HSBC vs NatWest business account – which one should you choose?

Looking for a business account that helps you manage your company finances without unnecessary costs? HSBC and NatWest are two of the UK’s best-known names, both offering solid digital tools and mobile apps.

But while they share a long banking heritage, their modern business accounts – especially HSBC Kinetic and NatWest’s free business account – are quite different in how they approach small business needs.

- In this article

- HSBC vs NatWest at a glance

- Quick look: HSBC vs NatWest

- Who are these accounts best for?

- Who can open an account?

- Eligibility criteria

- Pricing and fees

- HSBC vs NatWest Fees

- Features comparison

- App and user experience

- Customer support and reviews

- Support channels

- Trustpilot score

- Security and trust

- Which is best for your business?

- Alternatives to consider

- Verdict: HSBC vs NatWest

This guide compares the main free plans from each provider, covering everything from features and fees to customer support and eligibility.

And because we’re ANNA, we’ll also show you how we stack up – especially if you’d prefer your business account to handle not just your payments, but also your admin, invoices, and taxes.

HSBC vs NatWest at a glance

If you just want the summary, here’s the quick view: HSBC’s Kinetic business account gives you a strong traditional backbone with app-based management, while NatWest’s digital business account is lighter, faster to open, and simpler for sole traders or freelancers.

Quick look: HSBC vs NatWest

| Feature | HSBC Kinetic | NatWest Business Account |

|---|---|---|

| Monthly fee | £0 | £0 |

| International payments | ✅ via SWIFT and SEPA | ✅ fee applies |

| Multi-user access | ✅ for limited companies | ✅ available |

| Cash deposits | ✅ via branches or Post Office | ✅ at NatWest branches |

| Cheque deposits | ✅ via app or branch | ✅ via app or branch |

| Overdraft | ✅ available (subject to approval) | ❌ not available |

| Virtual/expense cards | ❌ | ❌ |

| Accounting integrations | ✅ QuickBooks, Xero, Sage | ✅ FreeAgent |

| FSCS protection | ✅ £85,000 | ✅ £85,000 |

| Customer support | 24/7 via chat, phone | 24/7 chat, phone (limited for Mettle) |

Takeaway: HSBC’s Kinetic account offers more traditional banking functionality with physical branch access, while NatWest focuses on a simple, entirely digital experience with no ongoing costs.

Who are these accounts best for?

⚡ The cheapest

If cost is your top priority, NatWest’s free business account is compelling. There’s no monthly account fee on the standard tariff for many users, and you get essential features such as UK payments, a debit card, and FreeAgent integration – but note: after the initial free-period business transaction charges may apply.

HSBC’s Kinetic account has no monthly account fee, so it now matches NatWest in being completely free to maintain.

Verdict: Both accounts are free to run, but NatWest still wins for simplicity if you don’t need branch access or international payments.

⚡ Best value for money

When weighing long-term value, HSBC’s Kinetic account delivers a more complete traditional experience: access to branches, overdraft facilities, and international transfers – all without a monthly fee. Those features only matter if your business actually needs them. For digital-first businesses that just need simple UK payments and invoices, NatWest’s free account gives excellent value with zero ongoing cost.

Verdict: HSBC offers more traditional tools and still costs £0/month, while NatWest remains better for purely digital businesses.

⚡ Best for sole traders

Sole traders will appreciate how quick and easy NatWest’s setup process is – you can open an account in minutes, directly from your phone, with no monthly fees. The built-in FreeAgent integration also makes tracking income and expenses effortless.

HSBC Kinetic also works for sole traders but involves more verification steps, though it’s now fully free with no expiry period.

Verdict: NatWest’s account is simpler and more cost-efficient for sole traders.

⚡ Best for limited companies

If your business is incorporated and you need more control over payments, HSBC’s Kinetic business account is the stronger option. It supports multi-user access for directors, overdraft facilities, and cash/cheque handling across the HSBC branch network.

NatWest’s digital account is lighter on features – good for basic operations, but not for companies managing multiple staff or significant transaction volumes.

Verdict: HSBC Kinetic is better suited to limited companies that need flexibility and traditional banking access.

⚡ Best for international business

HSBC clearly leads here. Kinetic supports international transfers and foreign currency payments through SWIFT (fees apply), whereas NatWest’s free plan supports international payments (though not necessarily free, and fees apply) – so while NatWest may suffice for occasional abroad transfers, HSBC remains stronger if you do frequent or complex international work.

Verdict: For international operations, HSBC Kinetic is the only practical choice.

Who can open an account?

Both target UK-based small businesses, but requirements differ slightly.

Eligibility criteria

| Requirement | HSBC Kinetic | NatWest Business Account |

|---|---|---|

| Accepted business types | Sole traders and single-director limited companies | Sole traders, limited companies |

| PSC requirements | UK-based directors only | UK-based control required |

| Industry exclusions | Yes (high-risk sectors excluded) | Yes (e.g. money services) |

| Verification process | Digital ID and address verification through the HSBC Kinetic app | Online ID and verification via app |

Takeaway: both are accessible to UK businesses, but NatWest’s process is slightly faster, while HSBC’s Kinetic uses in-app verification and credit checks.

Pricing and fees

HSBC pricing

No monthly account fee. Standard charges apply for cash deposits (according to HSBC Business Price List) and international transfers via SWIFT.

NatWest pricing

Free in terms of monthly account charge for many users on the standard tariff, but transaction-based fees apply after initial period (for example, £0.35 per automated item, £0.70 per £100 cash in/out) according to current tariff. International transfers are supported but with fees.

Value for money

If you want a full-service business account with international and branch access, HSBC is worth paying for.

If your business runs entirely online, NatWest’s zero-cost model is more efficient.

HSBC vs NatWest Fees

| Fee type | HSBC Kinetic | NatWest Business Account |

|---|---|---|

| Monthly fee | £0 | £0 |

| UK bank transfers | Free | Free |

| Cash deposits | Available at HSBC branches and Post Office | Free at NatWest ATMs |

| International payments | Available, fees apply | Available (fees apply) |

| Overdraft | Yes, up to £30,000 (subject to approval) | No |

| Cheque deposits | Free via app/branch | Free via app/branch |

Verdict: HSBC gives you more tools and remains free to maintain, while NatWest’s simplicity still makes it ideal for small digital businesses that don’t need international or branch-based services.

Features comparison

Payments and transfers in the UK

Both accounts support Faster Payments, standing orders, and Direct Debits.

Cash and cheque handling

HSBC: cash and cheque deposits accepted at branches or Post Offices (fees apply).

NatWest: cash and cheque deposits available (fees may apply depending on transaction type/volume); check current charges.

Cards and spend management

Both accounts offer physical debit cards, compatible with Apple Pay and Google Pay. NatWest’s free business account – virtual/expense card functionality is not guaranteed on the standard free plan; check terms.

Invoicing and integrations

HSBC integrates with Xero, QuickBooks, and Sage.

NatWest integrates with FreeAgent (included free for eligible customers).

Lending and overdrafts

HSBC provides overdrafts and small business loans.

NatWest’s free plan doesn’t include lending features.

App and user experience

Both providers now focus on mobile-first management, but they approach it differently.

App interface

HSBC Kinetic’s app is designed for small business owners – modern, responsive, and focused on clarity and spending insights.

Source: App store

Source: App storeNatWest’s app (and Mettle’s variant) is sleek, colourful, and easy to navigate, appealing to freelancers and entrepreneurs used to app-based finance.

Source: App store

Source: App storeYou can explore both apps yourself:

- HSBC on the App Store / Google Play,

- NatWes on the App Store / Google Play.

Web access and APIs

HSBC offers full web banking and exports for statements and reports.

NatWest’s free plan is mostly app-driven, though desktop access is available for standard accounts.

Onboarding speed and switching

NatWest’s digital setup is faster; HSBC requires more steps for ID verification but supports the Current Account Switch Service (CASS).

Customer support and reviews

Support channels

| Support feature | HSBC Kinetic | NatWest |

|---|---|---|

| In-app chat | ✅ 24/7 | ✅ 24/7 |

| Phone support | ✅ | ✅ |

| Email support | ✅ | ✅ |

| Support team location | UK-based | UK-based |

App Store / Google Play ratings

Both score above 4.5, with NatWest’s mobile interface receiving slightly higher praise for ease of use.

Trustpilot score

| HSBC | NatWest |

|---|---|

| 4.7 (≈1,700 reviews, Kinetic-specific) | 1.3 (≈120 reviews) |

Note: Both major banks face criticism for account access delays and slower compliance checks, which is common among legacy providers.

Security and trust

Both are fully licensed UK institutions with FSCS protection up to £85,000 per account.

Two-factor authentication, biometric logins, and fraud monitoring are standard for both.

Verdict: Both offer the same high level of protection and regulatory oversight.

Which is best for your business?

- Freelancers and sole traders: NatWest’s free account is ideal – fast, simple, and no hidden fees.

- Limited companies: HSBC Kinetic suits those who need overdrafts, branch access, or a full-service setup without ongoing fees.

- International businesses: Only HSBC supports global payments.

- Cash-heavy businesses: Both allow deposits, but HSBC offers more branch options.

- Digital-first startups: NatWest’s modern app-based experience fits perfectly.

Alternatives to consider

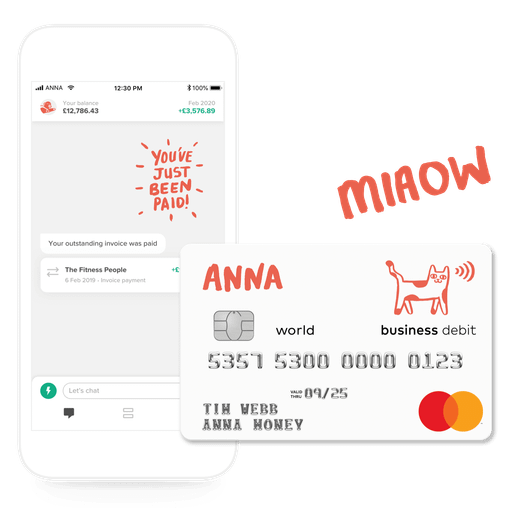

ANNA – your business account and admin sidekick

Here’s where we do things differently.

ANNA isn’t just a business account – it’s your admin partner that helps with all the behind-the-scenes work of running a business.

- Create and send invoices in seconds

- Capture receipts automatically and track expenses

- File VAT and Corporation Tax automatically

- Add your team members – not just co-directors

- 4 free SWIFT payments a month on the Big Business plan

- Real humans available 24/7

And yes, ANNA starts at £0/month. Check the current plans →

Fed up with apps that give you half the features and charge for the rest?

ANNA’s the smarter, simpler alternative – combining business account and admin in one place.

Revolut Business

Great for international transactions and multi-currency accounts, with competitive FX rates – but no FSCS protection.

How to open Revolut Business Account →

Wise Business

Ideal for holding and sending foreign currencies. Perfect for freelancers invoicing abroad.

How to open Wise business account →

Tide

Quick to open, simple to use, and made for startups – though it’s an e-money account rather than a licensed bank.

How to open Tide business account →

Mettle by NatWest

A free, lightweight business account backed by NatWest, perfect for side hustles and small startups.

How to open Mettle business account →

Verdict: HSBC vs NatWest

Checklist:

- Traditional features and international reach → HSBC Kinetic

- Simplicity and long-term zero fees → NatWest

- Built-in admin, invoicing, and tax tools → ANNA

Whichever you choose, your business account should make life easier – not more complicated. Whether you prioritise low costs, global reach, or automated admin, there’s a smart option waiting to fit your business perfectly.

Disclaimer: All info accurate as of December 2025. Always check official websites for the latest details.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)