Maximise your business cash back with ANNA – get up to 35% back on hotels

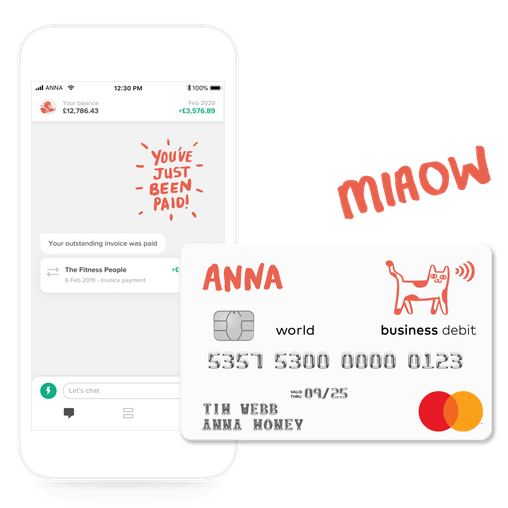

With your new ANNA card it’s simple and easy to book business travel through Final Price and get cashback at the same time. We’ll walk you through the process, but first of all we thought we’d look at how travel expenses work.

What are travel expenses?

Travel expenses are the costs that come with business-related journeys made by a business and its employees. As a business owner, you’re eligible to claim tax relief on some travel expenses and we’ve provided a breakdown of what these might be.

Transport Costs: If you're using public transport like a train or bus, you’re taking a taxi or Uber, or you’re renting a car for a business trip or to meet a client, these costs can be claimed back.

Hotel Accommodation: If you need to stay overnight for business reasons, the cost of accommodation can be claimed.

Meals: Reasonable costs for meals and refreshments while on business trips can be claimed. But lavish meals won’t be accepted – a 12-course-tasting menu and wine pairing is very much not on the cards.

Incidental Costs: While you’re travelling for business you might incur small expenses like parking fees, toll charges, business calls or internet charges. These can be claimed.

What’s not a business expense?

Personal Expenses: Expenses like personal shopping or leisure activities during a business trip wouldn’t be considered business expenses by HMRC and shouldn’t be bought with your ANNA card.

Entertainment Costs: Any expenses relating to client entertainment (think extravagant dinner or concert tickets) aren’t tax deductible, whether it’s a business trip or not.

Ordinary Commuting: Sadly, travel to and from a regular workplace doesn't qualify as a business travel expense and the costs can’t be claimed. If you live in Walthamstow and your office is in Warren Street, that’s your daily commute and it’s not tax deductible.

How to book your hotel through ANNA

Now that you’ve got that out of the way, here’s how you can book a hotel through ANNA, and get that sweet, sweet cashback.

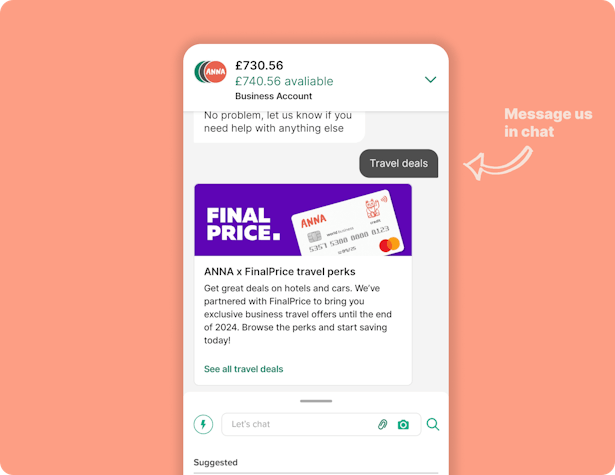

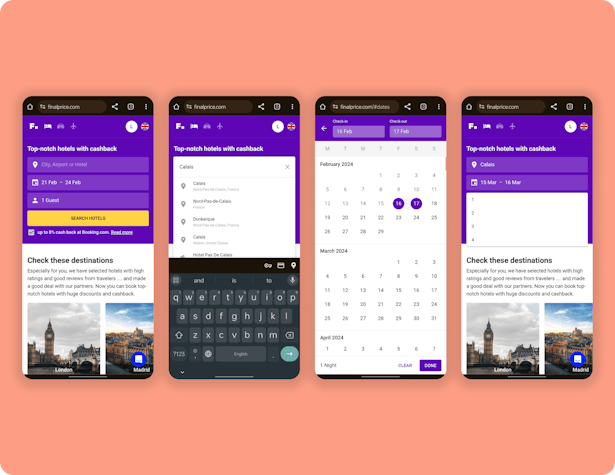

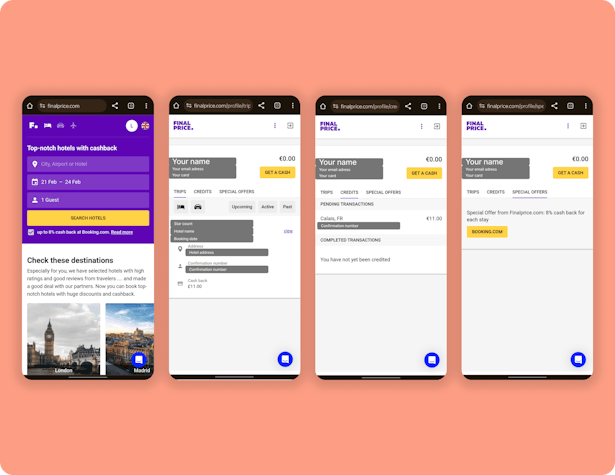

In the app, type ‘travel’ in the chat box. This will bring up the Final Price travel perks and you can see all the deals available.

Then you choose the city, the dates and the number of people you’re booking for, up to a maximum of 4 people.

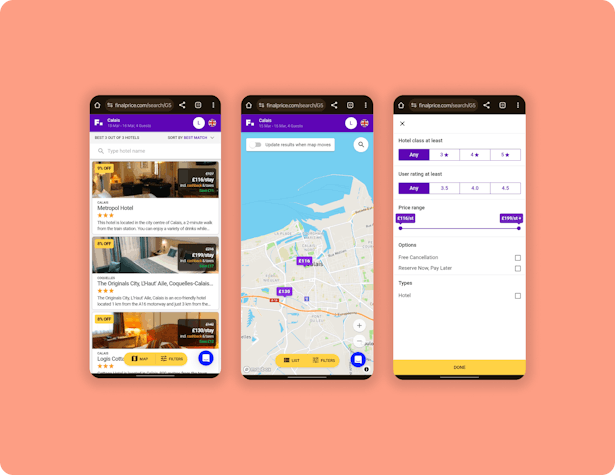

Next you choose your hotel. You can sort by list or map view, and you can filter the results (for example if you want a hotel with a pool 💦). You’re shown the price on booking.com as well as the price on Final Price, with the cashback factored in.

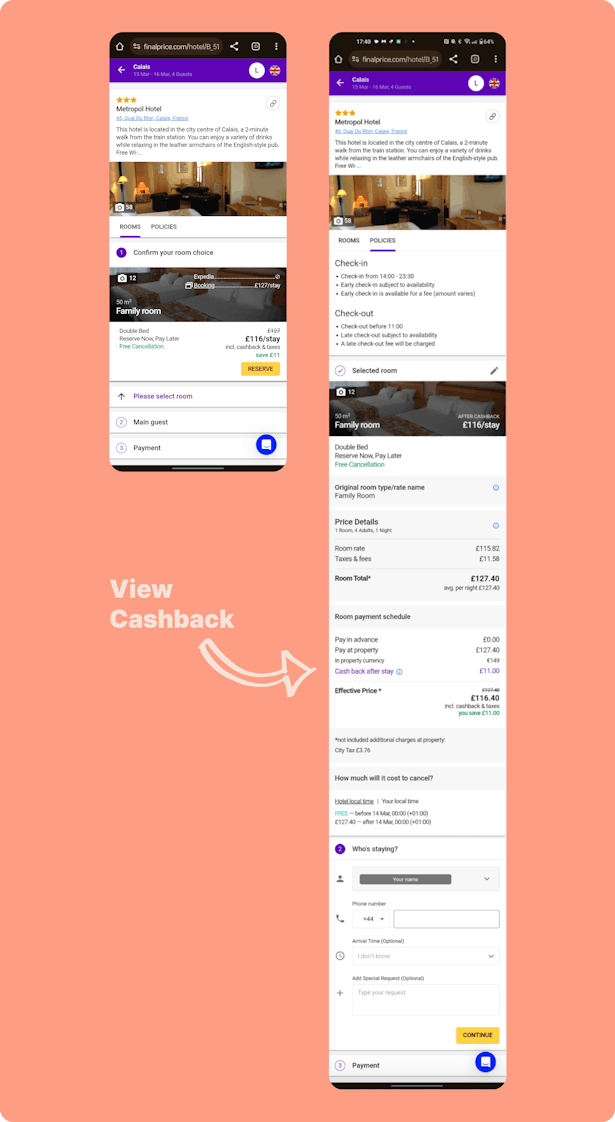

Choose your room, then hit ‘reserve’ to continue with the booking.

You’re then shown more information about the room, the price, the offer, and the cancellation policy. Add your contact details and hit ‘continue’.

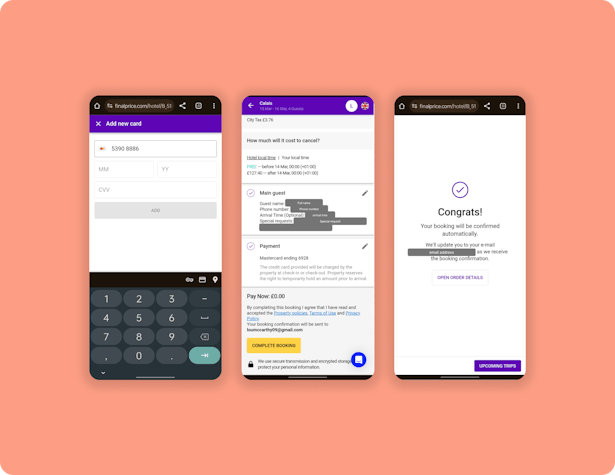

Now it’s time to pay! If you haven’t already added your new ANNA Expense card (the one with the lucky waving cat on it) you can add it here. Once you’ve added your card, tap ‘complete booking’.

That’s it! The cashback is automatically paid back into your ANNA account after a few days. There’s no need to request it or chase it.

If you want to check your cashback status, you can tap on your initial on the top right of the screen to view your upcoming trips, and any cashback that’s due.

Get booking

So what are you waiting for? If you haven’t ordered a new card, just type ‘new card’ in chat to get started. And if you’ve got your new card, type ‘travel’ to book your hotel room. Where will your business take you? Rome? Paris? Dunstable? Wherever you go, make sure you book your hotel through the ANNA app and get that well-deserved cashback.

Open a business account in minutes