Discover how to start a gardening business with tips on setup, legal steps, pricing, tools, and finding clients to grow your services fast.

In the fourth quarter of 2024, approximately 164,500 individuals were employed as gardeners or landscape gardeners in the United Kingdom, either directly or through self–employment, up from 149,800 in the previous quarter.

In recent years, more people have taken pride in their gardens, particularly after lockdowns and the rise in remote work.

With the country's deep-rooted appreciation for outdoor spaces, garden maintenance remains a consistently high-demand service. From simple lawn mowing to advanced landscape design, there are countless opportunities to grow a thriving business.

How to start a gardening business? Let’s find out!

Understanding the market

While spring and summer are peak seasons, many garden services remain relevant throughout the year. Winter pruning, hardscaping, leaf clearance, and seasonal planting plans can keep your calendar full even in colder months. Offering year-round packages can help you maintain consistent cash flow.

Who needs gardening services?

The customer base for gardening is wide and varied:

- Busy professionals often want low-maintenance gardens and rely on others to manage routine care.

- Elderly or disabled residents may need help with basic tasks to keep their gardens safe and functional.

- Landlords and letting agents often require garden clean-ups between tenants to maintain property appeal.

- Commercial clients such as pubs, hotels, and offices also invest in green space maintenance to create welcoming environments for guests.

Market trends to watch

There’s a clear shift in the UK toward sustainable, eco-conscious gardening. Clients are increasingly interested in creating wildlife-friendly gardens using native plants, rain gardens, or features like bee hotels and wildflower meadows.

Edible gardening is also trending. Homeowners want assistance building raised beds, planting fruit shrubs, or maintaining herbs and vegetables year-round.

In urban areas like London, Manchester, and Bristol, gardeners are helping clients maximise small or paved spaces with vertical gardens, smart containers, and minimalist designs. These trends offer an opportunity to specialise and differentiate your business.

Growing demand for design and outdoor living

Growing demand for design and outdoor living

Garden design is becoming more sophisticated. Many homeowners now view their outdoor areas as an extension of their home.

They want structured planting, clearly defined seating areas, ambient lighting, and aesthetic hardscaping.

This opens opportunities for gardening businesses to expand into design consulting or collaborate with landscape architects.

Legal requirements & company setup

Do I need to register a business? Yes. Before you start charging clients, you must register with HMRC or Companies House. Choose between:

- Sole trader: Quick to set up, minimal paperwork, personal liability.

- Limited company: Separate legal entity, added credibility, more admin, but safer financially.

➡️ Want to register your business quickly? ANNA makes it fast, simple, and affordable. You can register your Limited Company for free and open a business account at the same time.

The whole process takes just a few minutes, and you'll receive your certificate of incorporation within hours.

ANNA also offers ongoing support services, including tax submissions, VAT registration, PAYE setup, and even a virtual office address to keep your home details private.

Choose from flexible plans, such as Basic, Essential, or Total Support, depending on how hands-on you want to be.

Essential legal requirements:

- Public liability insurance protects you in case someone is injured or property is damaged while you're working. Most councils and commercial clients will ask for this.

- Employers’ liability insurance is a legal requirement if you employ staff or apprentices.

- Professional indemnity insurance is useful if you provide garden design, planting advice, or landscape consultancy.

- Waste carrier licence: If you transport grass, branches, or any green waste from job sites, you must register as a waste carrier with the Environment Agency. It costs around £150 and lasts three years.

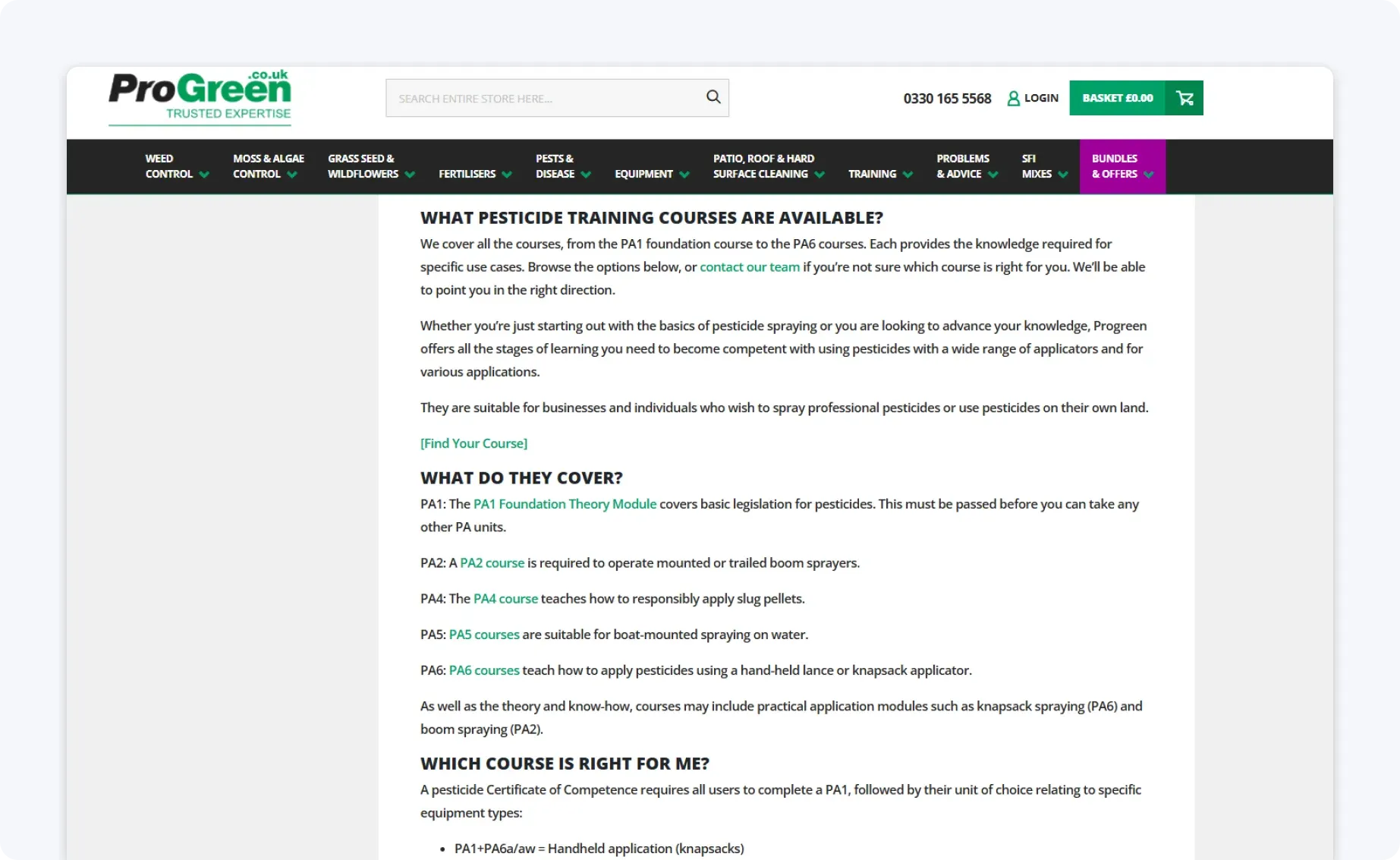

- Chainsaw certification: Using a chainsaw professionally requires training and certification under the Provision and Use of Work Equipment Regulations (PUWER).

- Pesticide certification: If you plan to apply chemical treatments (e.g., weed killers or insecticides), you must be trained and certified to handle them safely.

Ignoring these requirements can lead to fines, lost clients, or worse, so get it right from day one.

Costs & finances

Starting a gardening business is relatively affordable, especially when compared to other trades like plumbing or construction. That said, having a clear picture of your startup and running costs will help you plan better and avoid common financial pitfalls.

Initial investment breakdown

Your upfront costs will vary depending on whether you’re starting small or offering a full-service operation from the get-go. Here’s a rough guide to what you might expect:

That brings the total initial investment to somewhere between £4,000 and £7,500 for most solo startups.

Ongoing operating costs

After setup, you’ll need to cover regular costs to keep your business running. For example:

- Fuel and vehicle maintenance – especially if you cover a wide area

- Tool maintenance and consumables – like blade sharpening, oil, and line replacements

- Marketing expenses – online ads or leaflet printing

- Subscriptions – accounting tools, CRM software, or route planners

Planning for these recurring expenses ensures you don’t run into cash flow issues, especially during slower winter months.

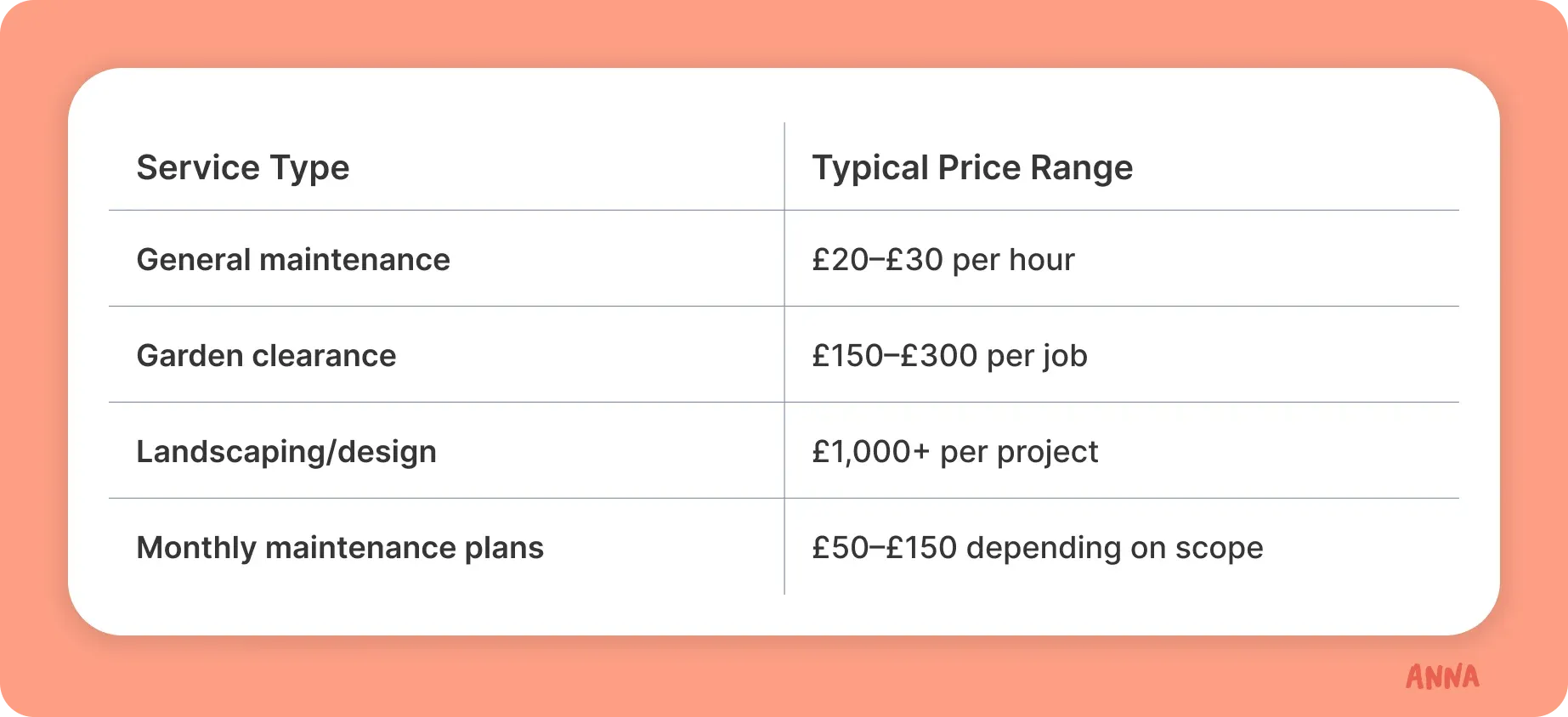

How to price your services

Pricing is crucial, and not just to cover your costs but also to reflect the quality of your work. Most gardeners charge by the hour, but fixed rates for specific jobs are also common.

Always factor in travel time, waste disposal, and equipment wear when setting prices. Don’t fall into the trap of undercharging just to win work because it’s a race to the bottom.

Profit margins & earnings

With careful planning and efficient scheduling, many gardening businesses maintain profit margins between 30% and 50%.

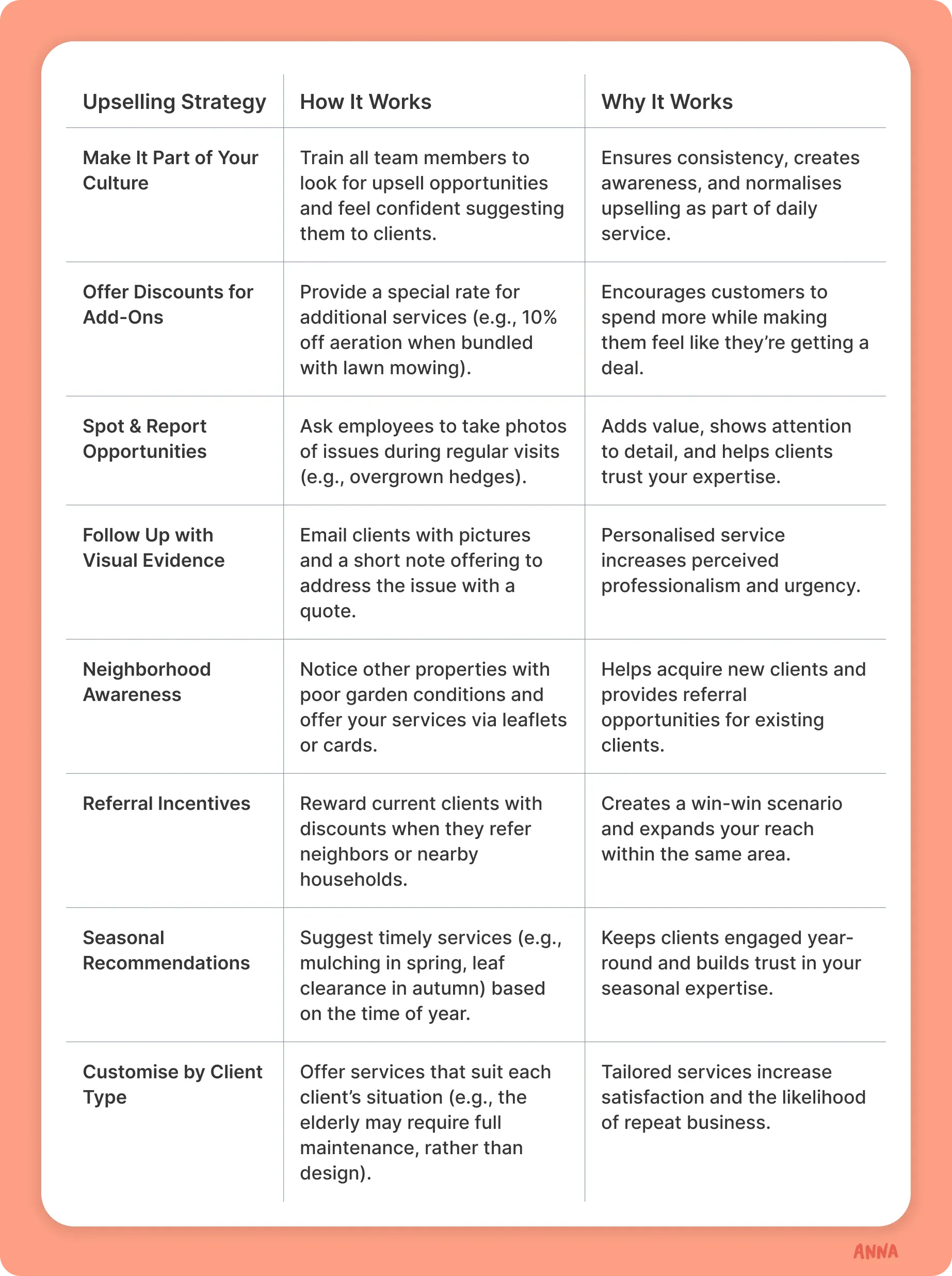

Streamlining your routes, taking on regular clients, and upselling seasonal services can help maximise earnings.

Funding & support options

Funding & support options

If capital is a concern, there are resources available to help:

- Government Start Up Loans – borrow up to £25,000 with a fixed interest rate and a 12-month repayment holiday.

- Local Enterprise Partnerships (LEPs) – offer grants, mentoring, and workshops to help small businesses launch and grow.

Client acquisition strategy

Getting your first clients is often the hardest part of launching a new gardening business, but there are proven methods to build trust, visibility, and a steady stream of inquiries. The key is to start hyper-local, focusing your efforts on the areas you can reach easily and regularly.

Start with local visibility

Begin by printing flyers or leaflets and distributing them to well-kept neighborhoods, especially those with older residents or families who may not have time for garden work.

You can also advertise your services on community noticeboards at local supermarkets, post offices, and garden centers.

Join community platforms like Nextdoor or local Facebook groups where residents often request recommendations for tradespeople.

Build a digital presence

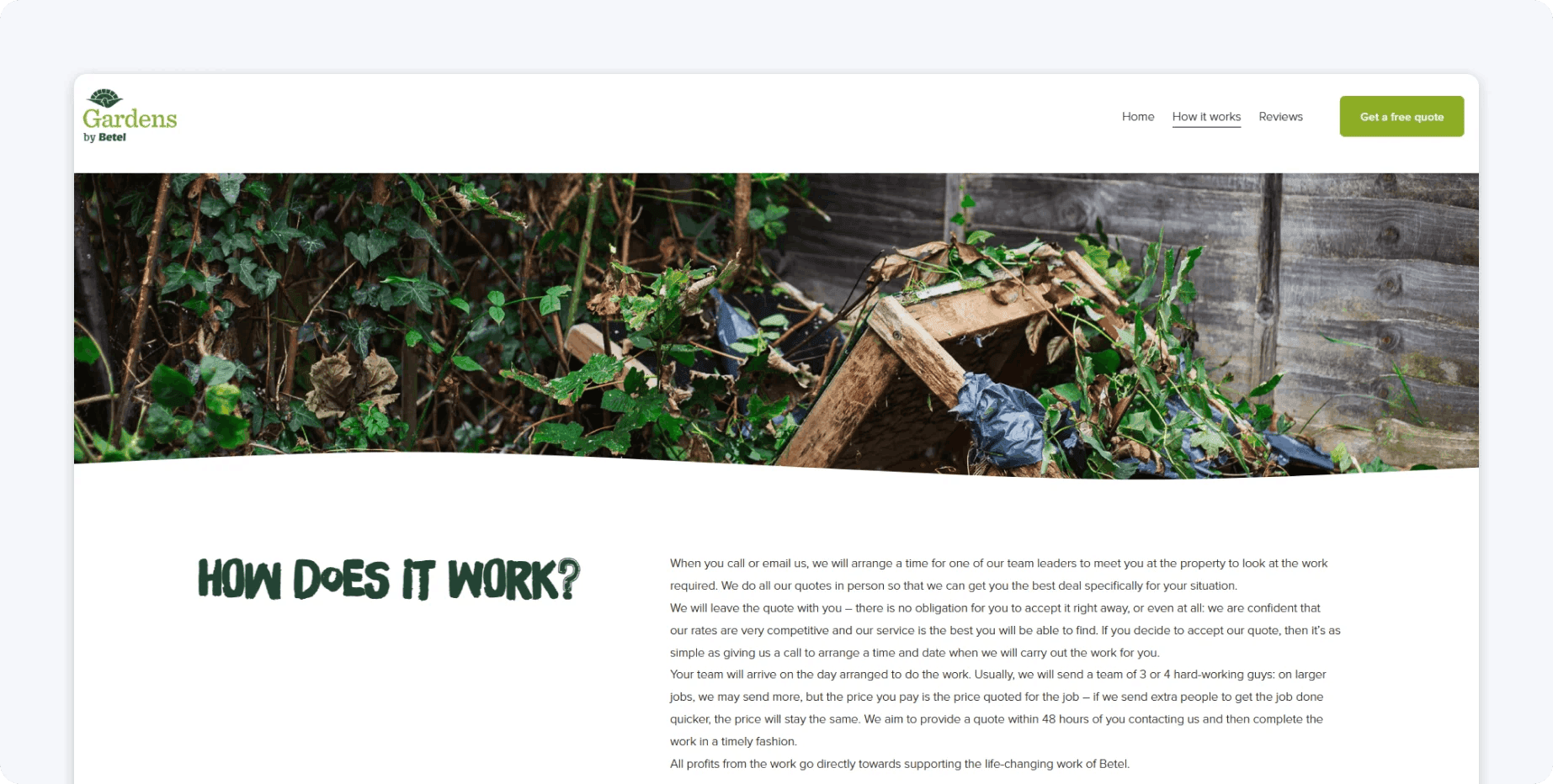

Creating a basic but professional website goes a long way. Include:

- Your services, pricing (if applicable), photos of completed work, and contact information.

- Make sure to claim and optimise your Google My Business listing so you appear on local searches and maps.

Build Trust and Credibility

Build Trust and Credibility

Once clients start booking, focus on providing excellent service with strong communication. Respond to inquiries promptly, arrive on time, and follow up with professional invoices or thank-you messages.

Wearing a branded uniform and driving a clean, marked vehicle also reinforces your professionalism.

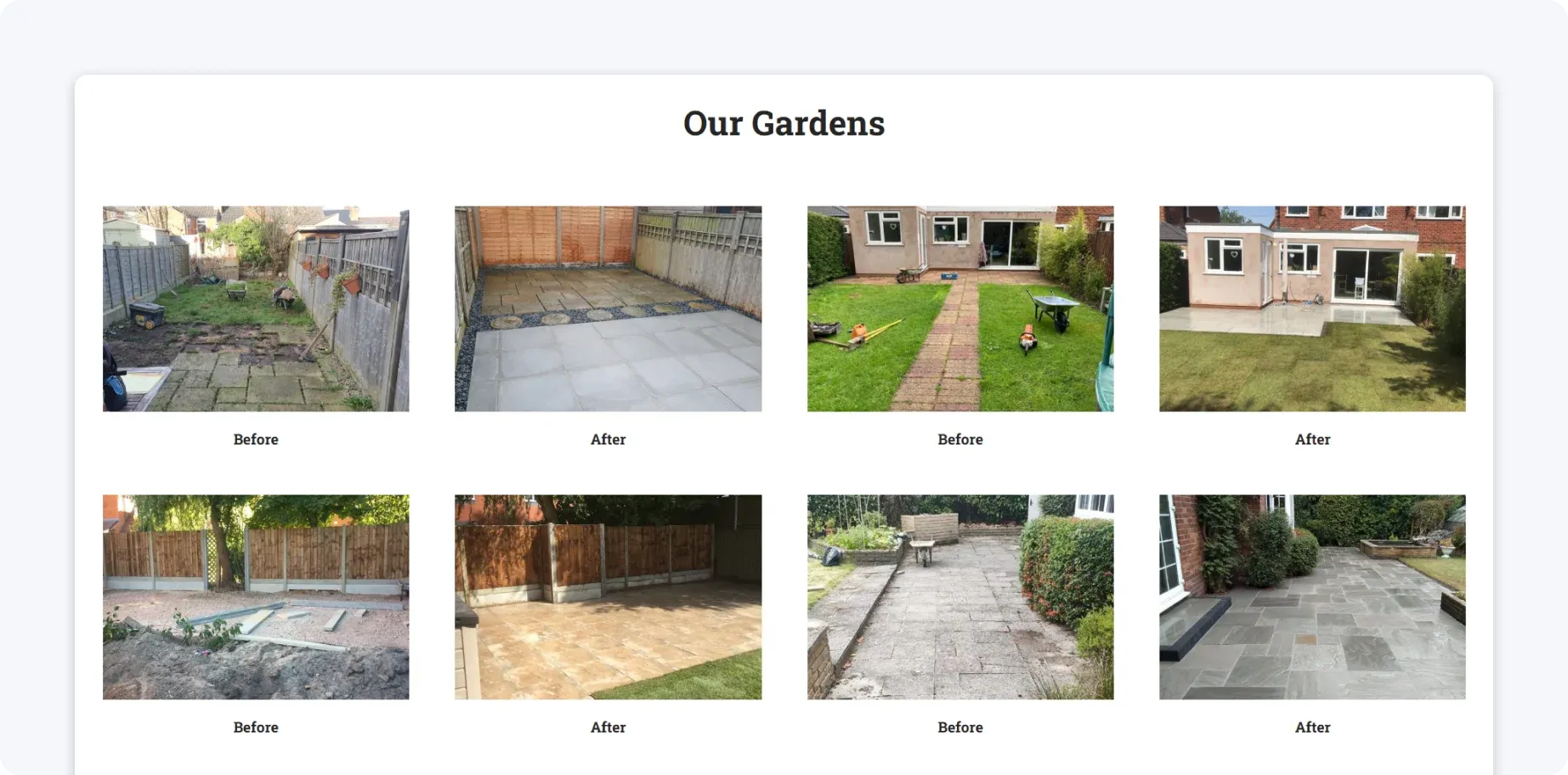

Before-and-after photos are powerful tools:

- Share them on social media to show results.

- Ask satisfied clients for testimonials and use them on your website or promotional materials.

The more evidence you have of quality work, the more likely prospects will trust you to handle their garden.

Operations & capabilities

Running a gardening business involves physical work, time management, and customer service. You'll need to plan each day efficiently to maximise earnings.

What skills are useful?

- Knowledge of plant care and pruning schedules

- Turf care (e.g., mowing patterns, scarifying)

- Communication and professionalism

- Time management and route planning

Certifications that can help your credibility:

- City & Guilds Level 2 Certificate in Practical Horticulture

- RHS Level 2 Certificate in the Principles of Horticulture

- NPTC/LANTRA for chainsaw and pesticide use

Daily processes include:

- Loading tools and planning your route

- Checking weather and adjusting schedules

- Completing jobs, invoicing clients, and logging payments

- Maintaining and cleaning tools after work

Solo vs hiring: Start solo to reduce costs. As your client list grows, hire a part-time gardener or apprentice. You may also subcontract for large one-off landscaping jobs.

Tools, systems & automations

Setting up your gardening business with the right tools and systems from the start can make your work more efficient, professional, and scalable.

You don’t need to spend a fortune, but investing in durable, high-quality equipment and using digital tools can save you time, reduce stress, and help you grow.

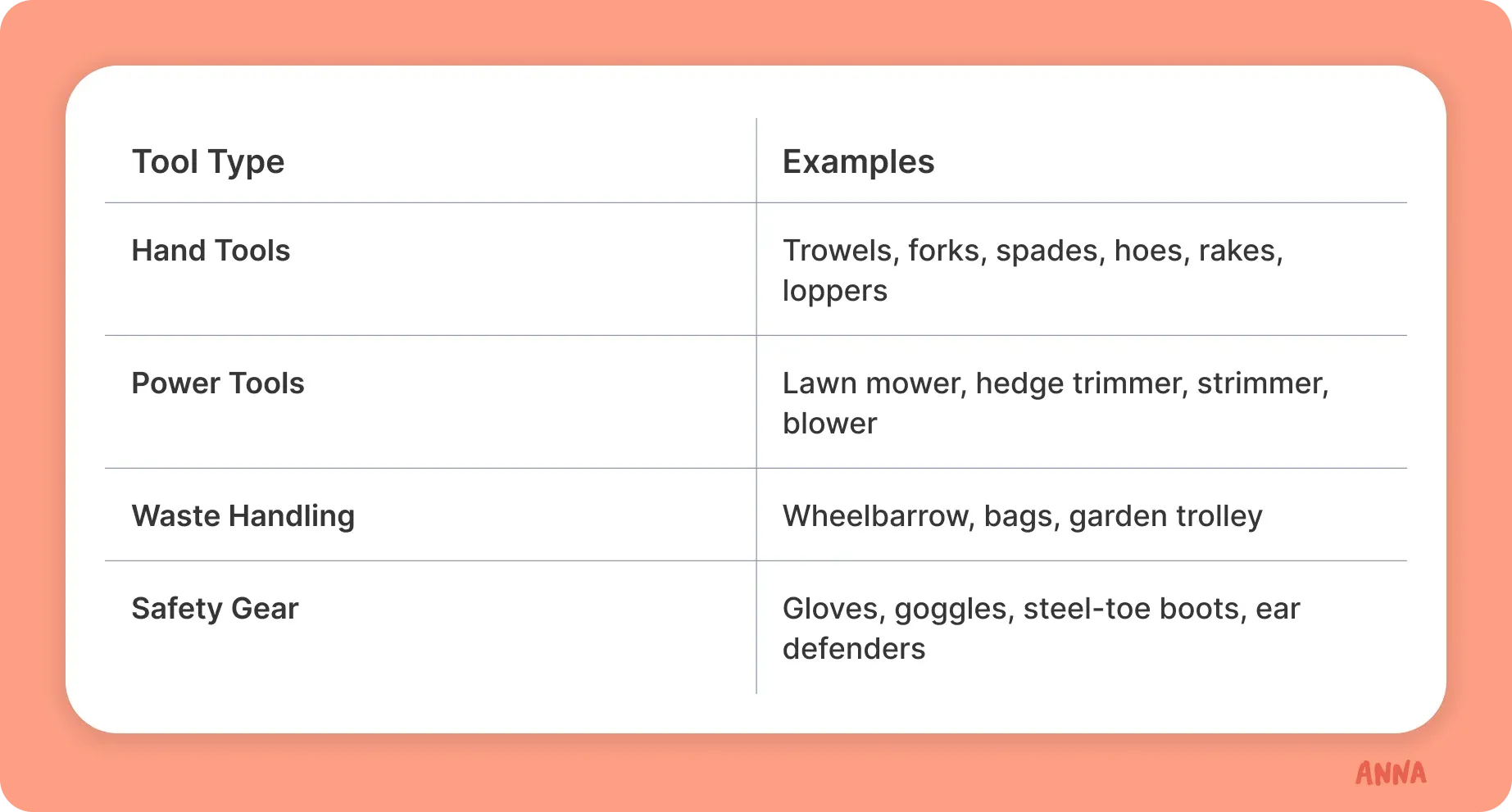

Core gardening tools

You’ll need a mix of hand tools and power tools to handle a variety of jobs. Starting with essential items gives you the flexibility to take on most tasks and expand your toolkit over time.

If your services include tree work or larger clearances, a chainsaw or pole saw will be necessary—but remember, these require proper training and certification under UK regulations.

Digital tools and software

Once your physical toolkit is in place, it’s time to look at systems to manage your business. These tools reduce administrative workload, streamline bookings, and enhance client communication.

These platforms allow you to stay organised without needing a full-time admin assistant. Many offer free trials or starter plans ideal for solo operators.

Automating key tasks

Once you’re established, automation helps reduce the repetitive work and keeps you focused on client jobs.

- Set up automatic invoice reminders so you don’t have to chase payments.

- Use email marketing tools to send out seasonal offers (e.g., spring tidy-up deals).

- Create templates for quotes and client communication to respond quickly and professionally.

- Automate appointment confirmations via SMS or email to reduce no-shows.

These systems save hours each week, improve your professionalism, and free you up to focus on delivering excellent service.

Taxes, accounting & compliance

Managing your tax and accounts properly will save you stress and money.

As a sole trader:

- Register for Self Assessment with HMRC

- File annual tax return and pay income tax + NI

- Keep accurate records of income and expenses

As a limited company:

- File annual accounts and Corporation Tax return

- Pay yourself via salary and/or dividends

- Maintain separate business bank account

When to register for VAT:

- Compulsory if your annual turnover exceeds £85,000

- Voluntary if it benefits you (e.g., reclaiming VAT on tools)

💡Invoicing and accounting with ANNA +Taxes

ANNA +Taxes gives you one place to manage your business finances. It’s purpose-built for small businesses, especially one-person or hands-on trades like gardening.

🔸Features that actually help

- Create and send branded invoices in seconds – Every invoice includes a payment link so clients can pay online or scan a QR code

- Accept card payments via Stripe – Makes it easy for residential clients or letting agents to pay quickly

- Snap, match, and sort receipts – Photograph receipts and ANNA automatically attaches them to transactions and sorts them into categories

- Tax Pots – Automatically reserve a portion of incoming payments for VAT, PAYE, or Corporation Tax so you’re never caught short

- Filing support – VAT, Payroll, and Corporation Tax filing done for you, direct to HMRC

- Confirmation statement and registration tools – If you're just starting, ANNA registers your company and handles your yearly returns

- Tax Terrapin, the AI-powered assistant – Ask questions anytime and get linked to HMRC guidance or answers in plain English

🔸 More than just software

- Bookkeeping Score – A visual tracker that shows how tidy your records are and what to fix

- Personalised calendar reminders – Built-in deadline prompts to stay compliant without an accountant

- Hands-off payroll – ANNA calculates and files your payroll if you pay yourself a salary

🔸 Pricing

- Start with a trial: £3/month for the first 3 months, then £24/month + VAT.

Final tips & common mistakes

Even with the right tools, licenses, and pricing strategy, your success will come down to the day-to-day choices you make.

What successful gardeners do well:

- Be reliable and consistent. Clients appreciate punctuality and steady quality, especially if they rely on you for regular visits.

- Present yourself professionally. Branded uniforms, a tidy van, and polite communication make a lasting impression.

- Focus on building relationships. Many clients will refer you to friends and neighbors if they like your work.

- Keep learning. Trends shift, especially with eco-conscious gardening. Attend local workshops or pursue additional certifications.

There are also some common mistakes to avoid:

- Underpricing your services. Charging too little may get you early work, but it can quickly lead to burnout and unsustainable margins.

- Skipping insurance. One accident could lead to thousands in damages or legal issues.

- Overcommitting. Taking on more than you can handle, especially without reliable transport or help, can damage your reputation.

- Neglecting safety and certification. Improper equipment use or handling pesticides without training can lead to fines or injury.

Final thoughts

Starting a gardening business in the UK can be a rewarding path if you're prepared with the right tools, services, and strategies.

From understanding your market and legal obligations to finding clients and offering seasonal upsells, there's a lot to manage, but also a lot of opportunity to grow.

Don’t let the admin hold you back. ANNA makes it easier to run your business day to day – handling registration, invoicing, taxes, expenses, and more, so you can focus on delivering top-notch gardening services.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)