- In this article

- Starling vs Revolut at a glance

- Quick look: Starling vs Revolut

- Who are these accounts best for?

- Who can open an account?

- Eligibility criteria

- Pricing and fees

- Starling vs Revolut fees

- Features comparison

- App and user experience

- Customer support and reviews

- Support channels

- Trustpilot score

- Security and trust

- Which is best for your business?

- Alternatives to consider

- Verdict: Starling vs Revolut

Both offer sleek apps, fast onboarding, and plenty of tools for payments and expense management – but they take very different approaches to pricing and features.

This guide compares Starling’s free business account with Revolut’s Basic (£10/month) and Grow (£30/month) plans, looking at everything from fees and features to support and who each account is best for.

✨ And because we’re ANNA, we’ll also show you how we stack up – especially if you want a business account that takes care of invoices, expenses, and tax admin, all in one place.

Starling vs Revolut at a glance

If you’re short on time, here’s the quick summary: Starling keeps things simple with one free account that includes most essentials, while Revolut splits features across several paid tiers – Basic (£10/month), Grow (£30/month), and Scale (£90/month).

Quick look: Starling vs Revolut

| Feature | Starling | Revolut Basic / Grow |

|---|---|---|

| Monthly fee | £0 | £0 / £19 |

| International payments | ✅ via SWIFT | ✅ with competitive FX |

| Multi-user access | ❌ directors only | ✅ available from Free |

| Cash deposits | ✅ Post Office, 0.7% | ❌ not supported |

| Cheque deposits | ✅ by app or post | ❌ not available |

| Overdraft | ✅ available (subject to eligibility) | ❌ none |

| Virtual/expense cards | ❌ | ✅ Free: 1 card / Grow: multiple |

| Accounting integrations | ✅ (FreeAgent, Xero, QuickBooks) | ✅ (Xero, QuickBooks, Sage) |

| Multi-currency accounts | ✅ EUR, USD (applications currently paused) | ✅ 35+ currencies |

| Customer support | 24/7 – phone, chat, email | Chat only, 24/7 for Grow |

Takeaway: Starling gives you more for free, while Revolut adds flexibility for international payments and team spending – but at a monthly cost if you want premium tools.

Who are these accounts best for?

⚡ The cheapest

If your top priority is running your business with zero monthly fees, Starling wins hands down. There’s no charge to open or maintain the account, and it covers everyday essentials like Faster Payments, Direct Debits, and accounting integrations out of the box.

Revolut’s entry Basic plan (£10/month) can work for very small or early-stage businesses, but you’ll quickly hit limits – for example, only 10 free local payments a month before fees apply.

Verdict: Starling is the cheapest long-term choice with full features at no monthly cost.

⚡ Best value for money

When you consider what you get for the price, Starling again feels like the better deal. Revolut Grow (£30/month) includes perks like team expense cards, bulk payments, and priority support, but many of these features are less critical for microbusinesses and freelancers.

Starling’s all-inclusive model gives you core functionality – from overdrafts to integrations – without subscriptions. Unless you make frequent international payments or need bulk team cards, Starling’s simplicity offers stronger overall value.

Verdict: Starling delivers better value unless you depend on Revolut’s multi-currency tools.

⚡ Best for sole traders

Sole traders will appreciate Starling’s no-nonsense approach. You get a professional account in your own name, with the ability to connect to accounting software and even add the optional Business Toolkit (£7/month) for VAT and invoicing.

Revolut’s Free plan is appealing if you’re testing the waters, but it lacks invoicing and has low free-payment limits. Upgrading to Grow helps, yet at £19/month, it’s a steep jump just to access features that Starling provides at a fraction of the cost.

Verdict: Sole traders who want simplicity and stability are better served by Starling.

⚡ Best for limited companies

Revolut edges ahead for small companies with multiple team members. It supports multi-user access from the start, offers physical and virtual cards for employees, and includes spending controls that make managing expenses easier.

Starling restricts access to company directors only, which works fine for micro-companies but can be limiting once your business grows and you want your accountant or staff to have controlled access.

Verdict: Revolut Grow is stronger for limited companies that need shared access and team cards.

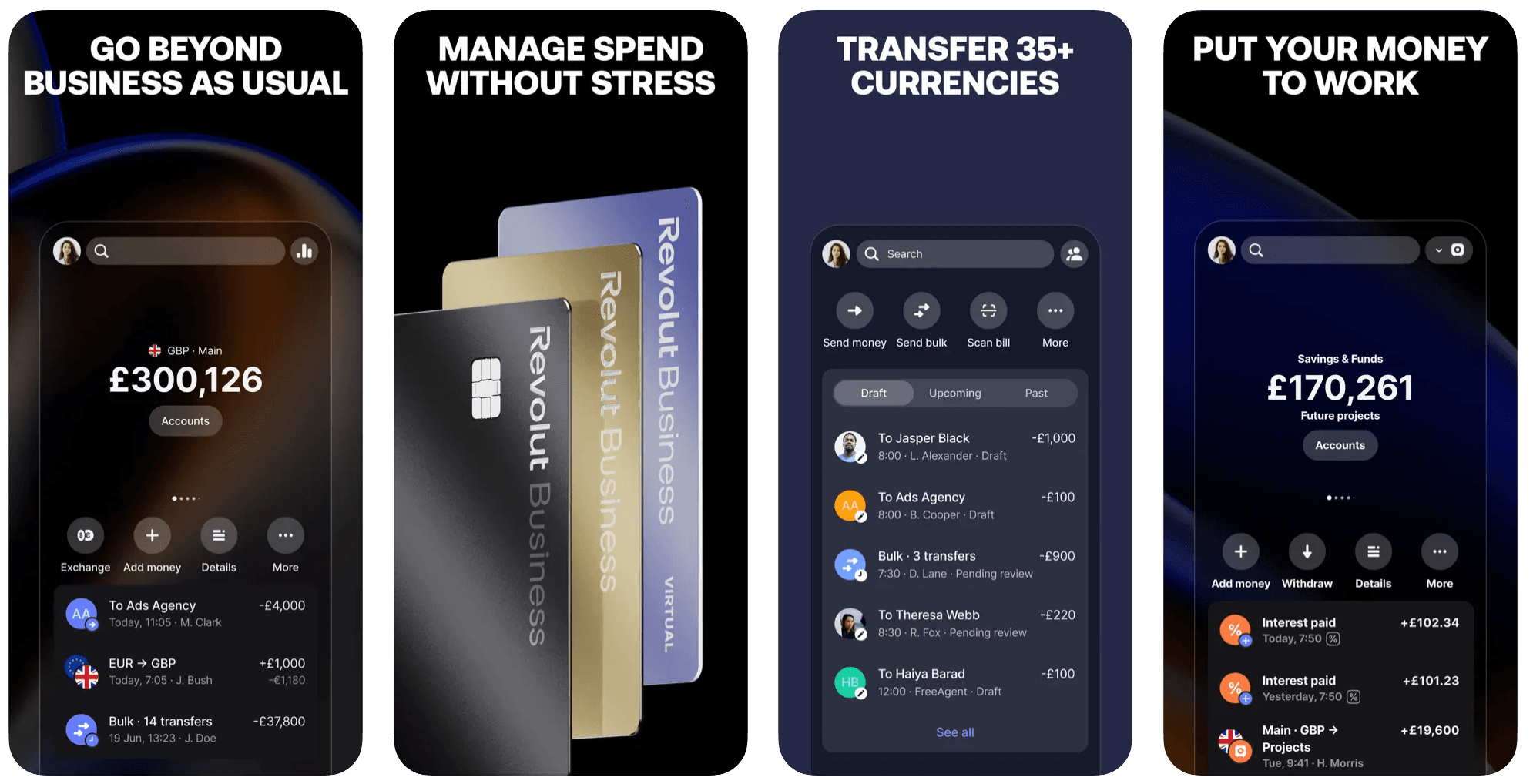

⚡ The smartest app – Revolut’s edge

Starling’s app is reliable, streamlined, and built with traditional business users in mind. Revolut’s, on the other hand, feels more like a financial dashboard – modern, colourful, and packed with extras like analytics, currency exchange, and even crypto management.

If you love data visualisation and hands-on control over your money, Revolut’s interface feels more advanced. Starling keeps it clean and functional, while Revolut goes for sleek and feature-rich.

Verdict: Revolut offers the flashier, more customisable app experience.

Who can open an account?

Both focus on UK-based businesses, but Revolut also accepts companies with international operations.

Starling

- Sole traders and limited companies registered in the UK

- All persons with significant control must live in the UK

- Requires ID, business documents, and a short video check

- Some high-risk industries excluded

Revolut

- Sole traders, limited companies, freelancers

- Can accept non-UK directors or shareholders

- Verification done entirely online

- Fewer industry restrictions, though crypto-related businesses are limited

Eligibility criteria

| Requirement | Starling | Revolut |

|---|---|---|

| Accepted business types | Sole traders, limited companies | Sole traders, limited companies, freelancers |

| PSC / director requirements | All must live in the UK | Global directors accepted |

| Industry exclusions | Yes | Some |

| Verification process | ID + video check | ID + online verification |

Pricing and fees

Money matters. Starling sticks to a single free model, while Revolut spreads features across multiple tiers.

Starling pricing

One free account with nearly all features included. Optional Business Toolkit (£7/month) for tax, invoicing, and cash flow tracking.

Revolut pricing

- Basic – £10/month (10 local + 0 international free transfers)

- Grow – £30/month (100 local + 5 international free transfers)

- Scale – £90/month (1 000 local + 25 international free transfers)

- Enterprise – custom pricing with bespoke limits

Value for money

- Sole traders: Starling’s free plan is hard to beat.

- Limited companies: Revolut Grow is worth the £19/month if you want multi-user features and spending controls.

Starling vs Revolut fees

| Fee type | Starling | Revolut Basic / Grow |

|---|---|---|

| Monthly fee | £0 | £10 / £30 |

| UK transfers | Free | 10 free (Basic) / 100 (Grow) then £0.20 each |

| Cash deposits | 0.7% (min £3) via Post Office | ❌ |

| International payments | 0.4% + £5.50 via SWIFT | ✅ with FX margin |

| Overdraft | Available (subject to eligibility) | ❌ |

| Cheque deposits | Free via app or post | ❌ |

Starling wins on value for everyday business banking, but Revolut’s paid plans add flexibility for companies trading overseas.

Features comparison

Both tick the core boxes – payments, transfers, and card access – but Revolut shines for international use, while Starling remains stronger for domestic businesses.

Payments and transfers in the UK

Both support Faster Payments, Direct Debits, and standing orders, though Revolut limits the number of free transactions on its Free plan.

Cash and cheque handling

- Starling: Post Office deposits (0.7% fee, £3 min), free cheque deposits.

- Revolut: No cash or cheque facilities.

Cards and spend management

- Starling: One debit card per director, Apple/Google Pay.

- Revolut: Multiple physical and virtual cards for team members (Grow+).

Invoicing and integrations

- Starling: Built-in accounting integrations; invoicing via optional Toolkit.

- Revolut: Invoicing available on Grow, with smart analytics and CSV exports.

Lending and overdrafts

- Starling: Overdrafts up to £50,000.

- Revolut: No overdrafts, but access to business credit through partners.

App and user experience

A good business account lives or dies by its app. Both are mobile-first, but their styles differ.

App interface

Starling: minimalist, professional, straightforward.

Source: App store

Source: App storeRevolut: bold, data-driven, visually rich.

Source: App store

Source: App storeYou can explore both apps yourself:

- Starling on the App Store / Google Play,

- Revolut on the App Store / Google Play.

Web access and APIs

Starling offers full desktop access and robust exports.

Revolut provides both app and browser access, plus an API for automation.

Onboarding speed and switching

Both allow sign-up in minutes via app. Starling supports the Current Account Switch Service (CASS) for easy migration – Revolut does not.

Customer support and reviews

Support channels

| Support feature | Starling | Revolut |

|---|---|---|

| In-app chat | ✅ 24/7 | ✅ 24/7 (Grow), limited hours (Free) |

| Phone support | ✅ | ❌ |

| Email support | ✅ | ✅ |

| Support team location | UK-based | Global (mostly EU) |

App Store / Google Play ratings

Both apps score above 4.5 stars. Users praise Revolut’s interface and analytics, while Starling wins for reliability and customer service.

Trustpilot score

| Platform | Starling | Revolut |

|---|---|---|

| Trustpilot | 4.2 (45k+ reviews) | 4.1 (150k+ reviews) |

Trustpilot complaints

- Starling: limited team access and slower onboarding during peak times.

- Revolut: occasional complaints about account freezes and automated support.

Security and trust

FSCS protection

Starling is a fully licensed UK bank, so deposits up to £85,000 are protected under the Financial Services Compensation Scheme (FSCS).

Revolut is an FCA-authorised e-money institution; funds are safeguarded in segregated accounts but not FSCS-protected.

Fraud prevention and controls

Both include 3D Secure, biometric login, instant card freezing, and spending limits.

Bank stability and licensing

Starling operates as a UK bank; Revolut remains an e-money institution regulated by the FCA.

Which is best for your business?

- Freelancers and sole traders: Starling’s free account is the best all-rounder.

- Small limited companies: Revolut Grow offers handy multi-user tools.

- Cash-based businesses: Starling supports Post Office deposits.

- International traders: Revolut’s FX and multi-currency accounts win.

- Businesses needing overdrafts: Starling is the only one that offers them.

Alternatives to consider

ANNA – your business account and admin sidekick

Here’s where things get easier.

ANNA is more than just a business account – it’s your admin helper in app form. You get an account with built-in tools for invoicing, expense tracking, and tax automation, so you can spend less time on paperwork and more time running your business.

- Create and send invoices in seconds

- Capture receipts and auto-categorise expenses

- File VAT and Corporation Tax automatically

- Add your team (not just directors)

- 4 free SWIFT payments a month on the Big Business plan

- Real humans available 24/7 on every plan

Plans start from £0/month, with clear pricing and no hidden fees. See current plans →

If you’re tired of juggling apps for your business finances, bookkeeping, and tax, ANNA brings everything together in one place.

Wise Business

Perfect for holding and sending money abroad. You get local account details in multiple currencies and the best exchange rates on the market – ideal for global freelancers and exporters.

How to open Wise business account →

Tide

A quick and simple e-money account that’s easy to open and manage. Great for startups that need fast setup and basic tools, though features are limited compared with Starling or ANNA.

How to open Tide business account →

Mettle by NatWest

A free account for sole traders and limited companies. Reliable and backed by a major bank, but feature-light compared to the digital challengers.

How to open Mettle business account →

Verdict: Starling vs Revolut

✅ Starling: Free, reliable, and feature-rich for everyday UK business use.

✅ Revolut: Great for international payments and multi-currency access.

✅ ANNA: The smarter choice if you want admin support, invoicing, and tax tools built in.

Whichever you choose, pick the account that does more than hold your money. Whether that’s Starling’s stability, Revolut’s global flexibility, or ANNA’s admin-friendly simplicity – your business deserves a financial partner that actually works for you.

Disclaimer: All info accurate as of December 2025. Always check official websites for the latest details.

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)