Introducing free Excel VAT filing from ANNA, and here's a quick tour of how to fill in that 9 boxes spreadsheet.

How do I file a VAT Return?

If your business is VAT-registered and has a taxable turnover over the VAT threshold (£85,000) you’re now required to follow the Making Tax Digital (MTD) rules. That means keeping digital records (no storing receipts in a shoebox) and using software to submit VAT returns.

There are plenty of ways to calculate your VAT return, including complicated accounting software, but the most convenient is often using a simple Excel spreadsheet. Hooray for good old Excel.

That’s great. But how to file a VAT return using Excel?

ANNA has just launched a free MTD compliant online VAT filing Excel tool. Just fill in your Excel spreadsheet, hit our page, and upload. Easy as pie.

If you’re not familiar with what you need to put in your VAT return Excel spreadsheet, don’t worry. We’ll explain the 9 boxes you need to include in your spreadsheet, and what goes into each box.

Can you give me a VAT return example?

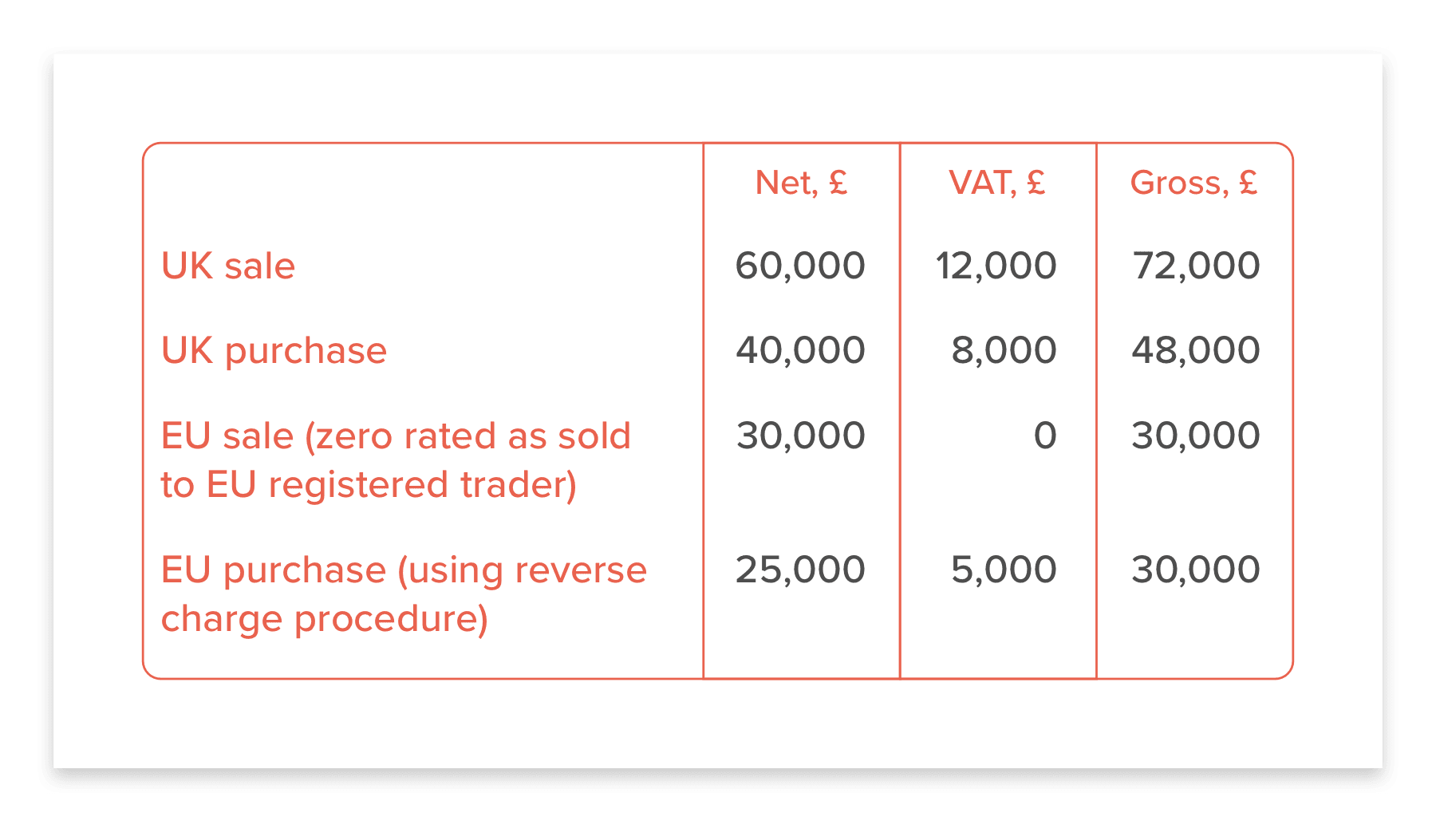

Imagine you run a company selling giant foam hands (everyone loves giant foam hands). The table below shows your sales and purchases over your last VAT period.

Based on the table, let’s look at what you need to put in the 9 boxes.

Box 1: VAT due in the period on sales and other outputs This is the VAT due on all the goods and services you supplied in your VAT period. In the case of our example, that’d be £12,000.

Box 2: VAT due in the period on acquisitions from EU member states This is the VAT due on all goods and related costs bought from VAT-registered suppliers in EU member states. In our case, it’s £5,000.

Box 3: total VAT due So that’s boxes 1 and 2 added together. £17,000.

Box 4: VAT reclaimed in this period on purchases and other inputs (including acquisitions from the EU) In our case that’s £8,000 plus £5,000. Which makes £13,000.

Box 5: net VAT to pay to HMRC or reclaim Take the numbers in boxes 3 and 4. Deduct the smaller from the larger and enter the difference in box 5. In our case, that’s £4,000.

Box 6: Total value of sales and all other outputs excluding any VAT This is the total value of all your business sales, but take off any VAT. In our case that’s £60,000.

Box 7: Total value of purchases and all other inputs excluding any VAT Similarly, this is all your purchases, but leave out the VAT. So that’s £40,000 (UK purchases) and £25,000 (EU purchases).

Box 8: The total value of all supplies of goods and related costs, excluding any VAT, to EU member states This one is pretty self explanatory. For us, it’s £30,000.

Box 9: The total value of all acquisitions of goods and related costs, excluding any VAT, from EU member states That’s £25,000. Simple.

This is a basic overview. With all 9 boxes there are nuances and exceptions, so it’s best to check the details on the government’s website. Then prepare your spreadsheet, visit our tool and get uploading. And wave those giant foam hands in the air.

Read the latest updates

You may also like

Open a business account in minutes

![Offshore Company Registration in the UK [2026 Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_cdb14668f7/small_cover_3000_cdb14668f7.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![How to Check a UK VAT Number [Comprehensive Guide & Tips]](https://storage.googleapis.com/anna-website-cms-prod/small_a_Ewt17_NJE_Fa_PX_8u_L_Cover3000_Howtochecka_UKVAT_Number_5c361cc53b/small_a_Ewt17_NJE_Fa_PX_8u_L_Cover3000_Howtochecka_UKVAT_Number_5c361cc53b.webp)