A Guide To The Company Registration Number In The UK

If you’re setting up a new business and it’s your first time going through the UK’s company formation process it can feel a little daunting. You’re going to come across various terms you may not be familiar with, and ‘company registration number’ (or CRN) might be one of them.

To put your mind at ease, we’ve created a brief guide to the use of the CRN in the UK. First off, let’s start by defining the term…

What is a Company Registration Number (CRN)?

A company registration number – sometimes shortened to CRN number – is a unique identifier assigned to every registered company in the United Kingdom. It consists of an eight-character code that helps identify and verify the existence of a company registered with Companies House.

Your CRN allows anyone to quickly identify your business, verify its authenticity and cross-reference it against official documents, contracts and correspondence.

Put simply, every registered company in the UK is assigned a CRN. These include public limited companies (PLC), private limited companies (Ltd), limited liability partnerships (LLP) and other incorporated organisations.

If you want to register a company in the UK you can use our free all-in-one company formation service and get not only your CRN number, but also your business banking and accounting sorted at the same time.

The Format of a CRN in the UK

If you ever need to check the authenticity of a company registration number, start by comparing it against the official format for each of the UK’s home nations.

Depending on the jurisdiction and specific circumstances, CRNs can vary. You can find the formats and examples for England, Scotland, Northern Ireland and Wales in the table below:

CRN formats in the UK

| Type of the company | Start with |

|---|---|

| England, Wales Limited companies | 0 or 1 |

| England, Wales LLP | OC |

| England, Wales LLP | LP |

| Scottish Ltd companies | SC |

| Scottish LLPs | SO |

| Northern Ireland Ltd | NI |

| Northern Ireland LLPs | NC |

How and Where to Find Your CRN

CRN number can be found on your certificate of incorporation which you will receive right after registering your business on Companies House.

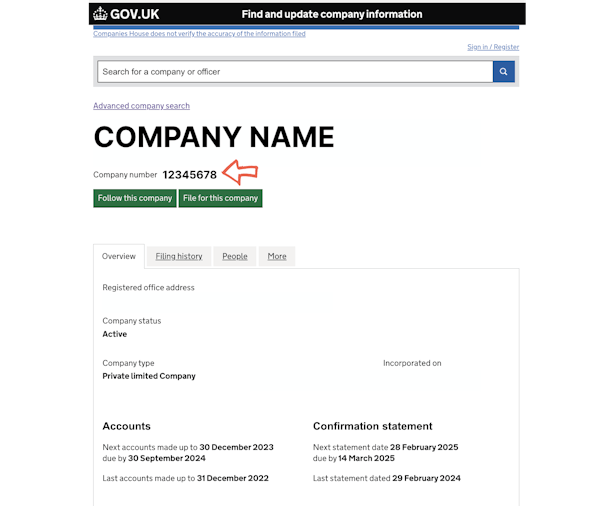

If you can’t find this document, you can look it up online on the Companies House page.

How Do I Find a Company Number (CRN) on Companies House? Step by step guide

The Companies House website is a great resource that’s free, easy to use and packed with useful information.

Follow this step-by-step process to find the CRN you’re looking for…

- Visit the Companies House Website: Go to the Companies House web page on the UK Government portal, which is a regularly updated database of all registered companies in the UK.

- Enter Company Name: Type the full name of the company you are searching for.

- Find the Company You’re Looking For: After entering the company name, browse through the search results to find the specific company you are interested in. Click on the company's name to view detailed information.

- Locate Company Registration Number (CRN): Once you have accessed the company's details, the company registration number (CRN) will be displayed alongside other relevant information.

Uses of Your Company Registration Number

You’ll need a valid CRN to set up all of the essential utilities a new business requires – you’ll be asked for it when you set up a company bank account, seek legal services, request an official UTR company number for tax purposes and apply for VAT registration. Put simply, you can’t run a company in the UK without a company registration number.

Do Sole Traders Need a CRN?

Sole traders aren’t legal companies; they’re self-employed individuals who operate businesses such as market stalls, taxi driving services and mobile hairdressers. If you’re a sole trader, you’re not compelled to register a company. Instead, you should register for Self Assessment and file your tax returns as a private individual.

What Are CRNs Often Confused With?

It’s not uncommon for a CRN to be confused with other numbers and identifiers linked to company formation, taxation and administration. The most common examples are:

VAT number

If your business exceeds the VAT registration income threshold you will have to register for VAT. However, anyone can register for a VAT number in the UK, which is a nine-digit number that begins with the prefix ‘GB’ in Great Britain and ‘XI’ in Northern Ireland.

Unique Taxpayer Reference (UTR)

A Unique Taxpayer Reference (UTR) number is a 10-digit code assigned by HMRC to identify individuals and organisations within the UK tax system.

Employer Reference Number

An Employee Reference Number (ERN) is a unique identifier assigned to employers by HMRC. It consists of a combination of letters and numbers used to identify an employer's Pay As You Earn (PAYE) registration.

FAQ

How do I get a company registration number for a new business in the UK?

To get your company registration number, you need to incorporate your business with Companies House, which involves the completion of various documents. Alternatively, you can register your company with ANNA for free, get a business account right away and become compliant with HMRC from day 1.

Do I need a Company Registration Number?

Yes you do. If you’re an incorporated company in the UK, you need a CRN to perform vital business functions such as registering for VAT and opening a bank account.

What is the difference between a CRN and a UTR number?

A CRN is a company registration number assigned by Companies House. A UTR number is a tax registration identifier assigned by HMRC.

Can I change my company's CRN? (or Update)

No, the number is automatically generated by Companies House, so you can’t choose or change it.

If I change my business name, will I receive a new registration number?

No, the entity linked to your company registration number will always remain the same – even if the name of the entity changes. Companies House will simply re-register the new business name against the existing CRN.

How does a CRN relate to company tax and VAT?

You will need to provide your CRN to register for company taxes and VAT with HMRC.

Is a CRN required for international businesses operating in the UK?

Yes, every limited company from abroad that wants to set up a business base in the UK must have a company registration number. However, if you’re simply exporting goods or services in the UK with no headquarters in the country, you don’t need a CRN.

Our final word on CRNs…

As you can see, your CRN is vitally important to the security and operations of your business, so keep it accessible at all times. The best way to obtain and manage your CRN effectively is through a company formation specialist such as ANNA. Get your company registration number quickly by contacting us today to register your UK company.

Sources:

Open a business account in minutes