Mettle vs NatWest business account – which one should you choose?

- In this article

- Mettle vs NatWest at a glance

- Quick look: Mettle vs NatWest

- Who are these accounts best for?

- Who can open an account?

- Eligibility criteria

- Pricing and fees

- Mettle vs NatWest Fees

- Features comparison

- App and user experience

- Customer support and reviews

- Support channels

- App Store / Google Play ratings

- Trustpilot score

- Security and trust

- Which is best for your business?

- Alternatives to consider

- Verdict: Mettle vs NatWest

Mettle is NatWest’s digital offshoot: a free, app-based account designed for sole traders and small limited companies who want simple money management without the paperwork. NatWest’s traditional business accounts, on the other hand, are aimed at more established firms that need in-branch access, credit facilities, and a wider range of business services.

This guide compares Mettle’s free account with NatWest’s Business Current Account – covering everything from features and fees to customer support, eligibility, and everyday usability.

And because we’re ANNA, we’ll also show you how we stack up – especially if you’d prefer your business account to come with built-in admin tools, tax support, and real humans available 24/7.

Mettle vs NatWest at a glance

If you’re short on time, here’s how they compare.

Quick look: Mettle vs NatWest

| Feature | Mettle | NatWest Business Current Account |

|---|---|---|

| Monthly fee | £0 | £0 for up to 24 months on eligible NatWest Start-up or Switch accounts, then standard tariff applies |

| Eligibility | Sole traders & small limited companies | Limited companies, partnerships & sole traders |

| Cash deposits | ❌ not supported | ✅ at branches & Post Office (NatWest – from £0.70 per £100 standard tariff) |

| International payments | ❌ not supported | ✅ via SWIFT and SEPA |

| Overdraft / lending | ❌ | ✅ business overdraft & loans available |

| Accounting integrations | ✅ FreeAgent (included) | ✅ FreeAgent (free if eligible) |

| Invoicing tools | ✅ built in | ✅ via online banking or software |

| Card payments | ✅ Mastercard | ✅ Mastercard |

| FSCS protection | ✅ £85,000 | ✅ £85,000 |

| Support | In-app chat, 7 days | Phone, branch & online support |

Takeaway:

Mettle wins on simplicity and price – everything’s free and managed through the app. NatWest gives you more advanced features like international payments, overdrafts and cash deposits, but standard transaction charges apply after the introductory free period (no fixed monthly fee).

Who are these accounts best for?

⚡ The cheapest

If cost is your biggest factor, Mettle is the clear winner. It’s one of the few truly free business accounts in the UK – no monthly fees, no charges for UK transfers, and even free integration with accounting software like FreeAgent (worth £150/year if paid separately).

NatWest’s Business Current Account starts free for 24 months, but after that you’ll pay a monthly fee plus charges for certain transactions such as cash deposits or international payments.

Verdict: Mettle is the cheapest long-term option, especially for freelancers and early-stage businesses.

⚡ Best value for money

While Mettle is completely free, it also comes with limitations – no cash deposits, no cheque support, and no overseas transfers.

NatWest’s account, though not free forever, includes full-service banking: overdrafts, lending, cash handling, and international payments. If your business needs those, paying the monthly fee could be worth it.

Verdict: Mettle offers unbeatable value for simple businesses; NatWest is better value if you need full banking services.

⚡ Best for sole traders

Mettle was designed with sole traders in mind. Its mobile app handles everything from sending invoices to tracking expenses, and FreeAgent integration makes tax time much easier. You can categorise spending, set aside money for VAT, and even get insights on your cash flow – all in one place.

Verdict: Sole traders and freelancers will find Mettle more intuitive and cost-effective.

⚡ Best for limited companies

NatWest’s Business Current Account provides the structure and flexibility that growing limited companies often need. You can manage multiple users, access lending products, and get in-branch support when required – features Mettle doesn’t offer.

For directors who prefer face-to-face help or want to build a credit profile for their company, NatWest is the stronger choice.

Verdict: Limited companies benefit more from NatWest’s broader services and credit facilities.

⚡ The smartest app – Mettle’s edge

When it comes to user experience, Mettle leads the way. The app is clean, fast and purpose-built for business owners who live on their phones. It lets you create invoices, track payments, and see real-time insights with minimal clicks.

NatWest’s app is solid but feels more traditional – it handles everyday banking well but isn’t as streamlined for micro-business admin.

Verdict: Mettle’s app is more modern, intuitive, and tailored to small business needs.

Who can open an account?

Eligibility criteria

| Requirement | Mettle | NatWest |

|---|---|---|

| Business type | Sole traders & limited companies (≤2 owners) | Sole traders, partnerships, limited companies |

| UK residency | All owners/directors must live in the UK | At least one director must live in the UK |

| Industry exclusions | Some restricted (e.g. gambling, crypto) | Standard banking exclusions apply |

| Verification | In-app ID & business details | Online or in-branch verification |

Summary: Mettle’s signup is faster and entirely digital, but it’s not available to every company type. NatWest covers a broader range of businesses, especially those with multiple partners or larger turnover.

Pricing and fees

Mettle pricing

Free forever. No monthly fees, no charges for UK payments, and FreeAgent accounting software included if you make at least one transaction per month.

NatWest pricing

After this period, the account moves to the Standard Tariff – no fixed monthly charge; fees apply per transaction (e.g., £0.35 per automated item, £0.70 per £100 cash).

Additional charges apply for cheques, international transactions, or optional services (like Bankline).

Mettle vs NatWest Fees

| Fee type | Mettle | NatWest |

|---|---|---|

| Monthly fee | £0 | £0 for up to 24 months (eligible customers), then standard tariff |

| UK bank transfers | Free | Free |

| Cash deposits | ❌ | 0.7% (min £3) Post Office / branch |

| International payments | ❌ | £22 via SWIFT |

| Overdraft | ❌ | Available (subject to approval) |

| Accounting integration | Free (FreeAgent) | FreeAgent free if eligible |

Verdict: Mettle is entirely free but minimalistic; NatWest adds traditional banking power, with pay-per-use fees after the introductory free period.

Features comparison

Payments and transfers

Both support UK Faster Payments and Direct Debits. Only NatWest supports international transfers.

Cash and cheque handling

Mettle doesn’t support cash or cheque deposits. NatWest does both through branches and the Post Office network.

Invoicing and accounting

Mettle has built-in invoicing and FreeAgent sync. NatWest also offers FreeAgent access and integrates with other accounting tools, but you’ll need to connect them manually.

Overdrafts and credit

Mettle offers no credit or overdraft options. NatWest provides business loans, credit cards, and overdrafts.

App and access

Mettle is mobile-only. NatWest offers both a mobile app and full online banking portal.

App and user experience

A good app can make running your business much smoother. Both Mettle and NatWest have strong mobile apps, but they serve different audiences.

App interface

Mettle’s app is clean, intuitive, and built entirely around freelancers and small business owners. It focuses on essentials – payments, invoices, and insights – with a clear dashboard that feels modern and uncluttered.

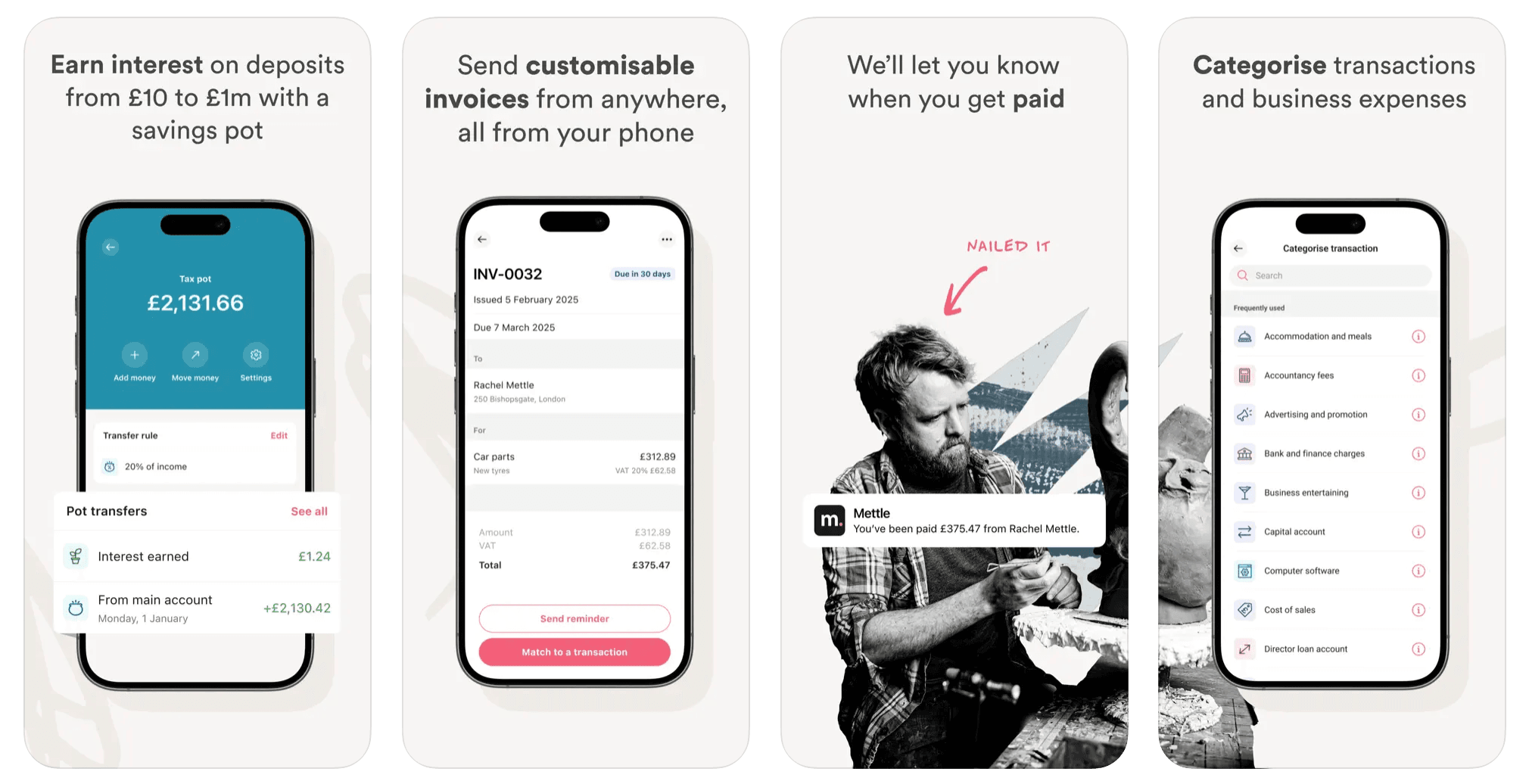

Source: App store

Source: App storeNatWest’s app, while equally well-designed, feels more traditional. It’s feature-rich and suits users who manage multiple accounts or need access to loans, cards, and savings in one place.

Source: App store

Source: App storeYou can explore both apps yourself:

- Mettle on the App Store / Google Play,

- NatWest on the App Store / Google Play.

Web access and APIs

Mettle is mobile-only – you can’t log in through a desktop web browser, which keeps things simple but limits flexibility.

NatWest offers full online banking, API access for business customers, and advanced features like downloadable statements and bulk payments.

Onboarding speed and switching

Mettle’s onboarding is fully digital and takes just a few minutes through the app – no paperwork, no branch visits.

NatWest supports online applications too, but the process can be slower and may require additional verification. Both support the Current Account Switch Service (CASS), making it easy to move from another bank.

Verdict: Mettle offers the faster, more modern experience for small businesses, while NatWest provides the depth and multi-channel access larger companies expect.

Customer support and reviews

Support can make or break your day. Here’s how Mettle and NatWest Business compare.

Support channels

| Support feature | Mettle | NatWest Business |

|---|---|---|

| In-app chat | ✅ 7 days a week | ✅ in mobile app |

| Phone support | ❌ | ✅ 24/7 helpline |

| Email support | ✅ | ✅ |

| Branch access | ❌ | ✅ 500+ branches UK-wide |

| Support team location | UK-based | UK-based |

Takeaway: Mettle keeps things simple with responsive in-app chat, but offers no phone or branch support. NatWest provides full multi-channel service – though response times can be slower.

App Store / Google Play ratings

| Platform | Mettle | NatWest |

|---|---|---|

| App Store (iOS) | 4.8 ★ (8 k+ ratings) | 4.7 ★ (200 k+ ratings) |

| Google Play (Android) | 4.6 ★ (7 k+ ratings) | 4.4 ★ (150 k+ ratings) |

Summary: Both apps are highly rated for reliability. Mettle’s users praise its simplicity and speed; NatWest’s reviews highlight comprehensive functionality but note occasional login or update glitches.

Trustpilot score

| Platform | Mettle | NatWest Business |

|---|---|---|

| Trustpilot | 4.4 ★ (1,500 + reviews) | 1.4 ★ (7,000 + reviews) |

Complaints:

- Mettle: most negatives mention lack of phone support or issues adding funds.

- NatWest: users frequently report account freezes, long wait times, and inconsistent communication between departments.

Security and trust

Both are backed by NatWest Group and offer FSCS protection up to £85,000.

Mettle operates under NatWest’s banking licence, and funds are fully FSCS-protected up to £85,000.

NatWest is a fully regulated UK bank with a long history and direct FSCS coverage.

Verdict: Both are secure, and since Mettle now operates under NatWest’s banking licence, funds in both accounts are covered by FSCS protection up to £85,000. NatWest still offers the reassurance of full-service banking and a longer track record.

Which is best for your business?

- Freelancers and sole traders: Mettle – simple, free, and efficient.

- Growing limited companies: NatWest – offers multi-user access, lending, and cash handling.

- Businesses handling cash: NatWest – only it supports deposits.

- Digital-only businesses: Mettle – everything managed from your phone.

- International traders: NatWest – SWIFT and SEPA transfers supported.

Alternatives to consider

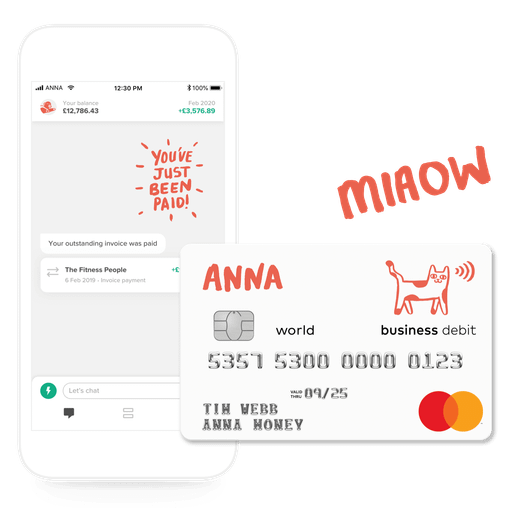

ANNA – your business account and admin sidekick

Here’s where we do things differently.

ANNA isn’t just a business account – it’s your financial co-pilot. You get smart money management plus built-in admin tools that take care of the boring stuff:

- Create and send invoices in seconds

- Capture receipts automatically

- Track expenses and categorise transactions

- Handle VAT and Corporation Tax automatically

- Add your team members and control access

- 4 free SWIFT payments a month on our Big Business plan

- Real humans, 24/7 – not bots

And yes, ANNA starts at £0/month. 👉 See all plans and pricing

Fed up with apps that give you half the features and charge for the rest?

ANNA’s the smarter, simpler alternative – combining business account and admin in one place.

Revolut Business

Ideal for international businesses with multi-currency needs. Great FX rates and fast global transfers, but no FSCS protection.

How to open Revolut business account →

Wise Business

Perfect for companies receiving or holding funds in multiple currencies. Transparent pricing and excellent international tools.

How to open Wise business account →

Tide

An easy entry-level option for startups that want quick setup and simple expense tracking, though it’s not a bank.

How to open Tide business account →

Starling Business

A fully licensed UK bank with a free business account, excellent mobile app, and optional Business Toolkit for tax tools.

How to open Starling business account →

Verdict: Mettle vs NatWest

| Business need | Best option |

|---|---|

| Simple, free setup for freelancers | Mettle |

| Cash deposits or international payments | NatWest |

| Full banking and credit facilities | NatWest |

| Modern app experience | Mettle |

| Admin automation and tax support | ANNA |

Whichever you choose, make sure your business account actually supports your work style – not just your transactions.

If you want to automate admin and get real support alongside your finances, ANNA could be the smarter alternative.

Disclaimer: All info accurate as of January 2026. Always check official websites for the latest details.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)