When you start a new business, it’s always best to open a separate business account. If you’re operating as a sole trader, a separate business account is useful for keeping your business and personal finances separate. If you’re operating as a Limited company, a separate business account is actually a legal obligation; you can’t keep your business funds in your personal account.

- In this article

- Barclays business account review

- Types of Barclays business accounts

- Start-up business account

- Business account for turnover of up to £400k

- Business account for £400k–£6.5m turnover

- What do you need to open a Barclays business account?

- Be prepared to wait

- Open an ANNA account in under 10 minutes

Barclays business account review

Barclays is one of the UK’s largest high street banks, offering a range of business bank accounts tailored to companies at different stages of growth. In this review, we’ll explore the key features of Barclays accounts, who they’re for, and whether they’re the right fit for your business.

Types of Barclays business accounts

Barclays currently offers three main types of business accounts:

- Start-up business account

- Business account for turnover of up to £400k

- Business account for £400k-£6.5m turnover

Start-up business account

This is an account for new businesses. If you’re a sole trader or a sole director LTD company you can apply for a Start-up business account online or in the Barclays app. If your company has more than one director, you can request a callback.

You get:

- Barclays banking app

- Business debit and credit cards

- Free invoicing and account software from FreshBook

- Simple, secure online banking

- UK-based business managers

- Free digital banking for the first 12 months

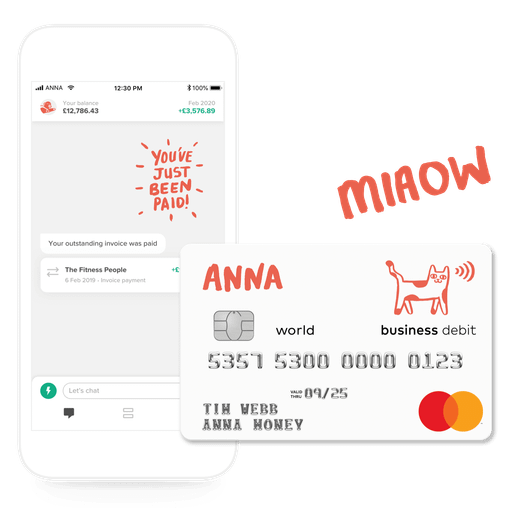

ANNA also offers a Start-up Business Account If you’re starting a new business and looking for an easy, fast and modern alternative to traditional banks, ANNA’s Start-up business account could be the perfect fit.

We’re a start-up ourselves, so we know exactly what new businesses need – because we’ve been through the same journey. From setting up your company to chasing your first invoices, we’ve built ANNA to solve the real problems that start-ups face.

Business account for turnover of up to £400k

This account is for more established businesses and Barclays can help with cash flow and lending, international expansion, different payment solutions and other opportunities for growth. You also get the same basic features as the Start-up account.

Business account for £400k–£6.5m turnover

This is an account for bigger businesses and Barclays provides a team of banking experts and Business Managers to work with you.

What do you need to open a Barclays business account?

- You need to be at least 18 years old

- You need the right to live permanently in the UK

- One document to prove your identity (e.g. passport or driving license)

- One document to prove your UK address (e.g. full driving license or council tax bill)

- If you’re a LTD company, you will need to provide your company registration documents

Be prepared to wait

At the moment the main obstacle to opening a Barclays business account is time. On the Barclays website it says it can take up to 10 days to open an account, however there are reports that it can take longer.

Open an ANNA account in under 10 minutes

In contrast, you can open an ANNA account in under 10 minutes. You’ll need ID and proof of address ( additional information about your business will definitely speed up the process) and you’re good to go.

You can be a sole trader or LTD company. You get a Debit card, virtual cards you can use instantly, as well as invoicing and receipt scanning tools. You can easily sort your expenses with ANNA and there’s even a payment link so you can get paid by QR code or online. There is 1% cashback on a range of business purchases, and you can use Apple Pay and Google Pay to pay with your phone.

ANNA also has award-winning 24/7 customer support in Cardiff, which may be one of the reasons we score 4.7 on Trustpilot, the best in our field. So if you’re looking for a business account, ANNA is a very good place to start.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)