You’ve put in the hours, done the work – why should sending the invoice feel like such a chore? The sooner it’s done the sooner you get paid, so here’s how to invoice like a pro (even if you’re a complete beginner).

So, what is an invoice?

An invoice is simply a document issued by you to your client stating the goods and services you’re providing and how much they owe you. If you and your customer are both VAT registered, it’s a legal requirement to send invoices. But it’s good business practice, even if you’re not - an invoice is a reminder of your customer’s obligation to pay you and provides a handy record of your business transaction. Which is one less headache when it comes to doing your tax return.

When should I invoice?

This kind of depends on how your business works. If you provide physical goods, you might expect to be paid in advance. If you deliver a service, you’re more likely to submit an invoice when you’ve completed the work. How long you give your client to pay - the ‘payment terms’ - is up to you, but it’s a smart move to state this on any email, quote or letter to your client in advance.

It’s good business practice to invoice, even if you’re not VAT registered.

How do I create an invoice?

Not sure what to put in an invoice, or want something a bit more professional than a hastily knocked up Word document? There are plenty of free invoice templates available online, but finding the one that’s right for you can be time-consuming. It’s also easy to make a mistake filling them in, particularly if you’re not used to invoicing.

Professional invoicing software like Xero is also available, but can be pricey and if you’re a small business owner, overly complex for your needs. A simpler alternative is a business account app that comes with automated invoicing tools, like ANNA. These act like a virtual PA, creating, sending and even chasing up invoices with you barely having to lift a finger. Because you’ve got enough to be getting on with, right?

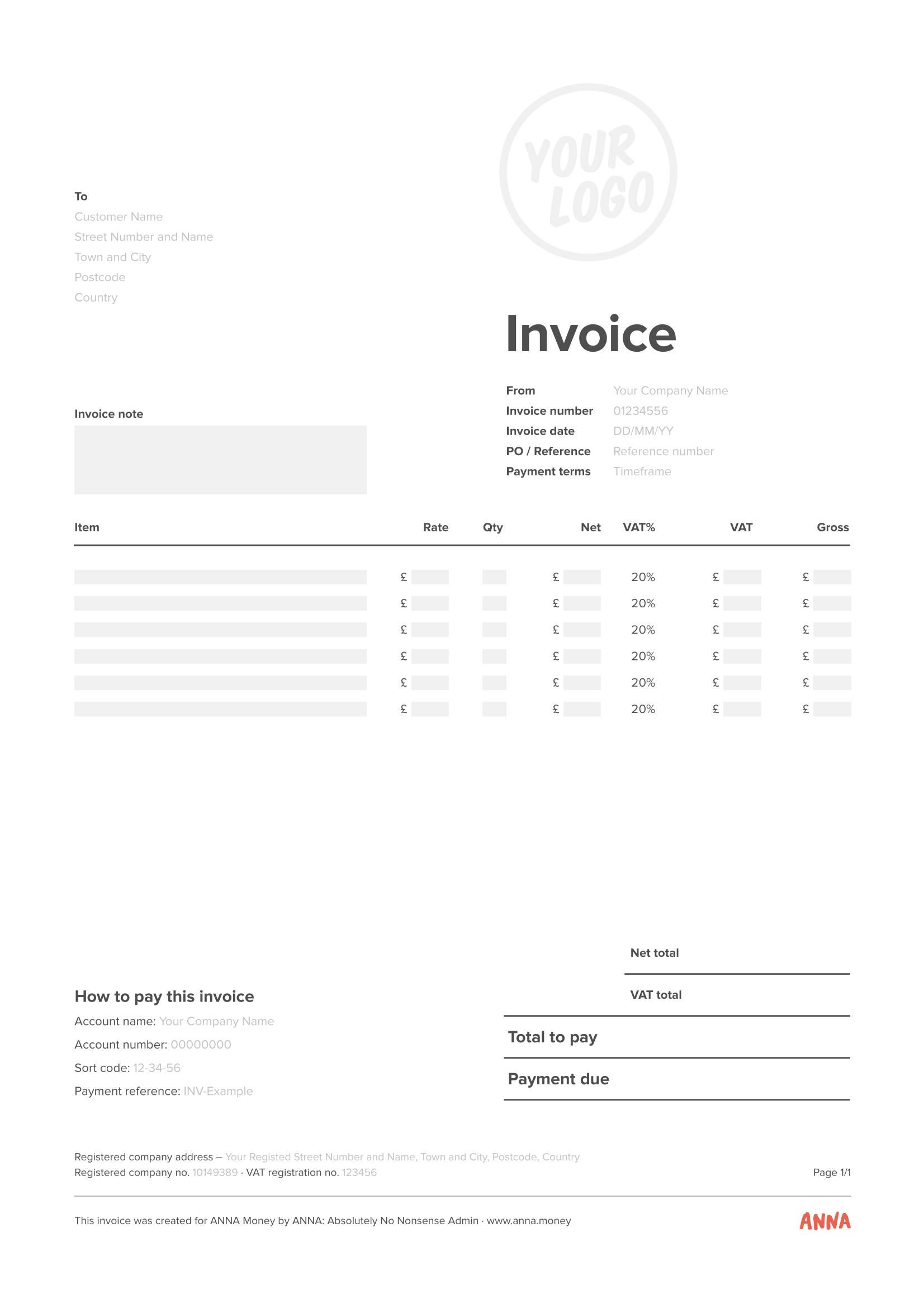

What should an invoice include?

Your exact invoice details will vary depending on your business. But as a minimum, you’ll need to include:

- Your company or trading name, VAT number (if you have one), address and contact detailsYour customer’s company or trading name, address and contact details

- A unique invoice number

- The date of the invoice

- A description of what you’re charging for

- If applicable, the date the goods or services were provided

- The amount you’re charging for the seIf applicable, the VAT amount

- The total amount you’re owed, and the date it needs to be paid by

- Your preferred payment methods (eg ‘please make payment via bank transfer to [insert bank details here]’

What is an invoice number?

It’s useful to add a unique number to your invoices to help you manage them. It makes it much easier to track invoices from months before and means everything is properly documented, which will help you with your accounting and tax return. So what invoice numbering system should you use? You could simply start with 001, although this will give the impression your business hasn’t had many clients, which isn’t ideal. Consider starting with the year (eg 2025001), or the first few letters of your client’s name (eg ANNA001), to create a unique identifier you can easily track.

How do I get paid on time?

It’s every self-employed person’s bug-bear: overdue invoices. But there are things you can do to increase your chances of getting paid promptly. Number one is double-checking your invoice is clear, comprehensive and has no missing information that could delay payment. Make sure also you’ve included your payment terms - how long your client has to pay - and that this is clearly displayed.

Asking for confirmation of receipt can be a useful way to make sure your invoice is logged and doesn’t get buried in someone’s inbox. And you could even offer a small discount, like 5%, for timely payment. It’s amazing what a little cash incentive can do.

Ask for receipt confirmation to ensure your invoice doesn’t vanish into someone’s inbox

How do I chase outstanding invoices?

You don’t want to pester your client, but you’d still like to get paid thanks very much. What do you do? Automated invoicing tools like ANNA can be worth their weight in time and stress savings. Your overdue invoice is automatically chased up with a polite reminder, so you don’t have to do anything. No more checking to see what’s been paid and what hasn’t, and no more awkward client conversations.

Looking for a quick and hassle-free way to create professional invoices? Try our free invoice generator – it’s simple, fast, and designed to save you time.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)