Invoicing for the Self-Employed: A Complete Guide

Whatever industry you’re in, and however your business works – whether you’re a self-employed sole trader or the owner of a limited company – chasing invoices is probably your least favourite thing to do. Fortunately, there’s an easy way to speed things along: you can send the perfect invoice each and every time you bill a client.

Creating an invoice that covers all the bases will make it easier for clients to pay you promptly, saving you time, effort, and stress. Here is our guide to invoicing like a pro.

Why do I need to invoice?

The simple answer to the question posed above is this: you need to invoice a client in order to receive payment for all your hard work. However, in reality, matters are a little more complicated.

If you are providing goods or services to a customer and you are both VAT-registered, it’s a legal requirement for you to invoice them. In any case, invoices are an essential part of the accounting and bookkeeping process: they serve as crucial records of business transactions and are vital for tax returns (you may need to produce such records if HMRC ever ask to see your accounts).

Invoices also establish – and enforce – the customer’s obligation to pay for the services provided. Preparing and issuing an invoice in a prompt manner will help ensure that you are paid within the agreed timescales.

Creating an invoice that covers all the bases will make it easier for clients to pay you promptly, saving you time, effort, and stress.

How to create an invoice

There are several ways to produce and send invoices when you are self-employed. If you’re just starting out, you might prefer to create invoices manually and email/post these to your clients. There are a number of free templates available online that you can adapt to suit your purposes. This process can be time-consuming, though, and it’s easy to make mistakes if you are busy with other things (or, worse still, you could forget to send the invoice entirely!).

If you’d like to cut down on the time spent creating invoices, there are a number of automated options to choose from, such as professional invoicing or accounting software (Xero, for example). These programmes remove the need for you to manually input reams of data, reducing the risk of mistakes; but they can be costly. And, if you’re a small business, they may provide more complexity than is needed.

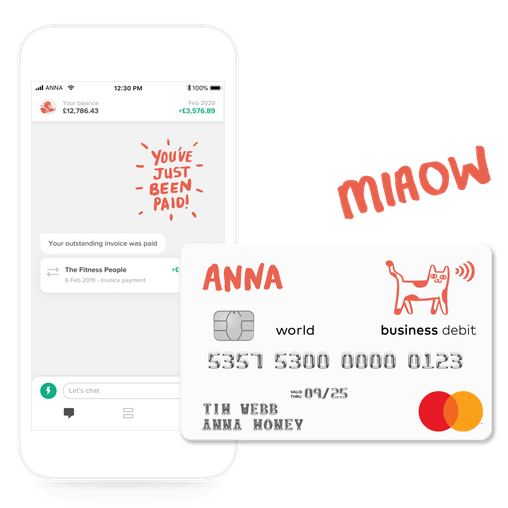

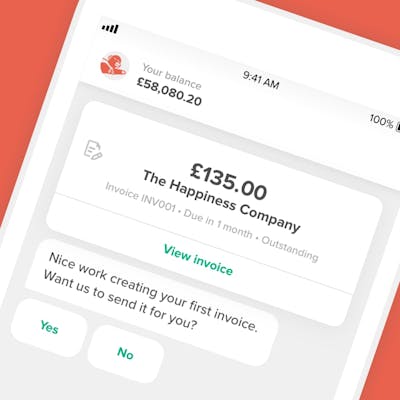

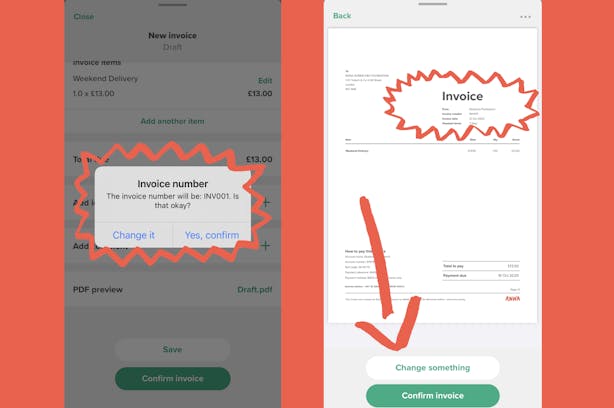

A great alternative is a business current account with a host of additional features – like those offered by ANNA. With an ANNA account, you’ll have access to personal reporting, 24/7 support, and a simple, secure method of creating sales and purchase invoices at speed: in just ten minutes, we will produce a professional-looking invoice for you (complete with your full details and logo) and send it on your behalf. Your completed invoice will not only be accurate, but will also look great. ANNA will even chase late payments for you (politely!).

What to include on your invoice

Invoicing details can vary, depending on the nature of your business. However, there are a few important elements that should be present on every invoice:

- Your company/trading name, VAT number (if applicable), address and contact info.

- Your customer’s company/trading name, address and contact info.

- A unique invoice number.

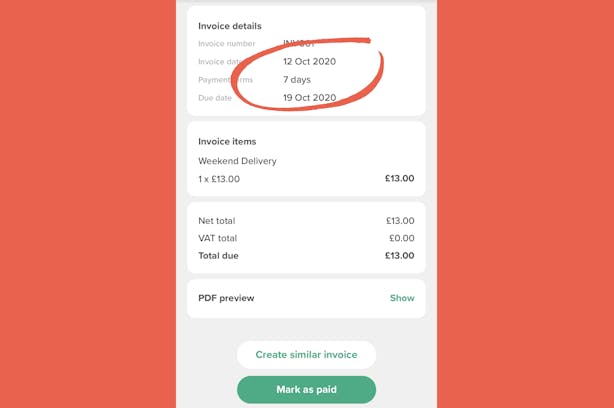

- The date of the invoice.

- A description of what you are charging for.

- If applicable, the date the goods/services were provided.

- The amount(s) you are charging for the goods/services.

- If applicable, the VAT amount.

- The total amount you are owed, and the date it needs to be paid by.

- Accepted payment methods (e.g. ‘please make payment via bank transfer to [insert bank details here]’.

When to invoice

When you invoice depends on the nature of your self-employed business. If you’re providing goods, you might expect the invoice to be paid in advance; if you are providing a service, you may simply submit a full bill on completion of the work. Note that if you’re working on an ongoing project, it’s important to agree on the invoicing schedule in advance: would your client like you to submit weekly timesheets, a bill at the end of each month, or an invoice at some other point in the process?

Make sure that you have stipulated your payment terms on any quote or correspondence with the client prior to commencing work. Knowing your client’s payment dates and scheduling your invoices accordingly is a smart move, too.

What if my invoice is not paid on time?

Late and unpaid invoices are one of the most frustrating aspects of running a self-employed business. If you’ve created a comprehensive invoice, been clear about the required payment terms, and have issued your invoice promptly, you are giving yourself the best chance of success. However, sometimes there is an element of chasing required.

Thankfully, there are some positive actions you can take – and our recent blog post, ‘7 ways to avoid unpaid invoices’, has some great tips. A few of our favourites are listed below:

- Ask for confirmation of receipt. In a busy workplace it can be easy for invoices to slip through the net, so it’s worth sending a polite enquiry (and perhaps attaching the invoice to the email as a reminder). If payment does not arrive at the expected time, chase to check that everything is in order.

- Offer discounts for prompt payments. Build a suitable figure into your costs (say, 5%) and include this on your invoice – an added incentive can work wonders for speeding up the payment process!

- Use an automated service. A platform like ANNA has so many benefits: it ensures that you’re on top of everything, reminding you automatically when invoices are unpaid, and even sends reminders to your client. It’s also a brilliant stressbuster – after all, who has the time to spend hours each day chasing unpaid bills?

Whilst there’s no guaranteed formula to receiving prompt payments, creating the perfect invoice is an ideal first step when you’re self-employed. ANNA’s specially-designed account for small businesses handles all essential admin and makes invoicing a breeze. Sign up and try ANNA for free or get in touch to learn more.

Open a business account in minutes