Open a UK business account

The business account that does your taxes

Open your business account online in under 10 minutes, and an expense card in the post in 3-4 days. Your account is free to open, and we offer flexible plans as your business grows. And yes, the app miaows when you make a payment!

Snap it. Sort it. Save it.

Snap your receipts for easy expenses and ANNA sorts them automatically, saving you the hassle.

Set up standing orders and Direct Debits.

Create and send invoices.

ANNA creates and sends professional-looking invoices for you – and even chases them when they’re overdue

Seamlessly connect to accounting software.

The business account for UK limited companies

If your business is a limited company, a business account isn't a luxury - it's a legal obligation. ANNA has the tools to handle your businesses' payments, expenses, payroll and taxes, as well as award-winning customer support

“Managing business finances and invoicing with ANNA is so simple and straightforward. It makes running my business on the go so easy”

The business account for small businesses

We've tailored our business accounts for UK small businesses, with all the support you need to grow. From instant invoicing to easy expenses, ANNA takes some of the stress out of your first steps.

Get more from ANNA

A card for your business

If you’ve got your ID to hand, you can get your UK business account and sort code in as little as 10 minutes, with your physical card arriving in the post after a few days

Virtual business expense cards

Don’t wait for your ANNA card to arrive in the post – you get a virtual card as soon as you sign up, and can start making payments straight away

Manage multiple cards

Skip the faff of reimbursing employee expenses. Give employees their own ANNA card, set a spending limit and ANNA automatically sorts their expenses

Use Apple Pay

Use ANNA Money with Apple Pay. It’s the simple, secure, and private way to pay. There’s no need to even carry your card – your iPhone or Apple Watch is enough

More details and how to set up

Business account cashback

Ker-ching! Get free money for your business: earn cashback when you use your ANNA card to pay for a range of business expenses from train travel to furniture

Use Google Pay

Use ANNA Money with Google Pay™. It’s the fast, simple, and secure way to pay at millions of places – on sites, in apps, and in stores. With Google Pay there’s no need to dig for your cards – you can pay quickly and easily with the device that’s already in your hand.

More details and how to set up

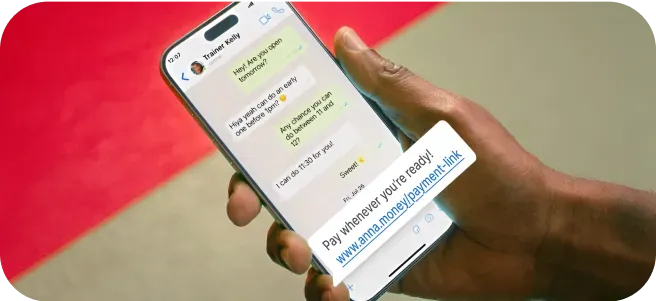

Get paid easily

Nothing grows a business like getting paid. ANNA gives you better ways to take payment, whether it's online or in person

Payment link and webpage

With ANNA you get your own unique payment webpage for getting paid online. Put the link on your business social account or ping it directly to customers

ANNA + Dojo card machine

Get paid in a tap! Get a Point-of-sale terminal from ANNA and our partner Dojo, so you can take card payments wherever you are

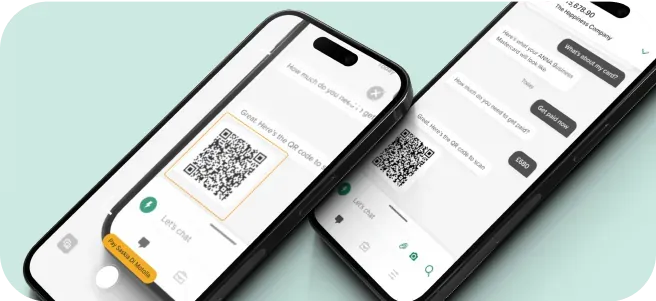

Payment link QR code

Generate a unique QR code for a payment, with the amount and your account details automatically included. All your customer has to do is scan and pay. Easypeasy

Open a business account

ANNA is more than just a business account. It feels like an assistant that sorts your financial admin. And even better, it's all free while you're getting started

Top up your account in cash

Trading in cash? You can now pay it into your account at thousands of PayPoints across the country

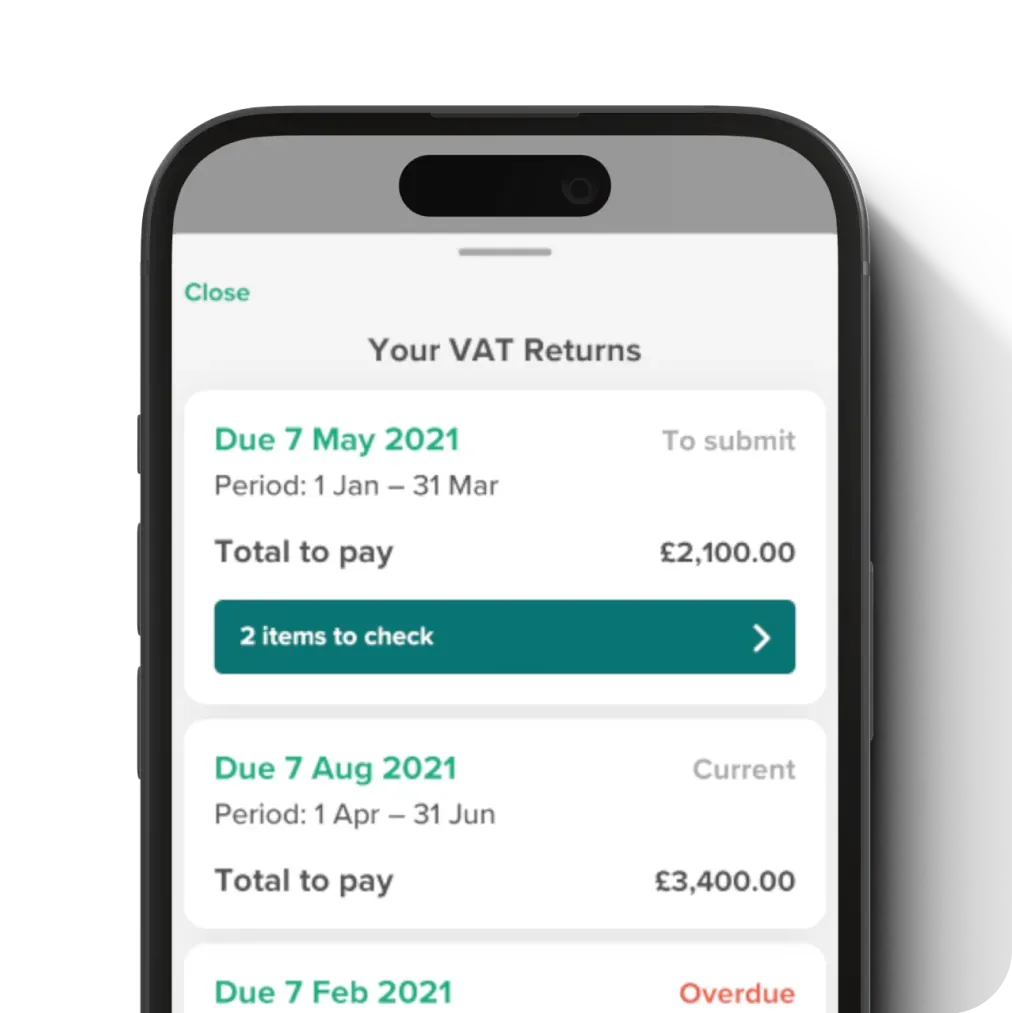

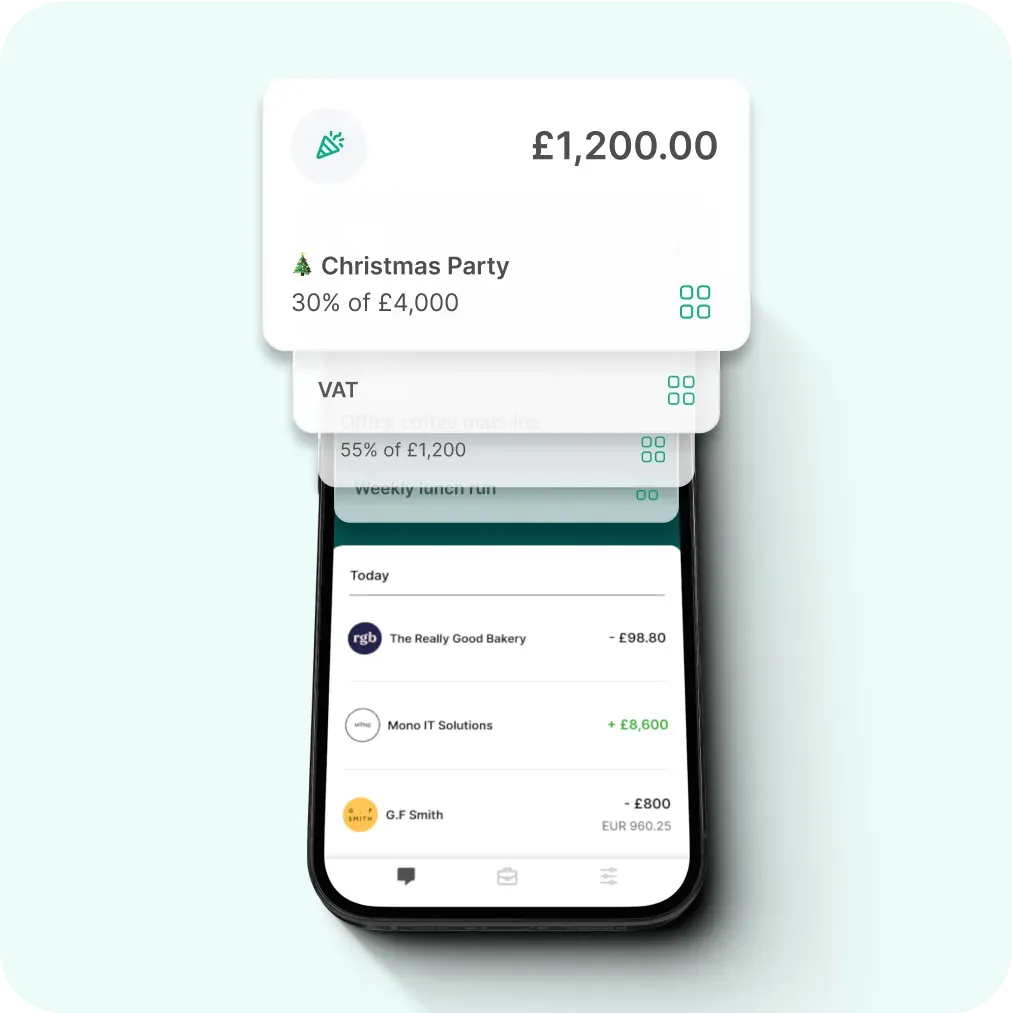

The business account with money-saving pots

Take the stress out of saving. Create pots and put money aside for taxes, salaries or other expenses. You can manually move your money or set up automatic top-ups, so you always have savings set aside

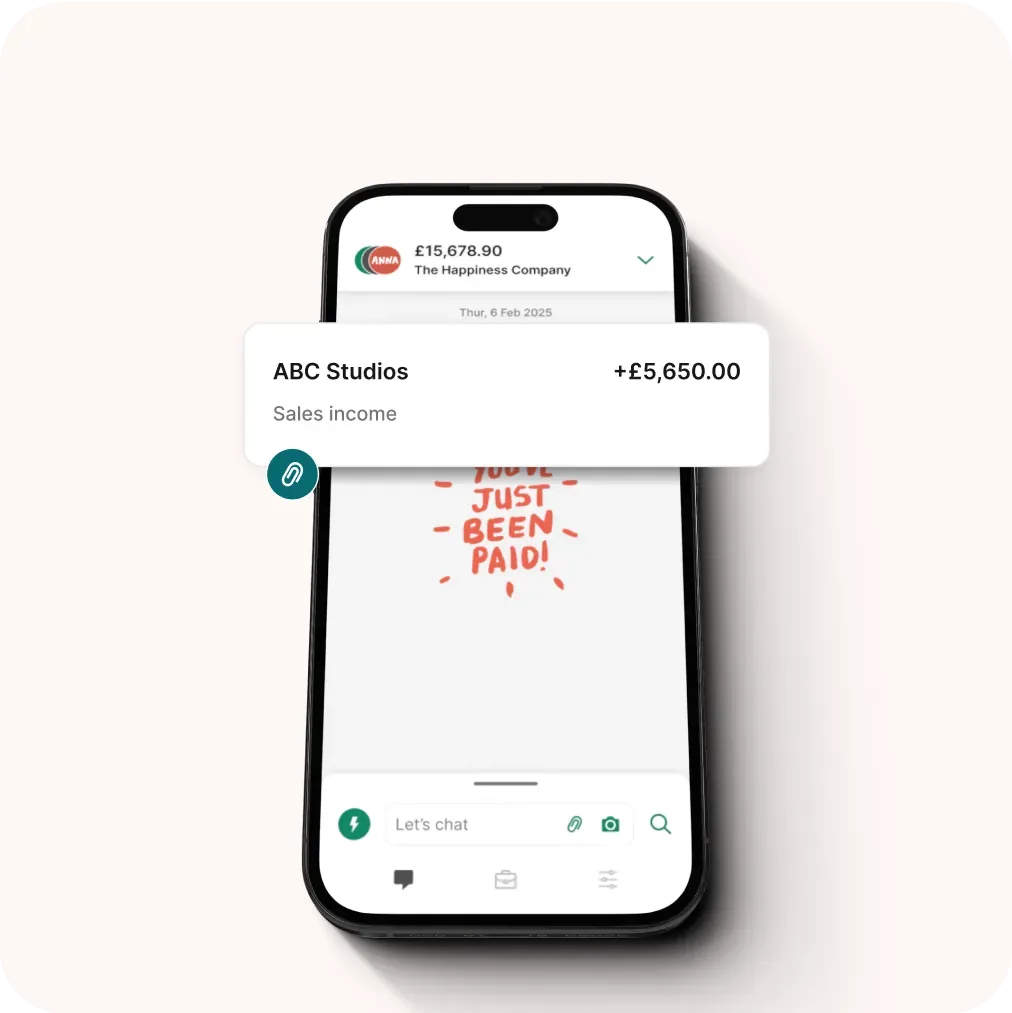

Instant payment notifications

Ding! ANNA instantly updates you when money comes in or out of your account, so you're always on top of your cash flow

“ANNA makes admin a breeze and helps me keep track of which reprobates haven't paid me. I love it when my card miaows, but I'd prefer it to 'woof’”

Free Direct Debits

You can set up Direct Debits at no extra charge, whatever your pricing plan. All payments are protected by the Direct Debit Guarantee Scheme

Open Banking

Stay on top of your money. With Open Banking you can connect your other business and personal accounts to ANNA to see all your money in one place

Standing orders

Need to pay someone regularly? Set up a scheduled payment and ANNA will send it for you when the time comes. We’ll notify you in advance so you can make changes if needed

Small business loans

Looking to grow your business? ANNA works with partners to find you additional financial support

International Business Payments

Take your business global. Make and receive payments around the world in a wide range of currencies.

Send professional quotes and invoices

ANNA makes it simple to create and send invoice, even when you're on the go. We can even chase your invoices for you

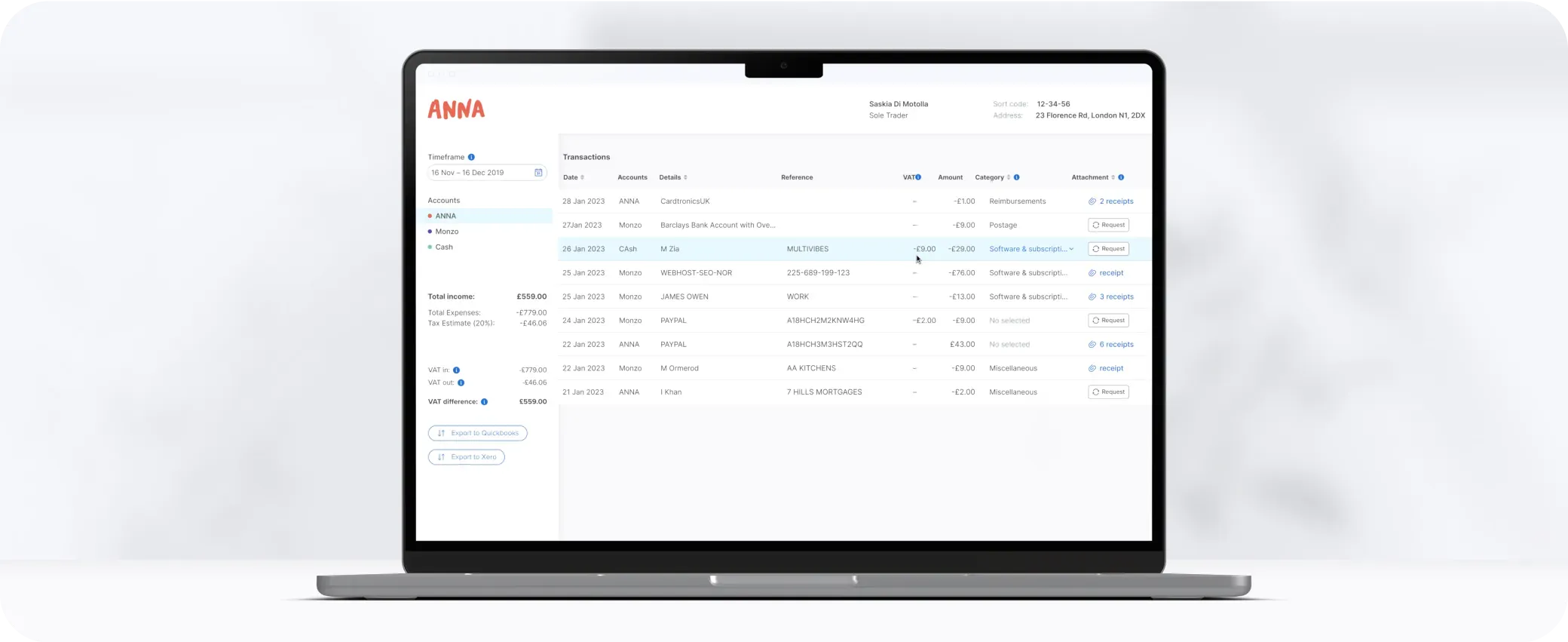

Sort your expenses

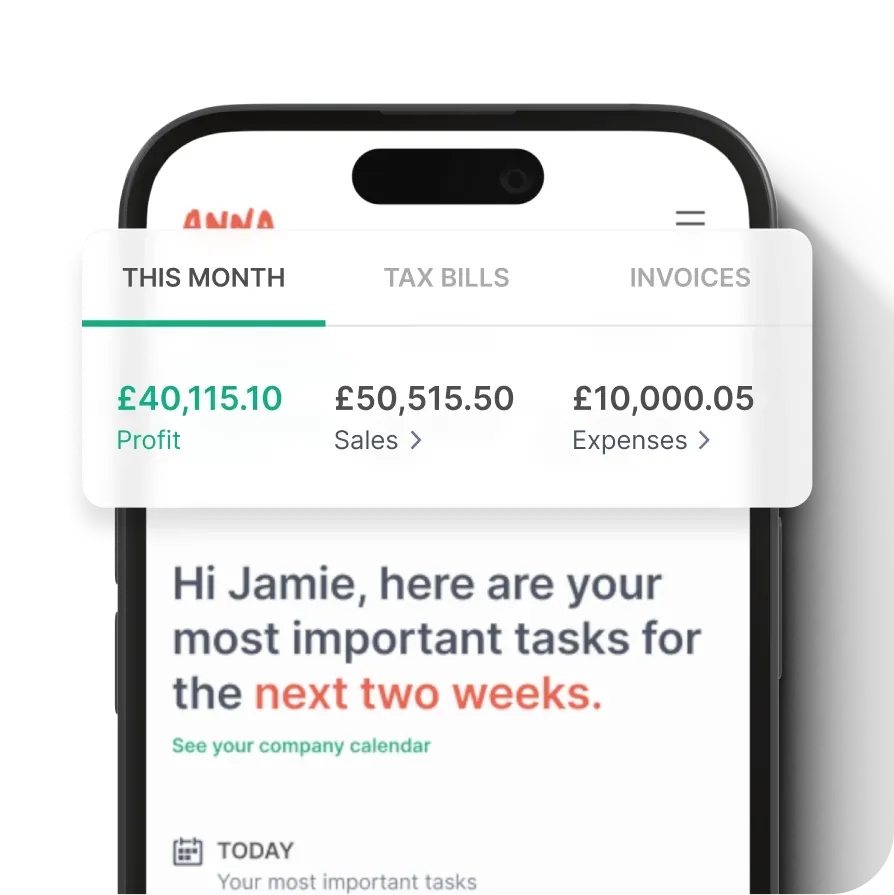

ANNA instantly updates you when money comes in or out of your account, helping you keep on top of your cash-flow. Because who has time to dig through statements?

“I find the app simple and fast to use. Simplicity is important for me. The search history for repeat payees is a big help, meaning I don’t need to re-enter their details”

Accountant access

Give your accountant real time access to your sales and expenses or sync with accounting software like Xero and QuickBooks

How to use the ANNA Money business account

What you pay depends on your business

Our plans start at £0 per month – you only pay for the services you use. Whatever your plan, if you don't use your account for a month, you don't pay the monthly fee for that month

Do I need a business bank account?

ANNA was created with small businesses in mind. Whether you're a sole trader, a director of a limited company (and you're listed on Companies House) or a partner in a Limited Liability Partnership (LLP) then ANNA is the account for you.

Is ANNA FSCS protected?

ANNA isn’t a bank, so your money isn’t covered by the Financial Services Compensation Scheme (FSCS). However, your money is still safe since it’s not loaned out anywhere, and is covered by a procedure called safeguarding, which is applied to all e-money institutions. You can read more about FSCS and keeping your money secure in this blog post.

Read the full article

Sign up in less than 10 minutes

ANNA is the best choice for small businesses in the UK

Fast, stress-free sign up

Whooosh! If you have ID and proof of address handy, sign up can take under 10 minutes

Saves you time and money

No one starts a business to do paperwork. ANNA handles your financial admin so you can get on with building your business

AI-powered accounting and bookkeeping

ANNA’s smart AI automatically categorises your transactions, which makes expenses, VAT and tax returns a doddle

Invoice chasing

With ANNA you can create and send professional-looking invoices in seconds. And if your customers aren't paying, we'll chase them for you

Exceptional 24/7 customer service

Our customer support team in Cardiff are available 24/7 and usually get back to you in under a minute!

Rated ‘Excellent’ with 4.6 on Trustpilot

How does ANNA compare? ANNA customers are happy customers. Check out our Trustpilot reviews

How we compare to the best business bank accounts in the UK

Not sure which business bank account out there is best for you? We got you. In this guide we compare business bank accounts based on Trustpilot reviews, ratings, key features, and pricing to help you make an informed decision.

How do I open a business account?

Here’s a step-by-step guide to opening a business account online, including all the documents you’ll need.

Step 1

Sign up with your email or install the ANNA mobile app.

Step 2

Provide us with basic information about you and your business. You’ll need ID and proof of address, and for your business you’ll need its legal name, type of business and if it's an LTD, information about the directors of your company (if there are more than one). You should also add your website or social media accounts.

Step 3

We’ll check your documents and information; this usually takes a few minutes, but we might sometimes ask for more time.

Step 4

We open your business account and you're good to go! You're ready to make and accept payments and order your ANNA card.

What do I need to open a business account?

There are eligibility requirements for opening a business account with ANNA. We’ll need to check your information and the documents, and there are a few things you can do to speed things up.

Photo ID and proof of address

We’ll need a photo of your full driving licence or a photo of your valid passport.

Take the photo on a flat, clear surface and make sure all four corners of the ID can be seen.

To verify your address we might ask for a utility bill, council tax bill or bank statement. They should be dated within the last three months.

Officially registered business – LTDs only

For limited companies, we’ll need the name your business is registered under with Companies House. If you haven’t registered your business yet, you can do it with us through our company registration service.

Your business online

If you have a website and public social media accounts for your business, the links will help us speed up the process

Open a business account

ANNA goes beyond a typical business account. It acts like a smart assistant, helping you stay on top of your financial admin – and it’s free while you get your business off the ground

Frequently Asked Questions

What is a business bank account?

If you’re a sole trader, then it’s a sensible move to open a business account. If you’re running a limited company, then having a dedicated account for your business is mandatory – because your business is legally a separate entity.

ANNA was created with freelancers, small businesses, and creative types in mind. If you’re a sole trader, a director of a limited company (and you’re listed on Companies House) or a partner in a Limited Liability Partnership (LLP) then an ANNA business account will be suitable for you.

Should I have a separate account for my business?

Sole traders aren’t legally required to open a separate account for business, but there are plenty of advantages to keeping your personal finances separate from your business finances. A business account will make things clearer for HMRC, and it’ll make it easier for you to claim tax relief.

If you’re running a limited company, then your business is considered a separate legal entity to you, and you’re legally obliged to hold an account just for your business.

How do I put money into my account?

To pay money into your account, you’ll need your ANNA business account details. Just open the app and tap the middle button at the bottom of your screen, and you’ll find your details under your Account Summary. Make a note of your account number and sort code, then set up your ANNA account as a payee with your other bank. Now you can pay into your ANNA account.

ANNA inbound payments are processed every 30 minutes on the hour and half hour (eg. 10am, 10.30am, 11am and 11.30am). It takes up to 15 minutes for payments to be credited to your account.

Can I pay cheques into my ANNA account?

Unfortunately not, we can’t accept cheques as a paying in method. You’ll need to cash the cheque elsewhere and transfer the funds over to your ANNA account. Don’t forget, you can also pay cash into your account via your nearest PayPoint.

What is Open Banking?

Open Banking is the secure way for third party providers to access your financial information, so you can connect your different bank account and banking apps. It can give you a better understanding of your accounts, and help you find new ways to look after your money.

ANNA is partnered with TrueLayer, Europe’s leading provider of Open Banking services. This means you can connect your other bank accounts in the ANNA app, and see all your transactions securely in one place.

Can I have an IBAN to receive foreign payments?

Yes.

Your ANNA business account comes with a UK sort code and account number, and you also get an IBAN to accept international payments. Check our pricing table for information about the fees.

Can I apply from outside the UK?

Yes, you can apply for an ANNA account from outside the UK. However, only UK residents are eligible for an ANNA account.

Do you have credit checks?

No, we don’t have credit checks. Instead we carry out an identity check to comply with UK anti-money laundering regulations. Traditional banks use a more complex credit check to vet future customers. ANNA isn’t a bank and doesn’t offer credit, which means our identity checking process is quicker, easier and won’t affect your credit score.

How long does it take to open an ANNA business account?

When you provide all the required documents during app setup, it usually takes about 3-5 minutes to open an ANNA business account. We may need more time if your documents need extra attention – for example when an ID photo is blurry or utility bills don’t match the address you gave us.

Does ANNA offer prepaid debit cards?

No, we don’t offer prepaid debit cards. The card you get with your ANNA business account is a Mastercard® Business debit card, issued by PayrNet Limited and licensed by Mastercard International Inc.

Can I open a joint business account at ANNA?

Yes, we offer joint business accounts for companies with multiple directors. After you open your ANNA account, let us know in the chat that you need to set up access for other people in your company. They will be able to install the ANNA app and use your joint account the same way you do.

Is ANNA a fully regulated UK bank?

No, ANNA isn’t a bank. We’re a financial services provider working under the e-money license of our partner Railsr.

Are business bank accounts protected?

Yes. However, ANNA isn’t a bank, so protection doesn’t apply to us. But don’t worry, your money is still safe – read about e-money and ringfencing, or just watch our YouTube video about it.

Can I get an overdraft?

ANNA doesn’t offer overdrafts, but there are a range of credit facilities available for eligible customers

What's the difference between an e-money account and a bank account?

E-money institutions (EMIs) aren’t banks but they offer accounts where you can store money, pay for things and get paid. They are overseen by the Financial Conduct Authority (FCA). Unlike banks, EMIs can’t loan out their money, so it’s kept secure in a special safeguarding account. Find out more here.

What types of business bank accounts are there?

ANNA isn’t a bank account, but it’s still worth understanding the different account types. Most business bank accounts are current accounts, which give you easier access to your money, but don’t offer interest. Some business bank accounts are savings accounts. These offer interest on the money in your account, but there are usually more restrictions on how you can access your money.

Can ANNA verify my identity for Companies House?

Absolutely. ANNA is an officially Authorised Corporate Services Provider (ACSP) for Companies House – which means we can verify your identity ahead of the 18 November 2025 deadline.

We’ve actually been doing this from day one – verifying your ID is part of opening an ANNA business account, so becoming an ACSP was a no-brainer. One less thing for you to worry about.

You can learn more about on our identity verification page.

Award winning 24/7 support

Need help opening your account?

If you need a hand opening your ANNA account, don’t worry - our customer support team is available 24/7 in the app, ready to answer any of your questions during onboarding. Just start signing up and we’ll guide you along the way.