Sit down at desk. Get up and tidy round. Sit back down at desk. Decide to hoover entire house. If this is your usual approach to anything financial admin related, your self assessment might be haunting you right now (although we’re sure your house is looking great). And you’re not alone: the stats show that one in five people leave their tax return to the last 48 hours before the 31 January deadline. Cut the stress and get it out of the way painlessly with our step-by-step guide.

Filing for self assessment tax - when should you do it?

It might seem obvious, but check you actually need to send in a tax return at this point. They’re submitted for tax years, not calendar years, so you only need to submit a tax return by 31 January 2020 for any untaxed income earned in the year to 5 April 2019. If you became self-employed after this, you’re reprieved until next year. Phew.

If you do need to submit one and you fail to meet the deadline, unfortunately you might be landed with one of HMRC’s famous £100 fines. Don’t forget you’ll also need to pay any tax you owe by 31 January, so make sure you’ve got the funds to cover it.

Register with HMRC, if you haven’t already

Anyone who’s self employed needs to register with HMRC for self assessment. If you’re filing for 31 January, you should definitely have done this bit by now as the deadline for registering was 5 October. But if you haven’t (tsk, tsk) do it ASAP on the Gov UK website and you might still avoid a fine.

If you’re about to start working for yourself and thinking ahead, you’ll need to register for self assessment by 5 October 2020 so HMRC can issue you with your Unique Taxpayer Reference (UTR). You use this to create a Government Gateway account, which allows you to file your tax return online. Registering with HMRC also means you’ll be issued with a notice to complete your self assessment at the right time, plus regular tax statements.

If you’ve been self employed and submitted a tax return before, you may already have a UTR. You can just use this to register and set up your account.

Get your paperwork ready

Ok, let’s do this. In a nutshell you need details of all your income and expenses over the tax year, plus some other bits and bobs.

- Get ready:

- your 10-digit Unique Taxpayer Reference

- your National Insurance number

- Invoices and bank statements showing any untaxed income you earned over the year, including self-employed income, dividends on shares and interest on savings

- Receipts or bank statements detailing any expenses relating to your business – see what you can claim for

- If you also earned money from paid employment, your P60 showing your taxed income for the year

- If you left paid employment during the tax year, your P45 showing your income and tax up to the date you left

- If you let out properties, records of any rental income you received

- If you sold property or shares, details of any capital gains you made

- Any contributions to charity or pensions that might be eligible for tax relief

Fill in the online form (it’s not that scary)

So you’ve got your login details and dug out all the paperwork you need? Congratulations! You’ve done the hard bit. The form itself is actually pretty easy. HMRC obviously want to avoid thousands of queries from befuddled traders in January, so the form is very clear and straightforward to complete. All the calculations are done for you - you just need to plug in the numbers, press submit and wait for the (hopefully not too) grand total.

A note for traditional types - the 31 January deadline is only for online submission. If you prefer old-school paper returns, you’ve missed the boat unfortunately, as these should have been filed by 31 October. At least you get to save some trees.

HMRC would prefer to avoid thousands of queries from befuddled traders, so the form is clear and straightforward to complete.

Be an early bird next year

That wasn’t too bad, was it? Now we don’t want to get preachy on you, but it’s always a good idea to file your tax return as early as possible. You’ll know how much tax you owe well in advance, so you can get the funds ready. You’ll also have time to get advice from an accountant or HMRC if you need to - and it’s a lot easier to get hold of those guys in June than it is in January, when the phone lines are jammed. So join the smug brigade, get it in early and enjoy a stress-free Christmas next year - even if your house is slightly less than spotless.

Read the latest updates

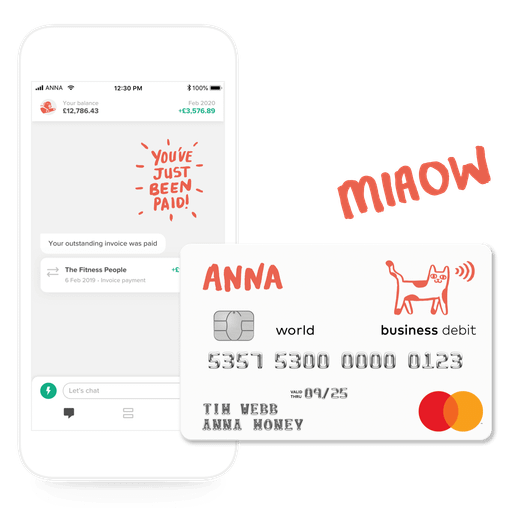

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)