Explore how to start a pop-up shop in the UK with guidance on setup, legal steps, costs, marketing, and tips to connect with customers.

Selling online is great for reach, but it doesn’t let you see your customers’ reactions, hear their questions, or create those spontaneous moments that lead to brand loyalty.

Then, opening a full retail store is expensive and comes with long-term commitments many small businesses simply can’t take on.

Pop-up shops give you a middle ground. They’re temporary retail spaces that let you showcase your products, meet your customers in person, and create a buzz around your brand – all without signing away years on a lease.

If you’re curious about how to start a pop-up shop in the UK, or want to test a product idea without committing to a long-term lease, this guide walks you through each step.

📢 Ready to make it official? Register your business quickly with ANNA – the simplest way to get your company set up, track finances, and stay compliant.

Why launch a pop-up shop?

There’s only so much growth you can achieve behind a screen.

If your online sales have plateaued or if you’re craving more direct interaction with customers, a pop-up can give you that boost.

In 2024, a study by IBM showed that 73% of shoppers still prefer physical stores for certain purchases.

Pop-ups tap into this demand while giving online-first brands a way to create memorable in-person experiences.

Here’s what makes them so effective:

- They create urgency. Pop-ups are temporary, which makes shoppers act fast.

- They build relationships. Meeting customers face-to-face deepens loyalty and trust.

- They let you test ideas. Whether it’s a new product or a new city, you can experiment without high risk.

- They move stock. Got inventory sitting in storage? A pop-up turns it into revenue.

Understanding the UK pop-up market

The UK pop-up scene has shifted from being a “trend” to becoming an essential retail strategy for brands of all sizes. Pop-ups now appear everywhere, from London high streets to rural markets, because they work for everyone involved.

Landlords keep empty properties active, councils encourage them to revive shopping areas, and shoppers love the exclusivity of something temporary.

For you, this means lower risk, more visibility, and access to customers who are eager for new experiences.

Real-life examples

Gymshark had a pop-up store in London to meet its online community in person. The event was packed, generating massive social media coverage and proving there was demand for physical retail. That success led to multiple pop-up tours worldwide, even in New York.

Glossier UK tested the London market with a limited-time pop-up in Covent Garden. Long queues wrapped around the block, and the event built enough hype to justify opening a permanent location.

Pop Up Grocer, though US-based, shows how rotating themes and local collaborations can keep customers coming back. Every city they visit feels like a new experience, not just a store.

📌 Takeaway: Even big brands use pop-ups to test ideas before committing to permanent retail. The same strategy works for your small businesses on a local scale.

Seasonal opportunities

Timing your pop-up with busy periods can make or break your success:

- November – December: Christmas markets, winter fairs, and festive shopping drive high sales.

- Spring and Summer: Outdoor festivals, beach markets, and tourist hotspots are ideal for lifestyle products.

- Cultural celebrations, such as Diwali, Eid, and Chinese New Year, attract audiences seeking themed gifts and experiences.

Types of pop-ups to consider

Your pop-up doesn’t have to look like a standard shop. You can choose a format that suits your brand and budget:

- Vacant retail units – Great for testing high streets.

- Market stalls – Affordable and community-focused.

- Shop-in-shops – Rent a corner inside an established store to leverage their traffic.

- Event-based pop-ups – Tie into festivals, trade shows, or art fairs.

- Mobile pop-ups – A branded van or trailer lets you bring the shop to your audience.

💡 If this is your first pop-up, start with a weekend market or shared retail space. It keeps costs low while letting you test your concept.

How to legally start a pop-up shop in the UK

Even though pop-up shops are temporary, they are still subject to UK business regulations. Setting everything up correctly from the start saves you from fines, last-minute cancellations, and costly mistakes. Landlords and event organisers also prefer working with businesses that have their paperwork in order.

Registering your business

You need to operate under a legal business structure. The two most common for pop-ups are:

- Sole trader – Easy to set up, lower admin, register with HMRC.

- Limited company – More professional, tax-efficient, better for hiring staff.

If you plan to run multiple pop-ups or hire staff, consider setting up as a limited company from the start with ANNA. It builds credibility and protects your personal assets.

Essential licences and permits

Depending on where and what you sell, you may need additional permissions:

- Licence to Occupy – The most common short-term agreement, giving you permission to use the space without the commitments of a full lease.

- Planning permission – Most pop-ups under 150 m² and open less than 28 days don’t need it, but always check with your council.

- Street trading licence – Required if you’re selling outdoors or at a market.

- Food safety registration – Mandatory if you handle or sell food and drink (apply at least 28 days before trading).

- Temporary Event Notice – Needed for alcohol sales or entertainment events.

💡When negotiating with a venue, ask what permits they already cover. Some landlords handle aspects like fire safety, accessibility, or even planning permissions.

Insurance – your safety net when starting a pop up shop

Pop-ups are exposed to risks like accidents, theft, or product-related claims. The right insurance keeps you covered.

- Public liability insurance – Protects against accidents involving customers or passersby.

- Product liability insurance – Covers you if your product causes harm or damage.

- Employer’s liability insurance – A legal requirement if you hire staff, even part-time.

- Contents and stock insurance – Covers your inventory and equipment against theft, fire, or damage.

Health & safety compliance

Your pop-up must be safe for customers and staff. This means:

- Conducting a risk assessment and addressing hazards.

- Ensuring fire exits, alarms, and extinguishers are functional.

- Using PAT-tested electrical equipment.

- Providing first aid kits and trained staff if necessary.

- Making the shop accessible to customers with disabilities.

Costs and finances

One of the biggest advantages of a pop-up shop is affordability compared to a permanent store. Still, costs can add up quickly if you don’t plan properly. The good news? With a clear budget, you can control spending and maximize your profits.

What you’ll need to budget for

A successful pop-up has several cost areas to consider:

🔸 Rent:

- Small town or market stall: £200 – £500 per week

- High street unit in a busy city: £1,000 – £3,000 per week

- Premium London locations: £5,000+ for prime spots like Covent Garden or Soho

🔸 Fixtures and décor:

- Expect £500 – £2,000 depending on how custom you go. Modular, reusable displays save money long term.

🔸 Insurance:

- Public liability and product liability together cost around £100 – £300 for short-term coverage.

🔸 Licences and permits:

Street trading licences, food safety registration, or event notices can cost £50–£500 depending on your activities.

🔸 Marketing:

- Flyers, ads, influencer collaborations, and content creation: £200–£500 for a small campaign.

🔸 Staffing (if required):

- Part-time staff wages start from £12.21/hour (UK minimum wage) and can add £300 – £600 to a multi-day event.

Don’t forget ongoing expenses

Even for a short-term shop, there are recurring costs:

- Utility bills (if not included in rent)

- Inventory restocks during the event

- Cleaning and waste disposal

- Travel and accommodation if your pop-up is in another city

📌 Always build a 10 – 15% contingency into your budget. Unexpected costs, such as last-minute signage or extra stock, are almost inevitable.

Pricing strategy – charge for more than the product

Your prices must reflect all costs, not just your product materials. Use this simple formula:

Product cost + Labour + Overheads + Profit = Final Price

Example:

You’re selling a hoodie that costs £15 to make. Labour (time to fold, pack, staff wages) adds £5. Overheads (rent, utilities, marketing) add £7. Add £8 profit, and your hoodie should retail at £35.

Don’t forget to include buffer room for discounts or bundle offers without eating into your margins.

❌ Don’t:

- Underestimate rent: ask for a breakdown of utilities, service charges, and insurance.

- Over-order stock: dead inventory eats profits.

- Forget card transaction fees, cause these can add up quickly.

✅ Do:

- Use a separate business account to track spending.

- Keep receipts for tax deductions.

- Monitor sales daily to see if you’re meeting your break-even target.

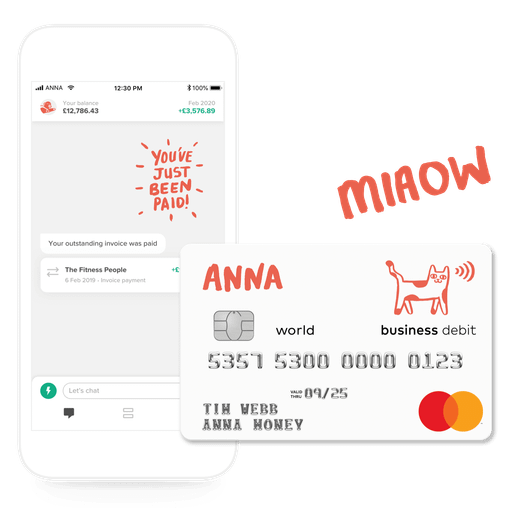

💡 ANNA’s business account makes running your business easier by combining banking with smart admin tools. Here’s what you get:

- Quick setup – Sign up in under 10 minutes, get a virtual card instantly, and receive your physical card in just a few days.

- Easy payments – Send professional invoices that ANNA chases on your behalf, generate payment links or QR codes for instant online payments, and take card payments in person with the Dojo card machine.

- Smart expense management – Snap receipts on the go, and ANNA automatically categorises them, making bookkeeping effortless.

- Automatic tax savings – Create smart pots to put money aside for taxes, salaries, or other expenses, with optional auto-top-ups.

- Employee-friendly – Issue multiple cards to employees, set spending limits, and let ANNA handle the expense tracking for you.

- Flexible payments – Use Apple Pay or Google Pay, set up Direct Debits and standing orders for free, and send or receive international payments with ease.

- Cashback rewards – Earn up to 40% cashback on over 150 business products and services.

- Seamless integrations – Connect your account to accounting software like Xero or QuickBooks and give your accountant real-time access.

- AI-powered support – ANNA’s AI and 24/7 customer service team help you stay on top of finances, with instant notifications on every transaction.

Choosing the right location and setting up your pop-up shop

Location is everything for a pop-up. You can have the best products in the world, but if the space is in the wrong place or poorly presented, customers won’t show up, or worse, they’ll come and leave unimpressed.

How to pick the right location

When choosing a location, think beyond cost. Cheap rent in a dead area won’t help you meet sales goals.

Here’s what to check before signing anything:

- Foot traffic: Visit at different times of the day to see when it’s busiest.

- Target audience: Do the people walking by match your customer profile?

- Accessibility: Is it easy to reach by public transport? Is there parking nearby?

- Neighbouring businesses: Are they complementary to yours (e.g., a coffee shop near a lifestyle brand)?

- Visibility: Can passersby easily see your shop from the street?

- Signage rights: Some spaces restrict what you can display outside, so always ask.

💡 Bring your own portable Wi-Fi hotspot if you’re using a mobile POS. Venue internet can be unreliable, and you don’t want to lose sales because of connection issues.

Taxes, tools, and compliance

Even though a pop-up shop is temporary, HMRC and other authorities still expect you to stay compliant. Treating your finances and record-keeping seriously from day one makes tax season stress-free and helps you understand if your pop-up was truly profitable.

Handling taxes for your pop-up

Your tax obligations depend on your business structure:

- Sole traders must keep accurate records of sales and expenses, then report profits on a Self Assessment tax return.

- Limited companies need to file Corporation Tax, annual accounts, and a confirmation statement with Companies House.

- VAT registration is only mandatory if your turnover exceeds £90,000 in 12 months, but voluntary registration can make sense if you’re trading with VAT-registered suppliers.

What to track during your pop-up

Accurate record-keeping isn’t optional. Here’s what you need to log:

- Every sale (cash, card, or online)

- All expenses, including rent, décor, marketing, travel, and wages

- Stock movement to understand what sold and what didn’t

- Mileage logs if you use your car for business runs

- Supplier details for compliance and potential VAT claims

Compliance checks you shouldn’t ignore

- Display your business name, contact details, and any required licences clearly on-site.

- If you collect customer emails, comply with GDPR by getting explicit consent.

- For food pop-ups, keep allergen labels visible and updated.

- Store financial records for at least six years as required by HMRC.

Where ANNA +Taxes steps in for pop-up shop owners

Most entrepreneurs don’t start a pop-up shop because they love paperwork. They do it to connect with customers, test ideas, and grow their brand.

But tax admin, record-keeping, and compliance still need to be done right and that’s where ANNA +Taxes makes life easier.

It’s a smart, automated service built for business owners who want to stay on top of finances without hiring a full accounting team.

Here’s how ANNA +Taxes helps pop-up businesses:

- Guides you through setup – from registering with HMRC to getting VAT or PAYE sorted when needed.

- Tracks all sales and expenses automatically through your business account, so you know exactly what’s coming in and going out.

- Lets you scan receipts on the go, matching them with transactions so nothing gets lost.

- Reminds you of every deadline with a built-in tax calendar, avoiding late filing penalties.

- Files your VAT and Corporation Tax returns accurately and on time, so you don’t have to worry.

- Gives you a Bookkeeping Score to help you improve record-keeping and stay audit-ready.

- Puts aside tax money automatically in separate Pots, so you don’t accidentally spend it.

- Answers tax questions 24/7 through Tax Terrapin, a clever AI assistant.

💡 And the best part? It starts from just £3/month for the first three months (less than you’d spend on a few branded tote bags) and saves you hours of admin that you can put back into growing your shop.

Most owners underestimate how much admin eats into their time. Missed deadlines and messy records can hold you back. ANNA removes that stress, letting you focus on what matters: your customers and your sales.

It’s fast, fuss-free, and comes with all the support you need to get trading. 👇

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)