File your VAT online through ANNA’s Google Sheets VAT Filing Add-on

The VAT landscape has been changed by Making Tax Digital, and filing VAT can seem complicated or intimidating, but it needn’t be. In fact, you can now file your VAT direct from a Google Sheet, using ANNA.

Making Tax Digital or MTD

From April 2021 all VAT-registered businesses that exceeded an annual VAT threshold of £85,000 were required to register for MTD. This meant they needed to maintain their business records digitally and had to file their VAT returns using HMRC-compatible software.

All VAT-registered businesses are now affected

Since April 2022, this requirement has expanded to include any VAT-registered business irrespective of their turnover and their VAT threshold. So if you’re a VAT registered business, no matter your turnover, you now need to comply with Making Tax Digital.

What does complying with Making Tax Digital mean?

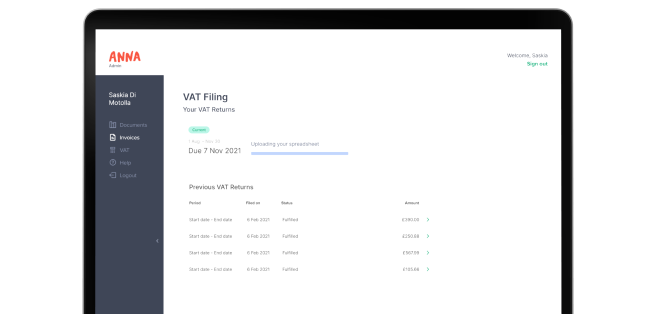

Making Tax Digital means VAT-registered businesses are legally obliged to submit their VAT returns using compatible software with an application programming interface (API). This sounds complicated, but it just means that there’s a direct connection between the two applications, so they can talk directly to each other. This maintains an unbroken digital link between your VAT return and HMRC – what you put into your software goes directly to HMRC.

The hope is that in the long run, this type of application will help avoid human errors and will provide a faster and more efficient method for submitting your VAT return online.

Finding the right software

There is a lot of compatible software out there that complies with MTD requirements. However, a lot of it comes with an eye-watering price tag, and businesses may not need every single element of the software they’re sold. In fact, lots of small businesses already prepare their VAT Returns on a spreadsheet and don’t want to transition to a large software package – they just need an API to bridge the VAT Return calculation to HMRC for submission.

More and more businesses are using Google Sheets™ as a free cloud-based alternative to traditional spreadsheet software. And the good news is that if you already use Google Sheets™ to record your VAT, you can easily file your VAT Return straight to HMRC with ANNA’s free add-on.

It’s quick and easy

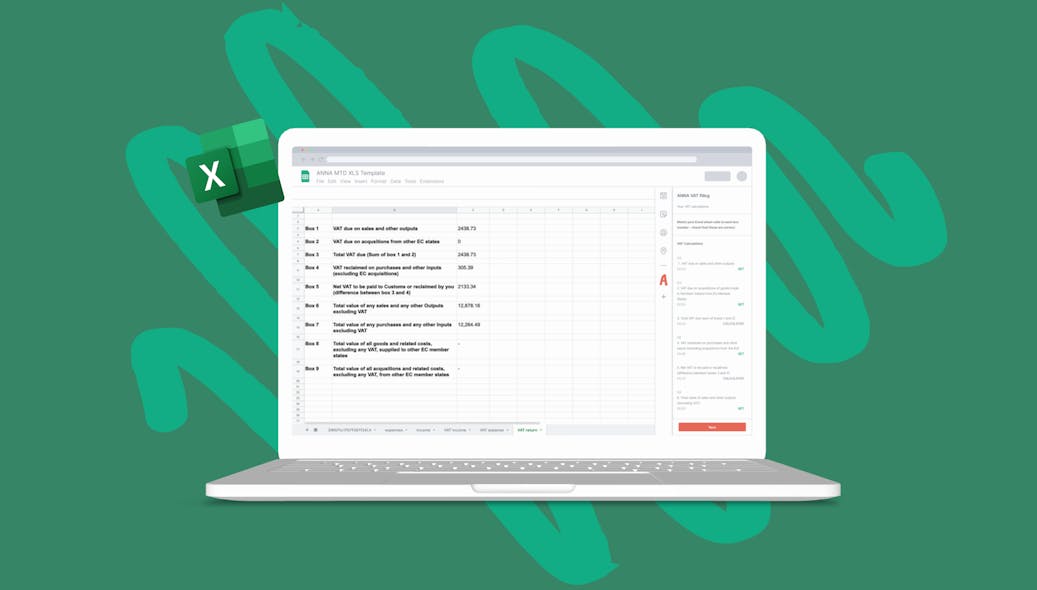

There are six simple steps to follow to file your VAT Return using Google Sheets™

- Install the ANNA add-on in Google Sheets™

- Fill in the 9 boxes of your VAT Return with your VAT calculations

- Connect to HMRC

- Enter your VAT number and company name

- Choose your VAT filing period

- Click submit

It’s as easy as that. And it’s totally free.

What if I’m not registered for VAT?

That’s simple enough. Before you can submit a VAT Return, you first need to register with HMRC on the UK government website. You’ll need to create a Government Gateway user ID, and if you are a business you’ll now also need a device or authenticator app to be able to log in. Once you’re registered, HMRC will send you a VAT certificate, complete with your VAT number.

For a comprehensive guide on how to pay your VAT online, check out our article on Everything You Need to Know to Pay VAT Online

Open a business account in minutes