Discover how to register a company in the UK as a foreigner with clear steps on setup, taxes, banking, and compliance made simple for you.

- In this article

- What are your options as a foreign entrepreneur?

- Step 1: Can a foreigner register a company in the UK

- Step 2: Choose the right business structure

- Step 3: Prepare the required documents

- Step 4: Register for taxes in the UK

- Step 5: Open a UK business bank account

- Step 6: Stay compliant with UK regulations

- Bonus: Where do overseas companies in the UK come from

- How to register a Company in the UK as a foreigner – Final thoughts

Confused by UK rules? Not sure if you need a local address? Wondering how to open a business account from abroad?

You're not alone.

Many non-UK residents feel overwhelmed by the idea of starting a company here, but the process is more straightforward than you think.

The UK welcomes overseas founders, with online company formation, automatic tax registration, and remote-friendly banking options.

In this guide, we break down how to register a company in the UK as a foreigner, step by step. From legal setup to taxes, banking, and compliance, everything you need to launch with confidence, wherever you are in the world.

What are your options as a foreign entrepreneur?

Foreign nationals do not need UK residency or citizenship to register a UK company. You can own 100% of a UK company, be its sole director and shareholder, and even manage it remotely.

There are two primary paths for registering a business in the UK as a foreign national:

Step 1: Can a foreigner register a company in the UK

Before registering a company, you need to understand if you’re legally allowed to do so. Fortunately, UK law is quite permissive when it comes to foreign entrepreneurs.

There are no restrictions based on nationality, and you don’t need to reside in the UK to be a company director or shareholder.

Key points of eligibility:

- You do not need to be a UK resident or citizen.

- You must be at least 16 years old to serve as a company director.

- Your company must have a registered office address located in the UK.

- A UK-based director is not required, though having one may make banking easier.

Do you need a Visa?

You don’t need a visa to form a company. But if you wish to operate or manage your business within the UK physically — such as hiring employees, signing contracts, or meeting clients in person — you’ll likely need a business visa.

The most common visa options are:

- Innovator Founder Visa: For entrepreneurs launching innovative, scalable businesses. You must show originality, secure an endorsement from an approved body, and meet English language and financial requirements.

- Skilled Worker Visa: If your company can sponsor skilled roles (including yours), this route may be suitable for you.

Visa rules are complex, so consult an immigration advisor if you plan to work in the UK.

Step 2: Choose the right business structure

For foreigners, the most common options include forming a private limited company, becoming a sole trader, forming a limited liability partnership (LLP), or registering your foreign business as an overseas company in the UK.

Here’s a quick comparison:

Private Limited Company (Ltd)

This is by far the most popular option for foreign entrepreneurs. A UK Ltd company is a legal entity separate from its owners, meaning your personal assets are protected.

It gives you credibility, allows you to raise capital through shares, and is eligible for Corporation Tax registration. You can register the company yourself or use a formation service, and it’s relatively inexpensive.

Sole Trader

This structure is simple and may suit freelancers, consultants, or digital nomads who want to start small. However, the lack of limited liability and potential banking challenges make it less appealing for non-residents.

Limited Liability Partnership (LLP)

An LLP is useful if you’re starting a business with one or more partners, particularly for professional services. Each partner’s liability is limited to their investment, and it offers tax flexibility.

Overseas Company (Branch)

If you already operate a company in your home country and want to expand to the UK, you can register a UK branch. This involves filing Form OS IN01 and providing legal documentation from your home country. However, you must do this within one month of opening a place of business in the UK.

Step 3: Prepare the required documents

Once you’ve chosen your business structure, the next step is to gather and prepare the necessary documents. The documentation you need will depend on whether you’re forming a new UK company or registering an overseas branch.

Registering a new company

🔸 For a new UK private limited company, you’ll typically need:

These documents form the basis of your company’s legal existence and structure. The SIC code is particularly important, as it tells Companies House and HMRC what type of business activities your company will be engaged in. Your Articles of Association can follow the standard 'model' template or be tailored to fit your company’s governance model.

Registering as an overseas company

🔸 If you are registering as an overseas company, you will need to provide some additional documents:

- Certified copy of your original incorporation documents in your home country

- English translations (if applicable)

- Company constitution or equivalent governing rules

- Names and addresses of any UK representatives

Having the correct documents ready ahead of time ensures your application is not delayed.

Also, it’s good to have them reviewed by a legal or company formation specialist, especially if English is not your native language.

Step 4: Register for taxes in the UK

After registering your company with Companies House, the next step is to ensure your business is properly set up for UK tax compliance. Fortunately, some steps are now handled automatically — making the process easier than ever.

Key Tax Registrations You May Need

- Corporation Tax is the main tax obligation for UK limited companies. Since April 2024, Companies House now automatically registers newly formed limited companies for Corporation Tax with HMRC, so you no longer need to do it manually. You’ll still receive a Unique Taxpayer Reference (UTR) and must keep track of your filing deadlines and obligations.

- VAT is required once your taxable turnover exceeds the threshold, but you can voluntarily register earlier to reclaim input VAT or appear more established when dealing with suppliers.

- If your company has employees — or you pay yourself a salary as a director — you must register as an employer for PAYE and run payroll properly.

How to access HMRC services

After incorporation, HMRC will send your UTR number by post to your registered office. With this UTR, you can:

- Create a Government Gateway account

- Add VAT or PAYE services as needed

- Track tax obligations, submit filings, and make payments online

Even though Corporation Tax registration is automatic, you’re still responsible for:

- Calculating Corporation Tax owed

- Filing your CT600 return annually

- Paying the tax due, usually within 9 months and 1 day after your accounting period ends

Pro Tip: Simplify your tax setup

Sounds like a lot to think about?

Save time on VAT, PAYE, and Corporation Tax with ANNA +Taxes.

✅ Includes tax registration, auto-calculations, filing reminders, and a smart receipt scanner.

✅ Personalised tax calendar and expense tracking tools to help you stay compliant and save money.

✅ Submit Corporation Tax and annual accounts directly (for new businesses).

… and so much more!

Try it for just £3/month for the first 3 months, then £24/month +VAT.

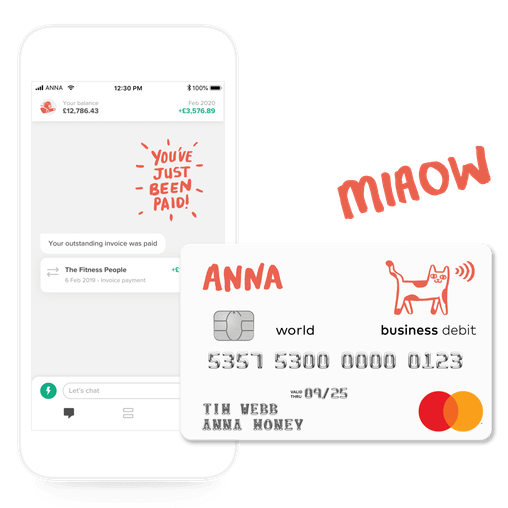

Step 5: Open a UK business bank account

To operate a company in the UK, you need to have a dedicated business bank account, especially if you're a foreign founder. It separates your personal and company finances, makes bookkeeping easier, and is often required by investors, payment processors, and HMRC.

Why a UK Business Account is Essential:

- Keeps business and personal finances distinctly separate.

- Facilitates effective cash flow management, invoicing, and tax record keeping.

- Is essential for receiving customer payments and paying suppliers efficiently.

- Is typically required for setting up VAT and PAYE schemes.

- Helps build financial credibility with UK institutions.

For non-residents or those based overseas, opening a traditional high street bank account in the UK can be a significant hurdle. Banks often demand proof of UK residency, in-person appointments, and extensive documentation, making the process time-consuming and often prohibitive.

While some traditional banks may allow remote account opening for specific international clients, most (like Barclays' general business accounts or Lloyds) often require a UK address and director presence. However, providers like Wise Business and Revolut Business make it significantly easier by offering business accounts without requiring physical presence in the UK or UK residency for all directors, making them excellent choices for global founders.

Pro Tip for Global Founders: If you are a non-UK resident looking to open a business, consider these points:

- Digital-First Solutions First: Services like Wise Business are often the most accessible initial step. They allow you to get a UK business account number and sort code, accept payments, and manage expenses quickly and remotely. But, Wise does not offer credit facilities like loans, overdrafts, or credit cards. If your business needs access to significant credit lines or complex financing products, a traditional bank might be necessary as a supplementary account.

- Residency Streamlines Traditional Banking: If you plan to establish a long-term presence, obtaining UK residency or a relevant business visa (e.g., Innovator, Start-up, Representative of an Overseas Business) will significantly ease the process of opening an account with traditional high street banks like HSBC or Barclays' standard business offerings, as they prioritize UK-resident businesses.

- Large Corporations: For substantial foreign businesses, international divisions of major banks like HSBC Expat or Barclays International are suitable, offering tailored solutions, though they come with high entry requirements and extensive due diligence.

Step 6: Stay compliant with UK regulations

Once your company is registered and your bank account is active, your responsibilities as a director don’t stop there. Ongoing compliance is key to avoiding fines, maintaining your company’s good standing, and operating smoothly in the UK.

These filings are not optional. Even if your company made no income, you still need to file a confirmation statement and submit dormant accounts if applicable. Missing a deadline can lead to fines, penalties, or even having your company struck off the register.

The director's responsibilities as a foreigner

As a foreign director, you are legally responsible for making sure your company meets its obligations. That includes:

- Keeping accurate company records

- Maintaining a registered office address in the UK

- Reporting changes to directors, shareholders, or address

- Filing reports on time

- Ensuring the company pays taxes and complies with employment law

You do not have to live in the UK to be a director, but you are still accountable under UK law. You can appoint a local accountant, tax agent, or use smart tools like ANNA +Taxes to manage these responsibilities efficiently.

Bonus: Where do overseas companies in the UK come from

The UK is a magnet for overseas businesses. With world-class legal infrastructure, an attractive tax system, and ease of doing business, many international founders choose to register their companies here, and the numbers prove it.

Overseas companies registered in the UK

By the end of March 2025, 14,574 overseas companies with a UK establishment were registered — a 1.9% increase from the previous year.

By region:

- Europe: 31.8%

- Americas: 21.6%

- Crown Dependencies: 17.4%

These figures reflect both long-standing businesses and newly registered branches. The top contributors — the US, Channel Islands, and Ireland — continue to show confidence in the UK as a base for expansion.

What industries do they operate in?

The sectors these companies operate in are just as interesting:

🔸 US-owned businesses

- Wholesale & retail trade — 29% of employees

- Scientific & technical/IT services — 22%

- Manufacturing — 14%

- Financial services — 9%, with turnover over £238.8 billion

US companies bring a wide industrial footprint, from software and science to exports and banking.

🔸 Channel Islands businesses

- Focus heavily on financial services — including banking, trust, fiduciary services, and wealth management

- Also active in legal, compliance, and accountancy support.

In Jersey alone, finance makes up 40% of GDP, and about 25% of the workforce is in financial services.

How to register a Company in the UK as a foreigner – Final thoughts

Setting up a UK company as a non-resident is easier than it looks. With online formation tools, automatic tax registration, and smart banking solutions, you can manage everything remotely — no UK address or citizenship required.

If you're ready to take the leap, make it simple with ANNA — the business account that does more than hold your money. From instant account setup to sorting your expenses, taxes, and invoicing, ANNA helps you launch and grow your UK business from anywhere in the world.

✅ Sign up with ANNA today and start strong from day one!

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)