To keep your business running smoothly, and to ensure you don’t fall afoul of the taxman, it’s essential that you register for VAT if you meet the minimum annual threshold. Here we cover how to register, how to pay your VAT bill online through HMRC, and what happens if you miss a deadline for your VAT tax payment.

Registering to pay VAT online

As a business or sole trader (self-employed) that is VAT registered, you will have the following responsibilities:

- Pay VAT on what you buy from other businesses

- Charge VAT for what you sell to other businesses and customers

- Submit your VAT Return every quarter

- Pay VAT over to HMRC

It’s the last point that we will cover in more detail here. Even though you are already VAT registered, you will still need to apply on the UK government website (Government Gateway) before you will be able to pay online. Have the following at hand before you start the sign-up process:

- Your VAT number

- Postcode for your principal place of business

- The date you registered for VAT

- The final month of last VAT Return you submitted

- The figure in Box 5 of your last submitted VAT Return

You will need to fill in some personal and business details and then will be supplied with a User ID. Shortly after this you’ll be sent a PIN for activation. Once your account is activated, you’re ready to go and can now pay your VAT bill online.

When do you need to pay your VAT bill?

For most businesses, you will have to complete a VAT Return every quarter. This will be due within one month and seven days following the end of the end of the specified period. Payment must usually be also submitted at the same time.

So, if the three-month period in question ran from 01 January to 31 March 2022, your VAT Return and payment would be due by 07 May 2022. Your quarterly dates will operate on a rolling cycle and do not necessarily have to be tied to a calendar year.

How to pay your VAT bill

You’ve gotten registered, checked the deadlines and now it’s finally time to pay your VAT bill. HMRC has several, different approved ways that you can settle what you owe.

It is critical that your payment reaches HMRC’s bank account before your deadline or you will face a penalty. Take note, if your deadline ends up being on a weekend or bank holiday, the payment must be received on the last working day before this at the very latest.

If you need the payment to be received on the same or next day, you can utilise telephone banking, CHAPS or through your online bank account. If the payment only needs to come through within three working days, you can use Direct Debit, BACS, a standing order (if your business is using the Annual Accounting Scheme or Payments on Account), through a debit or corporate credit card or, finally, at your bank or building society.

We generally find that the most convenient option is to pay your VAT bill online through your bank account. To do so, you will need to sign in online with your VAT registration number. Then you must select the “pay by bank account option”. After this, you will be directed to sign into your bank account and approve the payment.

What happens if your VAT bill payment is late?

Should HRMC not receive your VAT Return or the full payment owed for VAT by deadline it will record a “default” against you. This can potentially lead to surcharges or penalties. This default status may have ramifications for the 12 months following its application. Should you default again during this period, it will be extended for another 12 months, and you may also have to pay a surcharge in excess of the VAT you already owe.

You won’t have to pay a surcharge on a late VAT Return so long as:

- Your VAT is paid in full by the deadline

- You don’t have any tax to pay

- You are due a VAT repayment

How much you owe for the surcharge is based on the amount of VAT that is still outstanding on the due date. A percentage is charged on the VAT amount, which is increased every time you default again within this period. For a business with an annual turnover of £150,000 or more, this can range from 2% for a second default to 15% for six or more defaults.

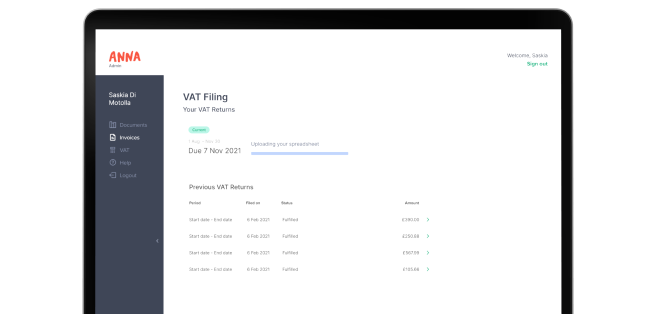

ANNA Money is the one-stop business account and tax app that will ensure you never miss a VAT deadline. Our awesome range of tools (including free templates for VAT filing) and services means that you spend less time dealing with the hassle of admin so you can get back to what’s important: focussing on running and growing your business. Have any questions, please get in touch by emailing hello@anna.money and we’ll get back to you as soon as we’re able.

Open a business account in minutes