We’re proud to be backing #TalkMoney Week (6-10 Nov), which aims to get us all talking more about our thoughts and feelings around money, and how and where to get help if and when you need it.

When you run a small business the highs are glorious. You fill your social media grid with emoji-filled posts about new product lines, bask proudly in glowing customer feedback and pinch yourself when you remember you’re your own boss.

Meanwhile, the lows – customers ignoring your invoices, pondering the stress of a looming tax bill you can’t afford, or the fact you haven’t actually made enough to pay yourself this month – go largely unspoken. Why is this? Perhaps it’s a cultural thing; historically, talking about money has always been seen as taboo. Throw in ego, fear and the pressure to paint an ever-positive picture of your business, and we only hear half the story.

But with the current cost-of-living pressures, we think it’s more important than ever that SMEs have the confidence to speak out about their finances – and get support for any money worries.

That’s why we’re proud to be backing #TalkMoney Week (6-10 Nov), which aims to get us all talking more about our thoughts and feelings around money, and how and where to get help if and when you need it.

Charlotte Jackson, head of guidance at the Money and Pensions Service (MaPS), which is spearheading the initiative, says, ‘This Talk Money Week, we’re asking people struggling with payments to “do one thing” and act fast.

‘If you think you’ll miss one, speak to your creditor, and if it’s already happened, it’s not too late to consider free debt advice. Acting now will help you get some control over what’s happening.’

We couldn’t agree more. If you’re a small business owner who is concerned about making payments you should talk to someone and seek help immediately – ignoring the emails or letters just makes matters worse, however tempting it is to stick your head in the sand. Your mental health and your business will thank you for it in the long run.

Find someone you can talk to. If you have an accountant, speak to them about what practical steps you can take. There are also lots of people in the small business community who are happy to help; many will have been in the same position themselves and understand the stresses and strains of running your own business.

Remember that it’s ok to open up and air your worries. Talk to a friend or family member. Sometimes you will be looking for practical advice, but often it’s just about feeling less alone and getting some perspective on the issues that are affecting you. Sometimes the support you need is financial, but sometimes – just as importantly – it’s emotional.

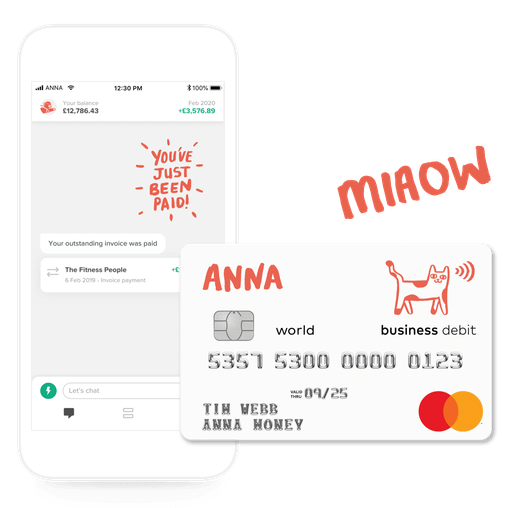

Open a business account in minutes