Standing orders are now possible on the ANNA app, so you can make scheduled and regular payments in a couple of taps. Standing orders can help you stay on top of your regular payments, so you can budget and plan ahead for your business. Late payment fees will never darken your door again!

- In this article

- What is an example of a standing order?

- What is the difference between a standing order and a direct debit?

- How do I set up a standing order in ANNA?

- How to cancel a standing order in ANNA

- What are the advantages and disadvantages of standing orders?

- How is a recurring payment different from a standing order?

- Do standing orders work on weekends?

What is an example of a standing order?

If you’ve never set up a standing order before, you might be wondering how they can help you and your business. Well, wonder no longer. Here are some solid-gold scenarios for using standing orders:

- Paying invoices with specific due dates. Schedule a standing order, and you won’t be scrambling for bank details when the due date arrives.

- Paying employees with fixed weekly or monthly wages. Setting these payments up as standing orders will ensure your employees are never paid late.

- Contracts which require regular payments. Set up regular payments, and specify their end date – all as per your contract. Tidy.

What is the difference between a standing order and a direct debit?

A standing order is an instruction to your bank to make regular, fixed payments to an organisation. A direct debit is an authorisation for an organisation to take a regular fixed or varied payment from your account.

The payer (that’s you!) is in control of the standing order; they set it up personally, and choose the amount and frequency. Standing orders are set up to cover a specific period of time (e.g. every month for a year), or until they are cancelled by you.

Direct debits work the opposite way – the payment is requested by the payee (the person you’re paying) and amount can vary each time (like a mobile phone bill, or your gas bill). Unlike direct debits, standing orders aren’t covered by a guarantee. Once you make a standing order payment, you can’t get it back. But if you’re making regular payments, including subscriptions and instalment payments, then a carefully-checked standing order is a smart way to pay.

How do I set up a standing order in ANNA?

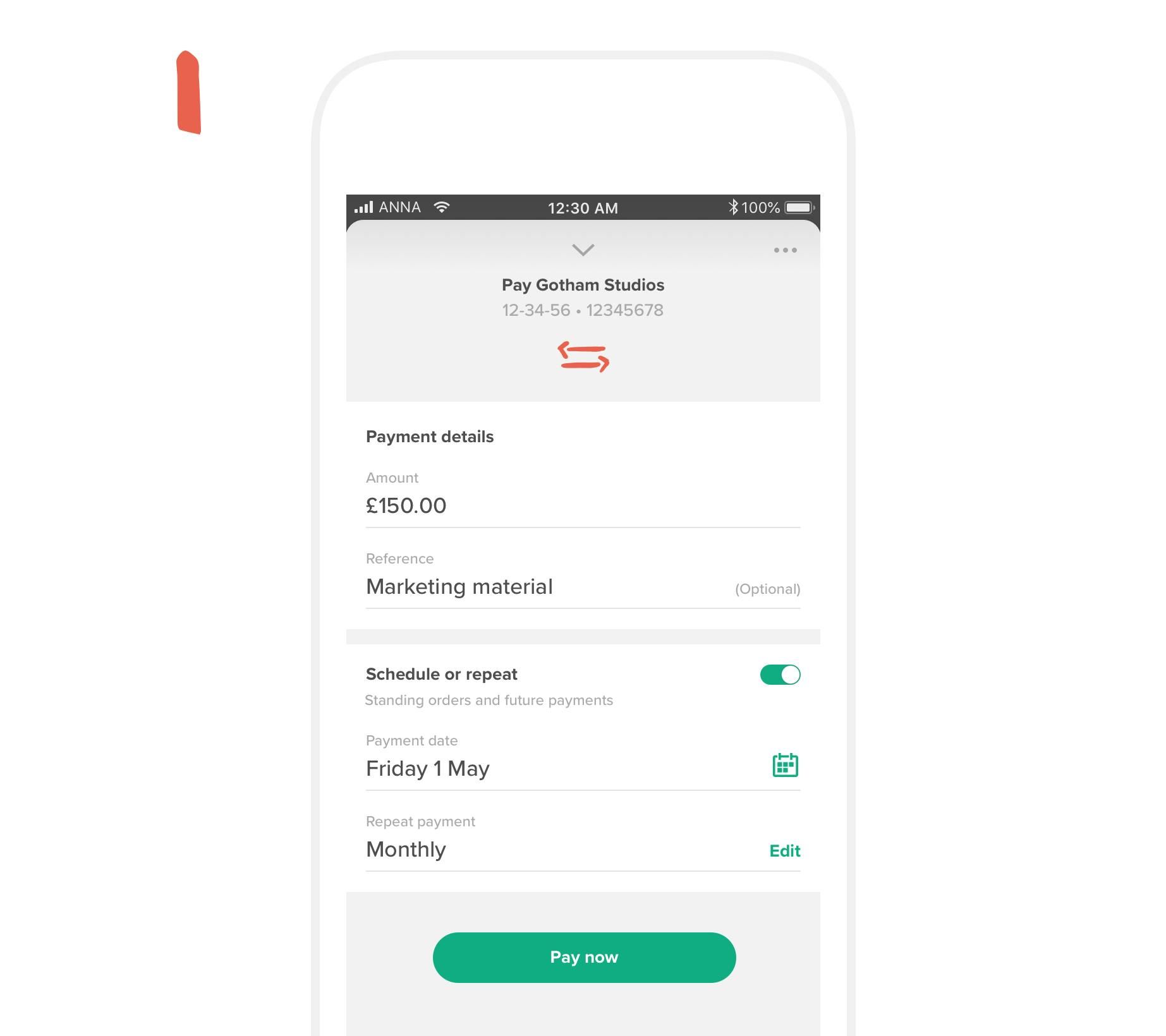

Good news: it’s as easy as pie. Simply head to your Account Summary page and tap ‘New payment’. Then select a previous payee, or tap ‘New payee’.

If you want to pay someone you’ve paid before, their account details will be automatically entered, or if it’s a new payee you’ll then have the chance to enter their bank details.

Then enter the amount you want to pay and a reference so it’s clear what the payment is when it reaches the payee’s account.

Now here’s the smart bit: slide the ‘Schedule payment’ toggle to the right to set up a future or repeat payment.

You’ll then be able to select the date of your payment, and the frequency of the payments. The default setting is ‘Never’ so you can make one-off payments, but when you click ‘Edit’ you’ll be able to select weekly or monthly payments as per your requirements.

Finally, tap on ‘Payment ends’ to confirm a final date for your standing order.

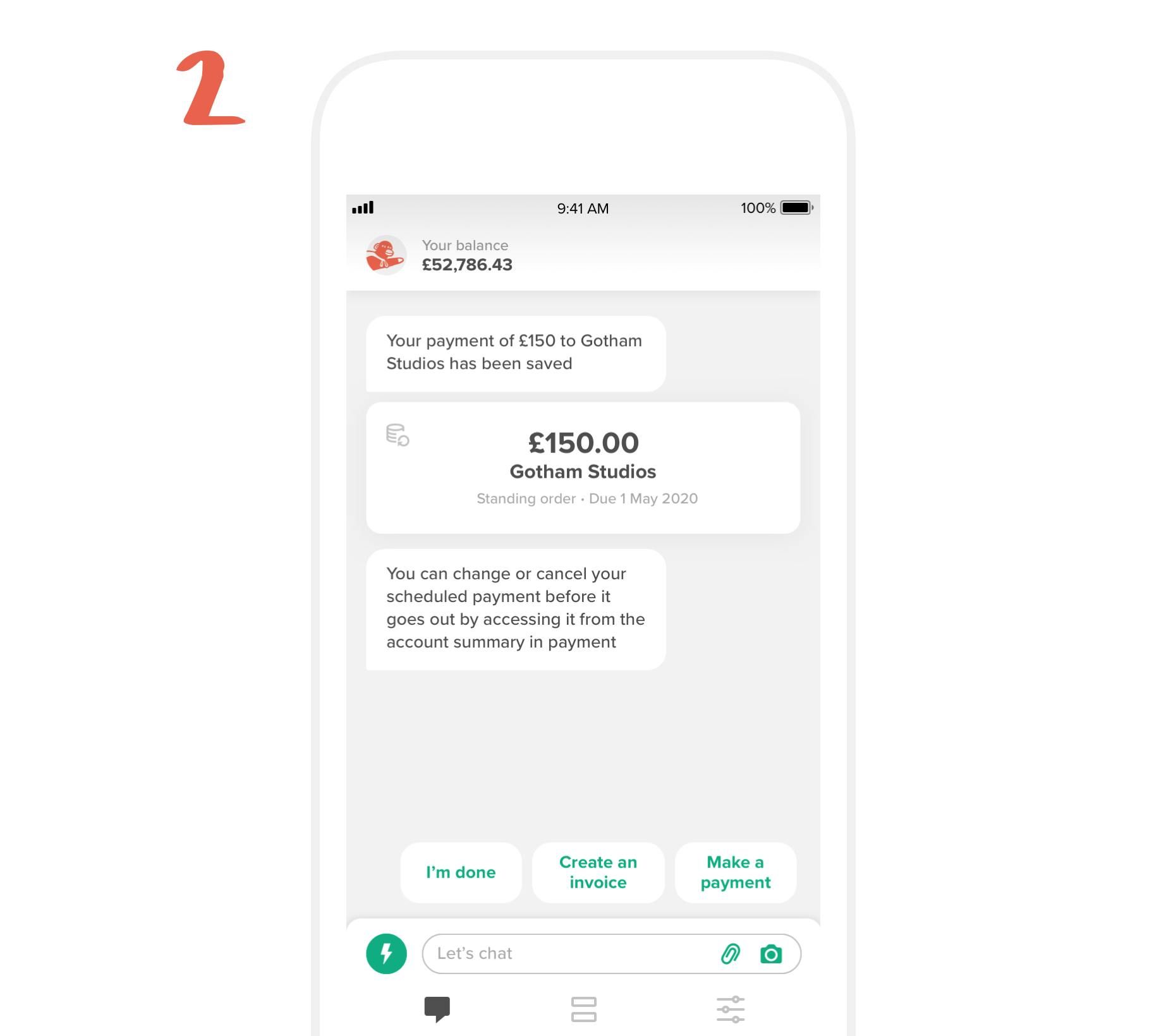

Once you click ‘Save’ you’ll either have to enter your PIN or go through Face ID to authorise your payment or payments. Not sure if all the details are right? Don’t worry – you’ll be able to check everything on the following confirmation card.

How to cancel a standing order in ANNA

Cancelling or amending a standing order is just as easy. Head to your Account Summary and tap on Payments’ to see all your scheduled payments. Tap on the standing order you want to cancel, and at the bottom of the screen you’ll see a ‘Delete payment’ button. Tap on this to delete future payments (remember, you can’t cancel any previous standing order payments which were previously paid out from your account).

What are the advantages and disadvantages of standing orders?

The advantages to standing orders:

- Usually free for the payer and payee.

- Quick and easy to set up.

- Ideal for making regular payments between individuals (e.g. tenant to landlord).

- Helps businesses to make regular payments on time.

The disadvantages to standing orders:

- No payment notifications. So it might take a while to find out a payment has failed, if a payer cancels a standing order, or doesn’t have the funds to cover it.

- Not as much flexibility. You’ll need to cancel the standing order and create a new one, if you want to change the amount or date of a payment.

- More admin. Businesses taking payments by standing order can end up constantly checking their bank (or chasing the payer) to make sure their payment has arrived.

How is a recurring payment different from a standing order?

Both are regular payment methods, but with a key difference. A recurring payment is where you give your business debit or credit card details to the payee, so that they can take regular payments from you via your card. Standing orders use your current account details, not your card information.

Do standing orders work on weekends?

In a word, yes! If you schedule a standing order for a date that falls over a weekend, then ANNA will send the payment out at the weekend. It can depend on your payee’s bank whether they will receive the payment that same day, but you’ll be able to see the payment has left your account. Remember, you’ll have to check that manually as standing orders can’t trigger a payment notification.

Read the latest updates

Open a business account in minutes

![How to Start a Hand Car Wash Business in the UK [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_43cd23898e.webp)

![How to Start a Petrol Station Business in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c/small_Cover_3000_Landscaping_Business_Names_Creative_Name_Ideas_78f637cb9c.webp)

![How to Start a Homecare Business Franchise in the UK [Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_91132e805d/small_cover_3000_91132e805d.webp)