The Best Business Bank Accounts in the UK: A guide for 2026

As a business owner, you know how important it is to make the right choices when it comes to your finances. There are seemingly countless business banking options in the UK, and the choice can feel overwhelming, so it’s useful to compare features, fees and services to work out which account is the best fit for your business. In this guide, we’re looking at the best business bank accounts in 2026 to try to show you which of the options available might work best for you.

- In this article

- What is a business bank account?

- Differences Between Business and Personal Accounts

- Pros and Cons of a Business Bank Account

- Different Types of Business Accounts

- How To Choose The Best Small Business Bank Account

- What’s Our Methodology?

- The Best Business Bank Accounts in The UK (202)

- Best Business Bank Account for Freelancers and Side Hustlers

- Best Business Bank Account for Start-ups and Small Businesses

- Best Business Bank Account for Easy Bookkeeping

- Best Business Bank Account for International Businesses

- Best Free Business Bank Account

- The Best High Street Business Bank Accounts

- Best Digital business banking platforms

- Features of Business Bank Accounts

- Conclusion: The Best Business Bank Account

- Frequently asked questions

What is a business bank account?

A business bank account is a dedicated account that’s used just for your business transactions.

This is useful for a few reasons. It helps you to separate personal and business finances, so it’s easier to manage cash flow, track expenses, and prepare for your tax reporting deadlines. Imagine looking through your bank statements and trying to figure out what is a business expense and what is just something you bought for yourself?

Also, business accounts will have features tailored to business needs, like invoicing tools, expense tracking, and integration with accounting software. When you’re just getting started in business you may not know if you need all of these, but they’re generally useful in getting on top of your business finances.

Differences Between Business and Personal Accounts

How exactly does a business bank account differ from a personal account, and why is it an essential for any business?

Purpose

Business accounts are designed just for commercial transactions, and personal accounts are for your individual financial needs. The separation of these transactions is important for business owners or anyone managing business finances. If you’re running a business you need to be able to accurately predict income and outgoings as well as budgeting for business (and personal) use, without crossover.

Features

Business and personal accounts will often have very different features. Business accounts will almost certainly offer additional services like payroll processing, merchant services, and business loans, while personal accounts might offer benefits that work better for an individual, like subscriptions or discounts.

Some larger businesses may already have things like payroll organised, but for small businesses these can offer big additional benefits that help them to save on other software expenses.

Regulatory Requirements

Limited companies in the UK are legally required to have a separate business account. Sole traders and freelancers aren’t, but are encouraged to have one for better financial management.

Separating personal finances from business expenses can be especially useful for things like self assessment tax returns and budgeting for a new financial year.

Pros and Cons of a Business Bank Account

With these differences in mind, what are the pros and cons of opening a business bank account in 2026?

Pros

Professionalism

Having a dedicated business account shows your customers, suppliers, and partners that you can be trusted.

A business account gives the world the impression you’re running an organised operation and not mixing personal and business finances.

For larger deals and big contracts, this financial trustworthiness can be very important and can be the difference if your customers or partners are choosing between you and other suppliers.

Financial Management

Business accounts help you keep accurate records of your business income and expenditure, which is vital for cash flow forecasting and staying within budget.

Many online banking providers also include features like categorised spending and instant notifications to keep you informed in real time and help you have transparency with any outgoings.

Tax Efficiency

A separate account simplifies bookkeeping and helps avoid mistakes during self-assessment or VAT returns.

With automatic transaction tagging and export-ready statements, you can provide your accountant with clear, organised data.

This clarity can also make it easier to identify and claim allowable expenses.

Cons

Fees

Unlike most personal current accounts, many business accounts come with monthly fees or per-transaction charges.

These fees usually cover more advanced features or added benefits. Many online bank accounts offer free plans that reduce these costs for micro-businesses and sole traders to allow them to take control of their business finances until they’re able to scale up their business banking.

Eligibility Criteria

Some banks, particularly traditional high street banks, can have strict onboarding requirements. These might include minimum turnover levels, business trading history, or UK residency.

Fintech options that mostly operate online are often more inclusive, and may require only basic ID and company information to get a simple account set up.

Different Types of Business Accounts

What are the main differences between these high-street banks and the digital providers?

High-Street Business Accounts

These are accounts offered by more traditional companies. Companies like Santander, Lloyds and NatWest are among the familiar high-street names that offer business bank accounts.

These options typically offer fewer online features but allow customers to access physical branches. This can be useful for the application process which can sometimes be more complicated than that of online-only accounts.

High-street banks can also be a good option for business looking for loans or those with more complex setup requirements.

Online-Only Business Accounts (App-Only)

Online-only business accounts are digital accounts provided by fintech (financial technology) companies, offering online-only services without the traditional banking infrastructure.

Many of them are also regulated by the Financial Conduct Authority (FCA) under the Electronic Money Regulations and operate in similar ways to traditional accounts.

These accounts are managed entirely through mobile apps or online platforms, providing convenience and often lower fees for users. Examples include ANNA Money, Tide, and Starling Bank, though there are many other successful examples suitable for businesses.

How To Choose The Best Small Business Bank Account

With the many options available to you, how can you find the best business bank account for your business?

Here are a few things you might want to consider:

Fees and Charges

This includes not only the obvious monthly account fees but also costs such as transaction fees, foreign exchange rates, cash deposit charges, and penalties for exceeding limits on your account.

For smaller businesses or those operating on small profit margins, these fees can be key for ensuring that your business is moving in the right direction.

Many high-street banks have recently started charging fees to charities and community groups who were previously entitled to free accounts, so it’s worth double-checking if you’re entitled to any exemptions for account fees.

Features & Tools

The right tools can save your business hours each week. Automated invoicing, tax deadline reminders, and expense tracking can give sole traders and service-based businesses an edge and are features that some online banks offer as standard.

Properly understanding what is included with both paid and free accounts can lead to cost-effective solutions that affect your business.

Accessibility

Mobile-first banking is now the norm, but not all apps are created equal.

Don’t just consider whether there’s an app, but how intuitive it is, how fast customer support responds, and how easy it is to perform core tasks.

Scalability

Some providers are better suited to sole traders and start-ups, while others are built for scale.

Larger banks like Metro Bank and Lloyds offer strong credit options and branch access for growing firms, while platforms like Mettle, Monzo, and ANNA cater to smaller or newer businesses with fewer overheads.

When you make decisions about your banking, think about where your business is heading, not just where it is now.

Weighing Up Your Options

The best business account isn’t about having the most features, but the right combination of affordability, functionality, and support. What’s essential for one business may be useless for another.

Comparing providers side by side using this criteria helps to determine the best match for you, whether you’re freelancing part-time or running a growing SME.

What’s Our Methodology?

To determine the best business bank accounts in the UK for 2026, we evaluated each provider against the following criteria:

- Pricing transparency and value

- Features and tools

- Customer service reviews (Trustpilot, App Store, Google Reviews)

- Specialisations (freelancer-focused, SME-focused, international, etc.)

- FCA regulation and FSCS protection (if applicable)

We also prioritised products that offered convenience, especially through mobile-first platforms, and those with clear pricing models.

The Best Business Bank Accounts in The UK (202)

So who did we find offered the best all-round solutions for business banking in 2026? We’ve broken it down into several categories.

Best Business Bank Account for Freelancers and Side Hustlers

WINNER: Monzo Business Lite

Monzo's Business Lite account has no monthly fees and offers a great selection of features. From free UK bank transfers, receipt capture, and spending categorisation to 24/7 support and super fast setup, there’s lots to like about Monzo.

For those who want to upgrade to their premium pro or team plan, there’s also the option of employee expense cards with limits and controls as well as customisable invoicing. It’s a great choice for freelancers or sole-traders who hope to scale up in the future.

Read our full Monzo business account review →

Best Business Bank Account for Start-ups and Small Businesses

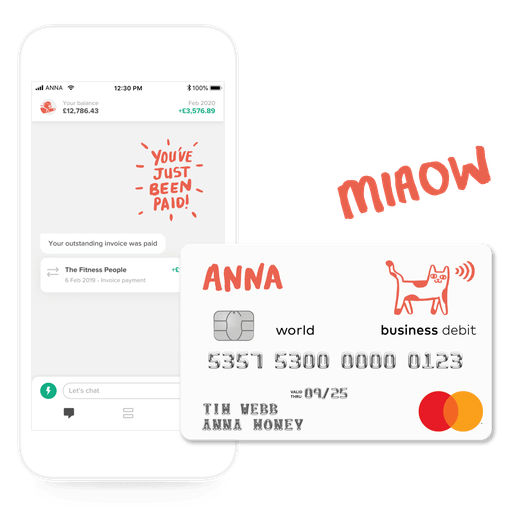

WINNER: ANNA Money

For financially-conscious small businesses, there are few options more user-friendly than ANNA Money.

With features tailored for small businesses, including invoicing, expense tracking, and a useful tax add-on, there are lots of tools included that will help you to stay on top of your finances.

ANNA's flexible pricing plans start at £0 per month, with pay-as-you-go additions, making it an accessible and affordable option for start-ups and small businesses.

Best Business Bank Account for Easy Bookkeeping

WINNER: Starling Bank

For businesses that have lots of expenses to manage, there are a number of excellent options out there.

Starling Bank’s Business Toolkit offers seamless banking with excellent tools for small businesses. From invoices and MTD to categorised spending insights, and integration with accounting tools like Xero and QuickBooks.

The basic plan is free and the more advanced toolkit is available for £7/month.

With ANNA, on the other hand, you don’t need any integrations, since ANNA will calculate everything for you automatically.

Read our full Starling business account review →

Best Business Bank Account for International Businesses

WINNER: Wise Business

Wise offers multi-currency accounts, allowing businesses to hold and manage funds in over 70 countries.

Specialisation in the international business account space means that resources are focused on creating the best possible experiences for businesses operating across multiple countries or in many currencies.

Wise provides competitive exchange rates and low fees for international transactions, making it ideal for businesses dealing with global clients.

Read our full Wise business account review →

Best Free Business Bank Account

WINNER: Mettle (by NatWest)

Mettle is a free account with no transaction fees. Created by NatWest to work specifically for self-employed customers, it’s an easy solution for those who run small businesses with up to two owners.

Reviews from customers praise the FreeAgent accounting software included with the account and its ease of use. For those looking for an all-in-one solution this is an appealing offering.

There is also a paid option in Mettle+ for £4 per month which will also allow you to use quotes, invoices and custom messaging.

Read our full Mettle business account review →

The Best High Street Business Bank Accounts

Which traditional high-street banks have the best offerings for businesses?

HSBC Kinetic Current Account

HSBC's Kinetic account is designed specifically for sole-traders and can be applied for through their app. It offers a mobile-first banking experience with features like cash flow insights and international payments.

New customers also receive 12 months of free banking and can apply for an overdraft in-app.

Read our full HSBC business acoount review →

TSB

TSB Bank offers a range of business banking solutions tailored to meet the needs of UK businesses.

Their flagship offering, the Business Plus Account, is designed to support small businesses, sole traders, and startups with a blend of cost-effective banking and practical tools.

With 30 months free day-to-day banking it’s a good option for new businesses with good potential to scale up as the business grows.

Read our full TSB business account review →

The Co-operative Bank

The Co-operative Bank has a big focus on ethical banking and has been named among the best options for charities and community groups.

They offer two main products on top of their specialist offering, one for businesses banking digitally, and Directplus for businesses that may need to pay in cash or cheques.

Read our full Co-operative bank business account review →

Barclays

Barclays offers a comprehensive range of business banking services for different business sizes and transaction sizes. Their flagship Business Current Account provides flexible banking with an additional bonus of specialist coaching for women in business who turnover between £50,000 and £6.5m per year. Which is something worth knowing about.

Read our full Barclays business account review →

Lloyds

They already support over one million businesses, and Lloyds Bank offers solutions for new businesses, established SMEs, and switchers looking for branch-based and digital support.

Their Business Current Account comes with strong introductory offers and a variety of business tools including free accounting software.

Read our full Lloyds business account review →

Metro Bank

Metro Bank offers 24/7 support to account holders. They have options available to suit larger finance teams and small businesses, and there are basic banking features included in their business banking products to suit those working in many different industries.

Read our full Metro bank business account review →

Santander

Santander's business accounts come with standard features like online banking, mobile app access, and integration with accounting software.

They also offer BrightHR where business customers can get expert HR and health and safety help. For small businesses these resources from larger high street banks can be really helpful as they look to expand.

Note: at the moment Santander are only accepting existing customers who also want to open a business account.

Read our full Santander bank business account review →

Best Digital business banking platforms

So, which digital or online bank accounts are best for businesses in 2026?

ANNA Money

ANNA Money is an intelligent business-first digital problem-solver. It’s the business account that also does your taxes. ANNA’s tools help to simplify administrative tasks like invoicing, expense tracking, and tax reminders to simplify life for business owners.

ANNA customers get their own unique payment link, so getting paid is as simple as sending a link to clients, or generating a QR code. They also have pots that can automatically set money aside for things like VAT or Corporation Tax bills. Plus, their award-winning 24/7 customer support means that you can get your questions answered quickly (usually in under a minute).

ANNA also offers a company registration service, as well as tax services. They can even file your taxes for you.

Flexible pricing plans make it a great choice for small businesses and freelancers.

Tide

Tide offers a free business account with the opportunity to upgrade for more advanced features.

With the ability to deposit cash at any post office or PayPoint location, they offer businesses lots of flexibility in how they get paid.

Zempler (Formerly Cashplus)

Zempler, formerly known as Cashplus, allows businesses to register with Companies House and apply for an account at the same time, simplifying admin work for owners and entrepreneurs.

They offer standard accounting tools like receipt capture, spending insights and an invoice generator and are a suitable option for many small businesses.

Starling Bank

Starling Bank continues to be a popular choice for business owners, sole traders and larger limited businesses with multiple directors.

The flexibility and ability to add on extra tools like The Business Toolkit and a US Dollar account.

Revolut

Revolut offers multi-currency accounts, expense management tools, and integration with accounting software.

Useful for growing teams, Revolut allows you to issue multiple cards, whether physical or virtual.

Monzo (Monzo Business Lite Account)

Monzo's Business Lite account is a free option that offers features like free UK bank transfers, receipt capture, and spending categorisation.

It's suitable for sole traders and freelancers seeking a no-frills banking solution.

As your business grows you can upgrade to a Pro or Team account for more features and expense cards to help you manage you and your team’s spending.

Amaiz

Amaiz allows mass card issuing, with limits of up to 10,000 cards issued per month. This allows businesses to securely manage both their physical and virtual cards.

Mettle (Mettle By NatWest)

Mettle offers plenty of practical accounting features with the ability to upgrade to Mettle+ for a more in-depth financial management toolkit.

Features of Business Bank Accounts

Which features are most important when you’re looking for the best business bank accounts in the UK?

Fees and Charges

Business bank accounts can vary significantly in their fee structures, so it’s important to understand both fixed and variable costs associated with the account you choose. Don’t assume that an account with no monthly fee is automatically the cheapest.

- Monthly account fees: Many providers, like ANNA, Monzo and Starling offer free basic accounts that can be upgraded as your business grows. Other banks, like Lloyds, will charge per month for a business bank account.

- Card transaction fees and ATM charges: Look for charges on contactless payments, international card use, and ATM withdrawals. Some of these may be more or less important to you depending on how you use your card.

- International transfer fees: If your business trades overseas, these costs can add up. Some platforms, such as Wise, specialise in low-cost international transfers, while others may apply a markup on exchange rates.

- Cash or cheque deposit fees: Traditional banks may charge per deposit or apply minimum monthly usage fees, whereas many fintech options may not support physical cheque or cash deposits at all.

- Hidden or usage-based charges: These can include charges for exceeding monthly transaction limits, requesting paper statements, or using additional services like overdrafts or credit assessments. Some banks also charge for physical cards or replacement cards.

Accounting and Invoicing Software Integrations

Modern business banking goes beyond storing and moving money, many banks now support your financial admin too. Most leading accounts will integrate with popular software like Xero, QuickBooks, Sage, and FreeAgent to help you better manage your business finances.

Some accounts like ANNA and Starling offer an all-in-one solution, including smart invoicing tools, automated reminders for late payments, and even gentle nudges around tax deadlines.

This built-in support is ideal for freelancers and small businesses who want to minimise time spent on bookkeeping so that they can focus on day-to-day operations.

Account Access and Management

Effective financial control depends on how easily and securely you can access and manage your account.

Most providers now offer both feature-rich mobile apps and browser-based dashboards so that you can easily manage your finances from anywhere.

As well as these apps, some banks offer instant spending notifications and real-time transaction tracking as well as adjustable permissions for additional users such as accountants or co-founders.

This digital-first approach makes it easier to stay on top of your finances without visiting a branch.

Credit Facilities

Credit access varies widely across providers.

Digital-first banks often have fewer lending products, while traditional banks still dominate business credit options.

Overdrafts, credit cards and loans should be assessed on a case-by-case basis as eligibility will often be different for every business.

Additional Services

Beyond the basics, business bank accounts can include:

- The ability to create and manage Direct Debits and Standing Orders

- Categorisation of expenses for better budgeting

- Physical debit cards, virtual cards for online spending, and card freezing features

- 24/7 support both online and via phone

- Multi-currency wallets and accounts for ecommerce or international trade

- Additional benefits such as memberships and discounts

- Bank-run mentorship schemes and workshops

Conclusion: The Best Business Bank Account

Your choice of a business bank account should be based on what your business needs most, whether that’s lower costs, better tools, or scalability.

That means that there’s no universal "best" business bank account. But through side-by-side comparison, you can identify which bank works with your business needs and ambitions.

With so many options available, it can be tricky to work out which business bank account will best support your specific needs. Rather than just choosing the account with the lowest fees or the flashiest app, it’s important to look at providers through a clear, structured comparison.

All of the options we’ve mentioned in this article serve thousands of UK businesses every year and help them to organise their finances and grow their business successfully. As long as you properly understand the features you need, many of these accounts could be the perfect match for you.

Frequently asked questions

Can I get a business account with bad credit?

Yes. Some providers offer accounts with minimal checks, so you can open an account even if you have poor credit history.

Are business bank accounts safe?

Most business accounts from UK-registered institutions are regulated by the FCA. Many of these also offer FSCS protection up to £120,000. Even business accounts that aren’t FSCF protected are generally safe, and the money held in customer accounts is ring-fenced, so it can’t be used for other purposes.

Are business banking charges tax deductible?

Yes. Most costs associated with operating a business bank account are considered allowable business expenses.

Can I get a free business bank account?

Absolutely. Providers like ANNA, Starling, Mettle, and Monzo offer free plans, often with optional premium upgrades.

Can I switch business bank accounts?

Yes. The Current Account Switch Service (CASS) makes switching easy for eligible providers.

Can I have a business account as a sole trader?

Yes. Many business accounts are tailored for sole traders, including those from ANNA, Monzo, and Countingup.

Does my limited company need a business bank account?

Yes. Legally, a limited company must have a separate account for its business transactions.

How do I open a business bank account?

Most digital banks allow you to apply in minutes via an app.

How much do business bank accounts cost?

Fees vary for business bank accounts. Some are free, while others charge £5-£20+ per month. Look closely at transaction fees and any add-on services when evaluating your options.

What is the Financial Services Compensation Scheme (FSCS)?

FSCS protects deposits up to £120,000 per financial institution. Some providers may not be a part of this scheme but still offer protections for customer money.

Read the latest updates

You may also like

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)