Starting a UK business for the first time? You’re going to need a business account to accept payments and pay bills. There are two elements to a business account in the UK: a sort code and a bank account number. Let’s break down both elements to make sure you know exactly what you’re getting.

- In this article

- What is a sort code?

- What is a bank account number?

- Why sort codes and account numbers matter?

- The mechanics of banking transactions

- How to find a bank account number or sort code

- Frequently Asked Questions

- Conclusion: Doing business Is impossible without a bank account number and sort code

What is a sort code?

So, we now know that the sort code identifies the bank that’s hosting the account. If you ever need to check the authenticity of a sort code, you can do it fairly quickly and easily by using a sort code checker. Now let’s break down the different elements of a UK sort code.

Structure of sort codes

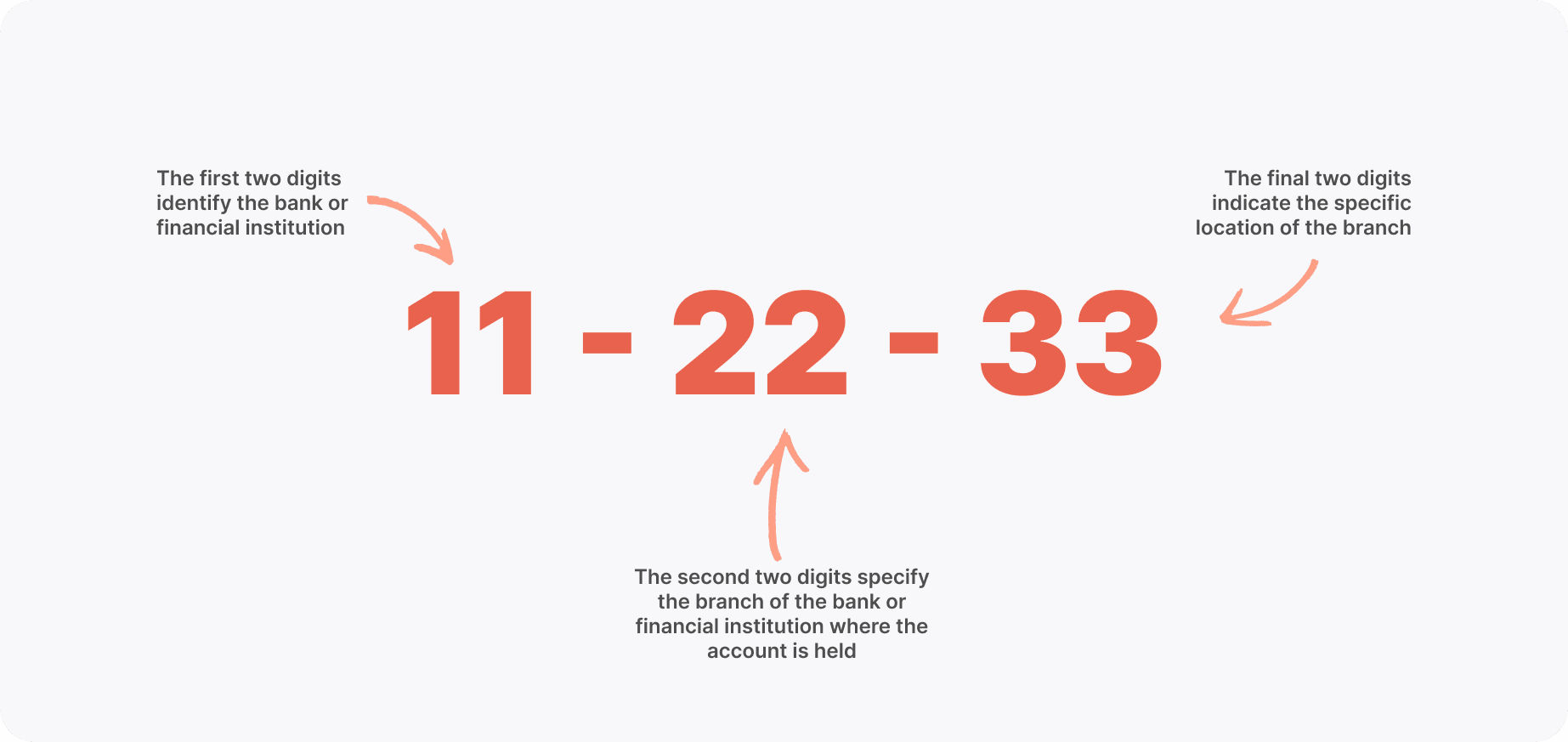

All UK sort codes have three groups of two numbers, with each group separated by a dash:

- Bank code (Digits 1–2): The first two numbers identify the bank or financial institution

- Branch code (Digits 3–4): The next two numbers specify the branch of the bank where the account is held

- Location code (Digits 5–6): The final two numbers indicate the specific location of the branch

Sort code structure

Sort code structureSo, let’s assume your business bank account provider gave you the sort code 12–34–56. This gives us the following information:

- ‘12’ is the bank code (e.g. Barclays)

- ‘34’ is the branch code (e.g. Muswell Hill)

- ‘56’ is the location code (e.g. the actual address)

You can verify the authenticity of any UK sort code using an online sort code checker.

For ANNA business accounts, the sort code is 23–11–85

The purpose of sort codes

An accurate and active sort code is essential for the transfer of money within the UK’s banking system. As we already know, the sort code identifies the bank that hosts the account. However, they have three other important functions.

Routing payments

Sort codes are vital for routing payments, such as salary deposits, bill payments, and transfers – to the right bank and branch.

Ensuring accuracy

By providing a standardised identification system, sort codes help minimise the amount of errors in processing financial transactions – so money reaches the intended recipient without delays or complications.

Enabling international transfers

Sort codes are used alongside account numbers to make international transfers, allowing financial institutions to route funds safely and accurately. Here the sort code is part of the larger IBAN (international bank account number).

What is a bank account number?

A bank account number is a unique identifier assigned to an individual's or organisation’s bank account. It typically consists of a string of numbers and serves as a reference point for lots of banking transactions – including deposits, withdrawals, transfers and electronic payments.

Note: No two bank account numbers are the same. They’re all different, which is vital to ensuring money reaches the right recipient. Just one wrong digit can result in money being misdirected and lost. Fortunately, automated payment systems now match bank account numbers with names to prevent mistakes and fraudulent activity.

Sort codes vs. account numbers

It’s important not to confuse sort codes with account numbers. In the vast majority of cases, UK bank accounts feature eight numbers. There may be accounts with seven, but even then a leading zero is added to standardise it to the eight-number format. Sort codes are six numbers long, comprising three groups of two numbers.

Why sort codes and account numbers matter?

There are financial, reputational and security-related consequences to providing or accepting the wrong sort codes and bank accounts.

Payment reversals

If money is sent to the wrong account because you’ve entered the wrong bank account details, claiming it back can be a complex and time-consuming process. Banks might not be able to retrieve the money without the recipient account holder's consent. So double check those numbers!

Financial loss

Sending money to the wrong account means the intended recipient doesn’t receive it — so there’s a financial hit for both the sender and the recipient.

Disputes

As you can imagine, if money is sent to the wrong account, there may be disputes between the sender and recipient, which can lead to difficult relationships or legal action.

Security risks

Providing the wrong bank details could also be a sign of fraudulent activity or errors in data entry, and this is a security risk.

Customer unhappiness

Needless to say, mistakes in transactions means unhappy customers, which means potential loss of business and reputation.

The mechanics of banking transactions

In the UK, international payments using the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system. This requires an IBAN number, which includes a sort code and bank account number, for international payments.

The process for a SWIFT bank transfer is as follows:

- Initiation – The sender instructs their bank to transfer funds internationally using the SWIFT network.

- Message Transmission – The sender's bank sends payment instructions securely through the SWIFT network to the recipient's bank.

- Recipient Bank Processing – The recipient's bank receives the payment instructions and credits the recipient's account accordingly.

- Confirmation – Both the sender and recipient receive confirmation of the transaction.

How to find a bank account number or sort code

Most of us don’t memorise our sort codes and bank account numbers, as so much of what we do now is automated and digitised. But if you ever need to find your bank details in a hurry, there are a few quick options:

- If you use cheques, both your sort code and account number will be printed on them

- On your bank statements – usually towards the top

- Online banking home screen or statements

- On your debit card (but not always!)

- Contacting your bank

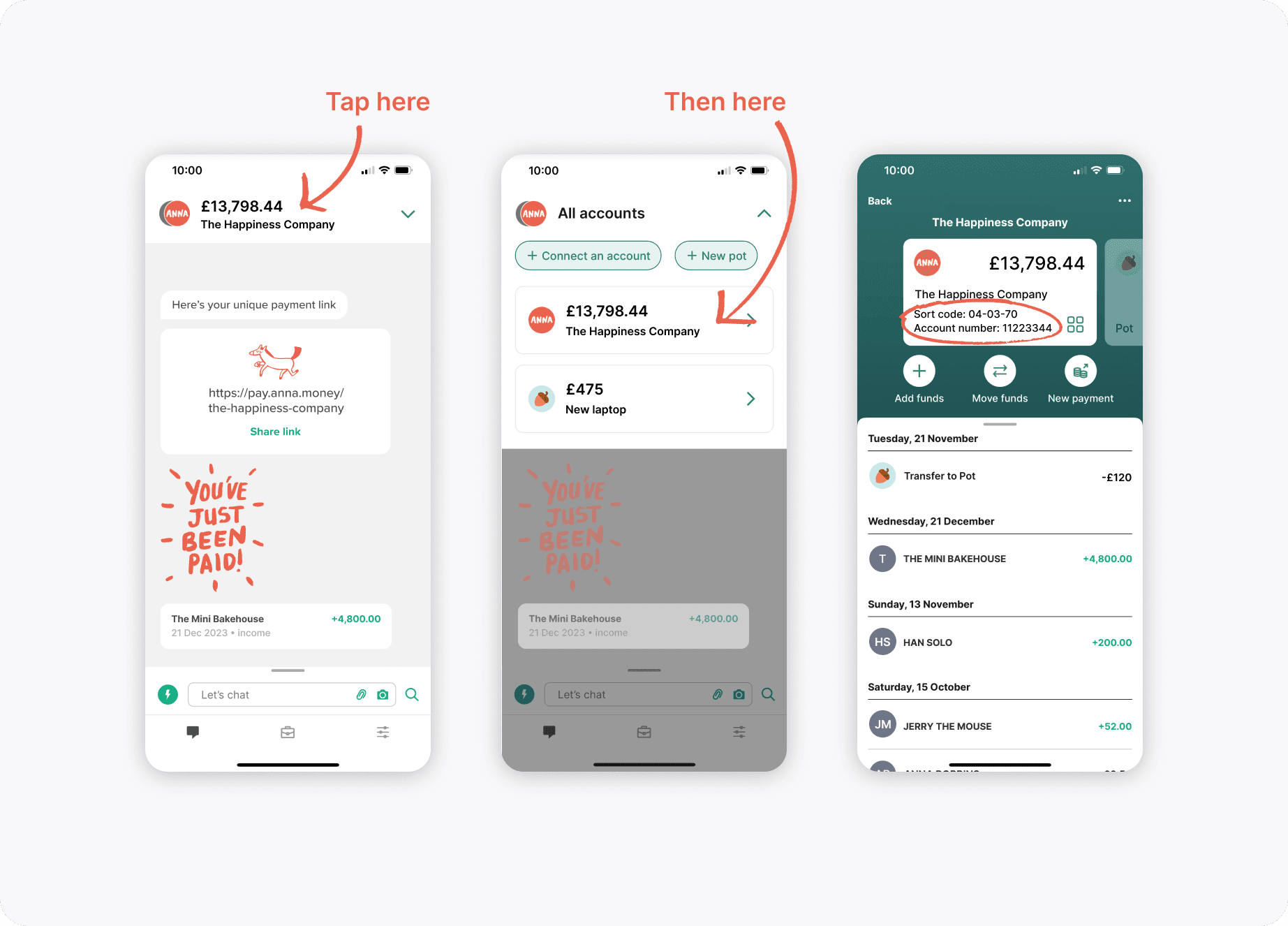

If you’re an ANNA customer, you can find your sort code and account number by going to the main menu and tapping on your name under the “Your accounts” section.

ANNA account details

ANNA account detailsFrequently Asked Questions

Are sort codes and routing numbers the same thing?

Sort codes and routing numbers serve similar purposes but are used in different countries. Sort codes are used in the United Kingdom to identify banks and branches, whereas routing numbers are used in the United States.

Where can I find the sort code and account number on my debit card?

You should be able to find your sort code and account number on your card. They’re typically printed at the bottom.

How do I find my sort code without a card?

You can find your sort code on your bank statements, through online banking or on cheques and paying-in books. You can also contact your bank directly for help.

How to find a sort code in an IBAN Number?

The IBAN (International Bank Account Number) contains the country code, the basic bank account number and the sort code. The sort code is often included immediately after the bank’s abbreviated name.

For example, if the sort code is 02-04-02 and the account number is 12341234, the IBAN will be: GB00ANNA02040212341234

How many digits typically make up a sort code, and does it vary across different banks?

Sort codes in the UK typically consist of six digits, although there may be variations depending on the bank or financial institution.

What should I do if I mistakenly enter the wrong sort code or account number in a transaction?

If you've mistakenly entered the wrong sort code or account number in a transaction, you should contact your bank immediately. Provide them with all the transaction details, including the incorrect account details. They’ll help you in retrieving the funds. However, most banks now require the bank account holder’s name, as well.

Are sort codes and account numbers the same worldwide, or do they vary by country?

Sort codes (called routing numbers in some countries) and account numbers are specific to each country's banking system. For example, in the UK, sort codes are used to identify banks and branches, while account numbers uniquely identify individual accounts. Other countries have their own systems and number formats for bank identification and account numbering.

Is it safe to share my sort code and account number with others - for example for receiving payments?

While sharing your sort code and account number is generally considered safe for receiving payments, there’s risk if they’re shared alongside other personal information. So we’d advise you to only share them with trusted parties and avoid sharing them publicly. But remember that you won’t be able to do business without sharing these details at some point!

Conclusion: Doing business Is impossible without a bank account number and sort code

You’ve probably realised it by now, but sort codes and bank account numbers are essential if you want to do business in the UK these days. It’s vital that yours are always on hand, but it’s also important that you look after them and only share them with trusted partners and customers.

Whether you need help opening a business account or forming a UK company, ANNA is here to make your life simpler and more secure.

Sources:

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)