Learn how to start a gutter cleaning business in the UK with tips on setup, costs, tools, safety, and winning loyal local customers.

- In this article

- In this guide, you’ll learn:

- Market opportunities and earning potential

- Legal requirements & company setup

- Costs and essential equipment

- Operations & day-to-day operations

- Tools, systems & automations for your gutter cleaning business

- Common mistakes to avoid

- Ready to start? Register your gutter cleaning business today

Thinking about how to start a gutter cleaning business, but not sure where to begin? You're looking at one of the smartest service businesses you can launch in the UK. In areas with heavy rainfall, blocked gutters can quickly turn into big headaches, and most homeowners would rather pay a professional than risk climbing ladders themselves. That creates steady demand for reliable gutter cleaners year-round. If you’re hands-on, safety-conscious, and ready to work, gutter cleaning can be one of the quickest ways to build a profitable local business.

In this guide, you’ll learn:

- How the UK gutter cleaning market works and where the demand comes from.

- The legal steps and business structures to get set up properly.

- Startup costs, running expenses, and potential earnings.

- Smart ways to win your first customers and keep them coming back.

- What day-to-day operations look like in a successful gutter cleaning business.

- The best tools, software, and systems to save time and boost profits.

- A quick sample business plan to guide your launch.

- Common pitfalls to avoid and pro tips from the field.

- How to get your business registered and ready to trade fast.

Market opportunities and earning potential

The UK gutter cleaning market is worth about £200 million and is growing by roughly 3% a year. Frequent rainfall and leafy residential areas mean gutters quickly fill with moss, leaves, and debris. Without regular cleaning, this can lead to overflowing water, causing dampness, wood rot, and even foundation damage.

For many property owners, hiring a professional is more appealing than attempting the job themselves, especially as it involves working at height and using specialist equipment.

Key customer segments include:

- Homeowners: Particularly elderly residents or busy professionals who prefer to outsource the work.

- Landlords and property managers: Require routine gutter maintenance to safeguard rental properties.

- Commercial properties: Larger sites such as shops, offices, schools, and churches that often need more complex cleaning solutions.

According to Checkatrade's report, typical annual earnings for gutter cleaning businesses are:

- Sole trader gutter cleaners: Gross income of around £36,876, with £22,530 take-home pay after expenses.

- Limited company owners: Gross approximately £44,369, with £29,908 take-home pay after costs.

Legal requirements & company setup

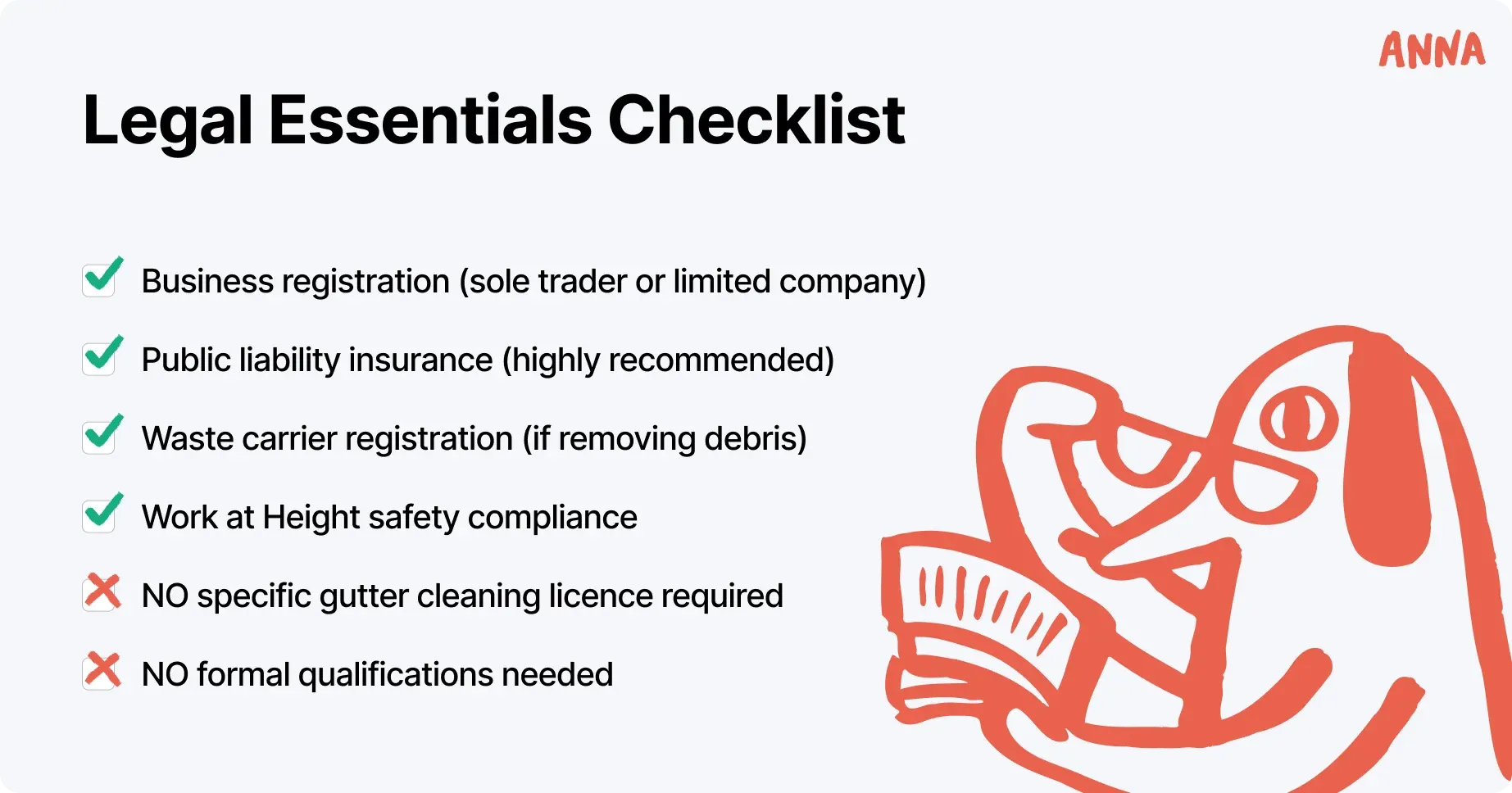

When starting a gutter cleaning business in the UK, you’ll need to handle the usual legal setup and choose a business structure. The good news: there are no specific licences or certifications required for gutter cleaning. However, you must still register your business and comply with general laws and regulations.

The main options are:

- Sole Trader – This is the simplest route. You register as self-employed with HMRC and file an annual Self Assessment tax return. You keep all profits after tax but are personally responsible for any debts or claims. No Companies House registration is needed.

- Limited Company – You register with Companies House, and your business becomes a separate legal entity. This offers limited liability protection (your personal assets are protected from business debts) and can appear more professional to clients. However, it comes with more admin and reporting requirements.

- Partnership – Similar to a sole trader but with more than one owner. Profits and responsibilities are shared, and a formal partnership agreement is strongly recommended.

💡 Tip

If you’re running a one-person operation and keeping things small, sole trader status is often easiest. If you plan to grow, hire staff, or sell the business in the future, a limited company can offer more legal and financial security.

💡 Pro tip

ANNA can take care of your company setup for you. With ANNA’s company registration service, you can register a Limited Company for free and open a business account at the same time.

It only takes a few minutes online, and you’ll get your Certificate of Incorporation fast.

ANNA can also help with ongoing requirements, like filing your Confirmation Statements and submitting your accounts.

⚡ Safety & compliance

While there’s no licence for gutter cleaning, you must follow health and safety regulations. Gutter cleaning usually means working at height, so the Work at Height Regulations 2005 apply.

This means you must:

- Use safe, well-maintained ladders or scaffolding.

- Take precautions to prevent falls (harnesses, stabilisers, etc.).

- Carry out basic risk assessments (check ladder footing, ground stability, and weather conditions before starting).

⚡ Waste disposal rules

When cleaning gutters, you’ll often collect leaves, moss, and debris. If you remove this waste from the customer’s property, you are legally considered a waste carrier.

- If you transport waste, you must register as a waste carrier with the Environment Agency. For gutter debris, this is usually a lower-tier registration (often free or low cost).

- If you leave waste on site, for example, in the customer’s garden waste bin, you usually don’t need to register.

⚡ Insurance essentials

Several types of insurance can help protect your gutter cleaning business, your equipment, and your clients:

- Public Liability Insurance (PLI) – Strongly recommended, even if you’re a sole trader. It covers you if your work causes injury or property damage (e.g., a ladder falling and breaking a window).

- Employers’ Liability Insurance – A legal requirement if you hire anyone, even part-time helpers. Must be at least £5 million in cover.

- Tool & Equipment Insurance – Protects your ladders, vacuums, and other gear from theft or damage.

- Commercial Vehicle Insurance – If you use a van for work, make sure your policy covers business use.

Costs and essential equipment

Gutter cleaning can be one of the more affordable trades to launch, especially if you start small. Many operators start with a kit costing less than £1,000, whereas a fully equipped setup, including a van and a pro-grade vacuum system, can cost £3,000 – £5,000+.

Typical startup items include:

⚡ Essential equipment

Your basic toolkit for safe, effective gutter cleaning:

- Extension ladder: £100 – £300.

- Ladder stabiliser & safety harness: £30 – £100.

- Hand tools (scoop, trowel, buckets, hose or leaf blower): £50 – £100.

- PPE (boots, gloves, helmet, safety glasses): £50 – £100.

- Optional: Gutter vacuum system for ground-level cleaning: £500 – £1,500.

⚡ Transport

How you’ll move your tools between jobs:

- Existing car + roof rack: £50 – £150.

- Second-hand small van: £2,000+.

- Business vehicle insurance is typically higher than personal coverage.

⚡ Business setup & branding

The basics for making your business official and visible:

- Limited company registration: around £50 (Companies House).

- Website & domain: £50 – £100/year.

- Flyers & business cards: from £50.

⚡ Ongoing costs

Once the business is running, there are regular expenses to keep things ticking smoothly.

Common ongoing costs include:

- Public liability insurance: £150 – £400/year.

- Fuel & vehicle maintenance.

- Marketing & advertising (Google Ads, flyers, website hosting).

- Tool upkeep & replacement.

⚡ Pricing & revenue

Your income will depend on the type of jobs you take and how efficiently you work.

Typical UK pricing:

- Typical home: £60 – £120.

- Hourly equivalent: £18 – £25+.

- Larger or complex jobs (multi-story, extensions) cost more.

- Commercial properties can command higher rates.

Operations & day-to-day operations

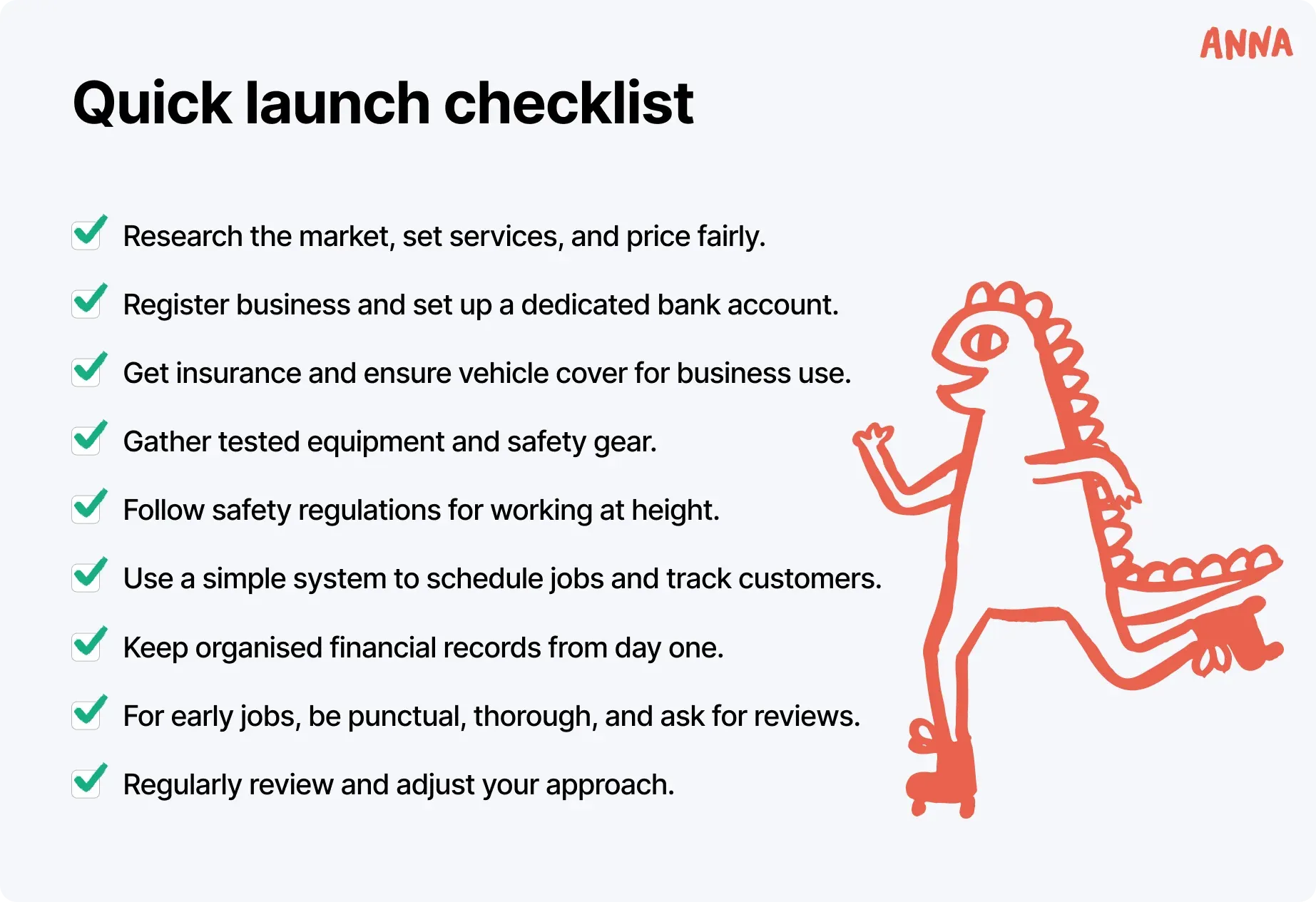

Running a gutter cleaning business means working safely at height, managing schedules efficiently, and providing reliable, professional service to every customer.

⚡ Necessary skills

- Comfortable working at heights and balancing on ladders.

- Good physical fitness and stamina for lifting and climbing.

- Strong coordination and safety awareness.

- Basic ladder safety and working-at-height knowledge (courses like Ladder Association or PASMA can help).

- Communication and professionalism with clients.

- Time management and organisational skills for scheduling and routing jobs.

⚡ Daily tasks

A typical day may include:

- Checking the weather and loading ladders, tools, and safety gear.

- Inspecting the property and planning safe access.

- Clearing debris, flushing gutters/downpipes, and tidying the site.

- Offering minor repairs or exterior cleaning as optional upsells.

- Responding to new enquiries and updating schedules.

- Keeping records of jobs, payments, and follow-up reminders.

⚡ Going solo vs hiring

Most start solo for low overhead and flexibility. As you grow, you might hire seasonal help during peak autumn months or partner with another tradesperson. Hiring adds responsibilities: payroll, safety training, insurance, and equipment for staff. Before expanding, have clear processes in place for scheduling, quality control, and client communication.

⚡ Seasonality

Demand is highest in October–November and March–April. Summer is generally quieter, making it a good time to offer related services such as fascia washing, roof moss removal, or pressure washing.

Tools, systems & automations for your gutter cleaning business

Equipping your gutter cleaning business with the right tools and systems will help you work more efficiently, look more professional, and spend less time on admin.

Here are key tools to consider:

1. Scheduling & booking tools

Managing appointments can get tricky as your workload grows. At first, a simple diary or Google Calendar might be enough. But as business picks up, consider using a job management or booking system built for trades and home services, such as Jobber, Tradify, ServiceM8, or Commusoft.

2. Accounting software

Popular options include Xero, QuickBooks Online, Sage Business Cloud, or FreeAgent. These handle bookkeeping, invoicing, and VAT returns, and most offer free trials. They connect to your bank account, so transactions are imported automatically. Pick one and learn it well as it will save you hours each month.

3. Business bank account

Always use a dedicated business account (not your personal account) to keep finances organised. ANNA’s business account is designed for small business owners and sole traders, offering automated bookkeeping features like receipt capture, expense categorisation, and tax pots to set aside VAT and tax.

4. Invoicing & payments

Most accounting apps include invoicing tools. Enable online payment links through Stripe or GoCardless so customers can pay easily by card or direct debit. Faster payment means better cash flow. QR-code invoicing (as ANNA offers) can also speed up on-the-spot payments after a job.

5. CRM & notes

Maintain a simple customer database to store client details, past jobs, and communication history. This can be a spreadsheet, Google Contacts, or a free CRM like Hubspot CRM. Keeping records allows you to follow up on repeat cleanings and upsell other services.

6. Document management

Use cloud storage, such as Google Drive, Dropbox, or ANNA’s receipts tool, to store scanned invoices, receipts, and service agreements, ensuring nothing gets lost.

When you connect your booking system, bank account, invoicing, and cloud tools, admin becomes quick and painless. For example, ANNA combines business banking, invoicing, and bookkeeping in one app, giving you automatic expense tagging and tax calculations without re-entering data.

With the right mix of software and streamlined processes, you’ll have more time for customers, more repeat business, and less stress at tax time.

Common mistakes to avoid

Here are some useful tips and common mistakes to keep in mind:

- Learn and adapt – Pay attention to what your customers say and what’s happening in the market. If people often ask about downpipe cleaning or gutter guards, consider adding those services, as they can bring in extra income. For work outside your skill set, build connections with other trades so you can refer jobs (and get referrals in return).

- Put safety first, every time – Always secure your ladder (4:1 angle rule), avoid stretching too far, and don’t work in bad weather. For high jobs, use a harness or proper equipment like a scaffold or cherry picker. One bad fall could cost you your health and your business.

- Charge what you’re worth – Don’t undercut yourself to win work, as it’s a fast track to burnout. Remember to include travel, insurance, tools, and growth in your pricing. For a 1–2 hour job, £70–£100 is fair when you’re keeping customers safe and doing a professional job.

- Look after your cash flow – Keep business and personal money separate, set money aside for taxes, and have a financial cushion for quiet months. Don’t blow your budget on shiny new gear until your finances allow it.

- Deliver top-quality work – Tidy up after every job, double-check all gutters, and keep customers in the loop. Be upfront if you hit a problem you can’t fix. Good communication and thorough work protect you from bad reviews.

- Stay on the right side of the law – Get public liability insurance, register your business, and if you take away debris, get a waste carrier licence. And keep your driving licence clean, as you can’t run a gutter business without your wheels.

Ready to start? Register your gutter cleaning business today

From working at height to winning your first customers, running a gutter cleaning business is easier when the paperwork, banking, and invoicing are already handled. With ANNA, you get everything you need in one place to turn your idea into income fast:

- Free business registration – Set up your new gutter cleaning business at no extra cost.

- Built-in support – ANNA helps you stay on top of tax, VAT, and essential filings as you grow.

- Fast and simple – Complete the process online in minutes. Add an optional virtual office address to keep your home details private.

- Trusted by UK businesses – Over 100,000 entrepreneurs use ANNA to manage their finances, stay compliant, and focus on their craft.

Take the leap and register with ANNA today! Focus on keeping gutters clear and customers happy, while ANNA keeps your business organised and stress-free.

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)