How do direct debits work? Everything you need to know if you’re self employed

You can invoice with ease – but could you do with a hand paying your bills on time? Direct debits are the easiest way to make regular payments from your business bank account. Here’s everything you need to know to set up and manage direct debits. Kiss late payment fees goodbye!

Right then, what’s a direct debit?

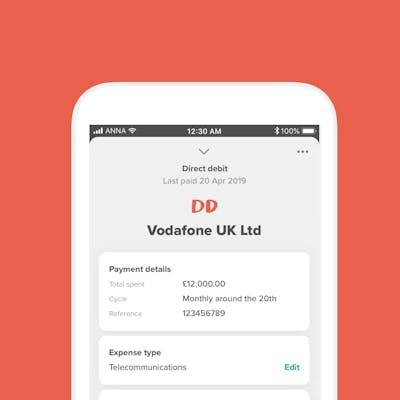

A direct debit is an authorisation that you send to your bank, which allows another organisation to take a payment from your account. They’re handy for paying regular bills, like your office rent, your electricity bill or your suppliers costs. You give this instruction to your bank by filling out a direct debit mandate form, either online or a paper version. Once the form has been processed, the organisation will be able to take regular payments from your account automatically, without you having to confirm the payment beforehand.

Using direct debits to pay your bills can help you avoid late payment fees, and save your small business loads of stress. Plus they’re quick, secure and easy to set up or amend. What’s not to like?

How to set up a direct debit

To set up a direct debit with an organisation you want to pay, you’ll need to complete a direct debit mandate. This can be done online and will include:

- Your name and address

- The name and address of your bank

- Your account number

- Your sort code

If you want to avoid the faff of paperwork or online forms, an app like ANNA makes it easy to set up a direct debit. You can share all your account details with the organisation you want to pay with just a tap of your smartphone.

Once you’ve filled out a mandate or shared your banking details, it will take between 5 and 10 days for the direct debit to be set up. (That’s worth bearing in mind, if you’re planning to make a payment within this timeframe). Once you’ve filled in the mandate – that’s it! The organisation can now take the money you owe them from your account, provided that they notify you of the amount and when it will be taken in advance.

What’s a Direct Debit Guarantee?

If the idea of an organisation taking a payment from you automatically makes you feel a bit wary – don’t worry! The Direct Debit Guarantee protects you from any payments taken by mistake or fraudulently. If a direct debit is taken from you in error, you’re entitled to a full refund from your bank, straightaway. To claim a refund you need to contact your bank, as they are responsible for refunding you, whether the fault was theirs or the organisation taking the payment.

Under the Direct Debit Guarantee, you must be notified before an organisation takes a direct debit payment from you. This usually happens 10 working days before the payment goes out, but you might get less notice if it’s been agreed beforehand. You’re also totally within your rights to cancel a direct debit at any time under the guarantee.

What’s the difference between a standing order and a direct debit?

A standing order is an instruction to your bank to make regular, fixed payments to an organisation. A direct debit is an authorisation for an organisation to take a regular fixed or varied payment from your account. But you knew that already, right?

When you set up a standing order, you tell your bank how much to pay and when. With a direct debit, the payment amount can vary according to the organisation you’re paying. Also, standing orders aren’t covered by a guarantee like direct debits are. Once you make a payment, you can’t get it back.

How do I cancel a direct debit?

Great news – it’s about as easy as falling off a log. Unless you don’t have a log to hand. To cancel a direct debit, you usually need to give your bank 24 hours’ notice before a payment is due. What’s really important is to let the organisation that you’ve been paying know that you’re no longer going to be paying them via direct debit. But (and this is the important bit) this isn’t the same as telling the organisation you no longer want their services, you’ve just changed the method of payment. So you’ll need to make sure it’s clear with the organisation what you want to do.

Are direct debits taken on Saturday or Sunday?

In a word, nope. If your direct debit is due to go out over a weekend, it will be paid on the next working day (Mondays, unless it’s a bank holiday – in which case it will go out on Tuesday).

Open a business account in minutes