The business account for start up businesses in the UK

Start up with the right business account

Your business account doesn’t just help you manage and move your money, it proves that you’re serious about what you do. Choosing the right business account can save you time, money and a lot of stress. Startups need partners that keep up with the speed of business. That means fast, intuitive internet banking with a clear transaction history, accounting tools, seamless integration with other services, and 24/7 support that knows what it’s like to start something from scratch.

Built by a startup, for startups

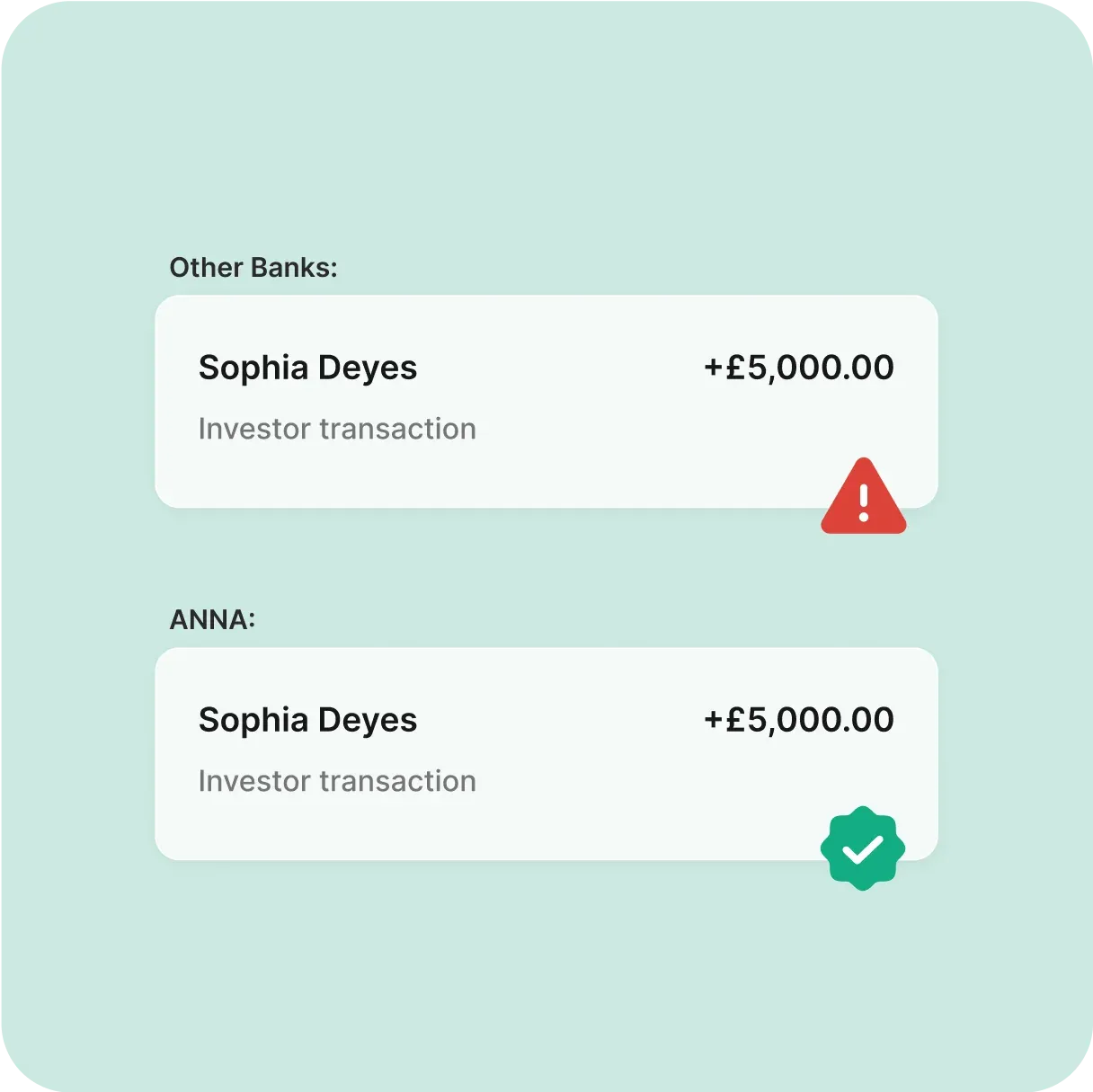

Most banks treat a large first payment into a new account as suspicious – especially if it’s a lump sum from an investor; the money gets frozen, and founders are left without access to their funds. Not the best start.

At ANNA, we take a different approach. Because we’re a startup too, we know what these payments look like and what they mean. Our team is trained to review incoming transactions quickly, and we’re usually able to release legitimate payments without delay. That means no frozen funds, no frantic phone calls, and no stalled launches.

Send and receive money

Get your account details the moment you register with ANNA. Sending payments, receiving investments and getting paid by customers is easy from day one.

Standing orders and Direct Debits

Once your account is up and running, set up standing orders and Direct Debits for your office or other scheduled and recurring payments.

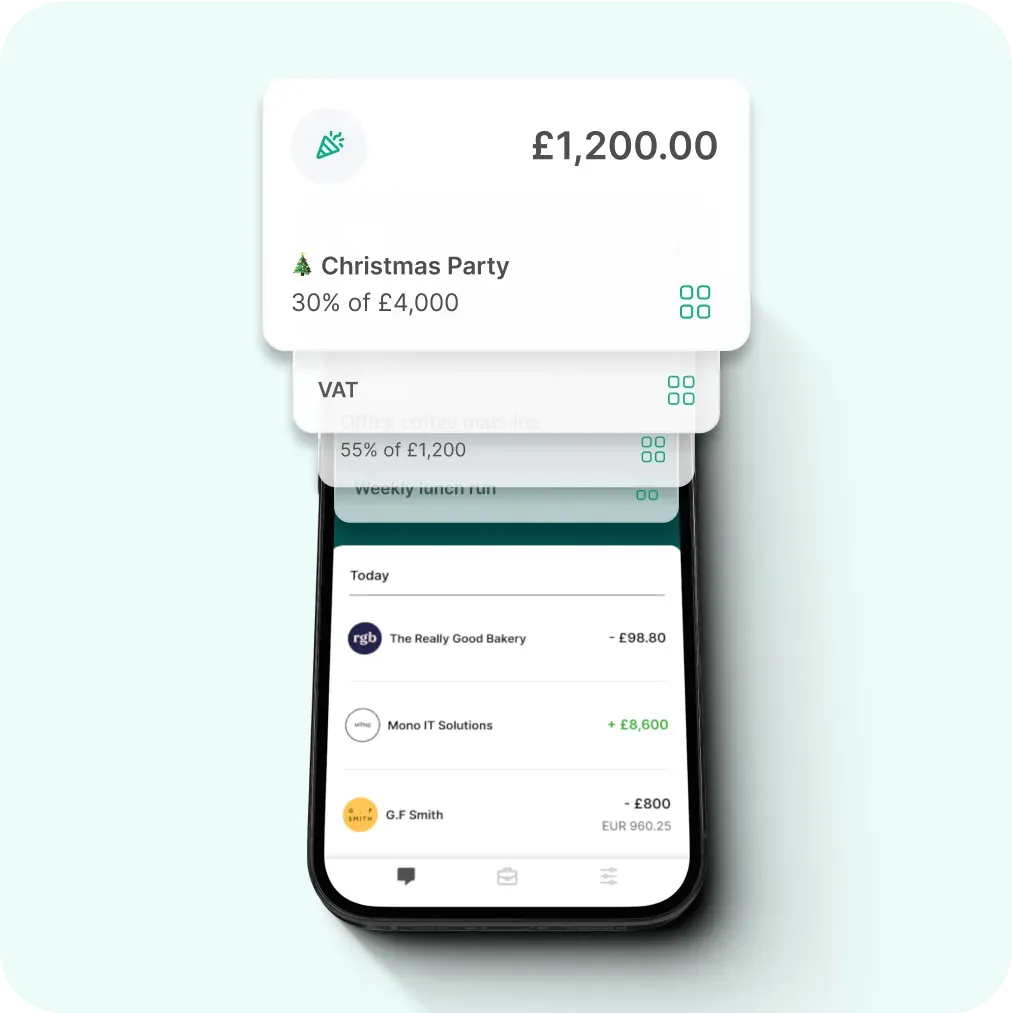

Get your accounting sorted

Get your money, invoices, receipt capture and tax all synced in one app. We’ve got you covered with ANNA +Taxes. Want to learn more? Visit the link below.

Do I need a business bank account?

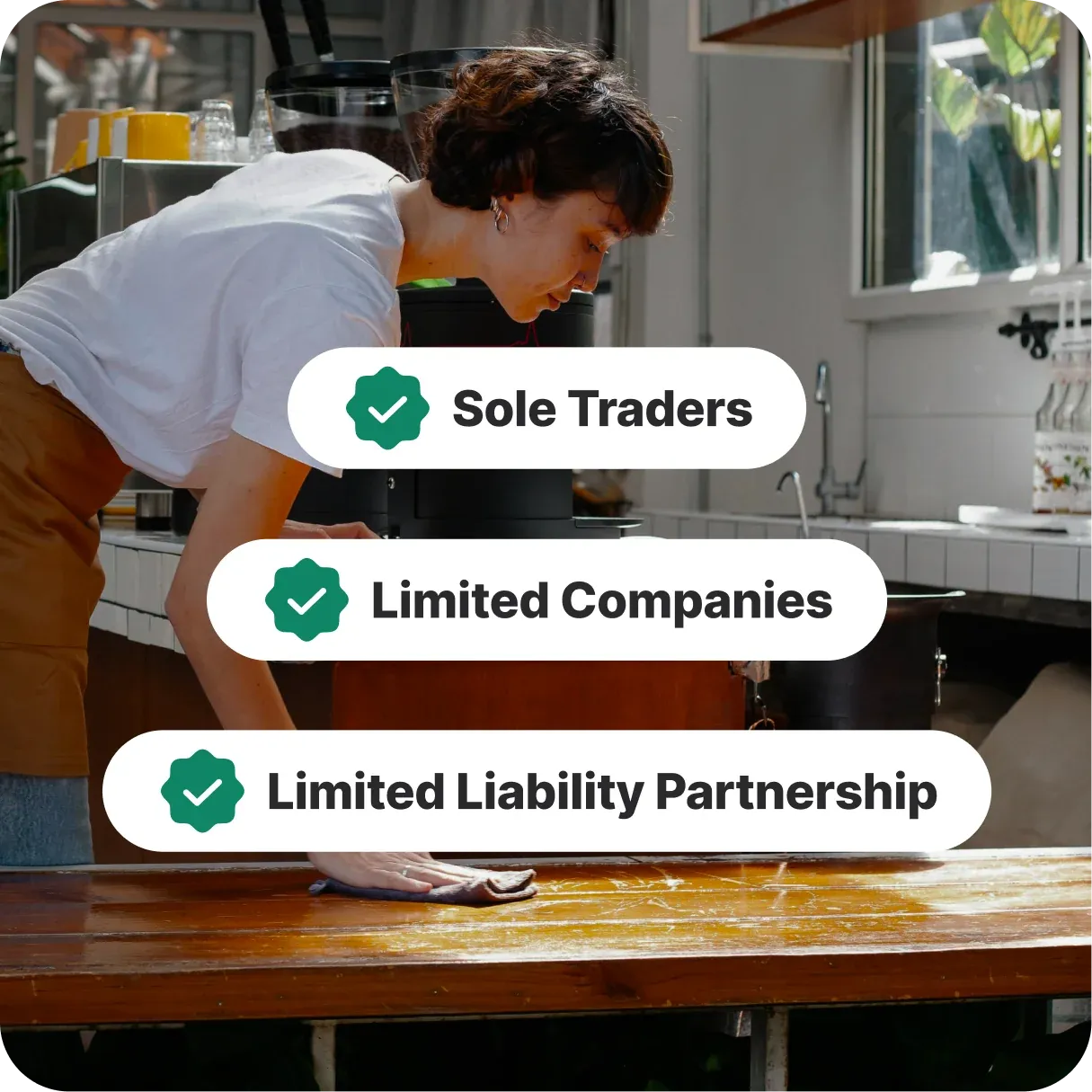

Whether you’re a sole trader, a director of a limited company, or part of an LLP – a business account isn’t just helpful, it’s often essential. It keeps your personal and business finances separate, makes tax and admin easier, and helps you look professional right from the start.

ANNA was built for small businesses and startups just like yours. So if you’re registered with Companies House (or planning to be), you’re in the right place. If you’re not registered yet, we can help with that too – check out our company registration service.

ANNA business expense card

A card for your business

If you’ve got your ID to hand, you can get your UK business account and sort code in as little as 10 minutes, with your physical card arriving in the post after a few days

Virtual business expense cards

Don’t wait for your ANNA card to arrive in the post – you get a virtual card as soon as you sign up, and can start making payments straight away

Employee expense cards

Avoid the faff of reimbursing employee expenses. Give co-workers their own ANNA card, set a spending limit, and the ANNA app automatically sorts their expenses

Use Apple Pay

Use ANNA Money with Apple Pay. It’s the simple, secure, and private way to pay. There’s no need to even carry your card – your iPhone or Apple Watch is enough

Business account cashback

Free money for your business! Earn 1% cashback when you use your ANNA business expense card to pay for a range of expenses, like train travel and office supplies

Use Google Pay

Use ANNA Money with Google Pay™. It’s the fast, simple, and secure way to pay at millions of places; on sites, in apps, and in stores. With Google Pay there’s no need to dig for your cards – you can pay quickly and easily with the device that’s already in your hand

Get paid easily

The ANNA business account gives you a range of easy ways to get paid, both online and offline

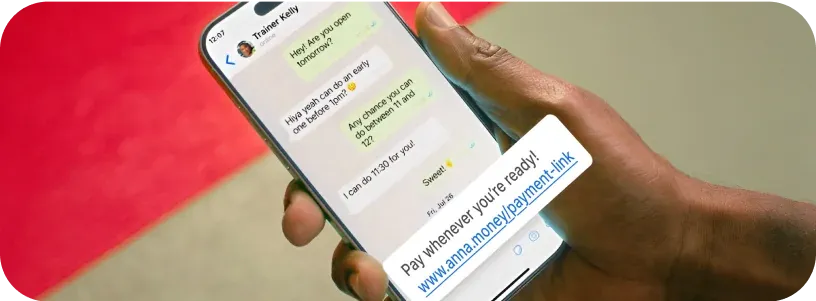

Payment link and webpage to accept payments

Use your personal payment webpage to get paid online. Put the link on your business’s social accounts or to send it directly to customers

Top up your account in cash

It’s easy to put cash into your ANNA business account with thousands of PayPoints across the UK

Instant payment notifications

Manage money in and out with instant notifications about incoming and outgoing payments

Money-saving pots in your business account

Create pots in your business account and put money aside for taxes, salaries or other expenses. Manually move money into and out of pots or set up automatic top-ups, so you always have savings set aside

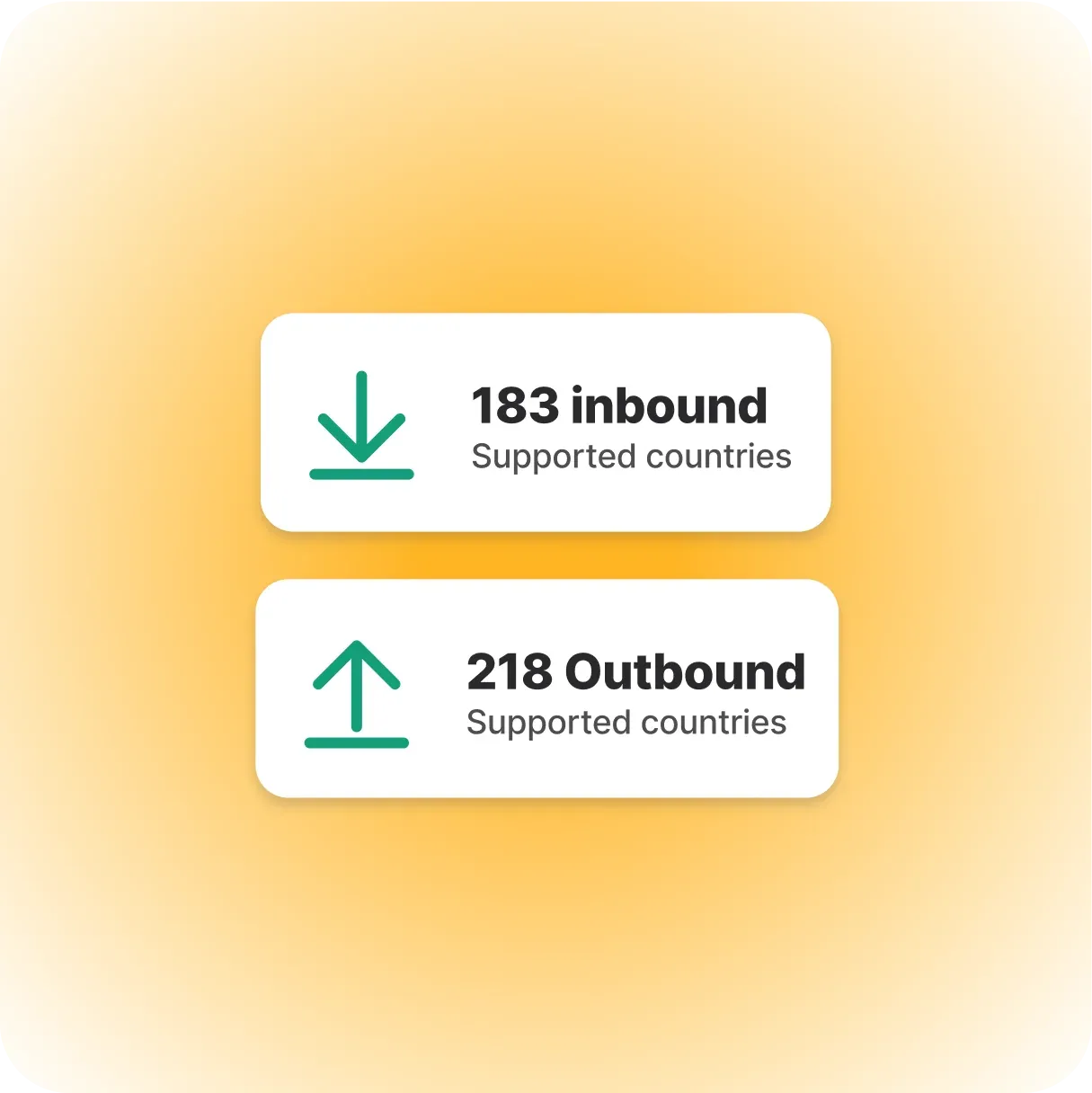

Send and receive international business payments

Make and receive payments from around the world in a range of currencies. Check out our lists of approved countries and currencies:

Small business loans

ANNA works with partners to find you additional financial support, tailored to the needs of your business.

Accountant access

Give your accountant real time access to your sales and expenses or sync with accounting software like Xero and QuickBooks

Open Banking

Thanks to Open Banking, you can connect your other business and personal accounts to ANNA to see all your accounts in one place

Sort your expenses

Take a photo of your receipts or forward email receipts to ANNA and they’re automatically scanned and categorised, so claiming back business expenses is simple and straightforward

Who can open a startup business account?

We’ve made sure ANNA is suitable for most types of startup businesses that are legal in the UK, and that you can get your business account up and running as fast and smoothly as possible.

Eligibility criteria

If your business is legally registered in the UK, you’re almost certainly good to go. That includes limited companies, sole traders, partnerships and more. However, we don’t support certain types of businesses, like those involved in cryptocurrency, gambling, or anything listed on our prohibited activities list.

Turnover eligibility

We get it. One month you’re pre-revenue, the next you’re scaling fast. Whether your business is still in stealth mode or you’re about to onboard your first customer, there’s no minimum turnover required to open an account with us. We might ask a few questions when you sign up (to understand your business better), but we know what it’s like to start from zero.

Transaction limit

To keep your account secure, we apply limits on things like card payments, ATM withdrawals, and bank transfers. These limits are designed to protect your money, not slow you down. If a legitimate transaction ever gets caught in the net, our team will work quickly to help sort it out. You can see the full list of account limits here.

Why ANNA is a smart choice for UK startups

Get started fast

Got your ID and proof of address? You can open an account in under 10 minutes – no paperwork, no drama.

Free up your time (and your headspace)

From sending invoices to tracking expenses, ANNA takes care of the financial admin so you can focus on building your product and growing your business.

Accounting that runs in the background

Our smart AI handles everyday bookkeeping, automatically sorting your transactions and making VAT, expenses and tax returns way easier.

Invoices that chase themselves

Create and send clean, professional invoices in seconds – and ANNA will even chase them up for you when they’re overdue. Because awkward payment emails shouldn't be your job.

Human help, 24/7

Need support at 2am before a product launch? Our UK-based team in Cardiff is here for you around the clock – and we usually reply in under a minute.

Loved by thousands of small businesses

Rated ‘Excellent’ on Trustpilot with a score of 4.2 – startup founders trust ANNA to keep things running behind the scenes.

How we compare to the best business bank accounts in the UK

Not sure which business bank account out there is best for you? No problem. In this guide we compare business accounts based on Trustpilot reviews, ratings, key features, and pricing to help you make an informed decision.

What does ANNA cost?

Our plans start at £0 per month – you only pay for the services you use. Whatever your plan, if you don't use your account for a month, you don't pay the monthly fee for that month

How to use the ANNA Money business account

How do I open a business account?

Here’s a step-by-step guide to opening a business account, including all the documents you’ll need.

Step 1

Sign up with your email or install the ANNA mobile app.

Step 2

Provide us with basic information about you and your business. You’ll need ID and proof of address, and for your business you’ll need its legal name, type of business, information about the directors of your company (if there are more than one) and your website or social media presence.

Step 3

We’ll check your documents and information; this usually takes a few minutes, but we might sometimes ask for more time.

Step 4

We open your account. You’re now ready to accept and send payments and order your ANNA card.

What do I need to open a business account?

There are certain eligibility requirements to open a business account with ANNA. We’ll need to check the information and the documents you provide. There’s a few things you can make sure of so this process goes swiftly and only takes a few minutes.

Photo ID and proof of address

We’ll need a photo of your full driving licence or a photo of your valid passport.

Take the photo on a flat, clear surface and make sure all four corners of the ID can be seen.

To verify your address we might ask for a utility bill, council tax bill or bank statement. They should be dated within the last three months.

Officially registered business: LTDs only

For limited companies, we’ll need the name your business is registered under with the Companies House. If you haven’t registered your business yet, you can do it with us through our company registration service.

Online presence of your business

If you have a website and public social media accounts for your business, the links will help us speed up the process

Sign up in less than 10 minutes

Frequently Asked Questions

Should I have a separate account for my start up?

If you’re running your startup as a limited company then yes, you’re legally obliged to have a separate account for it. If you’re operating as self-employed or a sole trader, then there’s no legal requirement, but it’s still a good idea as it helps you keep your business finance from your personal expenses. We wrote a whole article about differences between business and personal accounts where we go into details – check it out.

Can any business open a start up account?

Any business that is legal in the UK can open an account with ANNA.

Can I get a free start up business account?

Absolutely – ANNA’s pricing plans start at £0 per month. The first month is free of subscription fees on any plan, and if you stay on Pay As You Go plan, you don’t have to pay anything for as long as there’s no movement on your account. Check our pricing page for more details about our plans.

Can I have an IBAN to receive foreign payments?

Yes. Your ANNA business account comes with a UK sort code and account number, and you also get an IBAN to accept international payments. If your investments come from abroad or you need to pay suppliers abroad, we’ll make sure to swiftly clear up any questions that might arise in the setup process. Check our pricing table for information about the foreign payment fees.

What age do I have to be to open a Business Bank Account?

You need to be 18 or older to open a business account with ANNA.

It’s legal to be a UK company director from the age of 16, but you won’t be able to open a business bank account yourself until you’re 18. If you're under 18 and running a company, someone over 18 will need to open the account as the main account holder – you can still be listed as a director on the account.

Can I add multiple directors or team members to the account?

Yes, you can. Once your ANNA account is set up, you can add other directors, team members or collaborators to help manage your business finances. You can give them access to the app, assign roles with different permission levels, and even give them their own ANNA cards (if needed).

It’s a great way to share the admin without sharing your login details – and keep things running smoothly as your team grows.

Can I switch my business bank account later?

Currently ANNA is not a part of Switching Scheme, so you won’t be able to do the switching procedure. However, if you ever decide to close your account with ANNA, we’ll make sure to provide you with all the necessary documents and account history to make the manual switch to a different account as smooth as possible.

Can I make international payments?

Yes, your ANNA business account comes with international account details, so you can send and receive payments to and from other countries. Check out our lists of available currencies and countries.

What is the best business bank account for a startup?

The best business account for a startup is one that’s easy to open, flexible with early-stage cash flow, and built to grow with you. Look for fast setup, fair fees, helpful support, and tools that simplify things like invoicing, tax, and expenses. Bonus points if the provider actually understands what it’s like to build a modern business from scratch.

Can ANNA verify my identity for Companies House?

Absolutely. ANNA is an officially Authorised Corporate Services Provider (ACSP) for Companies House – which means we can verify your identity ahead of the 18 November 2025 deadline.

We’ve actually been doing this from day one – verifying your ID is part of opening an ANNA business account, so becoming an ACSP was a no-brainer. One less thing for you to worry about.

You can learn more about on our identity verification page.