Top tips to avoid manual errors in VAT preparation

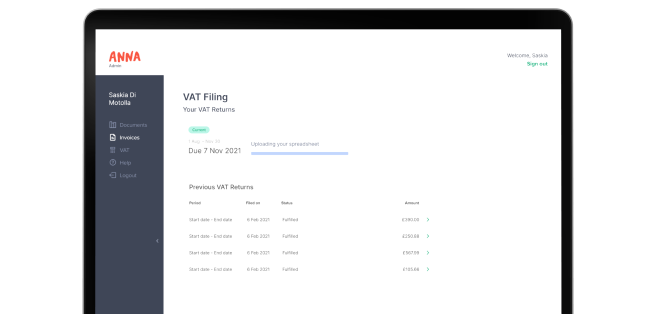

We’re happy to see a lot of business owners are using our VAT filing tool to submit their VAT returns. But, however good or intuitive the tool is, we understand it might be tricky not to miss anything in those steps you still need to do manually.

We are here to give you some tips and tricks on what to look out for when preparing your VAT returns, ways you can avoid mistakes and gain the luxury of time for your business.

1. Entering the wrong figures

Manual intervention in accounting of any kind comes with its risks. As attentive as one may be, with a keen eye on detail, errors are sometimes human nature. When preparing your VAT return in software such as a spreadsheet, it takes a lot of time and effort to make sure you calculate credible figures for your VAT return, along with ensuring you’re fulfilling all the requirements of Making Tax Digital for VAT.

But what if there was a way you could save time, ensure all MTD requirements were fulfilled and human error in calculation was avoided, would this interest you?

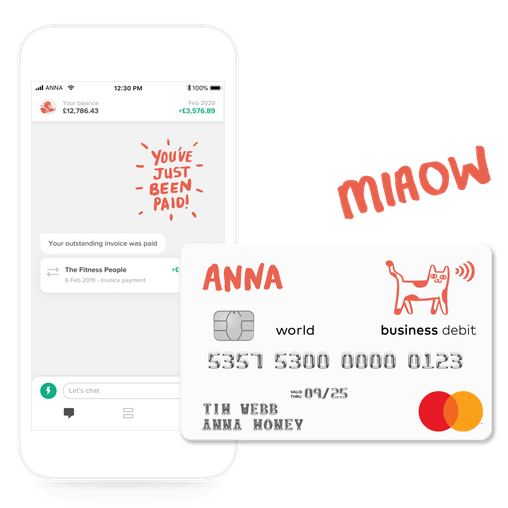

ANNA VAT automation tool automatically categorises your business transactions, directly from source, once you connect your business current account to the tool. It automatically prepares your VAT return figures from this, so all you need to do is check you’re happy with the figures and authorise ANNA to submit the VAT return for you at the click of a button.

2. Trying to reclaim input VAT without having a valid VAT invoice

You cannot reclaim input VAT on a purchase, unless you have a valid VAT invoice supporting your VAT claim. Make sure you always have your evidence in possession if you’re including a purchase transaction in your VAT return. If HMRC find you have claimed VAT on goods or services you don’t have evidence for, it will be seen as incompliant to VAT regulations and will risk incurring penalties.

An efficient and easy way to practice compliance can be by going through your list of transactions and checking you have a corresponding copy of your supporting evidence to claim it in your VAT return.

Or alternatively, you can have ANNA do this for you. If you use the VAT automation tool, it will match any purchase invoice you snap and send over via your phone. It will attach it to the corresponding transaction to ensure each item has supporting evidence, as a quality check for tax compliance.

3. VAT invoices need to be correct and issued on time

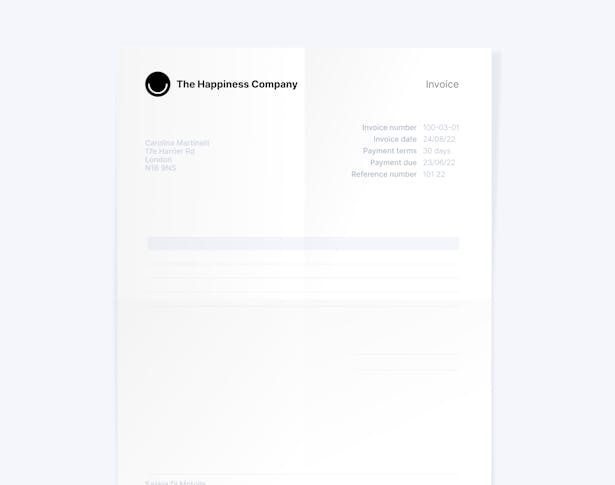

You need to send a full VAT invoice to your customers. It must include:

- a unique VAT invoice number that follows on from the previous VAT invoice

- your business name and address

- your VAT number (it begins with the letters GB and is followed by nine numbers

- invoice date

- tax point or “time of supply” if this is different to the invoice date

- customer’s name/trading name and address

- description of the goods or services supplied

- total amount excluding VAT

- total amount of VAT

- price per item excluding VAT (if applicable)

- quantity of each type of item (if applicable)

- discount rate per item (if applicable)

- VAT rate charged per item (if something is exempt or zero-rated you should make it clear that no VAT has been charged on these items).

A simplified VAT invoice, which can be issued for retail supplies below £250, need only include:

- a unique VAT invoice number that follows on from your previous VAT invoice

- your business name and address

- your VAT number

- tax point or “time of supply” if this is different to the invoice date

- description of the goods or services supplied

- VAT rate charged per item (if something is exempt or zero-rated you should make it clear that no VAT has been charged)

- Total amount including VAT.

If you want help issuing invoices, ANNA can assist you. ANNA can prepare the invoice for you with consideration to VAT regulations and requirements on an invoice and take it that step further by sending it to your customer. As soon as the money is received from the customer, ANNA will attach the invoice to the transaction and include it into your VAT return. You don’t have to do anything really, other than tell ANNA the customer details (only the first time as then ANNA will remember for the future) and watch the figures come together without manual intervention.

4. Failing to submit VAT returns and pay any VAT due on time

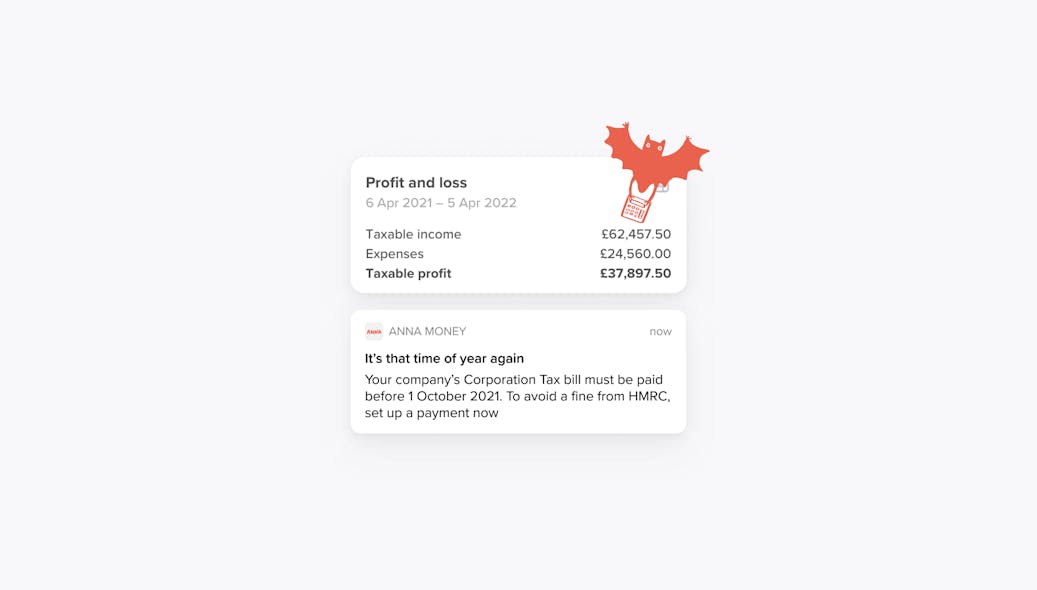

Failing to submit a VAT return or pay your VAT bill on time will result in incurred charges in the shapes of penalties issued by HMRC.

Keeping an alarm in your phone can be handy as a reminder to submit your return and pay your VAT on time. It may be handy to set a reminder to prepare it too.

With ANNA VAT automation tool, you wont need to do either. ANNA will prepare your VAT return for you and remind you to submit and pay. All you need to do is click the button to make it happen.

Now what sounds easier? You decide.

To get started with better VAT management, head to ANNA VAT automation tool.

Open a business account in minutes