Wise vs Revolut business account – which one should you choose?

- In this article

- Wise vs Revolut at a glance

- Quick look: Wise vs Revolut

- Who are these accounts best for?

- Who can open an account?

- Eligibility criteria

- Pricing and fees

- Wise vs Revolut Fees

- Features comparison

- App and user experience

- Customer support and reviews

- Support channels

- App Store / Google Play ratings

- Trustpilot score

- Security and trust

- Which is best for your business?

- Alternatives to consider

- Verdict: Wise vs Revolut

But when you dig deeper, their approaches start to diverge. Wise focuses on transparent FX rates and simple transfers. Revolut adds more team tools and smart automation.

This guide compares Wise and Revolut business accounts side by side – covering everything from pricing and features to customer support and who each one suits best.

And because we’re ANNA, we’ll also show you how we stack up – especially if you’d prefer your business account to come with admin support, tax tools, and real humans on hand 24/7.

Wise vs Revolut at a glance

If you want the quick answer: Wise is best for low-cost international transfers, while Revolut gives you more control and team features – especially on paid plans.

Quick look: Wise vs Revolut

| Feature | Wise Business | Revolut Business (Basic / Grow) |

|---|---|---|

| Monthly fee | £0 | £10 / £30 |

| Multi-currency accounts | ✅ 40+ currencies | ✅ 35+ currencies |

| Exchange rate | Mid-market rate | Revolut rate with small markup after plan allowance (FX allowance £1 000 Basic / £15 000 Grow / £60 000 Scale) |

| International transfers | ✅ low-cost, transparent | ✅ free within plan allowance, then fees apply (0 Basic / 5 Grow / 25 Scale free per month) |

| Team access | ✅ | ✅ (more controls on paid plans) |

| Expense cards | ✅ | ✅ |

| Virtual cards | ❌ | ✅ (paid plans) |

| Accounting integrations | ✅ (Xero, QuickBooks) | ✅ (Xero, QuickBooks, Sage) |

| Cash deposits | ❌ | ❌ |

| FSCS protection | ❌ (e-money account) | ❌ (e-money account) |

| Customer support | Chat & email (business hours) | Chat (24/7 on paid plans) |

Takeaway: Wise wins for international money management at real exchange rates. Revolut stands out for businesses that need cards, roles, and team controls in one place.

Who are these accounts best for?

⚡ The cheapest

If you’re counting every penny, Wise keeps things straightforward – there’s no monthly fee, and you only pay small, transparent charges per transaction. Revolut has no free business plan – the entry Basic tier (£10/month) includes small FX and transfer allowances. Once you exceed those, small markups apply.

Verdict: Wise is the cheaper option for regular international transfers.

⚡ Best value for money

Wise’s pay-as-you-go model means you never pay for features you don’t use. Revolut’s £30 Grow plan introduces higher limits, team cards, bulk payments and priority support – worth it if you have a team that spends frequently in multiple currencies.

Verdict: Wise offers the best value for lean international businesses. Revolut Grow makes sense for larger teams.

⚡ Best for sole traders

Freelancers and sole traders often just need to invoice clients abroad and keep track of payments. Wise is ideal for that – it gives you local account details in multiple currencies (like USD, EUR, and AUD), so clients can pay you as if you were based there.

Verdict: Wise is simpler and cheaper for freelancers and one-person businesses.

⚡ Best for limited companies

If your company has several directors or team members, Revolut takes the lead. It offers role-based permissions, virtual cards, and expense control – all built in. Wise supports multiple users too but lacks the same level of access management.

Verdict: Revolut is better for limited companies with teams and shared expenses.

⚡ Best for international traders

This one’s easy – Wise is designed for global business. It supports 40+ currencies, always uses the mid-market rate, and keeps conversion fees low. Revolut handles international payments too, but charges may rise once you hit your monthly limit.

Verdict: Wise is the clear choice for international trade and global payments.

Who can open an account?

Both accounts cater to UK-based small businesses and freelancers, but their onboarding requirements differ slightly.

Wise

- Sole traders, limited companies, and partnerships

- Verification: ID, address, and business documents

- Available in 170+ countries

- Usually approved within 24 hours

Revolut

- Sole traders, limited companies, and charities

- Verification: ID, short video, business info

- Available in 200+ countries

- Instant in-app approval for most

Eligibility criteria

| Requirement | Wise | Revolut |

|---|---|---|

| Accepted business types | Sole traders, limited companies | Sole traders, limited companies, charities |

| Industry exclusions | Yes | Yes |

| Verification process | ID + documents | ID + video |

| Setup time | Within 24 hours | Usually instant |

Takeaway: Both are easy to open online. Revolut is faster for UK companies; Wise supports more countries overall.

Pricing and fees

Wise pricing

- Account: Free

- Monthly fee: £0

- International transfers: From 0.4%, mid-market rate

- Cards: Free to issue, small replacement fee

- ATM withdrawals: Free up to £200/month, then 1.75%

Revolut pricing

- Basic – £10/month (10 local transfers, 0 international free)

- Grow – £30/month (100 local + 5 international free)

- Scale – £90/month (1 000 local + 25 international free)

- Enterprise – custom pricing with tailored limits

Scale and Enterprise: Custom pricing for larger teams

Wise vs Revolut Fees

| Fee type | Wise | Revolut (Basic / Grow) |

|---|---|---|

| Monthly fee | £0 | £10 / £30 |

| International transfers | From 0.4% | Free up to limit, then markup |

| Currency exchange | Mid-market rate | Small markup (after free quota) |

| Expense cards | ✅ | ✅ |

| Team access | Unlimited | Limited on free, extended on paid |

| Priority support | ❌ | ✅ (paid plans) |

Value for money

For simple global payments and transparent pricing, Wise is unbeatable.

For teams managing shared budgets or needing advanced controls, Revolut Grow (£30/month) earns its fee.

Features comparison

Payments and transfers

Both support domestic and international payments. Wise focuses on 170+ countries and real FX rates, while Revolut adds integrated bulk payments and spending controls.

Cash and cheque handling

Neither accepts cash or cheques. Both are digital-only.

Cards and spend management

Wise offers debit cards for you and your team with real-time tracking.

Revolut adds virtual and expense cards, with adjustable spending limits and approvals.

Invoicing and integrations

Both integrate with Xero and QuickBooks; Revolut also connects with Sage and offers expense automation.

Lending and overdrafts

Neither offers loans or overdrafts – both are e-money institutions, not banks.

Takeaway: Wise is focused on clean, transparent transfers. Revolut goes further with expense tools and team control.

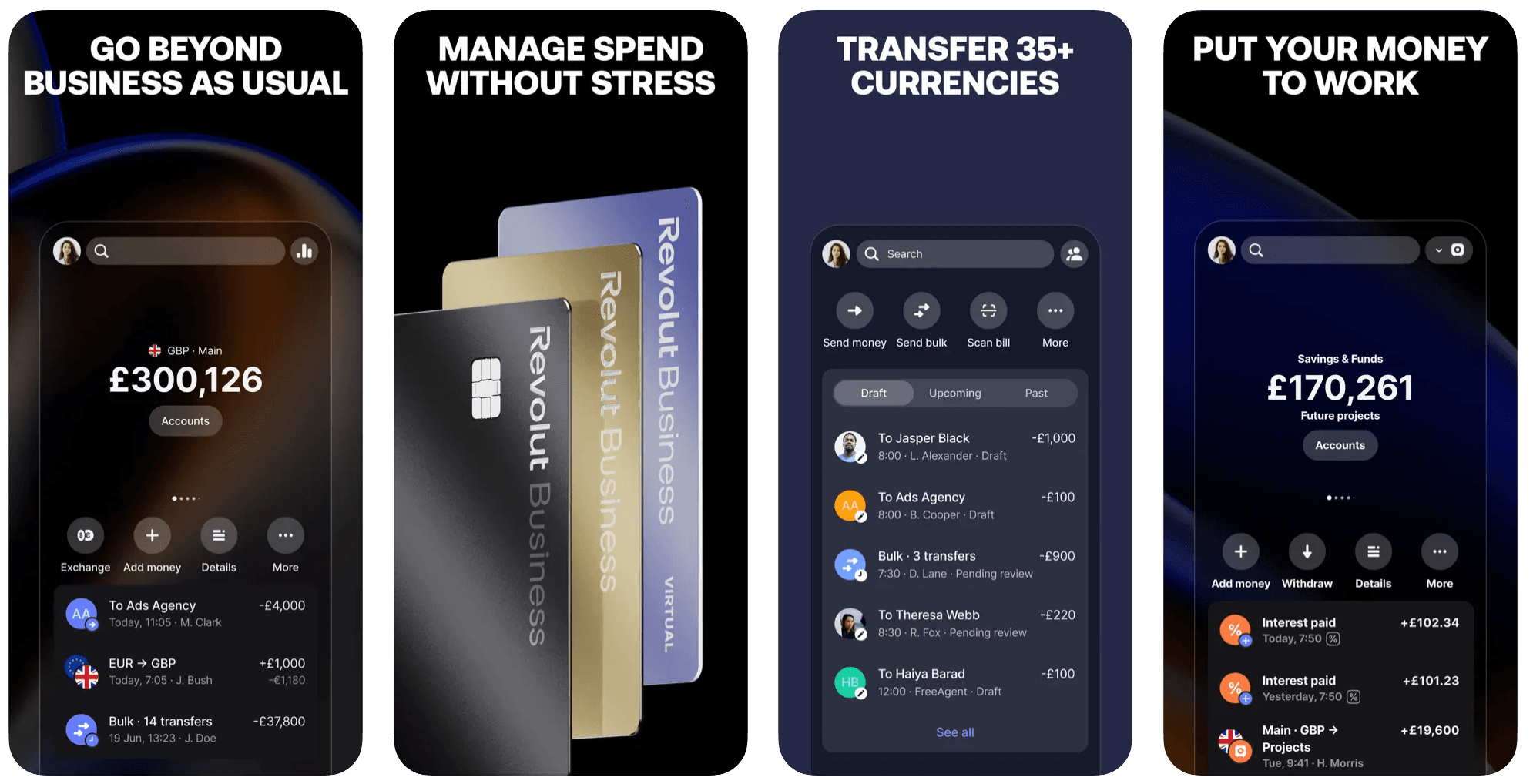

App and user experience

A business account lives or dies by its app. Both are highly rated, but their priorities differ.

App interface

Wise keeps it minimalistic and easy to navigate. Revolut packs in more analytics, cards, and expense views – great for power users, though a bit busier visually.

Wise

Source: App store

Source: App storeRevolut

Source: App store

Source: App storeYou can explore both apps yourself:

- Wise on the App Store / Google Play,

- Revolut on the App Store / Google Play.

Web access and APIs

Wise provides a full web interface and an open API, ideal for developers and finance teams. Revolut’s web version is improving but remains secondary to the app.

Onboarding and switching

Both accounts can be opened directly from your phone. Revolut’s approval is often instant; Wise takes a few extra checks but supports more global setups.

Verdict: Wise wins on clarity, Revolut wins on versatility.

Customer support and reviews

Support can make or break your day. Here’s how Wise and Revolut compare.

Support channels

| Support feature | Wise | Revolut |

| In-app chat | ✅ (business hours) | ✅ (24/7 on paid plans) |

| Phone support | ❌ | ❌ |

| Email support | ✅ | ✅ |

| Support team location | UK / EU | UK / EU |

Takeaway: Wise offers consistent business-hours support, while Revolut replies faster on paid plans – but free users often experience longer wait times.

App Store / Google Play ratings

Both apps enjoy high ratings, but their strengths differ slightly.

| Platform | Wise | Revolut |

| App Store | 4.8★ (200k+ reviews) | 4.9★ (1M+ reviews) |

| Google Play | 4.7★ (800k+ reviews) | 4.5★ (3M+ reviews) |

Takeaway: Wise users praise simplicity and reliability. Revolut users love the features but note occasional clutter.

Trustpilot score

| Platform | Wise | Revolut |

| Trustpilot | 4.3 ★ (270k+ reviews) | 4.6 ★ (325k+ reviews) |

Common complaints:

- Wise: occasional delays during identity checks or large transfers.

- Revolut: reports of account freezes and slower replies on free plans.

Verdict: Revolut scores higher overall, but Wise earns stronger feedback for consistency and transparency.

Security and trust

FSCS protection

Neither account is covered by FSCS, as both are FCA-authorised e-money institutions. Funds are safeguarded in segregated accounts under FCA rules.

Fraud prevention and controls

Both support biometric logins, instant notifications, and 3D Secure for online payments.

Stability and licensing

Wise and Revolut are FCA-regulated, long-established fintechs with millions of global users.

Verdict: Both are safe and reputable – just remember that FSCS protection doesn’t apply.

Which is best for your business?

- Freelancers & consultants: Wise for transparent FX and simple invoicing.

- Small teams: Revolut for roles, expense cards, and shared spending.

- International traders: Wise for 40+ currencies and true exchange rates.

- Scaling companies: Revolut Grow for team control and automation.

- Developers: Wise for API and web access.

Takeaway: Wise is simpler and cheaper for global payments; Revolut suits growing teams who want more control.

Alternatives to consider

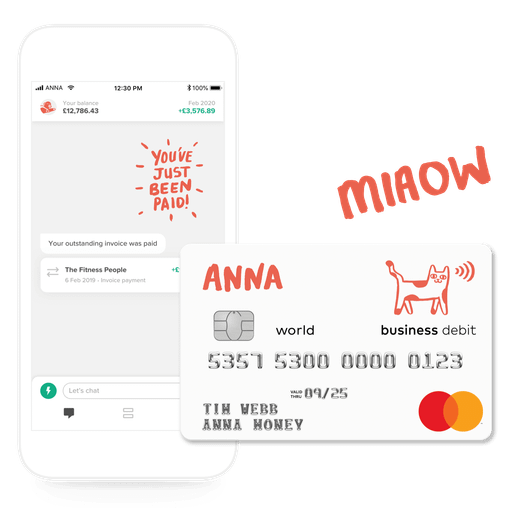

ANNA – your business account and admin sidekick

Here’s where we do things differently.

ANNA isn’t just a business account – it’s your clever admin assistant. You get smart banking features combined with automated support for all those time-consuming tasks.

- Create and send invoices in seconds

- Capture receipts and categorise expenses automatically

- Get VAT and Corporation Tax filed for you

- Add your team – not just co-directors

- 4 free SWIFT payments per month on our Big Business plan

- Real humans, 24/7 – every plan, every day

And yes – ANNA starts at £0/month.

If you’re tired of juggling apps for invoicing, accounting, and payments, ANNA brings everything together in one simple place.

Starling Business

A fully regulated UK bank with FSCS protection. Great if you prefer traditional support, overdrafts, and no monthly fees.

How to open Starling business account →

Tide

Quick setup for startups and freelancers. Fast approval, built-in invoicing, but limited FX tools.

How to open Tide business account →

Mettle by NatWest

A free, simple account backed by NatWest – ideal for sole traders testing the waters.

How to open Mettle business account →

Verdict: Wise vs Revolut

Checklist:

- Solid FX rates and transparency → Wise

- Team cards and automation tools → Revolut

- Built-in admin and tax automation → ANNA

If your business is global, Wise offers unmatched transparency and low costs.

If you need team management and smart controls, Revolut is more powerful.

And if you want to go beyond payments – automating admin, receipts, and taxes – ANNA is the smarter, simpler alternative.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)