Fuel Scale Charge – Claim back all your VAT on fuel

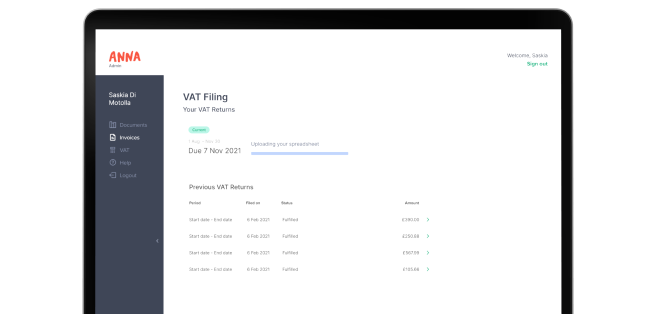

HMRC has lots of complicated rules and methods for claiming the VAT back on business expenses. Thankfully ANNA’s here to make things simpler and easier – and we’ve just introduced a new feature for claiming VAT back on the fuel you’ve purchased.

How to claim VAT on fuel for business

If you have a company vehicle (or a vehicle that’s used solely for the purpose of business) then HMRC says you can claim VAT back on fuel costs charged. Simple enough, right? However, if you’re using a vehicle for both private and business travel, there are three different approaches you can take.

- You only reclaim the VAT on fuel you use for business trips – by maintaining a mileage log and calculating the amount you can claim based on your business travel. As you can imagine, this means a lot of day-to-day admin.

- Reclaim all the VAT from fuel costs and just pay a fuel scale charge for your vehicle.

- Don’t claim back your VAT on fuel – it’s too much bother.

What is the fuel scale charge?

If you use your own car for business, then HMRC says you can claim all the VAT back if you pay them a fuel scale charge for the vehicle. This is basically a tax you pay HMRC to account for the personal use of the car. It is an easy method for claiming VAT on fuel because you don’t have the administrative burden of keeping mileage records of every business trip made.

How does it work?

You can calculate the fuel scale charge for your car using the calculation tool on the gov.uk website. All you need is the following info:

- The financial year that you’re accounting for the charge in

- The accounting period to have the charge calculated for – monthly, quarterly or annual

- The car’s CO2 emissions

Then all you need to do is include the charge in your VAT return. The net amount will go into box 6, but you don’t need to actually pay the net amount over to HMRC! All they want is the VAT amount, which you will include in box 1 and pay to them by factoring it into your VAT return. Easy peasy, right?

Well, ANNA makes it even easier by doing the job for you.

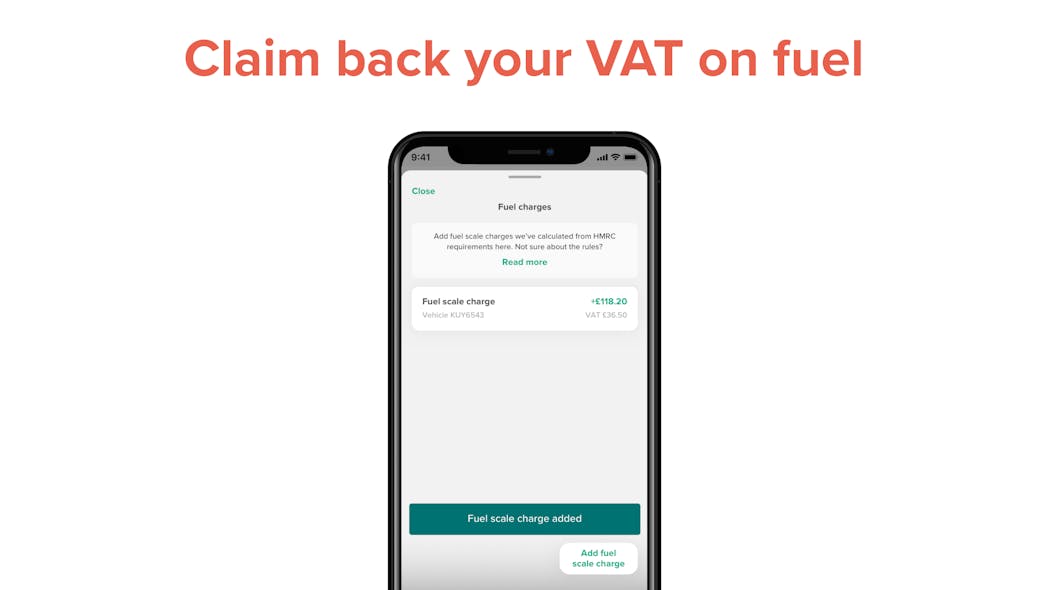

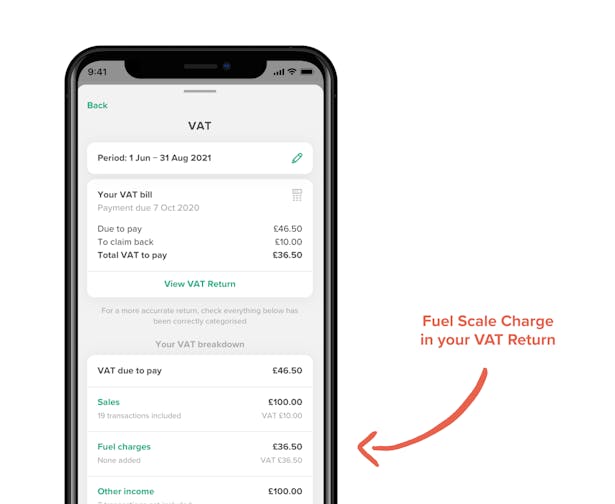

ANNA’s new fuel scale charge feature asks you for all the necessary details and then automatically includes the fuel scale charge in your VAT return for you.

Step-by-step Guide

It’s very simple.

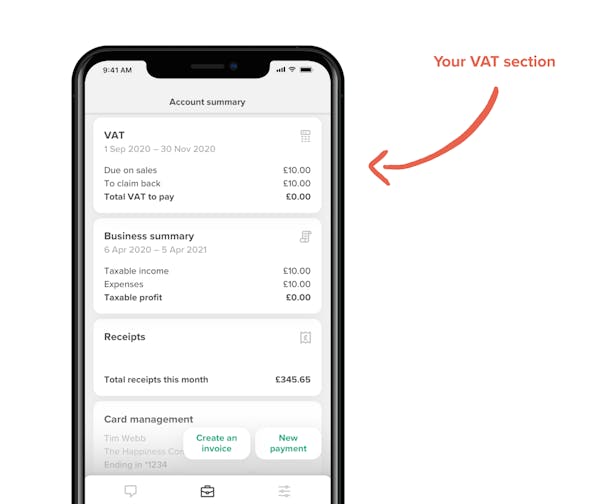

1. Go into your account summary and click on the VAT section

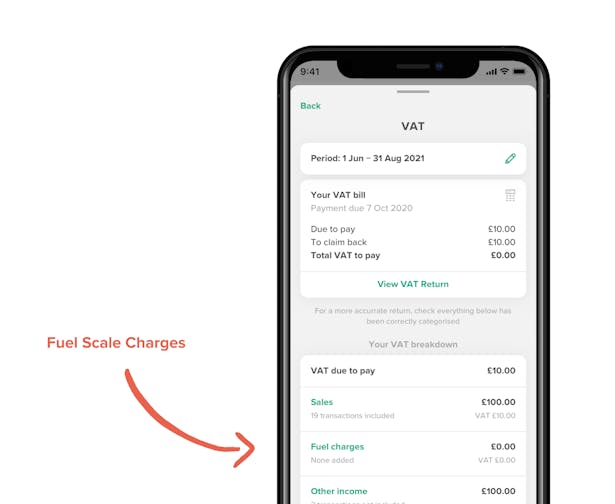

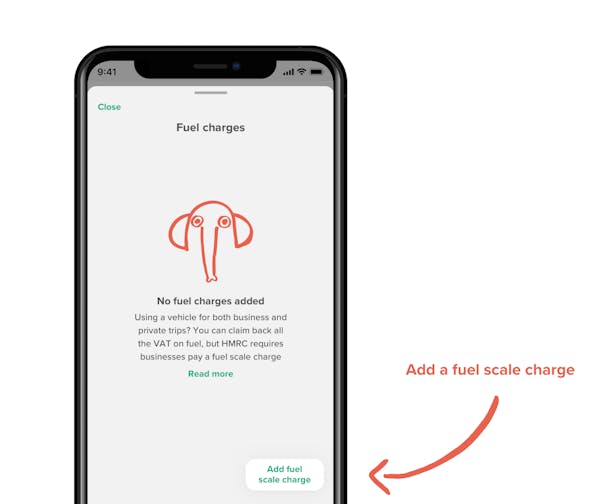

2. You’ll see the fuel charges subheading under VAT due to pay

3. Once you tap on this, you’ll see the option to Add fuel scale charge

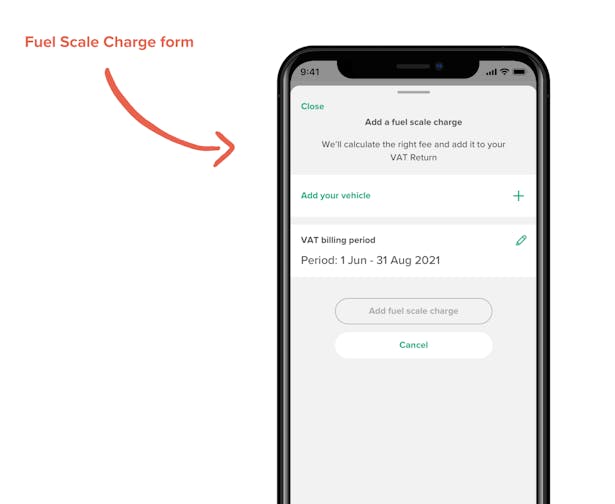

4. Add your vehicle registration under Vehicle by tapping the + sign, and add the VAT billing period you want to include the fuel scale charge into

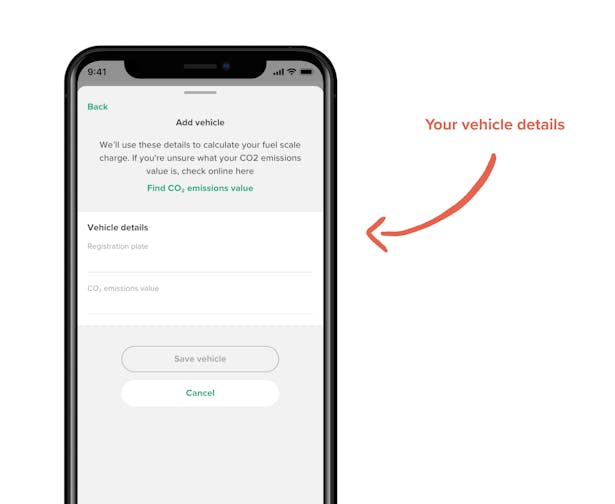

5. Tap Add vehicle to enter your details. If you don’t know your CO2 emissions don’t worry – tap on Find CO2 emissions value and it’ll take you to HMRC’s tool for working it out

Once you have done this, remember to tap on save!

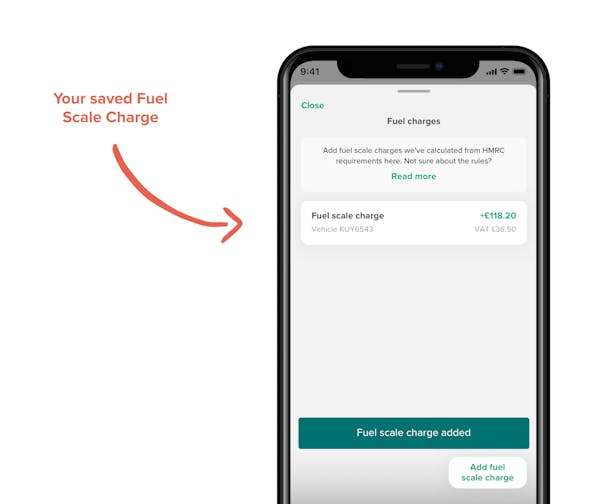

6. Refresh the page and you’ll see the fuel scale charge has been added

7. It’s now in the VAT summary section and has been included in your VAT return.

It’s as easy as that. Sorting out your VAT fuel scale charge needn’t drive you to distraction.

Open a business account in minutes