As a subject, it might seem drier than a lizard sunbathing in the Sahara. But bank reconciliation is a fact of life for every small business, ensuring your accounting records are a true picture of your business’s financial health and fit for the beady eyes of HMRC. Here’s how it works – and how to make it as painless as possible.

What is bank reconciliation?

Reconciliation is essentially checking two sets of records against each other to see if they agree.

You’re probably familiar with scanning your personal bank statement to make sure you recognise all the transactions listed. With bank reconciliation, you’re checking your business bank statement in the same way, and also comparing it with your business accounts for the same period. If they don’t match up, you need to find out why.

How does bank reconciliation work?

It’s pretty straightforward – IF you have a separate business bank account. Get your bank statement for a particular period, say the last month. It has an opening balance and a closing balance. Now look at your income and expense log for the same period. Your closing balance minus your opening balance should be the same as your income minus your expenses. If they don’t match, you’ve probably missed something (eg a small charge like bank interest), typed a number in wrong, or entered something twice.

If you use the same bank account for both business and personal transactions, reconciliation is nigh-on impossible. Your start and end balances will reflect personal transactions as well as business ones, and you (or your seething accountant) are going to have a high old time unpicking what’s what. So if you want to enjoy the benefits of regular reconciliation – get a separate business account.

Why is bank reconciliation important?

Bank reconciliation gives you peace of mind on two fronts: you can rest assured your accounts are correct and it keeps HMRC happy, just in case they choose to investigate your business.

It gives you a clean bill of health

If your accounts fully match up with your bank statements – seen as a trusted record of your transaction – it confirms they’re a true picture of your business’s financial health and that you haven’t overstated or understated your profits. This will give you top marks from HMRC.

You can keep track of your money

Regular account reconciliation helps you know what’s coming in and out of your business. You can detect and fix any errors, for example if you’ve entered a payment twice or missed one completely. You can identify any business expenses you haven’t yet accounted for, and take another slice off your tax bill. And if you spot any suspicious activity or unfamiliar transactions, you can get to the bottom of it.

Avoid HMRC penalties

If you’re investigated by HMRC, the first thing they will want to look at is your bank reconciliation and they will be immediately suspicious if your accounts don’t match up. Keeping on top of reconciliation can help you avoid penalties if they decide to enquire into your affairs and find anything amiss.

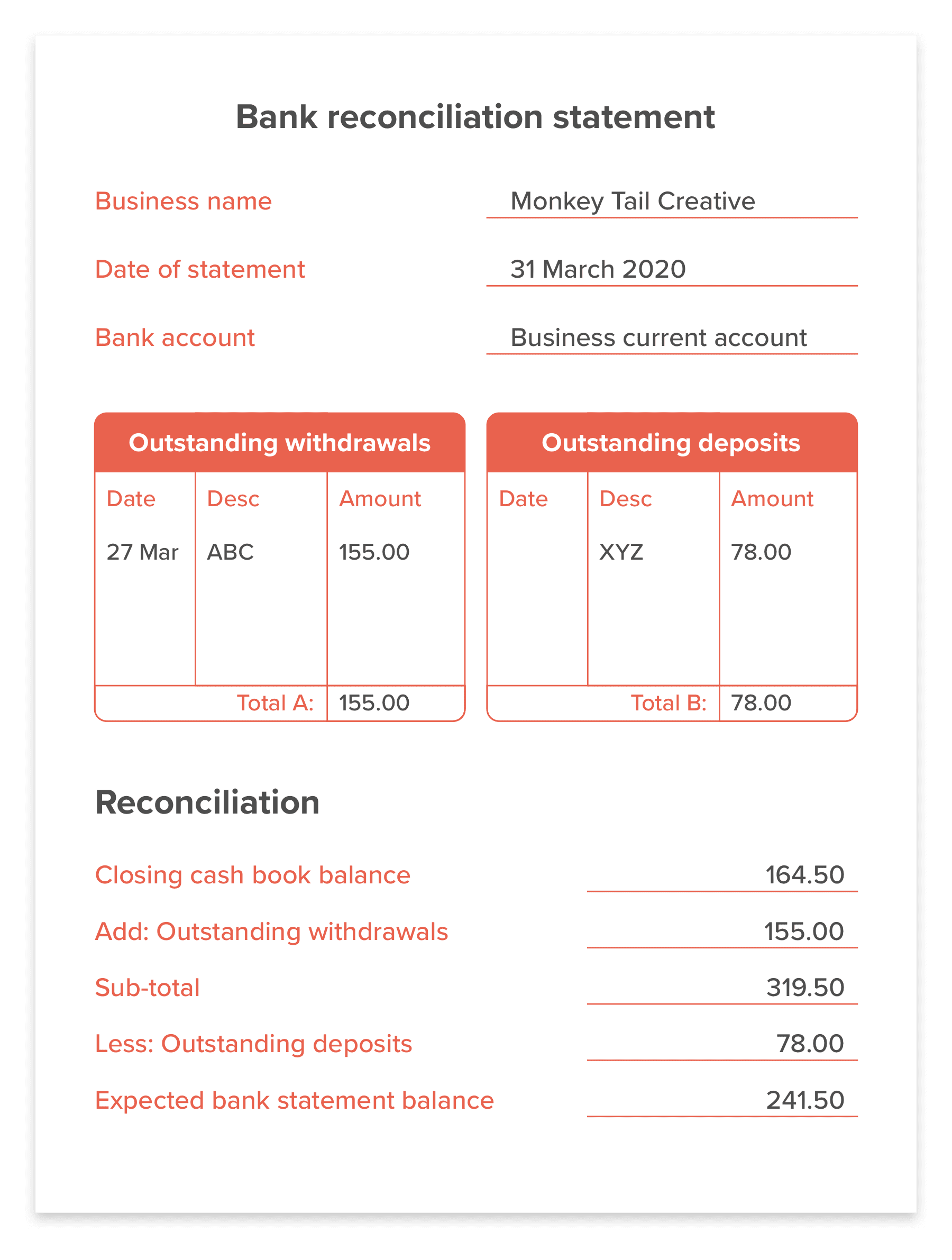

What is a bank reconciliation statement?

Here’s how reconciliation traditionally used to happen. Business owners or their accountants would enter withdrawals and deposits into the business’s cash book (now often referred to simply as transactions).

Every month they would do a reconciliation and check that the closing balance of the cash book matched the closing balance of the bank statement. Often they wouldn’t match – perhaps because an incoming or outgoing cheque hadn’t yet cleared.

In this situation, they would prepare a bank reconciliation statement detailing the adjustments needed to be made to the cash book to bring the two balances into line.

It looked something like this:

You might be thinking that all sounds rather a lot of faff – and you’d be right. Thankfully, things have changed, partly because cheques have fallen out of fashion, but mainly due to the advent of accounting software with in-built reconciliation features.

Typically these programs bring up one transaction at a time and suggest a match with a corresponding entry in your accounts. If it can’t find a match, you type it in manually. With apps like ANNA, which combine a business account with accounting tools, it’s even easier as everything is automatically reconciled as you go.

Top tips for bank reconciliation

Keep a separate business account

This is the number one tip for doing reconciliation. In fact, it’s almost a prerequisite. Keeping a separate business current account means all the transactions in your bank statement are business related and should all appear in your accounts, making cross-checking easy.

If you love the simplicity of just one account, it’s worth remembering that managing multiple accounts is pretty easy these days. Thanks to Open Banking, apps like ANNA are able to access all your business and personal accounts, so you can see them in one place.

Do it regularly

The more often you do your bank reconciliation, the quicker and simpler it is. You’ll have fewer transactions to go through and the ones you’re reviewing will be fresher in your mind, making it easier to figure out any discrepancies. Don’t leave it till just before filing tax – get into a weekly or even daily routine and it’ll pay you back in peace of mind.

Automate and forget about it

If that all sounds eminently worthy yet totally mind numbing, there are plenty of ways to speed up reconciliation – and even automate it entirely.

You can feed your banking transactions directly into accounting software like Xero or QuickBooks, which will compare them with your accounts on screen and suggest matches. If it can’t find a match, it’ll ask you what the transaction was for and add it to your accounts.

With a banking and accounting app like ANNA, your reconciliation is done for you.

When money goes out of your ANNA business account, it’s automatically flagged up as a business expense and assigned a category. There’s no risk of entering anything twice or making an error in the amount. Your reconciliation is done without you even realising. Ta-dah!

Read the latest updates

Open a business account in minutes

![Offshore Company Registration in the UK [2026 Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_cdb14668f7/small_cover_3000_cdb14668f7.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)