If you run a VAT registered business, you probably think that if you haven’t traded during a quarter you don’t have to file a VAT Return. Think again…

- In this article

- How to file a Zero VAT Return

If you’re VAT registered, you have to file a VAT Return every quarter.

Even if there is no VAT due for that period (for example, if you registered your company for VAT but haven’t started trading, or if your company is registered for VAT but just hasn’t traded in the relevant period) you still have to file a Return.

This is known as a Zero VAT Return or a Nil VAT Return.

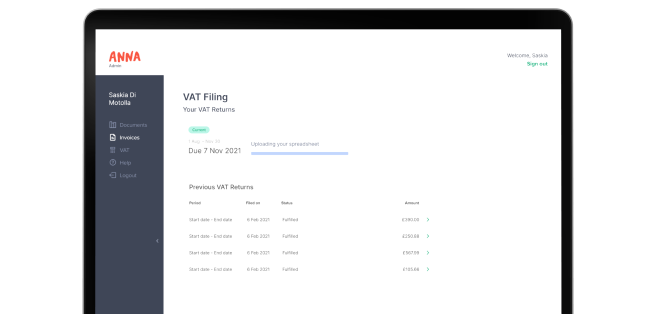

How to file a Zero VAT Return

If that all sounds like a bit of a headache, the good news is that it’s really quick and easy to file a Zero VAT Return with ANNA. Just use our VAT filing tool and fill in all the values as zero. It’s as simple as that.

Open a business account in minutes