Making Tax Digital for Income Tax

MTD Self Assessment done for you. For free.

Say hello to your fully automated MTD solution, powered by ANNA’s Auto Accountant.

- Simple sign up process

- Connect any UK bank account

- The rest is done automatically

Limited offer

Get your 2025/26 Self Assessment prepared and filed for free!

Already paid for accounting software? We’ll refund you.

How MTD affects you

From April 2026 sole traders with qualifying income over £50,000 will have to digitally submit tax updates four times a year using HMRC compliant software. The good news? MTD is mandatory, but your involvement is not. So just sit back, relax, and leave it all to ANNA.

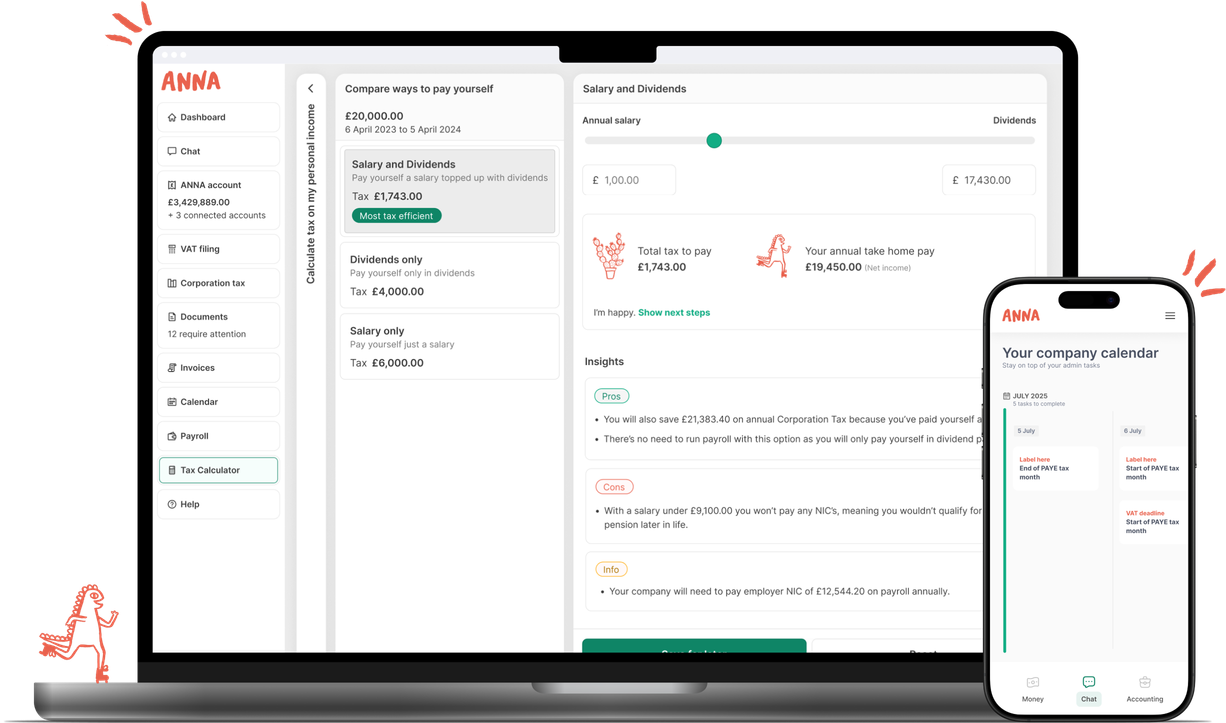

The perfect solution for Making Tax Digital

A lot of MTD solutions still expect you to buy pricey software, learn new rules, remember a long list of deadlines, and open a specific type of business account. That didn’t seem fair to us, so we built a solution that does it all for you.

How it works

Sign up for free with ANNA

Sign up for an ANNA account for free and choose the type of Self Assessment you want us to file.

Connect your bank account

Connect ANNA to your business bank account. With Open Banking it’s simple, secure and fast. We are FCA registered.

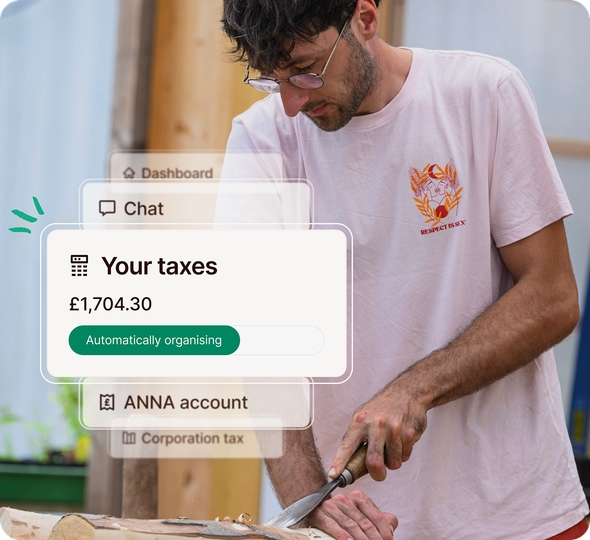

Auto Accountant gets to work

Auto Accountant crunches the numbers, so ANNA can automatically file your updates and annual return.

No software to learn. No training needed. No feature overload.

No last-minute panic. And no strings attached.

Auto Accountant takes care of MTD for you

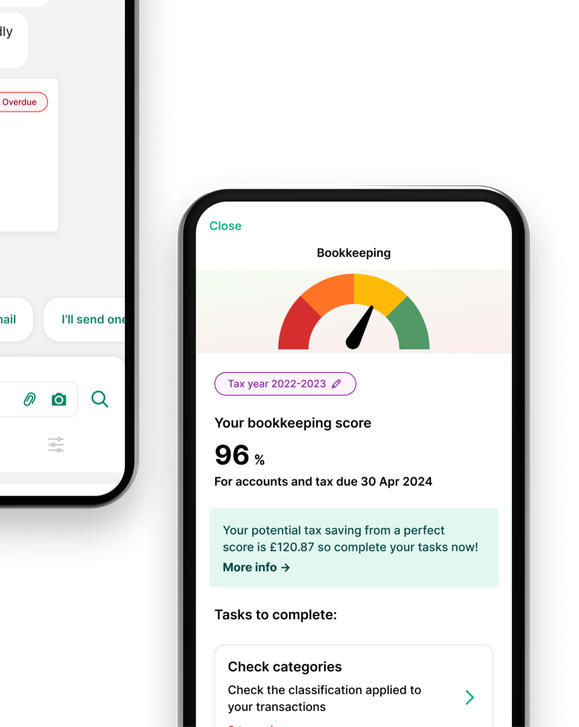

Auto Accountant is AI-based, trusted by thousands of UK businesses and designed specifically for the UK tax system. Auto Accountant will file your MTD for you. First time and error-free.

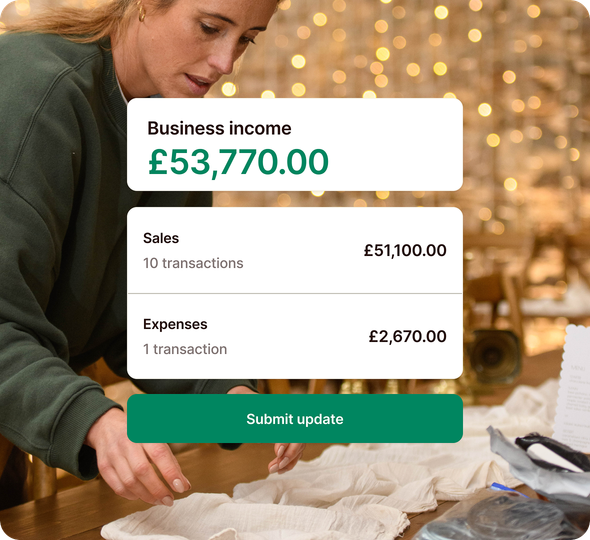

Digital records are created automatically from bank activity

Quarterly updates are prepared ready for filing

You review and approve the files – we file them to HMRC

You don’t even have to think about it.

Files everything on time

Everything you need to submit is filed on time with HMRC

No costly human errors

No worrying if you’ve copied the wrong figure from a spreadsheet

Every transaction logged

Money in, money out, receipts and payments. All logged automatically

Every expense claimed

Auto Accountant makes sure you don’t miss out on tax savings

It’s always at your side

Fully secure and protected

Bank-level security keeps your data safe24/7 UK-based customer support

Real humans in Cardiff, ready to help when you need itTrusted by business owners

Thousands of UK businesses already use ANNA

Unlock the power of Auto-Accountant

MTD Self Assessment

Let Auto Accountant handle it for you, automatically.

Free

Limited offer

Get your 2025/26 Self Assessment prepared and filed for free!

Already paid for accounting software? We’ll refund you.

Read the latest updates

Frequently asked questions

To qualify for the refund, you need to:

- Be registered for MTD (Making Tax Digital)

- Sign up for the ANNA MTD service

MTD for Income Tax is coming in 2026

From April 2026, HMRC will require digital record keeping and quarterly updates from the self-employed and landlords earning over £50,000. ANNA is getting ready now, so you’ll be ahead of the game when MTD launches.

Sign up for free