When you're self-employed, it can feel like buying your own home will always be out of reach. But by tidying up your accounts and shopping around, you could be on your way to home ownership. Working for yourself often means your income varies from month to month, and that can affect your mortgage application.

Right now, 13-14% of the UK workforce is self-employed – with more people joining the freelance revolution year on year. But more than 1 in 5 of these people have had their mortgage application rejected* because they can’t prove their future earnings to a lender’s satisfaction. No wonder so many people running their own businesses haven’t taken the first step up the property ladder.

First, the facts

There’s no such thing as a ‘self-employed mortgage’. If you’re self employed, you’re entitled to the same rates as anyone else.

If you work for yourself, you just need to be able to prove you’re earning regularly. When a lender reviews your mortgage application, they’re just assessing how much you earn, and how likely you are to continue to earn this amount. Simple as that.

If you’re self employed, you’re entitled to the same rates as anyone else.

Proving your income

If you’ve been trading for at least 3 years, and have 2 years of business accounts or self assessment tax returns available, then most lenders will consider your mortgage application.

The longer you’ve been self-employed the better – if you can prove you’ve stayed in business for a while, you’re less of a risk for a mortgage lender. Some stricter lenders might want to see future income predictions to make sure you can afford your mortgage repayments.

Another thing that could help reassure mortgage lenders that your income is likely to remain stable is by sharing details about any regular contracts you have.

Want to know how your mortgage will be calculated?

The amount you can borrow towards the cost of your first home varies from lender to lender. Some lenders set the amount you can borrow based on your previous few years' income, whereas others will calculate it based on only your preceding year of trading.

It’s all about your self-employment category

If you’re a sole trader

If you’re a sole trader, lenders will base their assessment on whether your income has increased or decreased in the past few years.

If your income has increased, lenders tend to take an average from the past two or three years.

If your income has gone down, they’re usually use the lowest annual income in recent years to make their calculation.

Running a limited company?

1. Then lenders will assess your income by one of two methods.

2. They’ll either base their calculation on your salary and any dividends from the business

Or on your salary and your retained profit within the company

Finding the right deal

You’ll need to shop around and compare mortgages from different providers to find the right one for you. Plenty of patience and access to a price comparison site won’t hurt either.

It can take a long time to broker a mortgage, even if you find your dream house on your first visit to an estate agent. You might find it beneficial to meet with a mortgage broker to help you find the right deal, and make sure you meet all the requirements for a successful application before you apply.

Improving your chances

If you have a good working relationship with your current bank (perhaps you took out a loan with them previously, which you repaid in good time) this could work in your favour. They know your repayment history, which should make them more likely to help you than a brand new lender.

The more you have in savings, the better – your application will be dictated by the size of your deposit, so having a healthy sum set aside will increase the odds of your mortgage being approved.

A good credit rating will also boost your chances of getting a mortgage. Lenders won't just credit check you personally, they’ll also credit check your business via the address registered at Companies House.

Read the latest updates

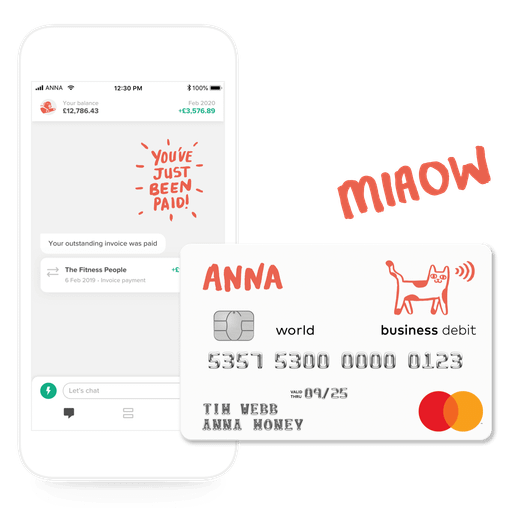

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)