ANNA updates

Maximise your business cash back with ANNA – get up to 35% back on hotels

13 November, 2024•6 mins

Your take home pay is

£0.00 a year

Taxes and Deductions

From gross income of £0

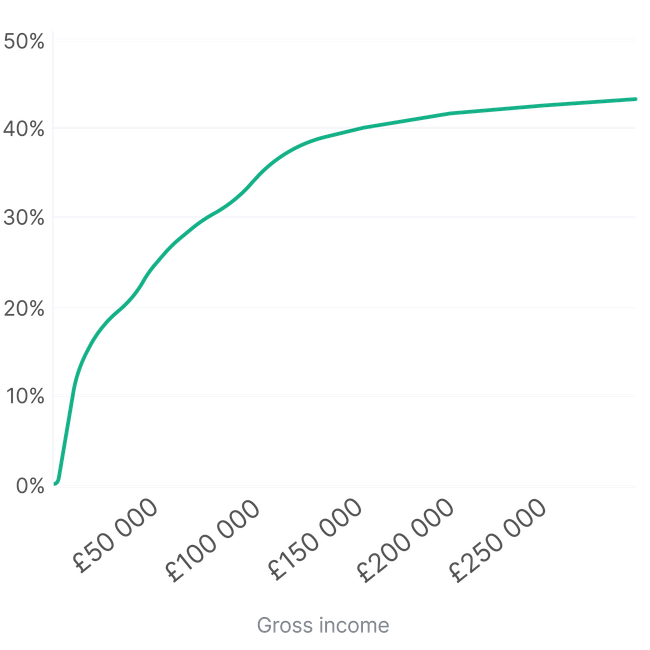

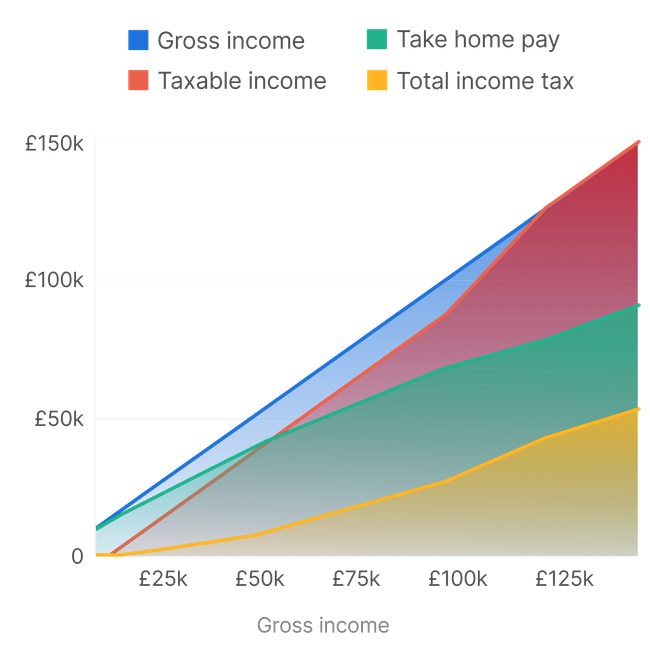

| Gross Income | Take home pay | Actual Rate % |

|---|---|---|

| £10,000.00 | £10,000.00 | 0% |

| £20,000.00 | £17,919.60 | 10.40% |

| £21,000.00 | £18,639.60 | 11.24% |

| £22,000.00 | £19,359.60 | 12.00% |

| £23,000.00 | £20,079.60 | 12.70% |

| £24,000.00 | £20,799.60 | 13.34% |

| £25,000.00 | £21,519.60 | 13.92% |

| £26,000.00 | £22,239.60 | 14.46% |

| £27,000.00 | £22,959.60 | 14.96% |

| £28,000.00 | £23,679.60 | 15.43% |

| £29,000.00 | £24,399.60 | 15.86% |

| £30,000.00 | £25,119.60 | 16.27% |

| £31,000.00 | £25,839.60 | 16.65% |

| £32,000.00 | £26,559.60 | 17.00% |

| £33,000.00 | £27,279.60 | 17.33% |

| £34,000.00 | £27,999.60 | 17.65% |

| £35,000.00 | £28,719.60 | 17.94% |

| £36,000.00 | £29,439.60 | 18.22% |

| £37,000.00 | £30,159.60 | 18.49% |

| £38,000.00 | £30,879.60 | 18.74% |

| £39,000.00 | £31,599.60 | 18.98% |

| £40,000.00 | £32,319.60 | 19.20% |

| £41,000.00 | £33,039.60 | 19.42% |

| £42,000.00 | £33,759.60 | 19.62% |

| £43,000.00 | £34,479.60 | 19.81% |

| £44,000.00 | £35,199.60 | 20.00% |

| Gross Income | Take home pay | Actual Rate % |

|---|---|---|

| £45,000.00 | £35,919.60 | 20.18% |

| £46,000.00 | £36,639.60 | 20.35% |

| £47,000.00 | £37,359.60 | 20.51% |

| £48,000.00 | £38,079.60 | 20.67% |

| £49,000.00 | £38,799.60 | 20.82% |

| £50,000.00 | £39,519.60 | 20.96% |

| £51,000.00 | £40,137.40 | 21.30% |

| £52,000.00 | £40,717.40 | 21.70% |

| £53,000.00 | £41,297.40 | 22.08% |

| £54,000.00 | £41,877.40 | 22.45% |

| £55,000.00 | £42,457.40 | 22.80% |

| £60,000.00 | £45,357.40 | 24.40% |

| £65,000.00 | £48,257.40 | 25.76% |

| £70,000.00 | £51,157.40 | 26.92% |

| £75,000.00 | £54,057.40 | 27.92% |

| £80,000.00 | £56,957.40 | 28.80% |

| £85,000.00 | £59,857.40 | 29.58% |

| £90,000.00 | £62,757.40 | 30.27% |

| £95,000.00 | £65,657.40 | 30.89% |

| £100,000.00 | £68,557.40 | 31.44% |

| £105,000.00 | £70,457.40 | 32.90% |

| £110,000.00 | £72,357.40 | 34.22% |

| £120,000.00 | £76,157.40 | 36.54% |

| £130,000.00 | £80,686.40 | 37.93% |

| £140,000.00 | £85,986.40 | 38.58% |

| £150,000.00 | £91,286.40 | 39.14% |