Wise - it used to be called Transferwise - was set up in 2011 to simplify international money transfers. Since then it’s expanded into banking, and if you’re a company expecting to do lots of international business, their business account could be a wise (apologies for the pun) choice.

- In this article

- What types of business bank accounts are available at Wise?

- Key Features

- Wise business account pros & cons

- What do you need to open a Wise Business Account?

- What documents do I need to open a Wise Business Account?

- How much does a Wise Business Account cost?

- How to apply for a Wise business account

- Wise Business Account customer reviews

- Wise vs ANNA – a case study

- ANNA vs Wise summary table

- Frequently asked questions

Wise is known for its transparency, real exchange rates, and low-cost transfers, and it’s become a popular choice among startups, freelancers, and SMEs. This guide will walk you through the process of opening a business account, highlight some key features, and offer a comparison with competitors - including ANNA.

What types of business bank accounts are available at Wise?

Wise only offers one type of business account, but it is very flexible and could be suitable for lots of different business structures. Here's how it caters to different business types:

Sole Traders

Suitable for freelancers and self-employed people, the Wise account allows you to invoice globally and receive payments in multiple currencies without the pain of high fees. Imagine you’re a freelance designer with lots of clients in America - Wise would be useful if you were being paid in dollars.

Limited Companies

Wise also supports UK-registered and international limited companies. That means you can pay employees and manage suppliers beyond the UK without being charged too much.

Partnerships

Business partnerships can use Wise to manage shared expenses and revenue.

Charities and Non-Profits

Wise also caters to registered non-profit organisations looking for efficient ways to manage donations and cross-border grants. At the moment Wise only allows accounts for charities or trusts in the European Economic Area (EEA), Canada, US, Switzerland, Australia, and New Zealand.

Key Features

So, what are the key features that make a Wise business account so appealing?

- Multi-currency accounts: Customers can hold and convert over 50 currencies

- Local bank details: You can get paid like a local in the UK, US, EU, Australia, and more

- Real exchange rate: There’s no markup on the mid-market rate (the mid-market rate is the point between much buyers are willing to pay for a currency, and how much sellers are willing to spend on the same currency)

- Business debit card: You can spend around the world with low conversion fees

- Batch payments: You can pay up to 1,000 people in one go

- Xero integration: you can sync your Wise account with your accounting software

- Employee access: You can give user permissions for your team, which means you can delegate spending or expenses to your employees

Wise business account pros & cons

Pros

- Transparent fees

- No hidden charges

- Easy international transactions

- Real exchange rates

- Relatively fast account setup

- Great for remote and global companies

Cons

- No cash or cheque deposit facilities

- Not a fully licensed bank (so no FSCS protection)

- No credit or overdraft services

- Limited accountancy support

What do you need to open a Wise Business Account?

As we covered earlier, to open a Wise business account you must be one of the following:

- Sole trader or freelancer

- Limited company (UK or international)

- Partnership or LLP

- Charity or non-profit

You must also:

- Be over 18 and legally authorised to act on behalf of the business

- Provide proof of identity and business registration

What documents do I need to open a Wise Business Account?

The required documents depend on the region, but in general they’ll include

- Proof of identity (e.g. passport, driving licence)

- Proof of address (utility bill, bank statement)

- Business registration certificate

- Business website or social media presence (this is optional but helpful as it shows that you’re a legitimate business)

How much does a Wise Business Account cost?

That’s all very well, but here’s the big question. How much does it cost?

Well, there’s a £45 fee to open a Wise account. (It’s free to open an ANNA account!)

Wise Monthly Account Fees

There’s no monthly fee to open or maintain the account

Wise International Payment Fees

Wise really comes into its own for international payments. The fee depends on the currency and destination (for example, it could range from 0.35% to 1% per transfer)

Wise’s International Payments for Business Accounts can be more Expensive than ANNA’s

Even though ANNA doesn’t specialise in international payments like Wise does, it offers competitive international payment fees that can undercut Wise's in some scenarios, especially for frequent users.

Wise local transfers In and Out

- UK Faster Payments: Free

- SEPA: Free

- SWIFT transfers: Small fee depending on currency

- There’s a $6.11 fee for receiving USD wire and Swift payments

- There’s a £2.16 fee for receiving GBP Swift payments

- There’s a €2.39 fee for receiving EUR Swift payments

Wise Pay Cash In Deposit

You can’t deposit cash into your Wise account.

Wise ATM Withdrawals

ATM withdrawals are free up to £200/month and 1.75% after that.

Can You Pay a Cheque in an Online Wise Business Account?

You can’t pay cheques into a Wise business account.

How to apply for a Wise business account

It’s pretty straightforward to open an online Wise business account.

- Go to wise.com/business

- Click “Open a Business Account”

- Sign up using your email or Google account

- Enter business details (name, type, registration)

- Upload verification documents

- Wait for approval (this can be very quick, but it usually takes 1-3 working days)

Wise Business Account customer reviews

Wise gets solid marks across the reviews system.

- Trustpilot: 4.3/5 (based on over 278,000 reviews)

- App Store: 4.8/5

- Google Play: 4.5/5

What customers like about it:

- Transparent fees

- Quick transfers

- Easy-to-use interface

What customers dislike about it:

- No telephone support

- There are limits on large transactions

Wise vs ANNA – a case study

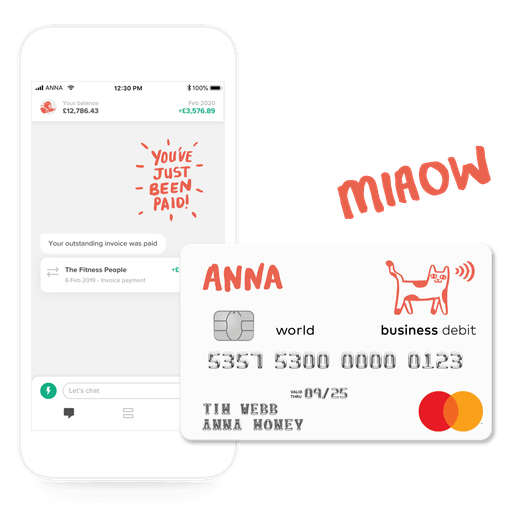

Like ANNA – and similar to other challengers such as Starling, Monzo and Tide – Wise is designed for modern businesses that want flexible online banking without branch visits or paperwork. But when it comes to day-to-day costs, the differences between the two can be quite telling.

To show how they compare, we’ve created an example based on a typical small UK business that trades locally and occasionally pays international suppliers.

Here’s what your average month might look like:

- 5 local transfers paid into your account (clients paying invoices)

- 8 local transfers paid out (suppliers, subscriptions, etc.)

- 3 international transfers (for overseas suppliers)

- 4 ATM withdrawals of £100 each

- 2 additional team debit cards in use

A Wise Business account would incur the following fees:

- Account setup: £45 one-off (spread over 12 months ≈ £3.75/month)

- Local transfers in/out: Free

- International transfers: ~£6 total (assuming 0.4% average on £500 each)

- ATM withdrawals: £3.50 (£0.50 per withdrawal, plus 1.75% on total over £200)

- Extra cards: £6 (£3 each)

- Monthly fee: £0

Total estimated Wise monthly costs: £19.25

An ANNA Pay As You Go plan would involve the following:

- Account setup: Free

- Local transfers in/out: Free

- International transfers: £4.50 (fixed fee per transfer)

- ATM withdrawals: £0 (free up to 3 withdrawals a month)

- Extra cards: Free (included)

- Monthly fee: £0

Total estimated ANNA monthly costs: £4.50

Verdict: Over the course of a year, the same small business would spend around £230 with Wise versus £54 with ANNA – a potential saving of around £175 a year.

While Wise remains a strong option for frequent international payments, ANNA offers far better value for UK-based small businesses – with free local transfers, no setup cost, and built-in admin tools that replace paid add-ons like accounting software.

ANNA vs Wise summary table

All the info you need in one, handy spot

| ANNA | Wise | |

|---|---|---|

| Trustpilot score | 4.5 | 4.3 |

| Free banking period | One month | No monthly charge |

| UK to UK bank transfers | Free | Small fee |

| Debit cards | Free for you and your team | Free. £3 for additional cards |

| ATM withdrawals | Up to 3 free per month. 1% after that | 50p per withdrawal. 1.75% on withdrawals over £200 |

| Pay cash in | Yes | No |

| International payments | Yes | Yes |

| Cheque deposits | No | No |

| Customer support | 24/7 support | 24/7 support |

| Cashback | Wide range of offers | 0.5% on UK accounts |

| Payment link | Yes | No |

| Money saving pots | Yes | Yes |

| VAT return calculation and filing | Yes | No |

| Corporation tax calculation and filing | Yes | No |

| PAYE | Yes | No |

| Payroll | Yes | |

| Invoicing tool | Yes | Yes |

| Receipt scanner | Yes | No |

| Confirmation statement filing | Yes | No |

| AI tax adviser | Yes | No |

| Personalised tax calendar | Yes | No |

It’s also worth noting that ANNA offers far wider tax support than Wise, from calculating VAT to filing your VAT Return and Corporation Tax Return. It can also incorporate your business and handle admin like Confirmation Statements.

Getting paid is simple with ANNA, as customers get their own unique payment link they can instantly share with their clients.

In terms of customer support (where Wise is sometimes lacking) ANNA has award-winning 24/7 customer support from our team in Cardiff, and we usually get back to customers in seconds, not hours.

Frequently asked questions

Can I open a Wise business account online?

Yes, as you might have guessed, the whole process is completed online.

How long does a Wise business account take to open?

It only takes a few minutes to set up your Wise Business account. You just need to enter the details for yourself and your business. Wise might need to verify your account before completing any transfers for you, and this can take 1-3 business days.

How do I close my Wise business account?

Go to Settings > Close account, or contact Wise customer support.

Read the latest updates

You may also like

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)