How to open a Revolut Business account

Has Revolut caught your attention for its modern look and cost-effective international transfers? Here’s how to open a Revolut business account.

- In this article

- What types of business bank accounts are available at Revolut?

- Revolut business account review: key features

- Pros and cons

- What are the requirements to open a Revolut Business Account?

- What documents do I need to provide to open a Revolut Business account?

- How much does a Revolut Business Account cost?

- Revolut vs ANNA fees

- How to apply for a Revolut Business account

- Revolut Business account customer reviews

- Revolut vs ANNA – a case study

- Summary Table

Revolut might only have launched in 2015, but it’s already one of the UK’s best-known challenger banks – especially for people who need to handle international payments. It also offers a dedicated business account, which is an interesting choice for companies with international operations. They are poised to reach 50 million customers worldwide by the end of 2024.

This guide covers how to open a Revolut business account, including eligibility requirements, fees, and how it compares to competitors.

What types of business bank accounts are available at Revolut?

Revout offers four different tiers for its business accounts:

- Revolut Basic

- Revolut Grow

- Revolut Scale

- Revolut Enterprise

Let’s look at each one in more detail.

Revolut Basic

A Basic account gives companies access to the core features that come with a Revolut account, which we’ll explore in more detail in our Features section.

It also offers:

- 5 fee-free local transfers

- Currency exchange of up to £1,000 at the interbank rate

Revolut Grow

Revolut Grow offers everything Revolut Basic does, but with some added features.

These include:

- 5 fee-free international transfers

- 100 fee-free local transfers

- Currency exchange of up to £10,000 at the interbank rate

- Bulk payments across multiple currencies

- A savings account where you can earn interest on up to £0.5 million

- Limit and stop orders when buying and selling foreign currencies

- One complimentary metal card

- Rewards (such as trials and discounts)

- Business APIs

- Expense approval and payment approval

- Analytics on profit and cashflow

- Control of account access for individual accounts

Revolut Scale

Revolut Scale is Revolut’s premier business account.

It offers the following (in addition to everything mentioned so far):

- 25 fee-free international transfers

- 1,000 fee-free local transfers

- Currency exchange of up to £50,000 at the interbank rate

- Two metal cards

- A savings account where you can earn interest on up to £1 million

Revolut Enterprise

For the largest companies, a cookie cutter assortment of features may not be enough. Enterprise is a plan Revolut tailors to individual organisations based on their needs.

It offers a custom number of fee-free international transfers, local transfers, and metal cards, plus a custom limit on how much you can exchange at the interbank rate.

You can also earn savings up to £2 million on this plan, and it’s the only tier that offers dedicated account management.

Revolut business account review: key features

We’ve already seen some of the features offered by different Revolut plans.

In addition to this, all Revolut tiers offer:

- Borderless accounts

- SWIFT account details

- The option to hold and exchange 25+ currencies

- Forward currency contracts to lock in exchange rates (at a fee)

- The chance to spend in 150+ currencies

- Recurring payments

- Plastic and virtual company cards

- ATM withdrawals

- Invoice creation

- Web payments

- Payment links and QR codes

- Revolut Pay for in-store payments

- Tap to Pay on iPhone

- Unlimited team members with their own permissions

- A mobile app

- Connections with other apps (like QuickBooks, Zapier, and Xero)

- 24/7 customer support

While this is a good range of features, there are a few things missing.

For instance, although Revolut offers some invoice-creation tools, it doesn't have sophisticated bookkeeping support. In contrast, ANNA, gives you the option to pay for a taxes add-on that includes help with Corporation Tax, VAT, payroll, and more.

Pros and cons

Unsure whether Revolut Business is right for you? We’ve outlined the main pros and cons below.

Pros

Revolut has plenty of good features when it comes to currency exchange. It supports borderless accounts and numerous currencies and offers competitive exchange rates, both for international payments and when using your card abroad.

It also offers low-cost plans, including a fee-free option, which makes it an accessible choice for new businesses.

You can apply for an account and manage it from your phone. This convenience is ideal for entrepreneurs with limited time.

Cons

One of Revolut’s major limitations is that it doesn’t accept cash or cheque deposits, which can be a major inconvenience for some customers.

It also doesn’t accept certain business structures, including sole traders, which counts a lot of people out of an account.

What are the requirements to open a Revolut Business Account?

To open a Revolut Business account, your company must meet the following criteria:

- Fully incorporated and active

- Registered in a country supported by Revolut (full list here)

- Not part of certain unsupported industries (full list here)

- Not a charity, in the public sector, a cooperative, or a sole trader

You must also have a legal home address in the UK, EEA, Switzerland, US, Australia, or Singapore.

Those who don’t meet the criteria can opt for another service instead, such as opening a business account with ANNA.

What documents do I need to provide to open a Revolut Business account?

To open a Revolut business account, you need the following:

- National ID or residence permit and video selfie to prove your identity

- Certificate of incorporation or registration of your business

- Document listing all directors and shareholders who have more than 25% of ownership

- Supported documents to provide company’s operating address (list outlined here)

You’ll also need to give a description of your company’s area and what it does, and outline how you plan to use your account.

How much does a Revolut Business Account cost?

Below, we’ve compiled the main fees associated with a Revolut business account.

Revolut Monthly Account Fees

- Revolut Basic: £0 per month

- Revolut Grow: £19 per month

- Revolut Scale: £79 per month

- Revolut Enterprise: Custom

There are discounts available on the Grow and Scale accounts for companies that subscribe to the annual plan.

Revolut international payment fees

Once you’ve used up no-fee international transfers, there is a fee of £5 per transaction.

Revolut local transfers

There’s a fee of £0.25 per transaction after using up your no-fee local transfers.

Revolut ATM withdrawals

There’s a 2% fee on ATM withdrawals made using your Revolut card.

Can you pay a cheque in online with Revolut Business?

Revolut doesn’t support cheque deposits. It also doesn’t accept cash deposits.

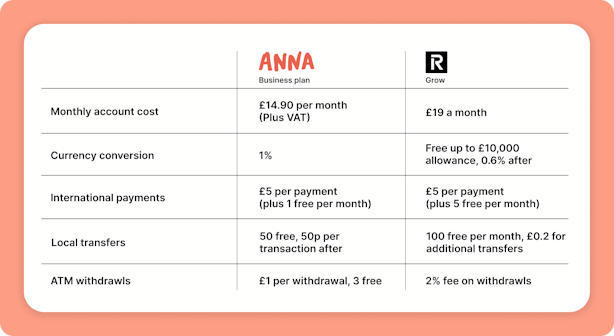

Revolut vs ANNA fees

Below, we’ve summarised the fees on ANNA and Revolut to help you compare the two. Since both platforms offer various plans, we have made a comparison between the lower-tier and higher-tier plans for each platform.

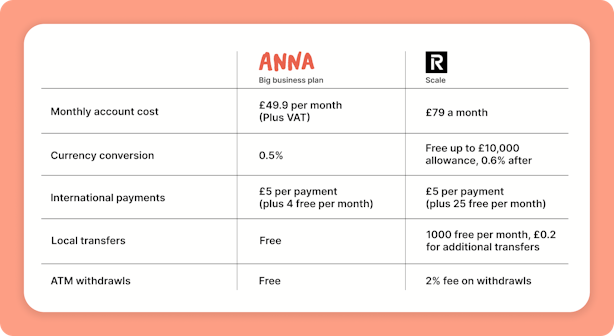

Comparing Revolut Scale with ANNA

How to apply for a Revolut Business account

Opening an account is simple. Just fill out a short form, which takes around ten minutes, and upload the documents asked for.

Then the team will need to review your account. This generally just takes a day or two, but if it’s longer, you can contact customer support.

Revolut Business account customer reviews

Revolut has a 4.2 rating on Trustpilot. There are lots of customers praising how easy it is to use the platform, especially when dealing with international transactions. Yet there’s also a significant number of customers who have left negative reviews. Some of them complained about poor customer services after experiencing fraud.

Revolut vs ANNA – a case study

Now, let’s compare the costs of a Revolut Grow account with those of an ANNA Business account.

In this example, a small business owner has the following costs:

Domestic payments: 15 transactions of £100 each

International payments: Two transactions of £500

Card payments: £1000

ATM withdrawals: Two withdrawals of £100

Revolut Grow:

- Domestic payments: £0 (100 free transactions per month)

- International payments: £0 (5 free payments per month)

- ATM withdrawals: £4 (2% fee on £200)

- Monthly account fee: £19

Total Revolut Grow fees: £23

ANNA Business Plan:

- Domestic payments: £0 (50 free transactions per month)

- International payments: £5 (one free payment per month)

- ATM withdrawals: £0 (3 free withdrawals per month)

- Monthly account fee: £14.90

Total ANNA fees: £19.9

As you can see, the numbers are close but ANNA comes out on top.

FAQs

Can I open a Revolut Business Account online?

You can either open a business account from the app or online. It involves filing in a small form.

How long does a Revolut Business Account take to open?

It takes 10 minutes to apply. Generally, it takes around 24 hours for verification, but may be longer in more complex cases.

How do I close my Revolut Business Account?

To close your account, just navigate to your settings while you’re signed in. Then, head to “accounts and documents,” select “close business account,” and say why you want to close your account.

Summary Table

Open a business account in minutes