As a company director, you may want to think about the most tax efficient way to pay yourself income from your business. You have the option to pay yourself a salary or pay yourself in dividends. But what difference does it make to your tax? Well, each type of income attracts a different rate of tax, which influences the amount of tax you are required to pay to HMRC. By considering how best to pay yourself and how much, you can save on the tax you end up paying.

So, what is Income Tax?

Income Tax is a tax you pay on your income. This can be on income from your employment or income gained via dividends.

PAYE

Most people pay Income Tax through PAYE, based on the salary paid for their employment. This is when your employer deducts Income Tax, National Insurance contributions and pension contributions from your salary before paying you. It’s all broken down in your payslip so you can see exactly where your money is going.

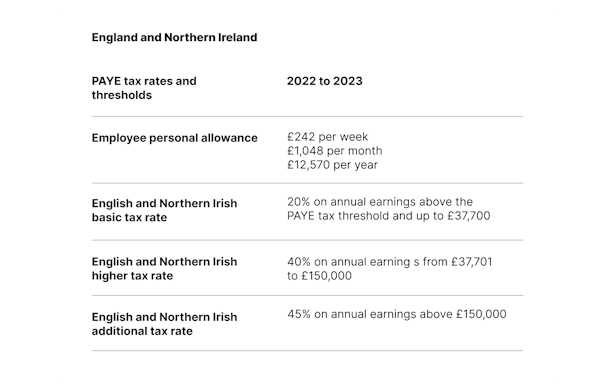

The standard Personal Allowance for income is £12,570, which is the amount of income you do not have to pay tax on. Any income you make above this allowance will incur a rate of Income Tax.

But once your income exceeds £100,000, then the personal allowance is decreased.

The amount of Income Tax deducted from an employee’s income depends on their tax code and how much of their taxable income is above their Personal Allowance.

Anything earned above £12,570 up to £37,700 per year will be taxed at 20%.

Anything earned above £37,701 up to £150,000 per year will be taxed at 40%.

Anything above £150,000 per year will be taxed at 45%.

Dividends

Dividends is an income which is distributed from the profits a business makes. It is different from salary income which is not only paid from profits.

A good point to note is that if a business does not make profits, it’s not possible to pay dividends to a company director.

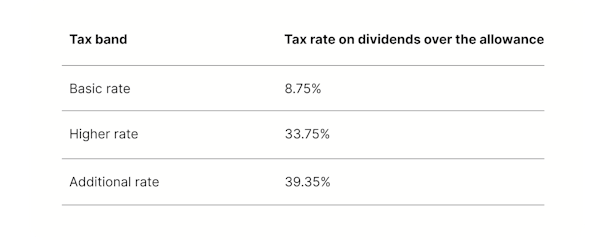

Dividends have their own personal allowance. You only pay tax on any dividend income above the dividend allowance, which is currently £2000.

The rate of tax you pay on dividends is different from the rate you pay on your Income Tax based on your employment income.

Once you have exceeded £2000 in your dividend income, you need to calculate your total income from salary and dividends. Once you have done this, you will know which tax band you fall into, and you can identify which tax rate will apply to your dividends income.

What about National insurance?

In addition to Income Tax, you will make a contribution to National Insurance on the income you make.

NIC thresholds

There are different ‘classes’ of National Insurance (NI). The class people pay depends on their employment status and how much they earn.

Employers and employees pay Class 1 National Insurance, depending on how much the employee earns.

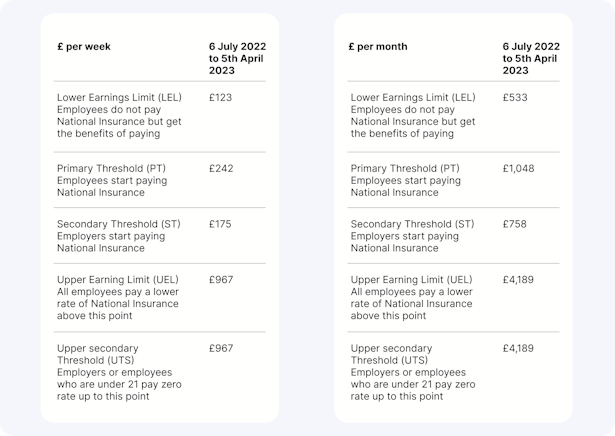

NIC explained…

LEL – if an employee earns below these amounts, they do not make NIC

PT – the threshold where an employee starts making NIC

ST – the threshold employers start making NIC

UEL – anything earned above this amount, employees will pay a lower rate of NIC

UST – if an employee is under 21, then the employer doesn't need to pay NIC until the employee makes above this amount

So if you consider the different rates of tax applicable to your salary income and dividend income, you can efficiently save tax you need to pay on your income!

Open a business account in minutes