income chart

On this chart you can see the visualisation of what portion of gross income is taxable, how much of it is paid on income tax and what is left as a take home pay.

Take home pay table

Gross to net income table

We created a chart with the most popular salaries and calculated the take home pay and actual percentage rate to be paid on taxes

| Gross Income | Take home pay | Actual Rate % |

|---|---|---|

| £10,000.00 | £10,000.00 | 0% |

| £20,000.00 | £17,919.60 | 10.40% |

| £21,000.00 | £18,639.60 | 11.24% |

| £22,000.00 | £19,359.60 | 12.00% |

| £23,000.00 | £20,079.60 | 12.70% |

| £24,000.00 | £20,799.60 | 13.34% |

| £25,000.00 | £21,519.60 | 13.92% |

| £26,000.00 | £22,239.60 | 14.46% |

| £27,000.00 | £22,959.60 | 14.96% |

| £28,000.00 | £23,679.60 | 15.43% |

| £29,000.00 | £24,399.60 | 15.86% |

| £30,000.00 | £25,119.60 | 16.27% |

| £31,000.00 | £25,839.60 | 16.65% |

| £32,000.00 | £26,559.60 | 17.00% |

| £33,000.00 | £27,279.60 | 17.33% |

| £34,000.00 | £27,999.60 | 17.65% |

| £35,000.00 | £28,719.60 | 17.94% |

| £36,000.00 | £29,439.60 | 18.22% |

| £37,000.00 | £30,159.60 | 18.49% |

| £38,000.00 | £30,879.60 | 18.74% |

| £39,000.00 | £31,599.60 | 18.98% |

| £40,000.00 | £32,319.60 | 19.20% |

| £41,000.00 | £33,039.60 | 19.42% |

| £42,000.00 | £33,759.60 | 19.62% |

| £43,000.00 | £34,479.60 | 19.81% |

| £44,000.00 | £35,199.60 | 20.00% |

| Gross Income | Take home pay | Actual Rate % |

|---|---|---|

| £45,000.00 | £35,919.60 | 20.18% |

| £46,000.00 | £36,639.60 | 20.35% |

| £47,000.00 | £37,359.60 | 20.51% |

| £48,000.00 | £38,079.60 | 20.67% |

| £49,000.00 | £38,799.60 | 20.82% |

| £50,000.00 | £39,519.60 | 20.96% |

| £51,000.00 | £40,137.40 | 21.30% |

| £52,000.00 | £40,717.40 | 21.70% |

| £53,000.00 | £41,297.40 | 22.08% |

| £54,000.00 | £41,877.40 | 22.45% |

| £55,000.00 | £42,457.40 | 22.80% |

| £60,000.00 | £45,357.40 | 24.40% |

| £65,000.00 | £48,257.40 | 25.76% |

| £70,000.00 | £51,157.40 | 26.92% |

| £75,000.00 | £54,057.40 | 27.92% |

| £80,000.00 | £56,957.40 | 28.80% |

| £85,000.00 | £59,857.40 | 29.58% |

| £90,000.00 | £62,757.40 | 30.27% |

| £95,000.00 | £65,657.40 | 30.89% |

| £100,000.00 | £68,557.40 | 31.44% |

| £105,000.00 | £70,457.40 | 32.90% |

| £110,000.00 | £72,357.40 | 34.22% |

| £120,000.00 | £76,157.40 | 36.54% |

| £130,000.00 | £80,686.40 | 37.93% |

| £140,000.00 | £85,986.40 | 38.58% |

| £150,000.00 | £91,286.40 | 39.14% |

Get ANNA business account

The business account that calculates your taxes

ANNA Money is the business account for startups, small businesses and sole traders. Say goodbye to branch visits and paper forms – you only need the app and the ANNA business debit card to make full use of all ANNA’s features. ANNA reconciles your accounts as you go, matching receipts and invoices to all your transactions. That means clean, tidy, up-to-date accounts and no awkward questions from HMRC.