Starling vs Tide vs Revolut business account – which one should you choose?

Looking for a business account that won’t make life harder than it has to be? Starling, Tide and Revolut are three of the most popular digital options for UK businesses.

Each offers quick setup, sleek apps and helpful tools to keep your business finances running smoothly – but the differences become clear once you look closer.

- In this article

- Starling vs Tide vs Revolut at a glance

- Quick look: Starling vs Tide vs Revolut features

- Who are these accounts best for?

- Who can open an account?

- Pricing and fees

- Starling vs Tide vs Revolut fees

- Features comparison

- App and user experience

- Customer support and reviews

- Support channels

- Trustpilot score

- Security and trust

- Which is best for your business?

- Alternatives to consider

- Verdict: Starling vs Tide vs Revolut

This guide compares their most suitable plans side by side, from features and pricing to support and security.

✨ And because we’re ANNA, we’ll also show you how we stack up – especially if you’d prefer your business account to come with admin tools, tax help and real humans available 24/7.

Starling vs Tide vs Revolut at a glance

If you want the short version, here it is: all three are designed for small UK businesses that want fast, digital-first money management – but they take very different routes to get there.

Starling keeps things simple with one free business account that includes most essentials and full FSCS protection.

Tide also has a free tier but charges small per-transaction fees unless you upgrade, while higher plans add team access and expense tools.

Revolut starts with a paid plan but gives you strong international functionality, multi-currency accounts and advanced features for global operations.

Quick look: Starling vs Tide vs Revolut features

| Feature | Starling | Tide | Revolut |

|---|---|---|---|

| Monthly fee | £0 | £0 (Basic) / from £12.99+VAT | from £10 |

| UK transfers | Free | 20p per transfer on free plan | 10 free (Basic) / 100 (Grow) / 1 000 (Scale), then 20p each |

| International payments | ✅ via SWIFT (0.4% + £5.50) | ✅ SEPA EUR (1.5% FX markup on free, 0.5% on paid plans) | ✅ multi-currency with FX |

| Multi-user access | ❌ directors only | ✅ on paid plans | ✅ included |

| Cash deposits | ✅ Post Office (0.7%, min £3) | ✅ Post Office (fee applies) | ❌ not supported |

| Cheque deposits | ✅ by app or post | ✅ by app | ❌ not supported |

| Virtual/expense cards | ❌ | ✅ on paid plans | ✅ on most plans |

| Accounting integrations | ✅ Xero, QuickBooks, FreeAgent | ✅ across all plans | ✅ with API and integrations |

| FSCS protection | ✅ £85,000 | ✅ £85,000 (via ClearBank) | ❌ No FSCS cover – e-money institution (not a UK bank) |

| Customer support | 24/7 – phone, chat, email | In-app & email (priority on paid) | 24/7 in-app (priority on higher tiers) |

Takeaway:

- Starling is best for UK-based businesses that want a free, complete account.

- Tide offers flexible upgrades for growing companies.

- Revolut suits international traders that need multi-currency tools and team control.

Who are these accounts best for?

⚡ The cheapest

If you want a free business account with no hidden fees, Starling is the clear winner. You get a full-featured account with free UK transfers and no monthly cost.

Tide’s free tier looks tempting but adds 20p per transfer – fine for low volume, but costly if you move money often.

Revolut starts from £10/month, so it’s not the cheapest, but it’s packed with features for cross-border businesses.

Verdict: Starling is the cheapest and most complete option at no cost.

⚡ Best value for money

When comparing what you get for the price, Starling’s single free plan is tough to beat. Tide’s Smart and Plus plans introduce extras like expense cards and cashback, while Revolut’s paid tiers include global payments and FX at fair rates.

If your business operates mainly in the UK, Starling’s all-inclusive plan delivers the best value. For international activity, Revolut justifies its subscription with powerful tools.

Verdict: Starling wins on everyday value; Revolut makes sense for global operations.

⚡ Best for sole traders

Sole traders usually want something fast and straightforward. Starling’s free plan is ideal – you can add the optional Business Toolkit (£7/month) for invoicing and VAT tracking.

Tide’s free account is also a good match, offering built-in invoicing and expense management, though per-transfer fees may add up. Revolut’s interface is excellent but may be overkill for one-person businesses.

Verdict: Starling is best for simplicity; Tide is a strong runner-up.

⚡ Best for limited companies

Limited companies often need multiple users or cards for employees. Starling limits access to directors only, which can be restrictive.

Tide’s paid plans let you add team members and expense cards, while Revolut includes team access and permissions on most tiers.

If you manage a growing company with several stakeholders, Tide or Revolut provide more flexibility.

Verdict: Revolut offers the most advanced team access; Tide follows closely behind.

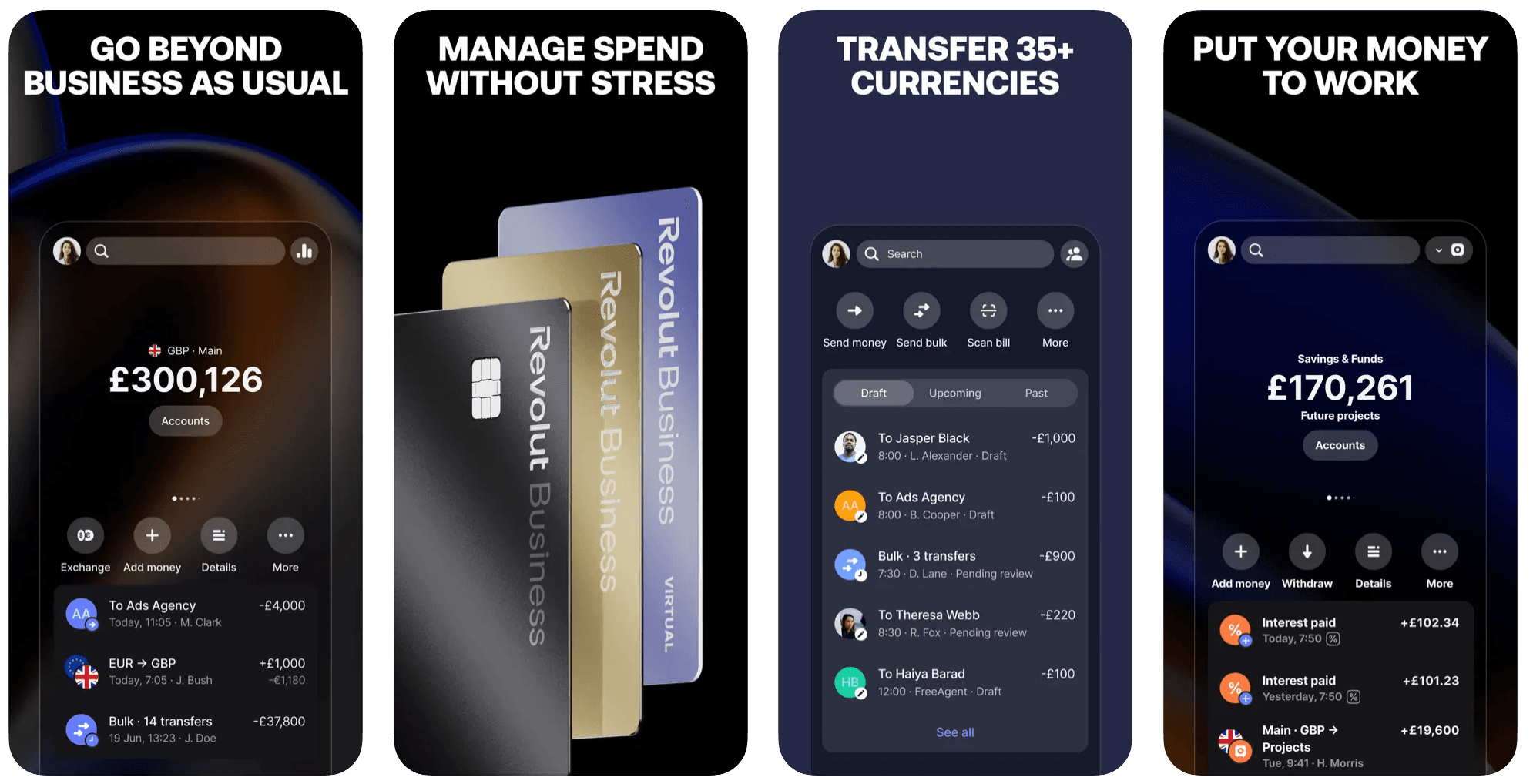

⚡ The smartest app – Revolut’s edge

All three apps are designed for mobile business management, but Revolut’s stands out for innovation. It combines global payments, analytics, and card controls in a polished interface.

Starling’s app is clean and reliable, while Tide focuses on simplicity and fast invoicing.

For visual clarity and depth of features, Revolut’s app experience is hard to beat.

Verdict: Revolut takes the crown for design and functionality.

Who can open an account?

Starling

Available to UK sole traders and limited companies. All directors and persons of significant control must live in the UK. Verification involves ID, company documents, and a short video.

Tide

Open to UK-registered sole traders, limited companies, and freelancers with a UK business address. Fully digital application, verified within minutes.

Revolut

Available to UK-registered companies and freelancers. Verification is online, though checks may take longer for complex structures.

Eligibility criteria

All three focus on small UK businesses but may exclude high-risk sectors such as gambling or crypto. Starling also requires all PSCs to be UK residents.

Pricing and fees

Starling pricing

- £0 monthly fee

- Optional Business Toolkit: £7/month

- International payments: 0.4% + £5.50

- Cash deposits: 0.7% fee (min £3)

- Overdrafts available (subject to eligibility)

Tide pricing

- Free plan with 20p per transfer

- Smart – £12.99/month

- Pro – £24.99/month

- Max – £69.99/month

- Higher tiers include unlimited transfers, expense cards, cashback (Max only), and enhanced support

Revolut pricing

- Basic – £10/month

- Grow – £30/month

- Scale – £90/month

- Enterprise – custom pricing

Includes free local and international payments up to plan limits.

Value for money

Starling offers full functionality at no monthly cost. Tide gives flexibility to scale features. Revolut’s plans are priced for companies with global needs.

Verdict: For domestic businesses, Starling wins; Revolut is worth it if you trade abroad.

Starling vs Tide vs Revolut fees

| Fee type | Starling | Tide | Revolut |

|---|---|---|---|

| Monthly fee | £0 | £0 / £12.99+ | £10+ |

| UK transfers | Free | 20p | Limited free, then 20p |

| Cash deposits | 0.7% (min £3) | Fee applies | ❌ |

| International payments | 0.4% + £5.50 | ✅ SEPA EUR (1.5%/0.5% FX markup) | Included (FX limits apply) |

| Overdraft | ✅ available (subject to eligibility) | ❌ | ❌ |

Features comparison

Payments and transfers in the UK

All three support Faster Payments and Direct Debits. Starling includes unlimited free transfers. Tide charges 20p per transfer on the free plan (Smart plan includes 25 free transfers, Pro and Max have unlimited). Revolut limits free transactions on entry tiers.

Cash and cheque handling

Starling and Tide both support cash deposits via Post Office (fees apply). Starling and Tide both support cheque deposits via app (Tide charges 90p per cheque). Revolut doesn't handle cash or cheques.

Cards and spend management

Starling provides one debit card per director. Tide and Revolut include expense and virtual cards, with Revolut offering the most flexibility.

Invoicing and integrations

Starling connects with Xero, QuickBooks and FreeAgent. Tide has built-in invoicing tools. Revolut integrates with accounting software and offers an API for automation.

Lending and overdrafts

Starling offers business loans and overdrafts. Tide and Revolut provide partner-based financing solutions.

App and user experience

App interface

Revolut’s app is the most advanced, packed with analytics and multi-currency management. Starling’s is more traditional, and Tide keeps things simple.

Revolut

Source: App store

Source: App storeStarling

Source: App store

Source: App storeTide

Source: App store

Source: App storeYou can explore both apps yourself:

- Starling on the App Store / Google Play,

- Tide on the App Store / Google Play.

- Revolut on the App Store / Google Play.

Web access and APIs

Starling provides full web access. Tide has a web portal for basic actions. Revolut offers strong API and automation options for tech-driven teams.

Onboarding speed and switching

All three feature fast onboarding. Starling supports the Current Account Switch Service, while Tide and Revolut handle setup entirely in-app.

Customer support and reviews

Support channels

| Support feature | Starling | Tide | Revolut |

|---|---|---|---|

| In-app chat | ✅ 24/7 | ✅ | ✅ 24/7 |

| Phone support | ✅ | ❌ | ❌ |

| Email support | ✅ | ✅ | ✅ |

| Support team location | UK-based | UK-based | Mixed (UK and international) |

Starling’s UK-based 24/7 team wins praise for speed and reliability. Tide’s support is friendly but sometimes slower on the free plan. Revolut offers fast in-app help, with priority for higher tiers.

App Store / Google Play ratings

All three apps are rated highly, with users praising ease of use.

Starling and Revolut often score above 4.5, while Tide is close behind.

Trustpilot score

| Platform | Rating | Reviews |

|---|---|---|

| Starling | 4.2 ★ | 45k+ |

| Tide | 4.2 ★ | 27k+ |

| Revolut | 4.1 ★ | 140k+ |

Trustpilot complaints

- Starling: limited multi-user functionality.

- Tide: slow support on free accounts.

- Revolut: occasional reports of account freezes and compliance delays.

Security and trust

FSCS protection

Starling protects deposits up to £85,000 under the Financial Services Compensation Scheme.

Tide provides FSCS protection up to £85,000 through its partnership with ClearBank for all new accounts. Revolut, as an e-money institution, safeguards funds in segregated accounts but isn't covered by FSCS.

Fraud prevention and controls

All three use biometric login, two-factor authentication, and real-time payment alerts.

Bank stability and licensing

Starling is a fully licensed UK bank. Tide and Revolut operate under FCA e-money licences.

Which is best for your business?

- Freelancers and sole traders: Starling’s free account is simple and complete.

- Limited companies with teams: Tide or Revolut offer multi-user tools.

- International traders: Revolut’s global payments and FX tools lead.

- Cash-handling businesses: Starling’s Post Office deposits are best.

- Tech-driven companies: Revolut’s API and automation stand out.

Alternatives to consider

ANNA – your business account and admin sidekick

Here’s where we do things differently.

ANNA isn’t just a business account. It’s admin support in your pocket. You get smart money tools and built-in automation to manage everything that normally takes hours.

- Create and send invoices in seconds

- Capture receipts and auto-categorise your expenses

- File VAT and Corporation Tax automatically

- Add your team – not just co-directors

- 4 free SWIFT payments a month on our Big Business plan

- Real humans on hand 24/7

And yes – ANNA starts at £0/month. See pricing →

If you’re tired of juggling multiple apps, ANNA keeps your finances, invoices and tax prep all in one place.

Revolut Business

Ideal for companies trading internationally, offering strong FX rates and multi-currency accounts. Not a fully licensed UK bank, so FSCS doesn’t apply.

How to open Revolut business account →

Wise Business

Best for holding and receiving money in multiple currencies, with low-cost international transfers.

How to open Wise business account →

Tide

Simple, fast setup for small UK businesses. Free to start, with optional upgrades.

How to open Tide business account →

Mettle by NatWest

A free, straightforward option backed by a major UK bank. Best for startups and sole traders.

How to open Mettle business account →

Verdict: Starling vs Tide vs Revolut

Checklist:

- Free, feature-rich UK account with FSCS protection → Starling

- Flexible pricing and easy upgrades → Tide

- Global reach and multi-currency tools → Revolut

- Built-in admin and tax automation → ANNA

Whichever you choose, your business account should simplify your life – not add to the admin. Whether you prioritise cost, control or global features, there’s an account that fits your goals.

Disclaimer: All info accurate as of December 2025. Always check official websites for the latest details.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)