How to Open Monzo Business Account Online

Monzo is one of the UK’s leading challenger banks, and for the last few years, it has also offered a business account. This offers a low-cost, mobile-first alternative to traditional financial institutions.

In this guide, we’ll cover how to open a Monzo business account online and break down extra details such as eligibility criteria, fees, and pros and cons.

- In this article

- What Types of Business Bank Accounts are Available at Monzo?

- Key Features

- Monzo Business Account Review: Pros and Cons

- What are the Requirements to Open a Monzo Business Account?

- Restricted businesses

- What Documents Do I Need to Provide to Open a Monzo Business Account?

- How Much Does a Monzo Business Account cost?

- Monzo vs ANNA Fees

- How to Apply for a Monzo Business Account

- Monzo Business Account Customer Reviews

- Monzo vs ANNA – A Case Study

- FAQs

- Embrace the Banking Revolution

- Summary table

What Types of Business Bank Accounts are Available at Monzo?

Monzo keeps things simple with its business accounts, offering just two plans: Business Lite and Business Pro.

Business Lite

Lite is Monzo’s free business account. It only offers basic features:

- Payment links

- Mobile and web access

- Stripe card payments

- Bank transfers

- Option to accept contactless payments

As well as the usual key features of Monzo (which we’ll cover shortly).

Business Pro

The Pro account has everything the Lite plan offers, but with additional features:

- Pots that automatically set aside money for taxes

- Accounting integrations with Xero, Freeagent, or Quickbooks

- Multi-user access

- Invoicing

- Virtual cards

- Automatic exports of transactions

- Connections with other business accounts and cards

Key Features

Both Monzo business accounts provide the following:

- 24/7 customer support

- Instant notifications about payments and transactions

- Pots to separate funds into categories (e.g., marketing and sales)

- Instant access saving pot offering 1.6% AER

- Option to add receipts to payments

- Sole trader loans up to £25,000 and overdrafts up to £2,000 for eligible customers

- Breakdown of monthly spending and transaction categories

It also provides the key features you’d expect from any business account, such as a debit card, instant UK bank transfers, mobile apps, and the option to pay in cash and cheques.

This simple set of features works well for many entrepreneurs. However, those who are looking for more business support may benefit from an account like ANNA, which offers tools to help you run your company. Our business account can calculate and file VAT return and corporation tax, alongside other similar features.

Monzo Business Account Review: Pros and Cons

No business account is perfect. Below, we’ve summarised the pros and cons of Monzo’s offering.

Pros

Monzo is part of the £85,000 FSCS protection scheme. This means that eligible deposits up to this amount will be protected, regardless of what happens to Monzo.

Another of the bank’s main selling points is that it's well-suited for those who want to use it internationally. It’s cheap and easy to use your business debit card abroad, and you can even withdraw some cash from foreign ATMs without fees.

Monzo also has a simple fee structure, with just two plans. Plus, even its most expensive tier is just £5 a month, which is cheaper than most traditional banks.

Cons

While Monzo’s simplicity is a draw to many, it can also be a limitation. For instance, you can’t manage your account over the phone or at a branch if you encounter issues, which is a dealbreaker for many.

Although its low fees are one of the primary draws, they may not always be as generous as they first appear. For some businesses, the £1 fee for paying in cash and the 1% currency conversion fee for receiving international payments can add up.

Also, relying on a third-party (Wise) for international transactions isn’t ideal in case something goes wrong with the process.

What are the Requirements to Open a Monzo Business Account?

To apply for a Monzo business account, you must be either a sole trader or a limited company director in the UK. Charities and partnerships aren’t eligible.

You must also meet the following criteria:

- 16 years of age or above

- Based in the UK

There are additional criteria for limited companies:

- Active status on Companies House

- Active company director

- At least one person of significant control on Companies House

- Tax resident in the UK

- Can’t make most of money from interest or investment

You can open a Monzo account for up to three businesses.

Restricted businesses

You can’t open a business account with Monzo if you are operating a business from the industries below:

- Tattoo and nail salons

- Used automotive vehicles

- CBD related businesses

- Scrap metal traders

- waste management

If this is your case, you are welcome to open a business account with ANNA.

Here is a common list of industries that can’t open a business account neither at Monzo nor at ANNA:

- Currency Exchange Services – providing foreign exchange services, including currency conversion and forex trading

- Quarries, mining, or processing of metal ores or coal

- Involvement in the manufacture or trading of weapons, firearms, explosives, complex weapons (e.g. guided missiles), poisons or nuclear materials and providing military-grade security services

- Consumer credit, credit repair, debt restructuring, debt recovery, debt settlement, and debt collection

- Dating or escort services

- Dealing with precious metals and precious stones

- Gambling/casino/betting

- Shell banks or shell companies

- Drugs

- Insurance

- Registered and unregistered charities, Community Interest Companies (“CIC”), non-profit companies where donations are the main source of income

What Documents Do I Need to Provide to Open a Monzo Business Account?

You’ll need the following documents to open an account:

- Proof of business address

- Registered company number

- Unique tax reference number

- Identification (passport, driving licence, national ID card, biometric residence permit)

How Much Does a Monzo Business Account cost?

A full breakdown of Monzo business account fees can be found on their website. However, we’ve summarised the fees below.

Monzo Monthly Account Fees

The Business Lite plan is free, while Business Pro costs £5 per month.

Monzo International Payment Fees

It’s free to use your card abroad – Monzo won’t inflate the exchange rate for a profit or charge other hidden fees.

Monzo keeps the fees for its international payments simple.

There’s a 1% currency conversion fee for receiving international payments, with a cap of £1,000 per transaction.

Monzo offers its outbound transactions through an integration with the payment solution Wise. Therefore, the fees in question are set by Wise and not Monzo.

Wise’s conversion fees vary depending on the currency, but they start at 0.33%.

Monzo Local Transfers

There are no fees on local transfers with a Monzo account.

Monzo Pay Cash In Deposit

There’s a £1 fee to pay in cash into your account from the UK.

Monzo ATM Withdrawals

In countries outside the European Economic Area, you can take out £200 every 30 days fee-free, after which there’s a fee of 3%.

Within the UK and the European Economic Area, this service is free.

Can you Pay a Cheque in an Online Monzo Business?

Yes. Monzo lets you pay in cheques of up to £500 through its app, and over £500 by post.

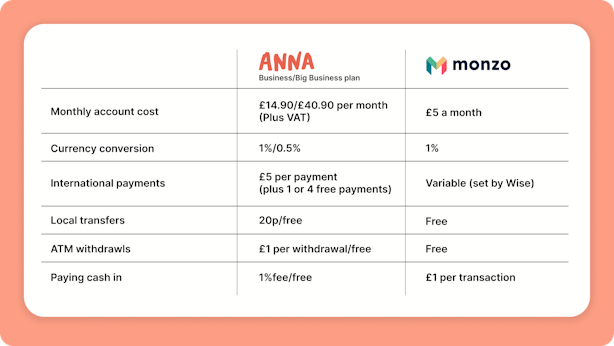

Monzo vs ANNA Fees

We’ve summarised the cheapest fees for ANNA and Monzo in the table below.

How to Apply for a Monzo Business Account

Monzo prides itself on a simple sign-up service, and you can carry out the process straight from your phone.

It involves the following steps:

- Download the app

- Answer some basic questions about your business (such as industry and address)

- Provide your UK tax identification number and financial questions

- Verify your identity (and any people with significant control in the case of a limited company)

- Wait to be approved

Or, if you already have a personal account with the bank, you can log into the app, click “Do more with Monzo” and select the option to open a business account. Then, the rest of the steps are the same as above.

You can’t apply for an account over the phone or at a branch.

Monzo Business Account Customer Reviews

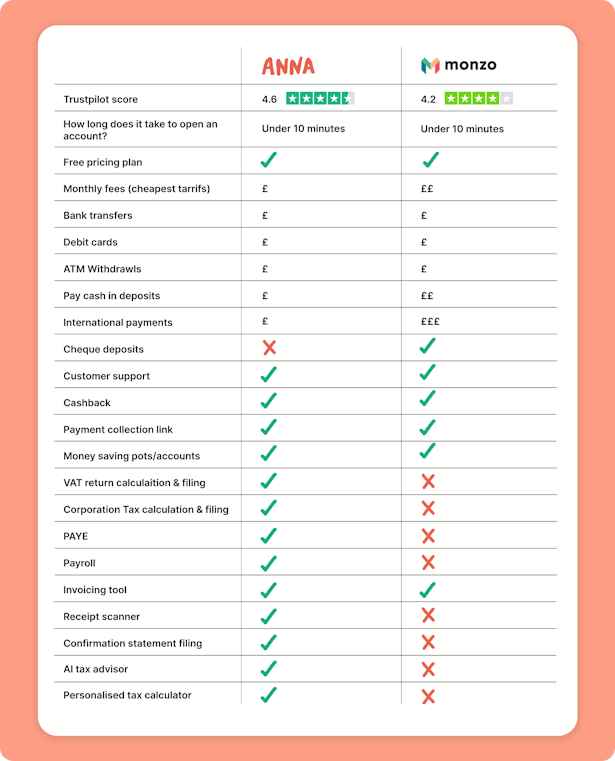

On Trustpilot, Monzo has an average rating of 4.1, which puts it in the “great” category. This is across more than 35,000 reviews.

Customers generally reported that they enjoyed using the app and its features and found it straightforward to navigate. However, some of the negative reviews were frustrated with the poor customer service and long wait times.

It has a much lower rating of 1.7 on Reviews.io, but this is only across 125 reviews.

This compares with an average rating of 4.5 for ANNA on Trustpilot, across more than 3,000 reviews.

Monzo vs ANNA – A Case Study

Let’s compare the costs of a Business Pro account on Monzo with a standard business account on ANNA.

In this example, an entrepreneur has the following costs:

- Domestic payments: 12 transactions totalling £500

- International payments: two transactions of £1000 each

- Cash deposits: ten deposits of £200

- Card payments: £400

When using Monzo Pro, the entrepreneur would face the following fees:

- Domestic Payments: £0

- International Payments: 10 * (1% of £100) = £20

- Cash Deposits: 10 deposits at £1 each = £10

- Card Payments: £0

- Monthly Account Fee: £5

Meanwhile, when using the Standard Business ANNA account, fees would be as follows:

- Domestic Payments: £0 (there are 50 free transactions)

- International Payments: one free, one £5 transaction = £5

- Cash Deposits: £0

- Card Payments: £0

- Monthly Account Fee: £14.90

Total fees for Monzo would be £35, while the fees for ANNA would be just £15.90, making ANNA the cheaper option.

FAQs

Can I Open a Monzo Business Account Online?

Yes, but you must download the app and open the account from your phone.

How Long Does a Monzo Business Account Take to Open?

It takes the average customer one day to open their account. In some cases, it may take a few days.

How Do I Close my Monzo Business Account?

First, make sure your balance is £0. Then, tap on your profile icon, go to settings, and click “close account.”

Embrace the Banking Revolution

Setting up a business account no longer means heading to the high street and registering with one of the big names. There are now a whole host of challenger banks vying for your attention with the allure of low fees and forward-thinking features, such as Monzo.

For a modern business account with all the trappings of Monzo plus additional support features, look no further than ANNA. Opening an ANNA business account will give you access to tools that help you file taxes and run your company, as well as low fees for international payments.

Best of all, you can give it a go for free.

Summary table

Sources:

https://monzo.com/legal/business-account-fee-information/#general-account-services

https://monzo.com/business-banking/eligibility/

Open a business account in minutes