Looking for a business account you can run from your phone – without losing your mind? Starling and Monzo are two of the UK’s digital banking darlings – sleek, modern, and made for businesses on the move.

- In this article

- Starling vs Monzo: Which business account actually works for you?

- Starling vs Monzo at a glance

- Quick look: Starling vs Monzo features

- Who are these accounts best for?

- Who can open an account?

- Eligibility criteria

- Pricing and fees

- Monzo vs Starling fees

- Features comparison

- Features table

- App and user experience

- Customer support and reviews

- Security and trust

- Which is best for your business?

- Alternatives to consider

- Verdict: Starling vs Monzo

Starling vs Monzo: Which business account actually works for you?

Bonus: there's a third option you might not have considered…

Looking for a business account that doesn’t make life harder than it has to be? Starling and Monzo are two of the most popular app-based banks in the UK – both digital, both modern, both designed for people who run their business from their phone.

But when you scratch beneath the surface, their offers start to look very different. This guide compares Monzo’s Lite Pro and Team business accounts with Starling’s free account – covering everything from features and fees to customer support and who can actually apply.

And because we’re ANNA, we’ll also show you how we stack up – especially if you’d prefer your business account to come with admin support, tax tools, and real humans on hand 24/7.

Starling vs Monzo at a glance

If you want the short version, here it is: Starling keeps things simple with one free plan that covers most needs, while Monzo splits features between a free “Lite” plan and a paid “Pro/Team” upgrade.

Quick look: Starling vs Monzo features

| Feature | Starling | Monzo Lite / Pro / Team |

|---|---|---|

| Monthly fee | £0 | £0 / £9 / £25 |

| International payments | ✅ (via SWIFT) | ❌ Lite ✅ Pro/Team via Wise |

| Multi-user access | ❌ directors only | ✅ Pro/Team only |

| Cash deposits | ✅ Post Office, 0.7% | ✅ £1 per deposit via PayPoint / Post Office |

| Cheque deposits | ✅ by app or post | ✅ by app or pos |

| Overdraft | ✅ available (subject to eligibility) | ✅ up to £2,000 |

| Virtual/expense cards | ❌ | ✅ Pro/Team only |

| Accounting integrations | ✅ | ✅ Pro/Team only |

| FSCS protection | ✅ £85,000 | ✅ £85,000 |

| Customer support | 24/7 – phone, chat, email | In-app chat (24/7 urgent), no standard phone support |

Takeaway: Starling gives you more included at no monthly cost, while Monzo holds some of its most useful tools behind the Pro paywall.

Who are these accounts best for?

⚡ The cheapest

If cost is your main concern, Starling is hard to beat. The account is completely free to open and run, with most everyday banking features already included. You don’t need to worry about hidden monthly charges just to unlock essential tools like Faster Payments or accounting integrations – they’re part of the package from day one.

The only time you’ll pay extra is for specialist services such as cash deposits at the Post Office or optional add-ons like the Business Toolkit. For startups, sole traders or anyone watching every penny, Starling delivers full-scale banking without an ongoing subscription fee.

Verdict: Starling is the cheapest option with the most features included for free.

⚡ Best value for money

When you weigh up what you actually get for the price, Starling also comes out ahead. Monzo Pro’s £9/month plan does unlock useful features such as invoicing, multi-user access and virtual cards, but Starling offers many comparable tools at no extra cost. For example, accounting integrations, cheque deposits and a generous overdraft facility are built in, while Monzo hides these behind the Pro tier or restricts them with limits.

Over time, those monthly fees with Monzo can add up, especially if you’re running a lean business. For companies that want maximum features at minimum cost, Starling’s one-plan-fits-all model is the stronger value proposition.

Verdict: Starling offers better long-term value without a monthly subscription.

⚡ Best for sole traders

If you’re working solo, simplicity is key. Monzo Lite does cover the basics with a clean app and free account, but many of the features sole traders rely on – like invoicing or bookkeeping tools – require an upgrade to Pro. By contrast, Starling’s free plan already includes a lot of functionality that freelancers and contractors will use day-to-day: UK transfers, cheque deposits, integration with accounting software, and the option to add the Business Toolkit for VAT and tax tracking.

That means you can start with zero cost and only pay for extras if and when your admin needs grow. For one-person businesses, Starling usually provides more flexibility without forcing you into a paid tier too early.

Verdict: Sole traders get more flexibility out of the box with Starling.

⚡ Best for limited companies

Running a limited company often means managing multiple directors, employees and payments – and this is where Monzo Pro shines. For just £9 a month you get access to multi-user features, virtual and expense cards for your team, and permission controls that help keep spending in check.

Starling does offer a strong base product, but it’s limited when it comes to sharing access: only company directors can use the account. That’s fine for very small companies, but less ideal if you want your finance manager or team members to handle expenses. If you’re a growing limited company with several stakeholders, Monzo Pro’s collaborative features make it a more practical choice.

Verdict: Monzo Pro/Team is better for limited companies that need team access.

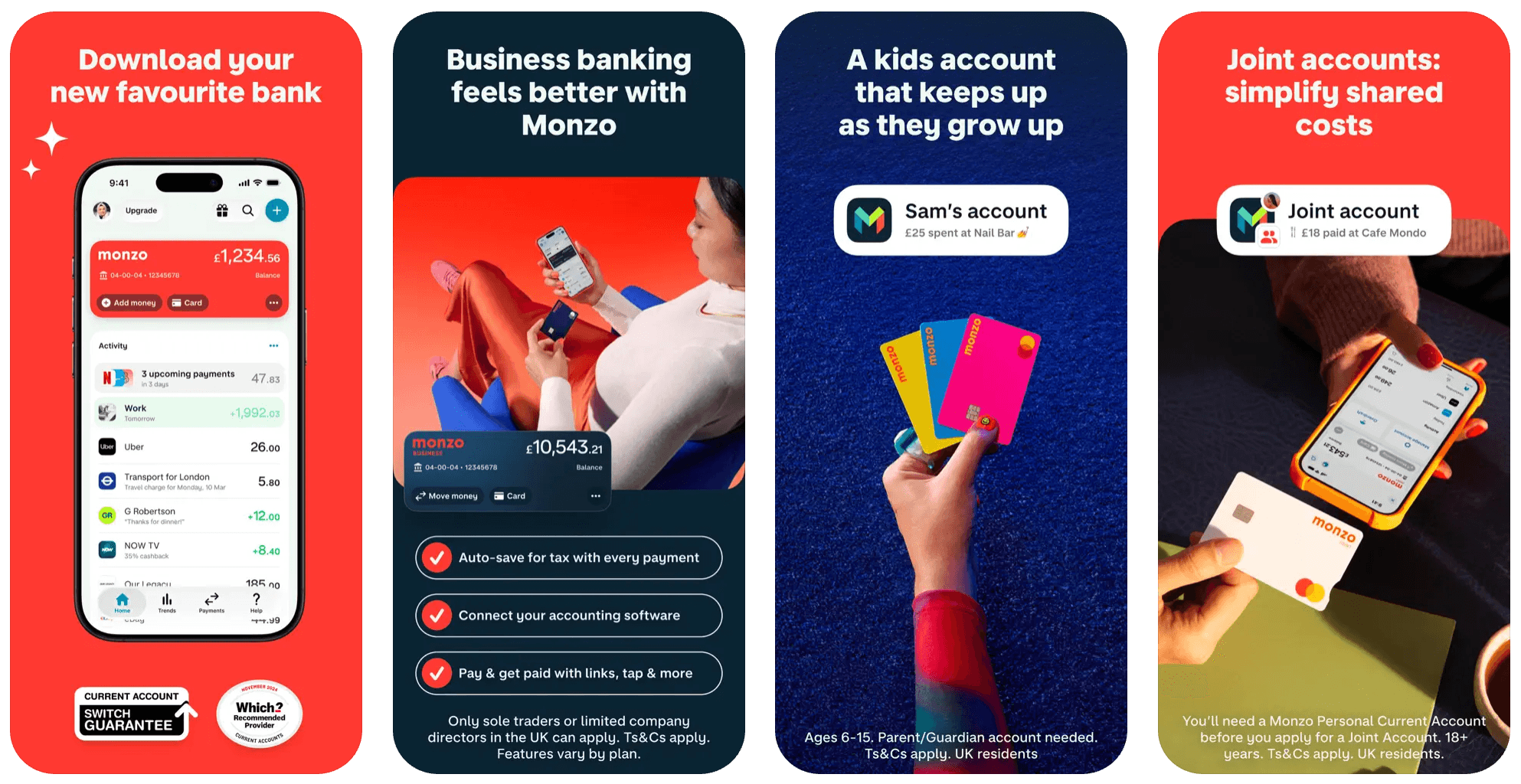

⚡ The smartest app – Monzo’s edge

Both banks are app-first, but the user experience is where Monzo stands out. Its interface is colourful, intuitive and designed with consumer-style usability in mind, which makes day-to-day money management feel simple and even enjoyable. Features such as instant notifications, easy-to-navigate menus and “pots” for budgeting are especially popular among business users who like clear visibility and control.

Starling’s app is clean, reliable and more traditional in style – it gets the job done, but it doesn’t have quite the same polish. If you value a slick, engaging mobile experience above all else, Monzo’s app is arguably the smartest and most enjoyable option on the market right now.

Verdict: Monzo’s app is the most polished and user-friendly for business owners.

Who can open an account?

Both banks focus on UK-based small businesses, but their eligibility rules aren’t identical. Before you waste time applying, check whether you fit their criteria.

Monzo

- Sole traders and limited companies.

- At least one director must be listed on Companies House.

- In-app verification only.

- Some industries are blocked (standard list – e.g. gambling, precious metals, crypto-related).

Starling

- Sole traders and limited companies

- Requires ID, business docs, and a quick video.

- All persons with significant control must live in the UK.

- Industry exclusions apply.

Eligibility criteria

| Requirement | Starling | Monzo |

|---|---|---|

| Accepted business types | Sole traders, limited companies | Sole traders, limited companies |

| PSC requirements | All must live in the UK | At least one listed on Companies House |

| Industry exclusions | Yes | Yes |

| Verification process | ID, video, business docs | ID, tax info, business questions |

Pricing and fees

Money matters. Starling sticks to a straightforward free model, while Monzo makes you pay if you want the full experience.

Starling pricing

One free account with most features included. Add the Business Toolkit for £7/month if you want invoicing, VAT tracking, and tax tools.

Monzo pricing

Lite (free) for basics, or Pro (£9/month) if you need invoicing, multi-user access, and accounting integrations.

Value for money

- Sole traders: Starling’s free plan is often enough.

- Limited companies: Monzo Pro could be worth the £9 if you need team access.

Monzo vs Starling fees

| Fee type | Starling | Monzo Lite / Pro / Team |

|---|---|---|

| Monthly fee | £0 | £0 / £9 / £25 |

| UK bank transfers | Free | Free |

| Cash deposits | 0.7% (min £3) via Post Office | £1 per deposit at PayPoint |

| International payments | 0.4% + £5.50 via SWIFT | Pro only, via Wise |

| Overdraft | Yes, available (subject to eligibility) | Yes, up to £2,000 |

| Cheque deposits | Free via app or post | Free via app or post |

So if you want all the essentials at no extra cost, Starling wins on value. But if features like virtual cards and team access matter to you, Monzo’s Pro plan might be worth the fiver.

Features comparison

On paper, both banks tick the main boxes. The big difference? Starling includes more up front, while Monzo hides its best tools behind Pro.

Payments and transfers in the UK

Both support Faster Payments, Direct Debits, and standing orders.

Cash and cheque handling

- Starling: Post Office deposits (0.7% fee, £3 min), free cheque deposits.

- Monzo: £1 per PayPoint deposit, free cheques via app/post.

Cards and spend management

- Starling: one debit card per director, Apple/Google Pay.

- Monzo Pro: virtual cards, employee cards, bulk payments.

Invoicing and integrations

- Starling: built-in integrations, invoicing via Toolkit.

- Monzo: invoicing and integrations only with Pro.

Lending and overdrafts

- Starling: overdrafts available (subject to eligibility).

- Monzo: Arranged overdrafts available to eligible sole traders.

Features table

| Feature | Starling | Monzo Lite / Pro / Team |

|---|---|---|

| Invoicing | Toolkit add-on (£7/month) | Pro/Team only |

| Accounting integrations | Built-in | Pro/Team only |

| Expense tracking | Included (Spaces + analytics) | Pots + manual tagging |

| Virtual cards | ❌ | ✅ Pro/Team only |

| Employee access | ❌ (directors only) | ✅ Pro/Team only |

| Bulk payments | ✅ | ✅ Pro/Team only |

| VAT estimates / tax tools | ✅ (Toolkit only) | ✅ Pro/Team only |

App and user experience

A business account lives or dies by its app. Both are highly rated, but they take different approaches.

Starling

Source: App store

Source: App storeMonzo

Source: App store

Source: App storeYou can explore both apps yourself:

- Starling on the App Store / Google Play,

- Monzo on the App Store / Google Play.

App interface

Monzo is colourful and playful, Starling is minimalist and businesslike.

Web access and APIs

Starling offers more robust web access and exports. Monzo is primarily app-only.

Onboarding speed and switching

Both allow fast sign-up through the app, and Starling supports the Current Account Switch Service (CASS).

Customer support and reviews

Support can make or break your day. Here’s how they compare.

Support channels

| Support feature | Starling | Monzo |

|---|---|---|

| In-app chat | ✅ 24/7 | ✅ Urgent 24/7, rest 7am–8pm |

| Phone support | ✅ | ❌ |

| Email support | ✅ | ✅ |

| Support team location | UK-based | UK-based |

App Store / Google Play ratings

Both have strong app ratings, with Monzo often praised for design.

Trustpilot score

| Platform | Starling | Monzo |

| Trustpilot | 4.2 (45k+ reviews) | 4.6 (59k+ reviews) |

Trustpilot complaints

- Starling: limited team access is a common gripe.

- Monzo: more frequent complaints about account freezes and slower compliance checks.

Security and trust

Your money’s only as safe as the bank that holds it. Thankfully, both are fully regulated in the UK.

FSCS protection

Funds up to £85,000 protected under FSCS.

Fraud prevention and controls

Both offer SCA, 3D Secure, biometrics, and card controls.

Bank stability and licensing

Both are licensed UK banks with strong reputations.

Which is best for your business?

- Freelancers and sole traders: Starling’s free account is the easiest win.

- Contractors and consultants: Monzo Pro makes sense if you need invoicing.

- Limited companies with teams: Monzo Pro offers multi-user access.

- Retailers and cash-heavy businesses: Starling works better with Post Office deposits.

- International traders and exporters: Starling’s multi-currency accounts give it the edge.

Alternatives to consider

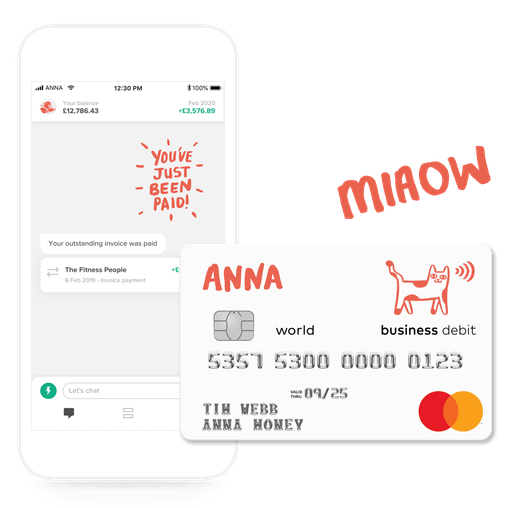

ANNA – your business account and admin sidekick

Here’s where we do things differently.

ANNA isn’t just a business account. It’s admin support in your pocket (the clever kind). You get smart banking and built-in tools to help with all the other stuff no one tells you about when you start a business.

- Create and send invoices in seconds

- Capture receipts and auto-categorise your expenses

- Get VAT and Corporation Tax filed – automatically

- Add your team – not just co-directors

- 4 free SWIFT payments a month on our Big Business plan

- Real humans, 24/7 – every plan, every day

And yes – ANNA starts at £0/month. Fed up with apps that give you half the picture and charge for the rest? ANNA’s the smarter, simpler alternative.

👉 Try ANNA today – and let the admin sort itself out.

Revolut Business

A strong choice if you work globally. Revolut Business shines with multi-currency accounts and competitive FX, making it ideal for international freelancers or companies that get paid in EUR or USD. But it’s not a fully licensed UK bank, so FSCS protection doesn’t apply.

How to open Revolut business account →

Wise Business

Best for holding and receiving foreign currencies. If your business invoices abroad or gets paid in multiple currencies, Wise offers excellent rates and low-cost international transfers.

How to open Wise business account →

Tide

Quick setup and simple tools for early-stage businesses. Tide isn’t a bank (it’s an e-money account), but it gives you fast access to business banking features with minimal paperwork.

How to open Revolut business account →

Mettle by NatWest

A free account backed by a big name. Mettle is a no-frills option, useful for startups testing the waters. But features are limited compared to Starling, Monzo, or ANNA.

How to open Revolut business account →

Verdict: Starling vs Monzo

Checklist:

- Solid free banking and reliable support → Starling

- Budgeting tools and a slick app → Monzo Pro

- Built-in admin and tax tools with automation → ANNA Money

Whichever you choose, your business account should work for you – not just hold your money. Whether it’s team access, tax filing, or simple everyday banking, there’s an option here that fits.

Disclaimer: All info accurate as of September 2025. Always check official websites for the latest details.

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)