What is a Confirmation Statement and How to File it

Everything you need to know about the confirmation statement or Companies House form CS01. Step by step guide to making changes to your company records and filing.

What is a confirmation statement?

A confirmation statement (aka Companies House form CS01) is a document containing all the key information about the company’s management, ownerships and activities, whether the company is dormant or non-trading. It needs to be filed every year by all LTD or LLP companies, even if your company is dormant or non-trading. Miss the deadlines and your company could be closed, so make it a priority!

This quick blog post will explain what you need to know about your confirmation statement, and how to make changes to it on the gov.uk website.

Do I need to file a confirmation statement?

Yes, all registered companies are required to file a confirmation statement at least once a year to confirm the details on file for the company at companies house are still correct. There are some details you need to update before filing the confirmation statement and some that can be updated during the filling process.

Before:

Information that needs to be updated before starting the filing process include:

- directors and secretary

- people with significant control (PSC)

- company’s registered office address

If any of these details have changed since you incorporated the company or since your last confirmation statement, you’ll need to update these details before filing the confirmation statement (we’ll say it again – you need to do it before you file).

Make sure you’re registered for online filing and then you can update those details online on the Companies House website.

During:

There are also some details you can change when you’re filing the confirmation statement itself:

- Standard Industrial Classification (SIC) code

- statement of capital

- trading status of shares

- exemption from keeping a PSC register

- shareholder information

If nothing has changed since your last confirmation statement or incorporation of the company, you still need to file a confirmation statement, even if your company isn’t trading or is dormant.

To file you’ll need your Company Number and your WebFiling login information. You can use the links below to jump to the relevant section for your filing:

What roles do you need to know about?

Directors and Secretary

If you’ve appointed a new director or secretary for your company, or the details of an existing director or secretary have changed, you will need to update this information on Companies House. You can also inform Companies House of the termination of an existing director or secretary.

People with Significant Control (PSC)

There are a number of definitions for Persons with Significant Control, usually these are people who hold:

- more than 25% of the company

- more than 25% of voting rights

- The right to appoint or remove the majority of the board of directors

Company’s registered office address

This is the official address where your company is registered and where all HMRC and Companies House letters will be sent. This can be different from your trading address – for example when you have a retail store.

Standard Industrial Classification (SIC)

The standard industrial Classification (or SIC Code) describes the nature of your business. You can change your SIC code or add additional SIC codes if your business has started working in other business areas.

Statement of Capital

This describes the number of shares, their value and type of shares in your company. Normally, your company would have been set up with one ordinary share owned by you as the company director. If you’ve issued more shares in the past 12 months or added new types of shares to your company, you have to state those changes here.

Trading Status of Shares

You need to inform Companies House if the shares of your company have started trading on any exchange (e.g. the London Stock exchange).

Exemption from keeping a PSC register

You can apply for an exemption from keeping a PSC register to keep the information of all or some PSCs in a company private. Listed companies, for example, are exempt from keeping a public PSC register but need to apply for exemption.

Shareholder Information

If you have new shareholders in the company or any shareholders that need to be removed from the company because they no longer hold shares in the business, you need to update this information on Companies House. You can also change the number of shares held by each shareholder.

How to file confirmation statement

Accessing the confirmation statement filing process

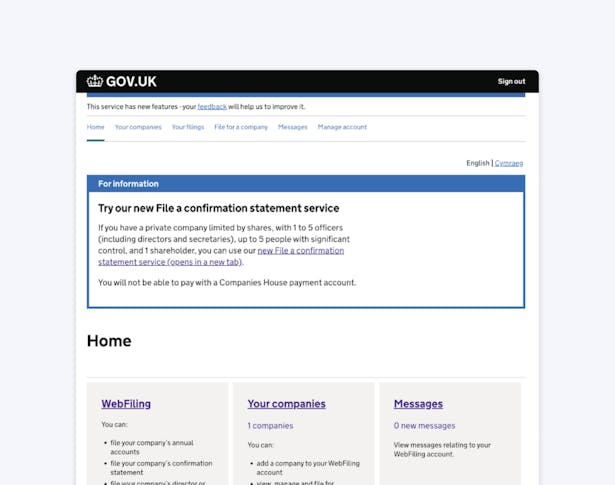

To make changes to your company records on file and file your confirmation statement, you’ll need to login into your WebFiling account.

After login, select WebFiling from your dashboard.

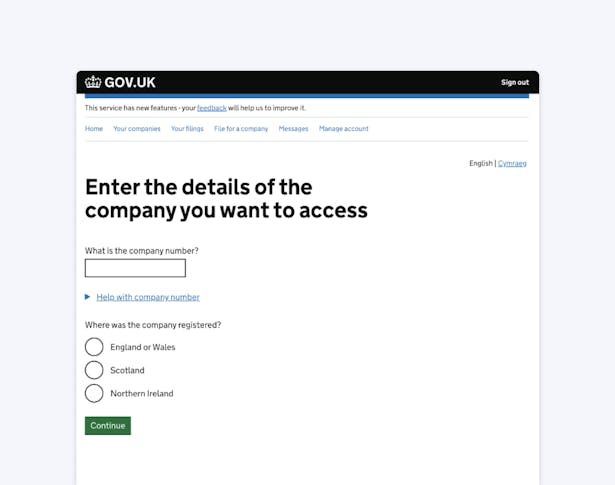

On the next screen you’ll need to enter your company number and check the correct box for where your company was registered.

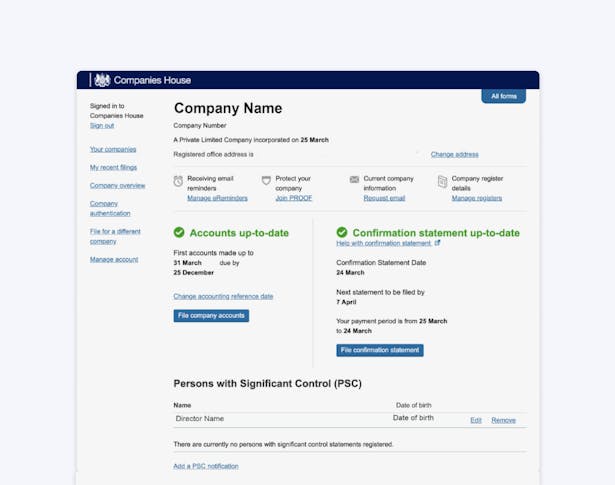

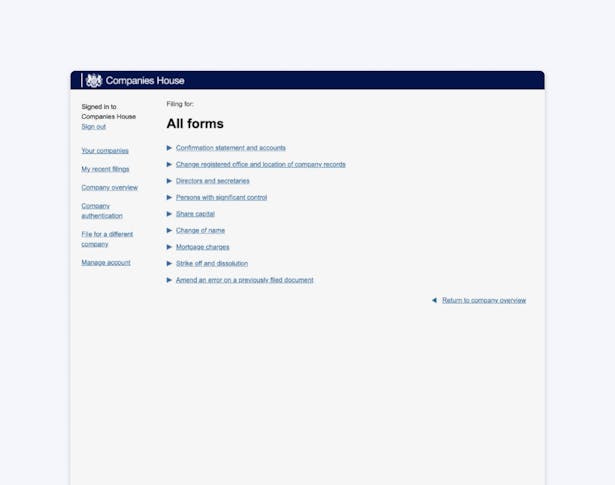

You’ll now see all available web filing options for your company.

Click ‘File Confirmation Statement’ to start the filing process. If you have any updates for your company, you can access the forms on the next page.

Filing your confirmation statement with no changes to your company information

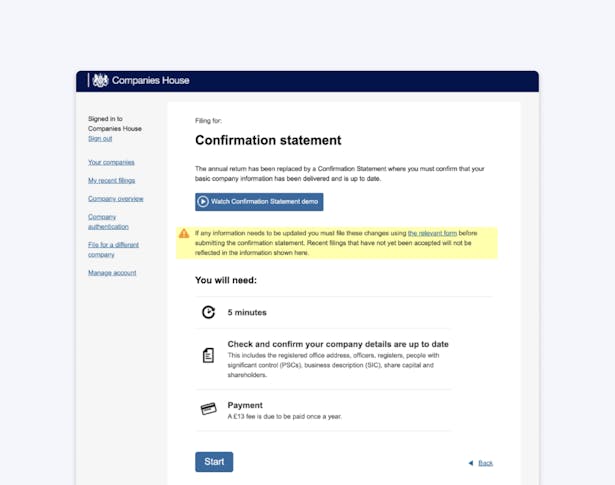

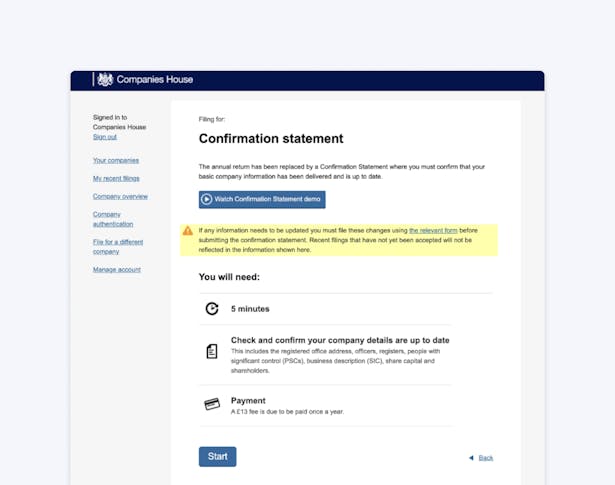

If you have no updates for your company, just click start on the next screen:

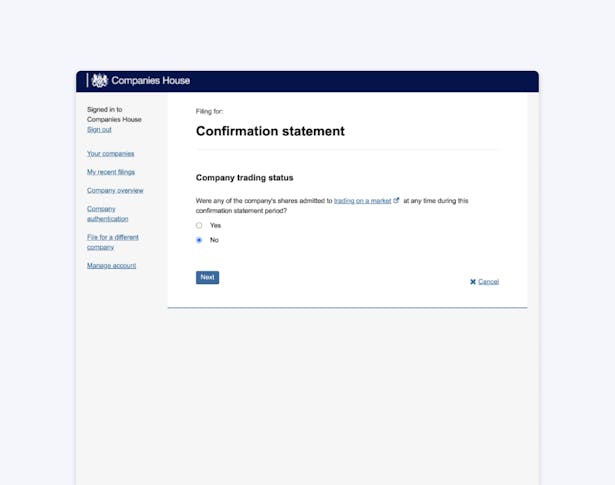

In the next step, confirm your confirmation statement date and whether your company shares have started trading on a stock exchange (eg. the London Stock Exchange). Click ‘No’ and continue.

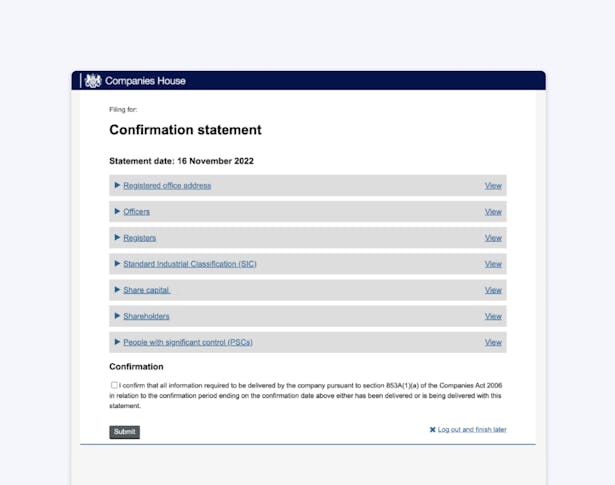

You can review all your company information on the next screen. You’ll be able to edit the following categories before you file your confirmation statement:

- Standard Industrial Classification (SIC) code

- statement of capital

- trading status of shares

- exemption from keeping a PSC register

- shareholder information

If nothing has changed or you have made all necessary changes, click confirm to finalise your confirmation statement filing. It’s as easy as that!

That’s it! Your confirmation statement is now filed.

Making changes to your company records before filing

When you need to make changes to the company details on file, click on ‘the relevant form’ in the yellow box to make changes to your account.

You’ll then be able to access change request forms for specific company details. You should update key information such as

- directors and secretary

- people with significant control (PSC)

- company’s registered office address

Do this before starting the confirmation statement filing process.

Once you’ve made all the necessary changes, click ‘Return to Company Overview’. You can then continue with the steps outlined in the “Filing your confirmation statement with no changes to your company information” part of this guide.

Open a business account in minutes