How to open an HSBC Business Account Online? (Updated 2026)

HSBC is one of the largest international banks in the world, and their business banking services are widely used by entrepreneurs and SMEs. But is an HSBC bank business account right for you? In this review, we’ll guide you through how to open an HSBC business account, explore account types, fees, and compare HSBC with modern alternatives like ANNA. We’ll also give a real example of a small coffee shop transaction activity and charges.

- In this article

- What types of business bank accounts are available at HSBC?

- What are the requirements to open an HSBC Business Account? Eligibility criteria

- What documents do I need to provide to open an HSBC Business Account?

- How much does an HSBC Business Account cost?

- HSBC Pay cash in deposit

- HSBC ATM withdrawals

- Can I open a HSBC business account online?

- How long does an HSBC business account take to open?

- How do I close my HSBC business account?

- Key takeaways from our HSBC business account review

- HSBC vs ANNA – a coffee shop case study

- Sources

What types of business bank accounts are available at HSBC?

HSBC has a range of 3 different business accounts, each designed to support different stages and types of businesses.

| Kinetic current Account | Sole traders or single director sole shareholder businesses. You must be a UK resident paying UK taxes and your business must turnover less than £6.5m |

|---|---|

| Small Business Banking Account | Small enterprises that require everyday transactional banking services. Suitable for sole traders, private limited companies and partnerships |

| Business Banking Account | Established small and medium-sized enterprises |

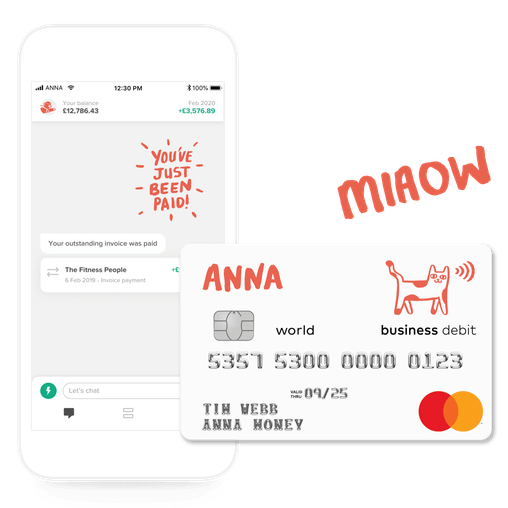

At ANNA we also have 3 different packages – Pay as you go, Business and Big business, however none of them have a turnover limit. Find out more about ANNA business accounts.

What are the requirements to open an HSBC Business Account? Eligibility criteria

To open HSBC business account you should be a:

- Sole trader or a limited company (not including Channel Islands or Isle of Man)

- UK tax resident

What documents do I need to provide to open an HSBC Business Account?

You will need the following information about your business at hand:

- full business address

- contact details (telephone number, email address)

- Companies House registration number (for limited companies and partnerships)

- your estimated turnover

As well as personal details from you and any partners or directors:

- full name and date of birth

- telephone number and email address

- current personal address (and previous address if you’ve been there under 3 years)

- account number (in case you already have HSBC bank account)

- details of your debit/credit cards

After you submit your application, HSBC will try to identify you online. If this doesn't work, you’ll be asked to provide proof of your identity (passport, ID, driving licence etc.) and address (utility bills, council tax letters etc.) via a smartphone or webcam.

How much does an HSBC Business Account cost? – A detailed examination of the fees

We used the latest updated Business Price List from 1 July 2025 for this report and this is what we found:

HSBC monthly account fees

The first 12 months are free for all the business banking products, however after 12 months in addition to the monthly fees you’ll have to pay an annual fee of £32 for each Commercial Card that you own.

| Business Banking Tariffs | Monthly fees |

|---|---|

| Kinetic Current Account | None for first 12 months, then £6.50/month |

| Small Business Banking Account | £0/month |

| Business Banking Account | None for 12 months, then £10/month |

At ANNA we don’t charge annual fees for our cards – you can have an unlimited number of cards on the Big Business plan and up to 5 free ones on the Business plan. With our Pay as you go plan you get charged only 20p per transaction which is equivalent to 32 transactions to match Kinetic Current Account of £6.50/month. Therefore, we conclude:

| ANNA Business accounts | Free cards |

|---|---|

| Pay as you go | 1 card included, £3 per extra card, per month |

| Business | Up to 5 cards included, £3 per card, per month after that |

| Big Business | Unlimited free cards |

HSBC International payment fees

International business accounts are charged an Annual Account Maintenance Fee (charged monthly), plus an additional £6/month for internet banking international payments functionality. The international payments charge is £17 per payment, incoming payments under £100 are free, otherwise it’s £6 per payment.

| Business Banking Tariffs | Annual Account Maintenance Fees |

|---|---|

| Kinetic current Account | N/A |

| Small Business Banking Account | £96/year or currency equivalent per account |

| Business Banking Account | £120/year or or currency equivalent per account |

At ANNA international payment fees are included in the packages and we don’t charge any Annual Account Maintenance fees.

| ANNA Business Accounts | Free SWIFT payments per month |

|---|---|

| Pay as you go | None, £5 per payment |

| Business | 1 free SWIFT payment, £5 per payment after |

| Big Business | 4 free SWIFT payments/month, £5 per payment after |

HSBC’s International Payments for business accounts are more expensive than ANNA’s

If you’re about to use International payments at HSBC you’ll pay £96/12=£8 per month Annual Account Maintenance Fee, plus £6/month for internet banking and £17 per payment, which adds up to £31 pounds a month, while at ANNA’s Pay as you go package alone you would be charged only £5.

HSBC Local transfers in and out

Payments made online via Business Internet Banking are free for all the tariffs

| Business Banking Tariffs | Local transfer fees |

|---|---|

| Kinetic current Account | Free |

| Small Business Banking Account | Free |

| Business Banking Account | Free |

At ANNA you have unlimited free bank transfers on the Big business plan, 50 free bank transfers on the Business plan, while on Pay as you go, we will charge you 20p per bank transfer.

| ANNA Business Accounts | Local free bank transfers |

|---|---|

| Pay as you go | 20p per bank transfer |

| Business | 50 free bank transfers, 20p per transfer after that |

| Big Business | Unlimited free bank transfers |

HSBC Pay cash in deposit

| Business Banking Tariffs | Cash in deposit fees |

|---|---|

| Kinetic current Account | 1.50% of the cash value deposited |

| Small Business Banking Account | 1.50% of value deposited |

| Business Banking Account | 1.50% of value deposited |

At ANNA you pay no commission fee on the Big business plan. On the Business plan you get £300 cash per month for free and 1% commission after that. On Pay as you go you pay 1% commission.

| ANNA Business Accounts | Local free bank transfers |

|---|---|

| Pay as you go | 1% of the cash value deposited |

| Business | £300 cash per month for free and 1% commission after that |

| Big Business | Unlimited deposits with no commission |

HSBC ATM withdrawals

Cash machine withdrawals are free during the first 12 months. Here are the fees that apply after that period:

| Business Banking Tariffs | ATM withdrawal fees |

|---|---|

| Kinetic current Account | 25p per withdrawal plus 0.60% of the value withdrawn |

| Small Business Banking Account | 25p per withdrawal plus 0.60% of the value withdrawn |

| Business Banking Account | 25p per withdrawal plus 0.60% of the value withdrawn |

At ANNA we offer Unlimited free ATM withdrawals on our Big Business plan. On the Business plan you get 3 free cash machine withdrawals per month and it’s £1 per withdrawal after that. On Pay as you go, it’s £1 per cash machine withdrawal.

| ANNA Business Accounts | ATM withdrawal fees |

|---|---|

| Pay as you go | £1 per ATM withdrawal |

| Business | 3 free ATM withdrawals per month, £1 per withdrawal after |

| Big Business | Unlimited free ATM withdrawals |

Can you pay a cheque in an online HSBC business?

Yes, you can deposit a cheque using the latest HSBC app as well as at the counter or using a self-service machine in the branch. You will pay 50p per cheque deposited. The limitations on the in app cheque deposit are: each cheque can’t be more than £2000 and the total amount can’t exceed £5,000 (the number of cheques is not limited though).

| Business Banking Tariffs | Cheque deposit fees |

|---|---|

| Kinetic current Account | 50p per cheque |

| Small Business Banking Account | 50p per cheque |

| Business Banking Account | 50p per cheque |

Currently ANNA has no option to deposit cheques to the account, but we will be introducing this feature in the future.

Can I open a HSBC business account online?

Yes, you can apply for an HSBC business account online. You will need to:

- Download the HSBC app

- Record a video and provide your ID

In order to be eligible for an HSBC business account you should be a UK tax resident, registered as a sole trader or limited company with HMRC. You might be asked to provide proof of address (utility bill, mortgage statement, council tax bill etc.) and a proof of your business activity as well.

How long does an HSBC business account take to open?

Most business accounts at HSBC are opened in 48 hours, while at ANNA you can open a business account online in under 10 minutes.

How do I close my HSBC business account?

You can close your HSBC business account by filling the closure form in your Internet Banking. Find the “Account services” tab and select “Account closure”. You can always apply for ANNA business account instead.

Key takeaways from our HSBC business account review

HSBC offers a solid range of business banking solutions designed for different stages of business growth – from sole traders to more established SMEs. The accounts come with a free 12-month introductory period, after which monthly fees apply depending on the account type.

International payments and cash handling services are available but come with additional charges, which can add up for businesses with frequent overseas transactions. The application process is fully online, although identity verification might sometimes require additional documentation.

Overall, HSBC remains a strong option for businesses that value traditional banking infrastructure and branch access, but it may not be the most cost-effective or flexible solution for small businesses looking for digital-first tools or automation features.

HSBC vs ANNA – a coffee shop case study

Meet Dwight, he runs a coffee shop in Shoreditch with his wife Angela (all characters are fictional and no relation to the US Office TV show). Last month they:

- Made 69 local payments in and out

- Received 1 international payment of £150 (refund for coffee they ordered by mistake from Columbia)

- And each of them has a debit card

With HSBC they would have pay: 69x£0 (for local transactions) + £96/12 (for international payments Annual Maintenance Fee) + £6 (online banking fee) + £6 (incoming international payment fee) + £64/12 (2 Commercial Cards, if applicable) + £0 (Small Business Banking Account monthly fee) = £25.30

With ANNA they would have to pay: £14.90 + 50*£0 + 19*£0.2 (for local transactions, given they choose Business package they have 50 free transactions, and 20p for the rest) + 1*£5 (for international payment) + 2*£0 (for debit cards) = £19.90 To sum up, Dwight and Angela save to themselves £5.40 a month with ANNA. Moreover, with the ANNA Business account they have access to the automated accounting features like VAT filing, Corporation Tax, Payroll, Confirmation statement and many other business tools that are already integrated in the app, so they don’t need to worry about additional pricey accounting softwares on the market.

HSBC vs ANNA comparison

HSBC vs ANNA comparisonThe business banking industry has evolved significantly over the last 5-10 years, leaving a lot of the old school high street banks behind.

For many high street banks, it is taking far too long to adapt to the changing market and introduce new features like integrated accounting software or invoice automation. What they can provide is a solid set of basic banking products (as well as long waits for customer support). But you’ll miss out on the latest features and the technology that will allow you to save time and money on your business. It’s also worth diversifying your risks by trying different business accounts to make sure you have the right one for your business. At ANNA you get your first month free, so it’s simple and easy to try out the new features and take advantage of the latest technology.

Sources

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)