For lots of small businesses across the UK, accounting isn’t just about following the rules and staying compliant, it’s the basis for good decision-making, cash flow control and making sure you submit your tax on time. So it’s not just about your legal obligations, it’s about making the most of your business finances.

- In this article

- What is business accounting software?

- Key Features to Look for in Small Business Accounting Software

- Top Small Business Accounting Software in the UK

- Specialised Accounting Software

- Cloud-Based vs Desktop Accounting Software

- Alternatives to Small Business Accounting Software

- ANNA – a simpler way to manage business finances

- Conclusion

- Frequently asked questions

The good news is that in 2025 the market for cloud accounting tools is very competitive, with plenty of options for sole traders, micro-companies and growing limited companies. That’s important, because the right software reduces errors, automates routine work, improves your understanding of your business finances and keeps you compliant with the UK’s Making Tax Digital (MTD) regime.

This guide explains what to look for and provides an up-to-date comparison of leading products available to UK businesses.

Accounting and bookkeeping software for business replaces (or in some cases works alongside) spreadsheets and paper processes thanks to automation for invoicing, bank feeds and reconciliation, and VAT returns, as well as things like payroll integrations, stock tracking and management reporting.

There are lots of options to make accounting simpler and make running your business less stressful (and hopefully more profitable).

What is business accounting software?

Why is accounting software increasingly important?

In the UK, VAT-registered businesses already have to use MTD-compatible software to submit VAT returns, and MTD for Income Tax (MTD ITSA) is being phased in by HMRC, starting in 2026. That means that anyone who does a Self Assessment tax return, and who has an income above the threshold, will have to start using MTD-compliant software.

Under MTD for Income Tax, you’ll no longer file a single annual return. Instead, sole traders and landlords will need to send quarterly updates and a final declaration through compatible software – all starting from April 2026.

How does accounting software work?

In most cases you connect your current account (or business account) and bank cards so your transactions are imported automatically into the software. The transactions are then categorised (e.g. income vs expenses), and you match them to your statements. From there you can issue invoices, record bills, run real-time dashboards and submit VAT returns directly to HMRC.

What are the benefits of using business accounting software?

- Time savings and automation – think automated invoicing, reminders, and receipt capture.

- Reduced errors – built-in validation and audit trails reduce mistakes compared to manual spreadsheets.

- Better visibility of your business – you get live dashboards and reports for cash flow, P&L and aged receivables.

- Scalability – you can add features (projects, inventory, multi-currency, payroll) as you grow.

- Compliance – HMRC-recognised MTD VAT filing and support for UK requirements such as CIS and RTI (via payroll add-ons).

- Easy collaboration – you can invite your accountant to securely review and adjust entries.

Do I need business accounting software?

Probably! If you raise more than a handful of invoices, or if you’re VAT-registered, software quickly becomes essential. Even sole traders can benefit from automated expense capture and tidy records for their Self Assessment. You may not need comprehensive (and expensive!) software, but you’ll almost certainly need some kind of software to stay on top of your accounts.

Why Use Accounting Software?

Three things: accuracy, efficiency and UK compliance. Software reduces your admin, gives you clarity and helps you stay on the right side of HMRC rules.

Types of Accounting Software

- Cloud-based accounting software – access anywhere; updates, security and backups handled by the provider.

- On-premise (desktop) accounting software – installed locally on your PC or laptop; more control but more maintenance.

- Open-source accounting software – flexible and low cost, usually needs more technical support.

- Enterprise accounting software – advanced features for larger organisations and groups.

- ERP accounting software – accounting module inside a broader ERP suite (inventory, HR, projects, etc.).

How do I choose the best accounting software for my UK business?

How to pick a UK accounting software provider? Prioritise HMRC recognition for VAT and (if that applies to your business) Income Tax submissions. Also, think about UK-relevant features and support hours that work for UK time zones - you don’t want to be in the position where you need help but you’re waiting for the support team in New York to wake up!

How to choose the right accounting software for your business? Think about your size, sector, transaction volume and plans to scale. Consider:

- Pricing (tiers, VAT, add-ons, user seats)

- Bookkeeping capability (bank feeds, rules, receipt capture)

- Accounting (double-entry, accruals/cash, journals)

- Accounts payable/receivable (bills, approvals, reminders)

- Financial reporting (P&L, balance sheet, cash flow, budgets/forecasts)

- Advanced features (projects, inventory, multi-currency, CIS)

- Software integrations (payments, e-commerce, CRM, payroll)

- Mobile capabilities (invoice/receipt capture on the go)

- Help and support (channels, response times, onboarding)

- Billing/invoicing (templates, online payments, late fees)

- Payroll (native or add-on/integration)

- Stock management (buy/sell businesses)

- Reporting (dashboards and exports)

- CRM (built-in or via integration)

- VAT (MTD VAT recognition and scheme support).

Key Features to Look for in Small Business Accounting Software

Ease of Use

Small teams don’t have time for steep learning curves. Clear menus, guided setup, sensible defaults and automation rules lower the admin burden. If it takes you a year to master the software, it probably isn’t suitable for you. That’s why ANNA’s +Taxes service is so attractive; it’s intuitive, easy-to-use and has 24/7 customer support.

Cost

Most suppliers use monthly subscriptions; some offer annual discounts. Watch for sneaky add-ons (payroll, extra users, advanced analytics) and promotional pricing that reverts after a fixed period.

Scalability

Your needs will change as your company grows. Choose a platform with room to grow (think of things like projects, inventory, multi-currency, additional users) so you don’t have to migrate later.

Integration with Other Tools

As a business you probably use lots of different services, and it’s useful if your accounting software can talk to them. Look for plug-and-play links to payment processors (e.g. card and direct debit), online stores, POS, and CRM. You want as much as possible to happen automatically.

Customer Support

UK-based support really helps when filings approach. Some vendors offer onboarding sessions and accountant portals for easier collaboration, and ANNA offers 24/7 UK-based customer support, with a typical response time of less than a minute.

Compliance with UK Regulations

Make sure the product is HMRC-recognised for MTD VAT today and has a credible roadmap for MTD Income Tax if you think you’re going to need it.

Top Small Business Accounting Software in the UK

QuickBooks Online

QuickBooks Online is a popular cloud-based accounting tool for UK businesses. It helps you manage invoices, expenses, cash flow, and VAT – all in one place. It’s HMRC-recognised for Making Tax Digital, so you can file your VAT returns directly from the app.

Features

- Create invoices, send estimates, and take online payments with automatic reminders.

- Connect your bank to track spending and match transactions automatically.

- Capture receipts on your phone and keep your books up to date.

- Manage customers, suppliers, and basic projects.

- File MTD VAT returns straight to HMRC.

- Add payroll and accountant access if you need them.

Pricing

Plans start around £10/month for sole traders, rising to £115/month for larger businesses (excluding VAT). QuickBooks often runs discounts - sometimes up to 90% off for the first few months - so check the latest offer before signing up. A 30-day free trial is occasionally available, though not always alongside the best deals.

Free trial or free plan? Promotional discounts are common; a 30-day free trial is sometimes available, but not always alongside the best introductory discounts. See QuickBooks pricing →

Pros and Cons

- Pros: Broad feature set, strong integrations, HMRC-recognised VAT filing, good accountant ecosystem.

- Cons: Pricing steps up as you scale; some advanced features reserved for higher tiers; offers and list pricing change periodically.

Xero

Xero is one of the UK’s most popular accounting platforms, known for easy bank reconciliation, great app integrations and strong compliance tools. It’s HMRC-recognised for MTD VAT, and price changes are coming from 1 September 2025.

Features

- Bank feeds and quick reconciliation

- Invoicing, quotes, bills and expenses

- Project tracking on higher plans

- MTD VAT submissions to HMRC

- Payroll available through add-ons or integrations

Pricing

There are a range of plans: Simple £7, Ignite £16, Grow £33 (rising to £37), Comprehensive £47 (to £50), Ultimate £59 (to £65). Xero regularly runs short-term UK discounts (e.g. 90% off for three months) and offers a 30-day free trial. See Xero pricing →

Free trial or free plan? 30-day free trial; no permanent free plan for businesses.

Pros and Cons

- Pros: Strong compliance features, stable platform, rich app marketplace; transparent pricing updates announced in advance.

- Cons: Some limits on lower tiers; multi-currency and advanced analytics live in higher plans.

FreshBooks

FreshBooks is ideal for service-based businesses that bill for time or projects. UK users can submit MTD VAT returns directly to HMRC, which makes tax time easier.

Features

- Time tracking, projects and client portal.

- Automated invoicing and recurring retainers.

- Expenses with receipt capture; easy reports for tax time.

- MTD-compliant VAT submission in the UK (on supported plans).

Pricing

Plans include: Lite £15, Plus £25, and Premium at £35 per month. Offers often include 50% off for three months. There’s a 30-day free trial but no permanent free plan. Check the UK page for current pricing and promotions. See FreshBooks pricing →

Free trial or free plan? Free 30-day trial; no permanent free plan.

Pros and Cons

- Pros: Excellent for time-based billing and retainers; intuitive UI; MTD VAT support for UK.

- Cons: Inventory and advanced stock are limited; payroll only handled via integrations.

Sage Business Cloud Accounting (Sage Accounting)

Sage is a well-established UK brand with plenty of local UK-related features. In 2025, Sage states that all three Sage Accounting plans now include Sage Payroll and Sage Copilot (AI assistant) at no extra cost; list pricing starts from £18 per month (excl. VAT) with periodic introductory discounts. Independent overviews commonly show that Start is £18, Standard is £39 and Plus is £59 as typical post-offer rates.

Features

- Unlimited sales invoices, bank reconciliation and UK VAT (MTD-ready).

- Cash-flow forecasting and custom reports on Standard and above.

- Payroll included across plans, with per-employee charges once limits are exceeded.

- Optional CIS support, multi-currency and inventory on higher tiers.

Pricing

Sage has a range of plans: Start £18, Standard £39, Plus £59 per month (excl. VAT). They often have 90% off for six months, or a one-month free trial. See Sage pricing →

Free trial or free plan? Trial offers are available (although it varies by promotion). There’s no permanent free plan for businesses.

Pros and Cons

- Pros: UK-centric feature set; MTD VAT; payroll and AI assistant included; clear path for construction/CIS needs.

- Cons: Interface can feel utilitarian; some advanced analytics/inventory require higher tiers.

Zoho Books

Zoho Books combines excellent value with lots of functionality and close ties to the wider Zoho suite. Crucially for UK users, Zoho Books is HMRC-recognised for MTD VAT and (as of mid-2025) announced HMRC recognition for MTD Income Tax, with guidance for UK sole traders.

Features

- Invoicing, bills, banking with rules and reconciliation.

- Inventory (on higher tiers), projects and client portal.

- MTD VAT filing and UK VAT configuration; MTD ITSA capabilities announced for eligible users.

- Integrations with payments and the Zoho ecosystem (e.g., CRM).

Pricing

UK pricing typically includes a Free plan (1 user and an accountant) and paid tiers from Standard at £12, Professional at £24, Premium at £30, Elite at £99 and Ultimate at £199 per organisation/month.. A 14-day free trial is also on offer. See Zoho Books pricing →

Free trial or free plan? Yes - both are available (free plan with limits; 14-day trial for paid tiers).

Pros and Cons

- Pros: Great value; HMRC-recognised MTD VAT and ITSA; strong automation and integrations; generous plan ladder.

- Cons: Payroll for UK typically via third-party integrations; some advanced analytics live in higher-priced tiers.

Other options worth considering

- FreeAgent – UK-centric accounting with time tracking and project tools; standard pricing and frequent introductory discounts; free for some customers through specific providers. 30-day trial available.

- QuickFile – free for small/medium accounts (under 1,000 ledger entries over 12 months); HMRC MTD VAT support; paid tiers for larger volumes and power-user features.

- Clear Books, Crunch, GnuCash, VT Cashbook, ZipBooks, Adminsoft Accounts – niche or lightweight options that can suit micro-firms (depth and UK compliance vary; you should always verify MTD status).

- ANNA. ANNA’s business account tracks your transactions and gives you great visibility and the +Taxes product feels like an accountant in your pocket - you can file your taxes directly from ANNA.

Specialised Accounting Software

Accounting Software for Retail Businesses

If you run a retail business, you may need specialist accounting software. It should prioritise inventory (FIFO/average costing), multi-location stock, and POS integration. Many retailers combine Xero or QuickBooks with dedicated inventory or POS apps. Sage’s upper tiers include stock tools; Zoho Books Premium/Elite add inventory and fulfilment.

Accounting Software for Real Estate Businesses

These should focus on rent schedules, deposits, service-charge accounting and multi-property reporting. General-purpose tools can work - if they’re paired with property add-ons or a specialist system.

Accounting Software for Construction Businesses

With these, look for job costing, project profitability, progress/retention billing and CIS support. Sage’s Standard/Plus and Xero with specialist add-ons are popular combinations for contractors needing CIS processing and staged invoicing.

Cloud-Based vs Desktop Accounting Software

Advantages of Cloud-Based Software

Cloud-based accounting software lets you manage your finances, bookkeeping, and tax tasks online - anytime, anywhere, from any device. You get automatic updates, built-in resilience, easy collaboration and scalable tiers. Cloud tools are well placed for MTD because they submit VAT digitally via direct HMRC connections.

Advantages of Desktop Software

With desktop software, you get more control over storage and offline access, and potentially lower long-term cost for static setups. However, you have to handle backups, updates and secure submission pipelines for VAT - they won’t happen automatically.

Free Accounting Software

QuickFile is free for smaller ledgers (under 1,000 entries in 12 months) and supports MTD VAT filing, which is rare at the free tier. Zoho Books also offers a free plan with limits, which is useful for sole traders testing the waters. Always check HMRC recognition for the features you intend to use.

Low-Cost Accounting Software

Entry tiers from Zoho Books, QuickBooks Sole Trader/Simple Start, Xero Ignite and Sage Start often cover core needs at accessible prices (depending on promotions).

Alternatives to Small Business Accounting Software

Not every micro-business needs a full service right away. Some owners prefer a lighter toolkit for invoicing, receipt capture and basic categorisation, and later step up to full accounting. Below we highlight a dedicated UK option and then review full accounting suites above.

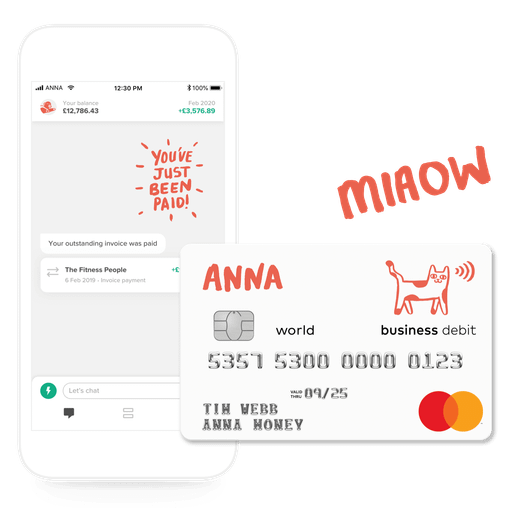

ANNA – a simpler way to manage business finances

ANNA provides a UK business account with built-in invoicing, receipt capture, expense management and useful automations for setting money aside for tax. You can give your accountant read access to your transactions, and add co-worker cards to control spending.

Plans start at £0 per month on a Pay As You Go basis, with transparent terms published on the ANNA site. Even though it’s not accounting software, it does allow you to seamlessly manage your business finances.

ANNA also offers +Taxes, an add-on that brings VAT filing, payroll calculations and Corporation Tax support into one subscription (intro £3/month for three months, then £24/month + VAT) – including reminders, automated categorisation and a personalised tax calendar.

This makes ANNA an approachable entry point for new sole traders and micro limited companies who want fewer moving parts from day one - it’s a great solution for smaller LTD companies or sole traders who want to manage their business finances but don’t need all the features of Xero or Quickbooks.

ANNA has also launched a ANNA MTD Self Assessment service, which provides an MTD-compliant Self Assessment service, including quarterly updates, End of Period Statement (EOPS), and a Final Declaration. It costs just £15 a month or £150 for the year.

Conclusion

Choosing the best UK accounting software means balancing short-term needs (invoicing, bank feeds, VAT) with near-term growth (projects, inventory, multi-currency, multi-user access).

For many, QuickBooks Online and Xero are the default shortlists thanks to their breadth and app ecosystems; Sage Accounting is compelling for its UK-first approach and included payroll; Zoho Books stands out on value and its HMRC-recognised MTD capabilities; FreshBooks is a top pick for service businesses with time-based billing.

If you’re just starting, QuickFile or ANNA can be a gentler stepping stone, particularly since ANNA offers 24/7 UK-based customer support to help you find your feet.

Before you commit, try a free trial where it’s available, check about HMRC recognition for the submissions you need, and confirm the total cost (including add-ons and users). That small bit of due diligence now will save you time, money and headaches later.

Frequently asked questions

What is the most used accounting software in the UK?

QuickBooks and Xero are among the most widely adopted for small businesses, with Sage and Zoho Books also well represented. Your best fit depends on features, sector needs and price tolerance.

Can I use Excel for bookkeeping?

You can, but spreadsheets lack automation, audit trails and direct HMRC submissions, which makes it trickier to stay MTD-compliant. Specialist software reduces errors and speeds up VAT prep and filing.

Does a sole trader need accounting software?

It’s not mandatory, but strongly recommended - especially if you invoice regularly or are VAT-registered. Sole-trader-friendly tiers and even free plans exist (e.g., Zoho Books Free, QuickBooks Sole Trader). ANNA’s new MTD Self Assessment service is also an option.

What are the Making Tax Digital requirements?

All VAT-registered businesses must keep digital records and file VAT returns via compatible software. MTD for Income Tax begins from April 2026 for some self-employed/landlords, with thresholds and dates detailed by HMRC; check current guidance as it evolves.

Is accounting software secure? (online + offline)

Reputable cloud providers handle encryption, access control and backups. Desktop users have to manage their own security and storage practices. Always enable multi-factor authentication and role-based access.

What is the difference between ERP and accounting software?

Accounting software focuses on ledgers, VAT and financial reporting. ERP suites combine accounting with inventory, HR, operations and more.

How does accounting software improve productivity?

Automation (rules, reminders, recurring invoices), faster reconciliation and on-demand reporting reduce admin and help you act sooner on cash-flow signals. Basically, you should be focusing on growing your business, not doing your accounting!

Which is best, QuickBooks or Xero?

There’s no universal winner. QuickBooks has strong breadth and frequent offers; Xero is valued for its stability and app ecosystem. Try each with real data and check pricing/limits in the tiers you’ll actually use.

Can you manage expenses and bills with accounting software?

Yes, you can capture receipts, record supplier bills, set approval workflows and pay on time, with ageing reports to avoid missed deadlines.

How can I check if my accounting software is HMRC-compliant?

Use HMRC’s list of compatible software for VAT and Income Tax. Vendors also publish MTD recognition on their UK pages. You should always verify this before filing.

Is accounting software tax-deductible?

Software subscriptions used wholly and exclusively for business are generally allowable expenses. Confirm with your accountant for your exact circumstances.

Can accounting software help with tax compliance in the UK?

Yes, that’s what it’s there for. From MTD VAT submissions and digital record-keeping to support for CIS and real-time payroll reporting (via payroll solutions).

How can accounting software help manage cash flow?

Live dashboards, invoice reminders, aged debtors reports and forecasting tools help you anticipate gaps and plan decisions with confidence.

Can accounting software handle multi-currency transactions?

Many higher tiers support multi-currency invoices, bills and revaluations (e.g., Xero, QuickBooks, Sage Plus, Zoho Books Premium/Elite).

Are there accounting software solutions for self-employed individuals?

Yes - look at QuickBooks Sole Trader, Xero Ignite, Zoho Books Free/Standard and FreeAgent’s sole-trader plan options. And of course, ANNA’s MTD Self Assessment service.

What is the best accounting software for a small business with inventory?

You should consider QuickBooks Plus/Advanced, Xero Grow/Comprehensive/Ultimate, Sage Plus or Zoho Books Premium/Elite, which include inventory features or pair well with inventory apps. ANNA’s MTD Self Assessment service is also a good choice.

Read the latest updates

Open a business account in minutes

![How Will Automation Affect Accounting in 2026? [Full Guide]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_11_514d5404c1/small_cover_3000_11_514d5404c1.webp)

![What Is Process Automation in Accounting? [Explained]](https://storage.googleapis.com/anna-website-cms-prod/small_cover_3000_12_7b691ef177/small_cover_3000_12_7b691ef177.webp)