If you’re a freelancer with a growing income and expanding client list, at some point you’ll probably consider setting yourself up as a limited company. Of course, your first call should be to your accountant, who’ll be able to advise you on exactly how to do it. But how do you know if it’s the right move for you?

- In this article

- What’s the difference between a sole trader and a limited company?

- How do the benefits and drawbacks of being a sole trader weigh up?

- What about the benefits and drawbacks of being a limited company?

- Why make the switch?

- How can I tell if it’s the right financial move?

- When should I consult an expert?

- What else do I need to know before I decide?

What’s the difference between a sole trader and a limited company?

Simply put, a sole trader is a one man band, where you yourself are the business. A limited company is a business that’s registered as a separate entity to the individual owner, which means you technically become both a shareholder and an employee of your own business.

How do the benefits and drawbacks of being a sole trader weigh up?

On the plus side:

- As a sole trader, you have total creative control over your brand and product, which means you can maintain the personal touch that larger business often lack.

- You’ll get to keep all your profits after tax.

Things to watch out for:

- If you get into debt while doing business (perhaps with a loan or credit card), that debt is entirely your personal responsibility.

- You’re also personally responsible for all of your business actions, so it might be worth looking into extra insurance just in case you run into trouble.

What about the benefits and drawbacks of being a limited company?

On the plus side:

- As a limited company, you can save money with tax breaks.

- You’ll be legally separated from your business, which is crucial the bigger it grows. Except in serious cases (like fraud), it’s very difficult to hold a company director personally liable for any damages or debt.

- You’ll be a shareholder of your own company, which means personal profit if it sells.

Things to watch out for:

- There’s no two ways about it – being a limited company will involve more admin.

- You’ll need to prepare and file annual accounts with Companies House, and file full corporation tax accounts to HMRC.

- While it’s possible to set up a limited company yourself, some people opt to hire someone else to do it, which involves extra cost.

Why make the switch?

When it comes down to it, people tend to set up a limited company for financial reasons – either to access the tax benefits that aren’t available to sole traders, or to protect themselves from liability when the company starts growing.

How can I tell if it’s the right financial move?

When in doubt, work it out! For a rough guide, search online for a specialist calculator that shows you what you could save per year. Otherwise, speak to an accountant who’ll be able to tell you in simple terms how becoming a limited company would affect your insurance, your tax, and everything else you didn’t know you didn’t know. But your first stop should be the government portal for setting yourself up as a business, as it’s packed with useful links.

When should I consult an expert?

If you’re unsure about something, it’s best to chat to someone who knows what’s what before you make any major decisions. That’s something ANNA customer Hamzah Malik, who runs digital agency Regent Branding, found out the hard way. When he switched from being a sole trader to a limited company, he mistakenly allocated himself too many shares.

“At the time we weren’t massive, so I had no idea each share was worth a pound,” he explains. “When I realised, I immediately called my accountant.” By not speaking to an expert first, Hamzah ended up having to jump through hoops with HMRC to set things right again. It all worked out in the end, but he would’ve saved time and money by asking for advice upfront.

What else do I need to know before I decide?

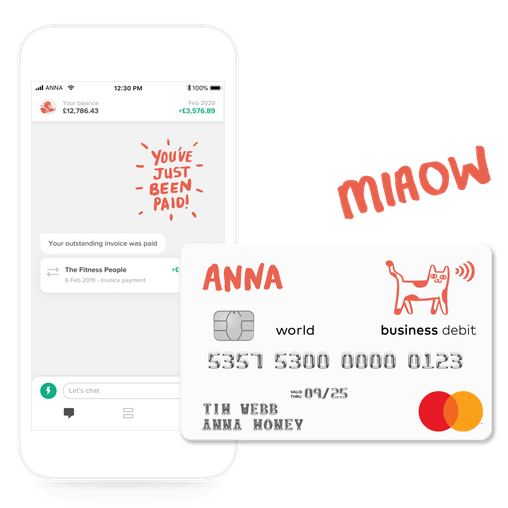

Whether you decide to stay as a sole trader or switch to limited company, ANNA is here for you. We offer business accounts that take care of your admin – everything from invoicing and expenses to tax reminders. Whatever’s the right move for you, get in touch and we’ll help make your business more fun to run.

Open a business account in minutes