Learn how to start a tutoring business in the UK with practical steps on setup, legal requirements, earning potential and finding students.

If you’re looking to start a tutoring business in the UK in 2026, there’s never been a better time. With demand for personalised learning on the rise, tutoring has become a practical and rewarding option for those with a passion for education.

Whether you plan to teach online or meet students face-to-face, the flexibility makes it an attractive path for new entrepreneurs.

But what exactly do you need to start a tutoring business? Do you need any licences, tools, or certificates?

In this guide, we’ll walk you through everything you need to know to get started.

Understanding the UK tutoring market in 2026

The global private tutoring market is experiencing strong growth, and it was projected to increase from $120.25 billion in 2024 to $130.91 billion in 2025. More parents are looking for support outside the classroom, especially with exam pressure growing.

At the same time, more adults are booking tutors for things like language skills or digital training.

Here are some of the most common tutoring needs:

- Grammar school entrance prep (11+)

- GCSE and A-level help in subjects like maths, science, English, and more

- English as a Second Language (ESL) for both children and adults

- University admissions guidance, including Oxbridge-style interviews

- SEND support for learners with special needs

- Adult education – business writing, spreadsheets, coding, or public speaking

The good news? You can work from anywhere. Most tutors now use Zoom, Google Meet, or even WhatsApp video for lessons. That means your clients don’t need to live nearby.

Legal requirements and business setup

Before you take on your first student, there are a few things you need to put in place. But don’t worry, it’s not as complicated as it sounds, because most of it you can sort in a day.

Choose a business structure

You’ve got two main options:

- Sole trader: This is the easiest way to get started. You register with HMRC and file a Self Assessment tax return each year. Many tutors use this route.

- Limited company: A bit more paperwork, but you get more legal protection. It also looks more professional if you want to expand or work with schools later on.

📍 If you’re just starting out, go with sole trader. You can always switch to a limited company later.

Do you need to register as self-employed for tutoring income?

Freelance tutoring income still counts as self-employment in the UK, so it’s vital to understand HMRC’s rules when you start your tutoring business.

Here’s what you need to know:

🔸The £1,000 trading allowance

HMRC offers a trading allowance of £1,000 per tax year for self-employed income, including tutoring.

If your gross income (total income before expenses) from tutoring is £1,000 or less in a tax year, you do not need to register as self-employed or report this income to HMRC.

This allowance simplifies tax reporting for small-scale or occasional tutoring.

🔸 When must you register?

- If your gross tutoring income exceeds £1,000 in any tax year, you must register as self-employed with HMRC.

- You need to register by 5 October, following the end of the tax year in which you exceeded the threshold. For example, if you earn over £1,000 in the 2024/25 tax year (6 April 2024 to 5 April 2025), you must register by 5 October 2025.

- Once registered, you must file a Self Assessment tax return annually, reporting your income and allowable expenses.

📍Important notes

- The £1,000 threshold applies to gross income, not profit. Even if your expenses reduce your profit below £1,000, you must register if your income exceeds £1,000.

- You are responsible for paying Income Tax on your profits (income minus expenses) above your personal allowance (£12,570 for 2025/26).

You may also need to pay National Insurance contributions:

- Class 2 NICs if your profits exceed the Small Profits Threshold (£6,845 for 2025/26).

- Class 4 NICs if your profits exceed £12,570.

Apply for a DBS check

While it’s not a legal requirement if you work privately, parents often expect tutors to have a valid DBS (Disclosure and Barring Service) check. It shows you don’t have a criminal record and that you’re safe to work with children.

You can’t apply for an enhanced DBS yourself, but you can get one through a tutoring agency or umbrella body. Some platforms (like Tutorful or MyTutor) will help with this when you join.

Get insurance

Accidents can happen, and it’s best to be covered. Here are the two main types of insurance tutors usually get:

- Public liability insurance: Covers accidents or injury during a session

- Professional indemnity insurance: Covers you if someone claims your teaching caused a problem (like wrong advice or a missed deadline)

If you’re teaching online only, the risk is lower, but insurance still gives peace of mind.

Follow GDPR rules

You’ll probably be handling personal information — student names, addresses, school details, notes on progress. Make sure you store this securely (password-protected files, encrypted platforms) and don’t use it for anything beyond lessons.

Costs and finances

Tutoring doesn’t need a big budget. You can get started with a laptop, internet, and some prep time. That’s why so many people choose it as a side gig or flexible business.

Startup costs

Here’s what you might spend to get going:

Ongoing costs

Here’s what to budget for each month or quarter:

- Scheduling tools (e.g. Calendly or Acuity): £0–£10/month

- Payment processing (Stripe or PayPal): 1.5–2% per transaction

- Insurance renewals: depends on provider and cover

- Teaching materials: optional subscriptions for worksheets or lesson plans

💡 Pro tip: Use ANNA to make your tutoring admin painless

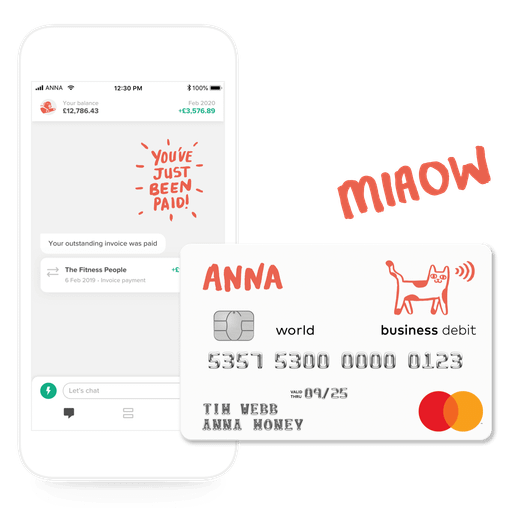

Opening an ANNA business account only takes about 10 minutes, and you’ll get both a physical and virtual Mastercard debit card — so you can start spending straight away online or via Apple Pay or Google Pay. You’ll also get instant payment notifications, a personal payment link, and even a QR code to help students or parents pay you without any hassle.

Need to stay on top of receipts and tax? ANNA sorts and tags your expenses automatically and keeps your invoicing and bookkeeping in one tidy dashboard. Oh, and the debit card meows when you use it. Yes, it actually meows.

How much can you earn?

Most private tutors charge between £20 and £60 per hour, depending on the subject, level, and experience.

Subjects like maths, science, or entrance exams often pay more.

If you work 10–15 hours a week, that’s already £800 – £2,000/month.

However, some full-time tutors earn more than £3,000/month.

Finding clients and growing your student base

Let’s talk about the tricky part — getting students.

1. Start with people you already know.

Friends, family, neighbours, basically anyone with school-age children or a cousin struggling through GCSEs. One well-timed Facebook post can go a long way.

2. Then move on to free tutor directories.

Sites like TutorHunt, Superprof, and UKTutors let you create a profile, set your rates, and wait for inquiries. You’ll be competing with others, sure, but if you have a strong profile and good subject coverage, you’ll get noticed.

3. Local Facebook groups and parenting forums are goldmines.

Post helpful tips (like "How to revise for A-level chemistry without falling asleep") and link back to your profile or website.

People love free advice, and once they trust you, they’ll be more likely to book.

If you’re feeling more ambitious, try leaflets or posters at local libraries, cafés, or schools. Just make sure they’re clear, friendly, and easy to read.

4. Most importantly, ask for reviews.

After each lesson or set of sessions, ask the parent or student to leave a short testimonial. Word of mouth still rules, especially when it comes to someone trusting you with their child’s education.

Running lessons and delivery formats

Once the students start booking, you’ll need to decide how you’ll deliver your sessions. Some tutors prefer face-to-face, others stick to online, and many do a mix. Your setup will depend on your subject, your students, and what works best for you.

1. Online tutoring

All you need is a laptop, stable Wi-Fi, and a quiet space. Most tutors use Zoom or Google Meet, but some also use Skype, Microsoft Teams, or even WhatsApp for simpler lessons. This is the go-to format these days for launching a tutoring service online quickly and on a budget.

It works well for:

- Secondary school students

- University prep or adult learners

- Busy families with packed schedules

You can use a shared Google Doc, screen share your slides, or walk through past papers together. If you're tutoring younger kids, using an iPad and stylus (or a whiteboard app) can help keep them engaged.

2. In-person tutoring

Some students (or their parents) prefer meeting face-to-face, especially for younger learners or subjects that need a more hands-on approach. You could:

- Teach at your home (make sure it’s a tidy, quiet spot)

- Visit the student’s home (factor in travel time and costs)

- Meet in a local library or community center

Just make sure you agree on the location clearly in advance, and think about safety, especially if it’s your first time meeting.

3. Group tutoring

Want to earn more per hour while keeping rates low for clients? Group sessions can work well, especially for:

- 11+ exam prep

- GCSE revision workshops

- Language classes for beginners

You can run them online or in person. Just ensure the group size is small enough that everyone still receives attention. Typically, 3 to 6 students is ideal.

Tools, systems, and automation

Managing bookings, payments, reminders, and even teaching materials manually can eat up hours every week. Luckily, there are tools that handle most of the admin for you.

At the very least, you’ll want a way to:

1. Schedule sessions and avoid double bookings

Try Calendly, Acuity, or Book Like A Boss. These let students book into your calendar at available times. No more back-and-forth emails.

2. Send payment requests or invoices

ANNA Money is a great option if you want a business account with built-in invoicing, a personal payment link, automatic reminders, and bookkeeping.

3. Track who’s paid (and who’s late)

Email automation tools like MailerLite or ConvertKit can help with sending reminders, homework tasks, or even newsletters. You don’t need to go full email marketing guru — just a few nudges can keep students engaged.

4. Share lesson notes or homework

Google Docs is still one of the best free tools for sharing worksheets, writing feedback, or co-editing notes live. If you use slides, Canva or Google Slides is free and simple.

Common mistakes and final tips

Even with the best intentions, a few things can trip you up when starting out. Here’s what to watch out for and how to avoid them.

❌ Undercharging for your time

Many new tutors begin by pricing too low, either to attract clients quickly or because they're uncomfortable charging more.

But if you're offering value, your time is worth paying for.

Parents often associate higher prices with quality, so don’t be afraid to set a fair rate. If you’re not sure where to start, check what others in your subject and area are charging.

❌ Taking on every subject or level

It’s tempting to say yes to every student request, especially when you’re getting started. But trying to cover everything from Year 3 phonics to A-level physics will stretch you too thin.

You’ll end up prepping more and delivering less value.

Focus on one subject area or age group and become known for that.

❌ Poor communication with parents or students

Keep it simple and clear. Confirm lesson times, send reminders, and follow up with quick updates after each session.

If something changes, let them know straight away. Good communication makes a big difference in how professional and reliable you seem.

❌ Not setting boundaries

It’s easy to let sessions overrun, answer messages at all hours, or give away too much time outside lessons. Decide your working hours and stick to them. It’s okay to be helpful, but your time matters too.

❌ Relying on one platform or referral source

If you only get clients from one listing site or one parent, things can dry up quickly. Spread the word on different platforms, stay active on social media, and build an email list or contact sheet as you grow.

Ready to launch your tutoring business?

If you're looking for a smarter way to stay on top of your finances from the very beginning, ANNA Money can make your life a lot easier. It’s a business account built for freelancers and small business owners, which means it actually understands how tutors work.

With ANNA, you get:

- A business account and debit card with your name or business name

- Easy invoicing with built-in templates and automatic reminders

- A personal payment link to share with parents or students

- Real-time tax estimates, so you’re not caught off guard by your Self Assessment

- Free bookkeeping tools to track what’s coming in and going out

- 24/7 chat support (yes, even when you’re prepping for Monday’s lessons on Sunday night)

.. and so much more!

Everything runs in one app, so there’s no need to juggle spreadsheets, emails, and random payment links. It’s especially useful if you’re switching from cash-in-hand to a more professional setup and want to make tax season less stressful.

➡️ Open your ANNA account today and simplify the business side of tutoring

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)