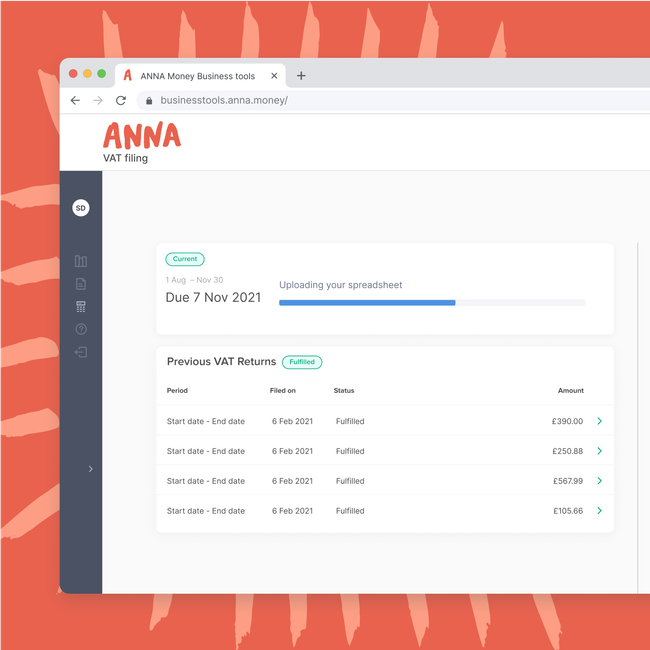

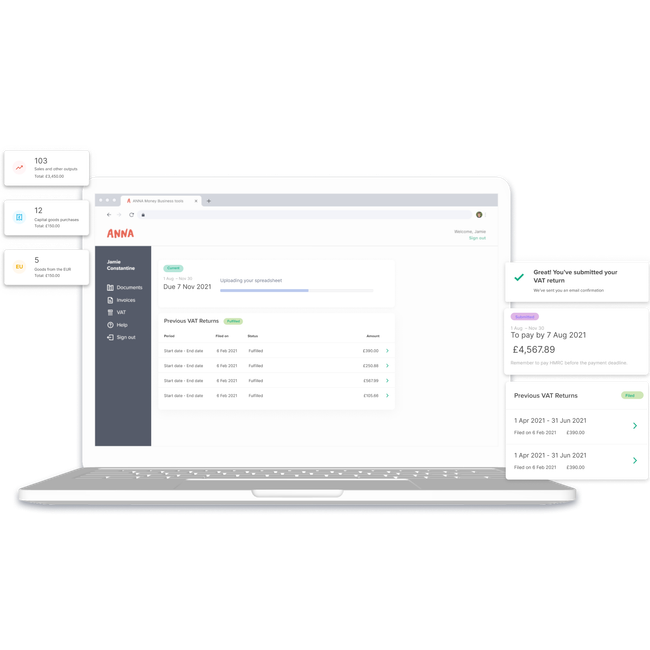

The quick, easy way to file your VAT Return

Automatically calculate your VAT within ANNA, or upload your VAT Return as an Excel spreadsheet and file it to HMRC in a jiffy. It’s simple, easy and fully compliant with Making Tax Digital.

MTD bridging software

File VAT from your Excel spreadsheet for free

Submit your VAT Return from any Excel or Google Sheets spreadsheet. It’s MTD-compliant and the first filing is free. Subsequent filings cost £4.50+VAT each.

Prepare your VAT return

No Excel file? We’ll calculate your VAT automatically

Connect your business bank account and we'll calculate your VAT and file it for you.

More than 45,000 companies have already filed VAT Returns with ANNA

JoinHow it works

If you’ve already prepared a VAT Return in an Excel file, then you can just upload and submit it.

If you don’t have a prepared VAT Return, we’ll do it for you. Just connect your bank account. ANNA automatically sorts all your transactions into VAT categories and extracts the VAT from your receipts.

Watch the video

How to file a VAT return to HMRC using a spreadsheet

Is it free?

It is free the first time you file your VAT Return through ANNA. After that, it costs £4.50 + VAT per filing.

As well as filing VAT Returns, ANNA provides plenty of other useful business tools. The majority of them are free, some involve a small fee.

Compare VAT filling providers

Cost

Web tool

Card payment per filling

Use your own spreadsheet in any format

Google sheets and Excel add ons

Tool for accountants

FIRST FREE

£4.50+VAT

Per filing

£6.99+VAT

Per filing

£4.99+VAT

Per filing

£5-£16+VAT

Per filing

£29.95+VAT

Billed annually

£26.70+VAT

Per filing

MTD Bridging software for accountants

Are you an accountant?

Stay connected to your clients and manage multiple VAT submissions, all in one place with our accountant features

Try our VAT filing tool for accountantsTake the stress out of VATSign up for free